UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM

10

General

Form for Registration of Securities of Small Business Issuers Under Section 12(g) of the Securities Exchange Act of 1934

Favo

Realty, Inc.

(Exact Name Of Company As Specified In Its Charter)

|

Nevada

|

|

88-04360717

|

|

(State

of Incorporation)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

1461

Franklin Ave., 1st Fl. South, Garden City, NY

|

|

11530

|

|

(Address

of Principal Executive Offices)

|

|

(ZIP

Code)

|

Company’s

Telephone Number, Including Area Code: (516) 835-7075

Securities

to be Registered Under Section 12(g) of the Act: Common Stock, $0.001

(Title of Class)

Indicate

by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

Smaller

reporting company

|

☒

|

|

|

Emerging growth company

|

☐

|

If

an emerging growth company, indicate by check mark if the Company has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

TABLE

OF CONTENTS

PART

I

ITEM

1. DESCRIPTION OF BUSINESS

Some

of the statements contained in this amended registration statement on Form 10 of Favo Realty, Inc. (hereinafter the “Company”,

“we” or the “Company”) discuss future expectations, contain projections of our plan of operation or financial

condition or state other forward-looking information. In this registration statement, forward-looking statements are generally

identified by the words such as “anticipate”, “plan”, “believe”, “expect”, “estimate”,

and the like. Forward-looking statements involve future risks and uncertainties, there are factors that could cause actual results

or plans to differ materially from those expressed or implied. These statements are subject to known and unknown risks, uncertainties,

and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking

information is based on various factors and is derived using numerous assumptions. A reader, whether investing in the Company’s

securities or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this

Registration Statement. Important factors that may cause actual results to differ from projections include, for example:

|

|

●

|

the success or failure of Management’s efforts to implement

the Company’s plan of operation;

|

|

|

●

|

the ability of the Company to fund its operating expenses;

|

|

|

●

|

the ability of the Company to compete with other companies

that have a similar plan of operation;

|

|

|

●

|

the effect of changing economic conditions impacting our

plan of operation;

|

|

|

●

|

the ability of the Company to meet the other risks as may

be described in future filings with the SEC.

|

General

Background of the Company

Favo

Realty, Inc. was incorporated as Beeston Enterprises Ltd. (“the Company”) on July 12, 1999 under the laws of the State

of Nevada. The Company changed its name to Favo Realty, Inc. on December 26, 2018, which was then declared effective by the Financial

Industry Regulatory Authority (“FINRA”) on January 9, 2019. Previously, the Company was an exploration stage company

engaged in the search of mineral deposits that could be developed to a state of a commercially viable producing mine. Currently,

the Company is a real estate investment company which intends to invest in a diversified portfolio of quality commercial real

estate properties and other real estate investments located throughout the United States and Puerto Rico. The Company intends

to have a dual investment strategy. The majority of the portfolio will be invested in what the company considers its Core Holdings.

The objective for these core holdings is to own stabilized, fully leased, secure real estate assets that provide durable, predictable

cash flow to the Company. A smaller percentage of the portfolio will be invested in what the Company classifies as Value-Add &

Opportunistic Real Estate. These investments may include development or redevelopment projects, repositioning of an asset and

could include making physical improvements to a property that will allow for higher rents and increased occupancy rates.

On

May 30, 2014, the Company received approval a 1-for-10 reverse stock split on its common stock outstanding from FINRA. On January

8, 2019, the Company received approval a 1-for-50 reverse stock split on its common stock outstanding from FINRA, as well as its

symbol to “FAVO.”

On

October 4, 2018, the eight judicial District Court of Nevada appointed Custodian Ventures, LLC as custodian for Beeston Enterprises

Ltd., proper notice having been given to the officers and directors of Beeston Enterprises Ltd. There was no opposition.

On

October 12, 2018, the Company filed a certificate of reinstatement with the state of Nevada, and appointed David Lazar as, President,

Secretary, Treasurer and Director.

On

October 19, 2018, the Company obtained a promissory note in amount of $464,150 from its custodian, Custodian Ventures, LLC, the

managing member being David Lazar. The note bears an interest of 3% and matures in 180 days from the date of issuance.

On

October 19, 2018, the Company issued 473,350,000 shares of common stock, with par value $0.001 for par value payable in cash and

a promissory note issued on that same day for $464,150, to Custodian Ventures, LLC. In addition, David Lazar thereafter, published

all of the missing filings with OTC Markets for the Company, so that it became current with Pink Sheets information. There was

no party that requested such services. Prior to October 19, 2018, Custodian Ventures, LLC held a de-minimus amount of shares of

capital stock in the Company

On

October 29, 2018, the Company terminated its registration with the Securities and Exchange Commission.

On

December 6, 2018, the Company issued 25,000,000 shares of super-voting shares of Series C Preferred Stock to Custodian Ventures,

LLC in exchange for services rendered to, and fees incurred by, the Company.

On

December 12, 2018, Custodian Ventures, LLC sold (i) the 25,000,000 shares of Series C Preferred Stock to Vincent Napolitano, (ii)

5,000,000 shares of common stock to Liro Holdings, LLC, and (iii) 468,350,000 shares of common stock to Favo Group, LLC for an

aggregate purchase price of $175,000. At this point there was a change of control of the Company and David Lazar resigned as President,

Secretary, Treasurer and Director and Vincent Napolitano was appointed as President, Secretary, Treasurer and Director.

Mr.

Napolitano is considered, and shall be treated as, a promoter for the Company.

On

December 26, 2018, the Company changed its name from Beeston Enterprises Ltd. to Favo Realty, Inc.

On

April 6, 2019, the Company acquired all of the assets (the “Assets”) of RLT Atwood International, LTD (“RLT”)

for 9,646,586 shares of common stock of the Company, issued to the shareholders of RLT.

The

Assets were contributed and rebranded under FAVO Blockchain, Inc, a wholly owned subsidiary of FAVO Realty, Inc. FAVO Blockchain,

Inc. is primarily a digital currency mining company who believes that mining has and will be the cornerstone of digital token

and decentralized ledger technology. Contrary to investing strictly in the virtual space, mining provided an opportunity of realizing

blockchain assets with a more tangible and a traditional approach. Digital currency mining involves earning block rewards and

transaction fees. These rewards are given in return for hardware efforts to process transactions through digital ledger exploration

systems.

FAVO

Blockchain, Inc. did not manage its mining operation. FAVO Blockchain sold its entire inventory of ASIC and associated equipment

to Hydro66 Holdings Corp for a nominal amount in return for a hash rate equivalent cloud services contract. This contract was

to be delivered from Hydro66 Holdings Corp’s data center in Boden, Sweden. Hydro66 Holdings Corp provides a managed

hashrate service contract and provides read access pool visibility which will show payouts, rewards history and performance data.

At this colocation datacenter they host third party IT infrastructure and provide purpose-built space and cooling, telecoms, IT

support services and 24/7 physical security. This data center is an ISO27001 accredited facility. Hydro66 Holdings Corp is quoted

on the OTCQB Markets under the symbols HYHDF and also trades in Canada on the CSE under the symbol “SIX”.

Consequently,

the Company ceased to fall under the definition of shell company as define in Rule 12b-2 under the Exchange Act of 1934, as amended

(the “Exchange Act”).

On July 2, 2019, the Company formed

Favo Blockchain, Inc. (“Blockchain”) and contributed all of the Assets to Blockchain which now operates the blockchain

business. On August 5, 2019, Hydo66 Svenska AB (“Hydro66”) purchased the Assets from Blockchain for 1 SEK Hydro66,

and Hydro66 provided a managed hash rate service for FAVO Blockchain, Inc, Hydro66 have installed, powered up and configured the

mining equipment. This includes managed switch LAN infrastructure, shelves and airflow containment, and WAN gateway device. The

mining infrastructure was connected to a mining pool under Hydrio66 management and they provided FAVO Blockchain, Inc read access

pool visibility.

Our business purpose for initially

engaging in digital currency mining was an opportunistic one, the opportunity to generate revenue and profit was viable. The Bitcoin

markets appeared to be on the rise and the sentiment both short and long-term for the price of Bitcoin was bullish. The mining

contract with HYDRO66 Holdings had no downside risk to FAVO and had significant upside potential. The contract as agreed upon

stated that any and all losses in mining would be credited back to FAVO from Hydro66. If the price of BTC mined exceeded the costs,

FAVO would be entitled to 100% of the profit. If the price of BTC dropped below profitability for HYDRO66 at their discretion

they could turn the equipment off until such time that it turned profitable. Over the last few months the price of bitcoin has

not been as bullish as anticipated and much more volatile than expected. The Company decided to sell the cryptocurrency mining

operation to focus on real estate investing. The Company also believes these machines if not profitable soon would become absolute

at some point in the near future and it is in the Company’s best interest to sell them and focus on Commercial Real Estate.

On January 31, 2020, the Company sold

Favo Blockchain Inc. to Basebay, LLC for $125,000.

Mr.

Napolitano has over 25 years of Wall Street experience, specializing in Capital Markets, Real Estate & Private Equity. Since

May of 2016 he served as Executive VP of Finance & Capital Markets for Richmond Honan Development & Acquisitions, L.L.C.

where he raised equity & debt to finance the acquisitions of 700,000 SF of medical office buildings (MOB) in multiple states.

He has served as Chief Investment Officer for several Special Purpose Vehicles, including Social Network Fund, LLC and Social

Media & Technology Fund, LLC, designed to acquire private stock in pre-initial public offerings.

Business

Objectives of the Company

Since

the custodial proceedings, the Company had no business operations. Management had determined to direct its efforts and limited

resources to pursue potential new business opportunities. Such opportunity was presented by the change in control and the new

business objective as directed by Mr. Napolitano. Now, the Company is a real estate investment company which intends to invest

in a diversified portfolio of quality commercial real estate properties and other real estate investments located throughout the

United States and Puerto Rico. The Company intends to have a dual investment strategy. The majority of the portfolio will be invested

in what the company considers its Core Holdings. The objective for these core holdings is to own stabilized, fully leased, secure

real estate assets that provide durable, predictable cash flow to the Company. A smaller percentage of the portfolio will be invested

in what the Company classifies as Value-Add & Opportunistic Real Estate. These investments may include development or redevelopment

projects, repositioning of an asset and could include making physical improvements to a property that will allow for higher rents

and increased occupancy rates.

Other

than as mentioned above, the Company does not intend to limit itself to a particular geographical area and has not established

any particular criteria upon which it shall consider an investment opportunity.

The

Company intends to engage Favo Group, LLC, a related party, as its external manager of the properties acquired.

Management

Agreement: The acquired properties are to be externally managed and advised by the Favo Group, LLC (“Manager”)

under a 20-year agreement with extensions. Pursuant to the Management Agreement, our Manager will provide us with management team

and appropriate support personnel to implement our business strategy and perform certain services for us, subject to oversight

by our Board of Directors. The Manager will be responsible for, among other duties, performing and administering all our day-to-day

operations, determining investment criteria in conjunction with our Board of Directors, sourcing, analyzing and executing asset

acquisitions, sales and financings, performing asset management duties, performing property management duties, and performing

financial and accounting management.

FAVO

Blockchain was externally managed and advised by the Favo Group, LLC (“Manager”) under a 5-year arm’s-length

agreement with extensions.

We

plan to reimburse Manager up to 2% non-accountable of gross offering proceeds from all offerings for organization, offering and

marketing expenses. We plan to pay our Manager 1.5% of the total contract purchase price of each property acquired. We plan to

reimburse Manager for expenses incurred (including personnel costs) related to selecting, evaluating and making investments on

our behalf, regardless of whether we make the related investment. Personnel costs associated with providing such services will

be determined based on the amount of time incurred by the applicable employee of Manager and the corresponding payroll and payroll

related costs incurred by Manager. In addition, we also will pay third parties, or reimburse Manager or its affiliates, for any

investment-related expenses due to third parties, including, but not limited to, legal fees and expenses, travel and communications

expenses, costs of appraisals, accounting fees and expenses, third-party brokerage or finder’s fees, title insurance expenses,

survey expenses, property inspection expenses and other closing costs, regardless of whether we make the related investment.

We

also plan to pay Manager a loan coordination fee equal to 1.5% of any assumed, new or supplemental debt incurred in connection

with an acquired property, or of 1.5% of 65% of the purchase price if the asset is not leveraged. In connection with the payment

of any loan coordination fee, the amount of that loan coordination fee will be reduced by the aggregate amount of all loan coordination

fees and loan origination fees previously paid on the same real estate or real estate-related asset. We will pay to Manager or

its permitted assignees the loan coordination fee promptly upon the closing of the financing or refinancing.

We

will pay Manager a monthly fee equal to one-twelfth of 1.50% of the total value of our assets (including cash or cash equivalents)

based on the adjusted cost of our assets before reduction for depreciation, amortization, impairment charges and cumulative acquisition

costs charged to expense in accordance with generally accepted accounting principles, or GAAP (adjusted cost will include the

purchase price, acquisition expenses, capital expenditures and other customarily capitalized costs) and as adjusted for appropriate

closing dates for individual asset acquisitions. This fee will be payable monthly in cash or shares of our common stock, at the

option of Manager. This fee will be appropriately pro-rated for any partial month. The Manager may request the management fees

be accelerated in advance up to 36 months. If the assets are disposed of prior to 36 months the Manager will return the accelerated

fees within 90 days.

If

our advisor or an affiliate provides property management and leasing services for our properties, we will pay fees equal to 4.0%

of gross revenues from the properties managed. We also will reimburse the property manager and its affiliates for property-level

expenses that any of them pay or incur on our behalf, including salaries, bonuses and benefits of persons employed by the property

manager and its affiliates except for the salaries, bonuses and benefits of persons who also serve as one of our executive officers

or as an executive officer of the property manager or its affiliates. Our advisor or an affiliate may subcontract the performance

of its property management and leasing services duties to third parties and pay all or a portion of its 4.0% property management

fee to the third parties with whom it contracts for these services. If we contract directly with third parties for such services,

we will pay them customary market fees and will pay Manager an oversight fee equal to 1.0% of the gross revenues of the property

managed. In no event will we pay our advisor or any affiliate both a property management fee and an oversight fee with respect

to any property.

We

plan to pay Manager a commission with respect to a new lease equal to 50% of the first month’s gross rent plus 4% of the remaining

fixed gross rent of the guaranteed lease term. In the event of co-broker participation in a new lease for an real estate asset,

the leasing commission determined for a new lease, with respect to such lease, will be 150% of the first month’s gross rent plus

6% of the remaining fixed gross rent of the guaranteed lease term. We will pay a commission to Manager with respect to a negotiated

renewal of an existing lease equal to 4% of the fixed gross rent of the guaranteed lease term or, in the event of a co-broker,

6% of the fixed gross rent of the guaranteed lease term. In no event shall the office leasing fees paid to Manager exceed customary

market rates. Manager may subcontract the performance of its office leasing duties to third parties or affiliates and pay all

or a portion of its office leasing fee to such persons with whom it contracts for these services. Manager will be responsible

for all fees payable to third parties or affiliates in connection with subcontracted office leasing duties. The office leasing

fee will be payable upon the earlier to occur of rent commencement or tenant’s opening for business.

Furthermore,

the Company plans to pay Manager a monthly fee equal to 2% of our monthly gross revenues in connection with the administration

of our day-to-day operations and the performance and supervision of the performance of such other administrative functions necessary

for our management. In addition to the general and administrative expenses fee, we may reimburse Manager for certain costs and

expenses it incurs in connection with the services it provides to us, including, but not limited to, personnel costs. The Company

will pay Manager a commission upon the sale of one or more of our properties or other assets in an amount equal to 1% of the sale

price of the asset, unless there is a conflict of interest. In such an instance, the fee will be waived

The

Company will pay the Manager a disposition fee upon the sale of one or more of the properties or other assets in an amount equal

to 1.5% of the total sale price.

The

Company plans to pay Manager a construction fee, development fee and landscaping fee at market rates customary and competitive

considering the size, type and location of the asset in connection with the construction, development or landscaping of a property.

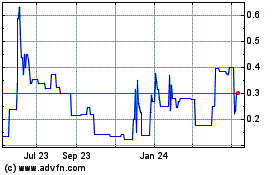

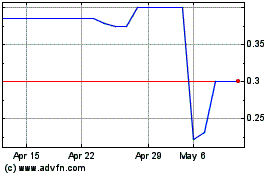

The

Company’s common stock is subject to quotation on the OTC Pink Sheets under the symbol FAVO. There is currently a trading market

in the Company’s shares. There can be no assurance that there will be an active trading market for our securities will continue

following the effective date of this registration statement under the Exchange Act. In the event that an active trading market

continues, there can be no assurance as to the market price of our shares of common stock, whether any trading market will provide

liquidity to investors, or whether any trading market will be sustained.

Management

of the Company (“Management”) would have substantial flexibility in identifying and selecting a prospective property.

The Company is dependent on the judgment of its Management in connection with this process. In evaluating a prospective property,

we would consider, among other factors, the following:

|

|

●

|

costs associated with pursuing a property;

|

|

|

●

|

experiences, skills and availability of additional personnel

necessary to pursue a potential new business opportunity;

|

|

|

●

|

necessary capital requirements;

|

|

|

●

|

the competitive position of the property;

|

|

|

●

|

stage of development; and

|

|

|

●

|

the market acceptance of the potential services;

|

The

foregoing criteria are not intended to be exhaustive and there may be other criteria that Management may deem relevant. In connection

with an evaluation of a prospective or potential opportunity, Management may be expected to conduct a due diligence review.

The

time and costs required to pursue new opportunities, which includes negotiating and documenting relevant agreements and preparing

requisite documents for filing pursuant to applicable securities laws, cannot be ascertained with any degree of certainty.

Management

intends to devote such time as it deems necessary to carry out the Company’s affairs. The exact length of time required for the

pursuit of any new potential opportunities is uncertain. No assurance can be made that we will be successful in our efforts. We

cannot project the amount of time that our Management will actually devote to the Company’s plan of operation.

The

Company intends to conduct its activities so as to avoid being classified as an “Investment Company” or a “Real

Estate Investment Trust” under the Investment Company Act of 1940, and therefore avoid application of the costly and restrictive

registration and other provisions of the Investment Company Act of 1940 and the regulations promulgated thereunder.

Very

Limited Liquidity of our Common Stock

Our

common stock trades on the OTC Pink Sheet Market. There is an active market maker in our common stock. However, there is only

limited liquidity in our common stock.

The

Company has not identified a target property

The

Company’s effort in identifying prospective target properties will only be limited to the United States and Puerto Rico. To date,

the Company has not selected any target property. To the extent that we acquire a property characterized by a high level of risk,

we may be affected by the currently unascertainable risks.

Sources

of target properties

Our

Management anticipates that target properties will be brought to our attention from various unaffiliated sources who may present

solicited or unsolicited proposals. Our Management may also bring to our attention target properties. While we do not presently

anticipate engaging the services of professional firms that specialize in finding available real estate on any formal basis, we

may engage these firms in the future, in which event we may pay a finder’s fee or other compensation in connection with an acquisition.

In no event, however, will we pay Management any finder’s fee or other compensation for services rendered to us prior to or in

connection with the consummation of an acquisition.

Selection

of a target property

Management

owns 58.165% of the issued and outstanding shares of common stock and 100% of the issued and outstanding preferred shares of the

Company, and will have broad flexibility in identifying and selecting a prospective target. In evaluating a prospective property,

our Management will consider, among other factors, the following:

|

|

●

|

financial

condition of the property;

|

|

|

●

|

experience

and skill of Management and availability of additional personnel;

|

|

|

●

|

degree

of current or potential market acceptance of the services;

|

|

|

●

|

regulatory

environment of the industry; and

|

|

|

●

|

costs

associated with owning and/or improving the real estate.

|

These

criteria are not intended to be exhaustive. Any evaluation relating to the merits of a particular property will be based, to the

extent relevant, on the above factors as well as other considerations deemed relevant by our Management consistent with our business

objective. In evaluating a prospective acquisition, we will conduct a due diligence review which will encompass, among other things,

inspection of the property, as well as review of financial and other information which will be made available to us.

We

will endeavor to structure an acquisition so as to achieve the most favorable tax treatment to us, our subsidiaries and our stockholders.

However, there can be no assurance that the Internal Revenue Service or applicable state tax authorities will necessarily agree

with the tax treatment of any acquisition we consummate.

The

time and costs required to select and evaluate a target and to structure and complete the acquisition cannot presently be ascertained

with any degree of certainty. Any costs incurred with respect to the identification and evaluation of a prospective target that

is not ultimately completed will result in a loss to us.

Possible

lack of business diversification

While

we may seek to effect acquisitions with more than one target, it is more possible that we will only have the ability to effect

a single acquisition, if at all. Accordingly, the prospects for our success may be entirely dependent upon a single property.

Unlike other entities which may have the resources to complete several acquisitions, it is probable that we will lack the resources

to diversify our holdings or benefit from the possible spreading of risks or offsetting of losses. By consummating a single acquisition,

our lack of diversification may:

|

|

●

|

subject

us to numerous economic, competitive and regulatory developments, and

|

|

|

●

|

result

in our dependency upon the development or appreciation of a single or limited number of properties.

|

Our

auditors have expressed substantial doubt about our ability to continue as a going concern

Our

audited financial statements for the years ended December 31, 2018 and 2017, were prepared using the assumption that we will continue

our operations as a going concern. Our independent accountants in their audit report have expressed substantial doubt about our

ability to continue as a going concern. Our operations are dependent on our ability to raise sufficient capital or complete acquisition

as a result of which we become profitable. Our financial statements do not include any adjustments that may result from the outcome

of this uncertainty. There is not enough cash on hand to fund our administrative expenses and operating expenses for the next

twelve months. Therefore, we may be unable to continue operations in the future as a going concern. If we cannot continue as a

viable entity, our stockholders may lose some or all of their investment in the Company’s shares of common stock.

Competition

In

identifying, evaluating and selecting a target property, we expect to encounter intense competition from other entities having

a business objective similar to ours. Many of these entities are well established and have extensive experience identifying and

effecting acquisitions, either directly or through affiliates. Many if not virtually most of these competitors possess far greater

financial, human and other resources compared to our resources. While we believe that there are numerous potential targets that

we may identify, our ability to compete in acquiring certain of the more desirable targets will be limited by our limited financial

and human resources. Our inherent competitive limitations are expected by Management to give others an advantage in pursuing the

acquisition of a target that we may identify and seek to pursue. Further, any of these limitations may place us at a competitive

disadvantage in successfully negotiating an acquisition. Our Management believes, however, that our status as a reporting public

entity with potential access to the United States public equity markets may give us a competitive advantage over certain privately-held

entities having a similar business objective in acquiring a desirable target with growth potential on favorable terms.

Employees

Vincent

Napolitano is our Chief Executive Officer, is one of our officers and directors. Mr. Shaun Quin is President of FAVO Group. LLC,

a 47.68% shareholder of the Company, is also an officer and director of the Company. They are not obligated to devote any specific

number of hours per week and, in fact, intends to devote only as much time as they deem reasonably necessary to administer the

Company’s affairs until such time as an additional acquisition is consummated. The amount of time they will devote in any time

period will vary based on the availability of suitable new target to investigate.

Vincent

Napolitano, 47, also serves as our Chairman of the Board of Directors. Shaun Quin, 37, also serves on our Board of Directors.

We do not intend to have any full-time employees prior to the consummation of an additional acquisition.

Conflicts

of Interest

The

Company’s Management is not required to commit its full time to the Company’s affairs. As a result, pursuing new business opportunities

may require a longer period of time than if Management would devote full time to the Company’s affairs. Management is not precluded

from serving as an officer or director of any other entity that is engaged in business activities similar to those of the Company.

Management has not identified and is not currently negotiating a new business opportunity for us. In the future, Management may

become associated or affiliated with entities engaged in business activities similar to those we intend to conduct. In such event,

Management may have conflicts of interest in determining to which entity a particular opportunity should be presented. In the

event that the Company’s Management has multiple business affiliations, our Management may have legal obligations to present certain

business opportunities to multiple entities. In the event that a conflict of interest shall arise, Management will consider factors

such as reporting status, availability of audited financial statements, current capitalization and the laws of jurisdictions.

If several opportunities approach Management with respect to an acquisition, Management will consider the foregoing factors as

well as the preferences of the Management of the operating company. However, Management will act in what it believes will be in

the best interests of the shareholders of the Company.

Description

of FAVO Blockchain, Inc.

The Assets were contributed and rebranded

under FAVO Blockchain, Inc, a previous wholly-owned subsidiary of FAVO Realty, Inc. formed on July 2, 2019. It, contracted with

Hydro66 Holdings Corp. to provide managed hashrate service and read access pool visibility which will show payouts, rewards history

and performance data. The Company has since sold Favo Blockchain, Inc. to Basebay LLC for $125,000. Therefore, we no longer intend

to use the information provided by Hydro66 in the Company’s operations. We previously conducted mining operations after

selling the digital mining assets acquired from RLT Atwood International to Hydro66. Using a hashrate equivalent contract, the

Company entered into a cloud-mining contract, otherwise known as the hashrate equivalent, which allowed FAVO Blockchain to mine

bitcoin indirectly and not have the large overhead and commitment to any potential downside if the markets did not go in our favor.

The hashrate contract protected the Company from any loss in operating overheads and allowed the Company to participate in 100%

of the upside potential, if any, on a monthly basis.

Introduction

to Blockchain and Cryptocurrency

Our business purpose for initially

engaging in digital currency mining was an opportunistic one, the opportunity to generate revenue and profit was viable. The Bitcoin

markets appeared to be on the rise and the sentiment both short and long-term for the price of Bitcoin was bullish. The mining

contract with HYDRO66 Holdings had no downside risk to FAVO and had significant upside potential. The contract as agreed upon

stated that any and all losses in mining would be credited back to FAVO from Hydro66. If the price of BTC mined exceeded the costs,

FAVO would be entitled to 100% of the profit. If the price of BTC dropped below profitability for HYDRO66 at their discretion

they could turn the equipment off until such time that it turned profitable. Over the last few months the price of bitcoin has

not been as bullish as anticipated and much more volatile than expected. The Company decided to sell the cryptocurrency mining

operation to focus on real estate investing. The Management also believes these machines if not profitable soon would become absolute

at some point in the near future and it is in the Company’s best interest to sell them and focus on Commercial Real Estate.

ITEM

1A. RISK FACTORS

Forward-Looking

Statements

This

amended registration statement on Form 10 contains forward-looking statements that are based on current expectations, estimates,

forecasts and projections about us, our future performance, the market in which we operate, our beliefs and our Management’s

assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on

our behalf. Words such as “expects”, “anticipates”, “targets”, “goals”, “projects”,

“intends”, “plans”, “believes”, “seeks”, “estimates”, variations of

such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees

of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict or assess. Therefore,

actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements.

Any

investment in our shares of common stock involves a high degree of risk. You should carefully consider the following information

about these risks, together with the other information contained in this annual report before you decide to invest in our common

stock. Each of the following risks may materially and adversely affect our business objective, plan of operation and financial

condition. These risks may cause the market price of our common stock to decline, which may cause you to lose all or a part of

the money you invested in our common stock. We provide the following cautionary discussion of risks, uncertainties and possible

inaccurate assumptions relevant to our business plan. In addition to other information included in this annual report, the following

factors should be considered in evaluating the Company’s business and future prospects.

Risks

Related to Our Business

The

Company has a limited operating history and very limited resources.

Since

being acquired through custodial proceedings, the Company’s operations have been limited to seeking a potential acquisition, and

the related change of control, and has had no revenues from operations. Investors will have no basis upon which to evaluate the

Company’s ability to achieve the Company’s business objective, which is to invest in a diversified portfolio of quality commercial

real estate properties and other real estate investments located throughout the United States and Puerto Rico. The Company intends

to have a dual investment strategy. The majority of the portfolio will be invested in what the company considers its Core Holdings.

The objective for these core holdings is to own stabilized, fully leased, secure real estate assets that provide durable, predictable

cash flow to the Company. A smaller percentage of the portfolio will be invested in what the Company classifies as Value-Add &

Opportunistic Real Estate. These investments may include development or redevelopment projects, repositioning of an asset and

could include making physical improvements to a property that will allow for higher rents and increased occupancy rates. The Company

will not generate any revenues until, at the earliest, after the consummation of an acquisition.

Our

auditors have expressed substantial doubt about our ability to continue as a going concern.

As

of December 31, 2018, we had zero cash and cash equivalents and an accumulated deficit of $nil. Our audited financial statements

for the years ended December 31, 2018 and December 31, 2018, were prepared using the assumption that we will continue our operations

as a going concern. Our independent accountants in their audit report have expressed substantial doubt about our ability to continue

as a going concern. Our operations are dependent on our ability to raise sufficient capital or complete acquisition as a result

of which we become profitable. Our financial statements do not include any adjustments that may result from the outcome of this

uncertainty.

There

is not enough cash on hand to fund our administrative expenses and operating expenses for the next twelve months. Therefore, we

may be unable to continue operations in the future as a going concern. If we cannot continue as a viable entity, our stockholders

may lose some or all of their investment in the Company’s shares of common stock.

Since

the Company has not yet selected a particular property to acquire, the Company is unable to ascertain the merits or risks associated

with any particular property.

Since

the Company has not yet identified a prospective target, there is no basis for investors to evaluate the possible merits or risks

of the target(s) which the Company may ultimately acquire. Although the Company’s Management intends to evaluate the risks inherent

in a particular acquisition, the Company cannot assure you that it will properly ascertain or assess all of the significant risk

factors. There can be no assurance that any prospective acquisition will benefit shareholders or prove to be more favorable to

shareholders than any other investment that may be made by shareholders and investors.

Unspecified

and unascertainable risks.

There

is no basis for shareholders to evaluate the possible merits or risks of potential acquisitions. Although Management will endeavor

to evaluate the risks inherent in a particular property, there can be no assurance that Management will properly ascertain or

assess all such risks that the Company perceived at the time of the consummation of an acquisition.

Dependence

on key personnel.

The

Company is dependent upon the continued services of Management. To the extent that his services become unavailable, the Company

will be required to obtain other qualified personnel and there can be no assurance that it will be able to recruit qualified persons

upon acceptable terms.

The

Company’s officers and directors may allocate their time to other businesses activities, thereby causing conflicts of interest

as to how much time to devote to the Company’s affairs and prioritize the availability of an acquisition with the Company. This

could have a negative impact on the Company’s ability to consummate an acquisition in a timely manner, if at all.

The

Company’s officers and directors are not required to commit his full time to the Company’s affairs, which may result in a conflict

of interest in allocating their time between the Company’s business and other businesses. The Company does not intend to have

any full-time employees prior to the consummation of an additional acquisition. Management of the Company is engaged in other

business endeavors and is not obligated to contribute any specific number of their hours per week to the Company’s affairs.

If

Management’s other business affairs require them to devote more time to such affairs, it could limit their ability to devote time

to the Company’s affairs or present the Company as a viable opportunity and could have a negative impact on the Company’s ability

to consummate an acquisition. Furthermore, we do not have an employment agreement with Mr. Napolitano or Mr. Quin.

We

rely on our senior management and will be harmed if any or all of them leave.

Our

success is dependent on the efforts, experience and relationships of the Favo Group, LLC (the “Manager”) and its Managing

Members, Vincent Napolitano and Shaun Quin. Should they become unable to continue in their respective roles, the Company’s

business would be adversely affected as to its business prospects and earnings potential. As a result, the success of the

Company, for the foreseeable future, depends solely on the abilities of the Manager. We do not currently carry any insurance to

compensate for any such loss. The Company and/or the Manager will consider purchasing key man insurance on the Manager and

possibly other key employees but there are no assurances that the Company and/or the Manager will obtain this insurance.

Conflicts

of Interest May Arise.

As

Vincent Napolitano is the Chief Executive Officer of the Company and the Managing Member of the Manager, conflicts of interest

may arise when negotiating the terms of engagement of the Manager or in the purchase of real estate. While Mr. Napolitano will

act with the best interest of the shareholders of the Company in mind, there is no assurance that such terms will be mutually

beneficial. Furthermore, Shaun Quin is the President of the Company and the Manager. Therefore, conflicts of interest may arise

when negotiating the terms of engagement of the Manager or in the purchase of real estate. While Mr. Quin will act with the best

interest of the shareholders of the Company in mind, there is no assurance that such terms will be mutually beneficial.

General

Execution.

The

Company’s success depends on the Managers ability to implement its investment strategy. Any factor that would

make it more difficult for the Manager to execute timely transactions may be detrimental to the Company’s strategy. No assurance

can be given that the investment strategies to be used by the Company and/or the Manager will be successful under all or any market conditions.

Delays

in or Failure to Close.

Generally,

any delay purchasing an asset or assets or failure to close on such assets may cause a delay in or failure to operate. Such failure

or delay may be caused by (but is not limited to), for example, the following events: force majeure, acts of terrorism, municipality

moratoriums and/or delays in approvals, labor or material shortages, or acts of war or conflict.

Lack

of Diversification & Risk Management.

Although

the Manager will attempt to structure the Company’s portfolio so that investments (both individually and in the aggregate)

have desirable risk/reward characteristics for the Company and are completed at an arm’s length basis, the Company may have

a non-diversified portfolio as a result of large amounts of Company’s capital invested in assets of the same general type and

character. Risk management is a fundamental principle in the development of the Company’s portfolio of assets and in the

management of each investment. Diversification of the Company’s portfolio by investment size and location is critical in

our attempt to manage portfolio-level risk. Such lack of diversification substantially increases market risks and the risk of

loss associated with an investment in the Company.

Funding

Risk.

Certain

of the Company’s investment assets may, from time to time, require additional funding in relation to closing on or development

of their underlying assets. As such, such entity may not have commitments for funding from any other source that will be sufficient

to complete any such development of the property. If such entity is unable to locate such additional commitments for other sources

of funding, the Fund may be unable to infuse additional loans into the entity and that could adversely affect such entity’s

ability to operate, which would significantly harm the Company’s revenues and financial condition.

Borrowing

Policy.

The

Company may use leverage. Our target leverage level on the entire portfolio is approximately 50% to 70%. Note, however that in

the early stages of the Company, the Manager may deem it necessary to utilize leverage to a greater degree in order to acquire

a greater number of properties with the cash available in order to achieve greater diversification sooner. The Company expects

to reduce that level of leverage over time by using funds from future offerings of the Company’s shares to either pay down

the borrowings or acquire additional properties for cash. There is no guarantee that the Company will be able to pay down these

borrowings in the future and will be subject to any and all risks associated with over leverage. There is no limitation on the

amount the Company borrows against any single property or against the portfolio or properties as a whole.

General

Risks of the Real Estate Industry.

The

ownership of real estate includes many risks including: declines in the value of real estate, general and local economic conditions,

unavailability of mortgage funds, overbuilding, extended vacancies of properties, increased competition, increases in property

taxes and operating expenses, changes in zoning laws, losses due to costs of cleaning up environmental problems, liability to

third parties for damages resulting from environmental problems, casualty or condemnation losses, limitations on rents, changes

in neighborhood values and the appeal of properties to tenants, changes in interest rates. An economic downturn could have a material

adverse effect on the real estate markets, which in turn could result in the Company not achieving its investment objectives.

Real property investments are subject to varying degrees of risk. The yields available from investments in real estate depend

on the amount of income and capital appreciation generated by the related properties. Income and real estate values may also be

adversely affected by such factors as applicable laws (e.g., the ADA and tax laws), interest rate levels and the availability

of financing. If the properties do not generate sufficient income to meet operating expenses, including, where applicable, debt

service, ground lease payments, tenant improvements, third-party leasing commissions and other capital expenditures, the income

and ability of the Company to make payments of any interest and principal on its indebtedness, if any, and its ability to make

distributions, will be adversely affected. In addition, real property may be subject to defaults by tenants.

The

performance of the economy in the region in which the commercial properties being acquired by the entities in which the Company

has its investments are located affects occupancy, market rental rates and expenses and, consequently, has an impact on the underlying

value of such properties. The financial results of major local employers also may have an impact on the cash flow and value of

certain properties.

Company

will have risks associated with land improvements and/ or construction.

The

cost of certain improvements and/or construction on properties acquired by the Company and the time it takes to do so may be affected

by factors beyond the control of the Company, including, but not limited to, worker strikes and other labor difficulties resulting

in the interruption or slow-down of improvements or construction; energy shortages; material and labor shortages; inflation; adverse

weather conditions; subcontractor defaults and delays; changes in federal, state or local laws, ordinances or regulations; acts

of God (which may result in uninsured losses); terrorist attacks; acts of war; and other unknown contingencies. The Company may

be required to engage substitute or additional contractors to complete any improvements or construction on properties in the event

of delays or cost overruns. If cost overruns resulting from delays or other causes are experienced in any construction, the Company

may have to seek additional debt financing. Further, delays in the completion of any improvements or construction could adversely

affect the ability of the Company to meet the debt service obligations burdening the properties. Payment of cost overruns could

impair the operational profitability of properties owned by the Company. The inability to complete any improvements or construction

on terms economically feasible to the Company may result in the sale of the property at a loss and a dissolution of the Company.

Such dissolution may result in the Company not having the ability to repay its debt obligations. One or more of such occurrences

may have an adverse effect on the Company.

Company

will make purchases with limited representations and warranties.

Properties

will likely often be acquired by the Company with limited representations and warranties from the seller regarding condition,

the presence of hazardous substances, the status of governmental approvals and entitlements and other significant matters affecting

the use, ownership and enjoyment of the property. As a result, if defects or other matters adversely affecting the property are

discovered, the acquiring Company may not be able to pursue a claim for damages against the seller. The extent of damages that

the Company may incur as a result of such matters cannot be predicted, but potentially could significantly adversely affect the

value of the property and/or the collateral pledged by the Company. Such factors may have an adverse effect on the Company.

Properties

purchased by the Company may contain toxic and hazardous materials; Company will likely have no environmental indemnity.

Federal,

state and local laws impose liability on a landowner for releases or the otherwise improper presence on the premises of hazardous

substances. This liability is without regard to fault for, or knowledge of, the presence of such substances. A landowner may be

held liable for hazardous materials brought onto the property before it acquired title and for hazardous materials that are not

discovered until after it sells the property. Similar liability may occur under applicable state law. Often times the seller of

a property will make only limited representations as to the absence of hazardous substances. If any hazardous materials are found

within the property in violation of law at any time, the Company may become jointly and severally liable for all cleanup costs,

fines, penalties and other costs. This potential liability will continue after the Company sells the property and may apply to

hazardous materials present before the Company acquired the property. If losses arise from hazardous substance contamination which

cannot be recovered from a responsible party, the financial viability of the Company may be substantially affected which would

in turn seriously compromise the Company’s. In extreme cases, a given property may be rendered worthless, or worse, where

the Company becomes obligated to pay cleanup costs, in excess of the value of the property. For shareholders, hazardous substance

contamination of properties acquired by Company could adversely affect the Company. In extreme cases, the entire investment would

need to be written off as a total loss.

Company

may have environmental liability.

Rarely

will the Company be required to complete a Phase I Environmental Site Assessment of a given property. While the Company itself

may at times require the seller of a given property to conduct such an assessment, any environmental hazards increase the risk

of environmental liability with respect to the Company’s acquisition of a property which could in turn adversely affect

the Company.

Company

face uncertain improvement and development costs and projections.

Any

financial projections or calculations respecting a given property will not be subjected to independent review nor will the it

require an independent assessment of such projections prior to the Company’s acquisition of a given property. Consequently,

the actual improvement or development costs of a property may be materially different from those originally anticipated. A property

may also require repairs, improvements, and other capital expenditures that are unknown to the Company. Such additional costs

and expenses may have a significant impact on the value of a property and may result in the Company’s inability to satisfy

its loans or obligations. One or more of such occurrences may have an adverse effect on the Company.

We

may be subject to uninsured losses.

The

Company will attempt to maintain adequate insurance coverage against liability for personal injury and property damage for the

properties acquired by such Company. However, there can be no assurance that insurance will be sufficient to fully cover such

liabilities. Furthermore, insurance against certain risks, such as earthquakes, floods, terrorism, etc., may be unavailable or

available only at unacceptable costs or in amounts that are less than the full market value or replacement cost of such properties.

In addition, there can be no assurance that particular risks which are currently insurable will continue to be insurable on an

economical basis or that current levels of coverage will continue to be available. If a loss occurs in connection with a property

that is partially or completely uninsured, the Company holding the property may not be able to complete its intended objectives

and may be unable to liquidate the property in an amount satisfactory to satisfy any loans or obligations burdening the property

or the Company’s other assets, if any. One or more such occurrences may have an adverse effect on the Company.

Our

collateral may be threatened by environmental and regulatory proceedings.

The

value of a property acquired by the Company may be adversely affected by legislative, regulatory, administrative and enforcement

actions at the local, state and national levels in the areas, among others, of environmental controls. In addition to possible

increasingly restrictive zoning regulations and related land use controls, such restrictions may relate to air and water quality

standards, noise pollution and indirect environmental impacts such as increased motor vehicle activity. Any one of these factors

could diminish the Company’s estimated equity in the property. If such the Company is unable to rectify adversary proceedings

in this context, the risk of default would be heightened and could have an adverse effect on the Company.

Company

face risks of zoning / eminent domain.

Real

property and the planned development thereof is subject to zoning changes by municipal and/or county authorities. A change in

a property’s expected final zoning designation may materially impact the Company’s ability to achieve its objectives

and satisfy its loan obligations. Also, all real property is further subject to the government’s power of eminent domain.

The “taking” or condemnation of a given property by city, county, state, or federal government authorities, and the

value of the property derived through such proceedings, could eliminate the anticipated income or profits of the Company and may

result in a full or partial default on any mortgages, loans or obligations of the Company. One or more such occurrences may have

an adverse effect on the Company.

Company

may face risks of investing in rental property.

On

occasion, the Company may purchase an existing residential or commercial rental property. The rental of units in residential apartment

buildings or leasing space in commercial buildings is a highly competitive business. Residential real estate is subject to adverse

housing pattern changes and uses, increased real estate taxes, vandalism (with attendant security costs), vacancies, rent contracts,

and rising operating costs. Problems can result from improper management and the inability of tenants to pay rents. Commercial

properties are subject to the same risks. Should the Company retain and operate such a property, the Company would be competing

with other properties to attract new tenants and subsequently may decrease rental or lease rates. Moreover, the Company’s

decision to retain and operate such a property could be adversely affected by periodic overbuilding of competitive properties

in its real estate market, which could affect the ultimate value of the property in the event it is sold in the future. The Company’s

success in this case, therefore, would depend in part upon the ability of the Company to retain a property manager with skills

adequate enough (i) to attract quality tenants to achieve significant occupancy levels of favorable rental rates, and (ii) to

provide an attractive and comfortable living environment for the tenants. The ability of the Company and its property manager

to attract tenants as well as to increase rental rates once tenants are attracted, will depend on factors beyond the control of

the Company, including the size and quality of competing properties, general and local economic conditions, competing rental rates,

the success and viability of the prospective tenants and renewals of existing leases. The inability to maintain a high occupancy

rate and favorable rental rates would adversely affect the income of the Company and value of the property. Although the Company

will be required to obtain insurance to cover casualty losses and general liability, ordinarily no other insurance will likely

be available to cover losses from ongoing operations. The occurrence of a casualty resulting in damage to such a property could

decrease or interrupt the payment of tenant rentals (See “Uninsured Losses”). Typical tenant leases allow tenants

to terminate their leases if the leased premises they occupy are partially or completely damaged or destroyed by fire or other

casualty unless such premises are restored to the extent of insurance proceeds received by the property owner. Such leases typically

also permit the tenants to partially or completely abate rental payments during the time needed to rebuild or restore such damaged

premises. Such leases also typically contain provisions which, under certain circumstances, permit tenants to assign their leases

or sublet the premises they occupy. Tenants generally would be able to assign or sublet leased premises with the prior written

consent of the property owner, which may not be unreasonably withheld. In the event of an adverse effect on the income of such

a property, the Company may find it necessary to obtain additional funds through additional borrowings, if available, subject

to the limitations on borrowing set forth herein. If additional funds are not available from any source, the Company would be

forced to either dispose of all or a portion of the property on unfavorable terms. Considering all of the above factors, this

could have an adverse impact on the Company.

Risks associated with the Company

may adversely affect the value of debt instruments issued in connection with an Investment Loan.

Because any

notes, deeds of trust, etc., issued by the Company will be linked to the overall financial health and stability of such Company

in addition to assets designated as collateral to secure an Investment Loan (real property, equity in the Company, etc.), any

adverse event affecting such stability may adversely affect their ability to repay indebtedness. This in turn may have a material

adverse impact on the Company.

We

may not be able to obtain adequate proof of title insurance.

Because

private money is typically used to purchase assets at auctions, the purchaser may be unable to secure adequate title insurance.

Thus, we may become subject to the risks associated with clouded title. This in turn may have a material adverse impact on the

Company.

Government

Regulation of Real Estate Business.

The

real estate business is subject to extensive building and zoning regulations by various federal, state and municipal authorities,

which affect land acquisition, development and construction activities, and certain dealings with customers, as well as consumer

credit and consumer protection statutes and regulations. Real estate operators are required to obtain approval from various governmental

authorities for its development activities, and new laws or regulations could be adopted, enforced or interpreted in a manner

that could delay a related entity’s ability to close on a property, which could, in turn, adversely affect the investments

of the Company. Development activities are also subject to risks relating to the inability to obtain, or delays in obtaining all

necessary zoning, environmental, land-use, development, building, occupancy and other required governmental permits and authorizations.

There is no assurance that regulations affecting the real estate industry, including environmental regulations, will not change

in a manner which could have a material adverse effect on the Company’s investments.

Limitations

on the Manager’s Liability and Indemnification.

To

the fullest extent permitted by law, the Company, in its sole discretion, shall indemnify and hold harmless the Manager and its

affiliates and the legal representatives of any of them (an “Indemnified Party”), from and against any loss, liability,

damage, cost or expense suffered or sustained by an Indemnified Party by reason of (i) any acts, omissions or alleged acts or

omissions arising out of or in connection with the Company, or any investment made or held by the Company (including, without

limitation, any judgment, award, settlement, reasonable attorneys’ fees and other costs or expenses incurred in connection

with the defense of any actual or threatened action, proceeding, or claim), provided that such acts, omissions or alleged acts

or omission upon which such actual or threatened action, proceeding or claim are based are not found by a court of competent jurisdiction

upon entry of a final non- appealable judgment to have been made in bad faith or to constitute fraud, willful misconduct or gross

negligence by such Indemnified Party, or (ii) any acts or omissions, or alleged acts or omissions, of any broker or agent of any

Indemnified Party, provided that such broker or agent was selected, engaged or retained by the Indemnified Party in accordance

with reasonable care.

The

Company has limited resources and there is significant competition for acquisitions. Therefore, the Company may not be able to

enter into or consummate an attractive acquisition.

The

Company expects to encounter intense competition from other entities having a business objective similar to the Company’s. Many

of these entities are well established and have extensive experience in identifying and effecting acquisitions directly or through

affiliates. Many of these competitors possess greater technical, human and other resources than the Company does and the Company’s

financial resources are limited when contrasted with those of many of these competitors. While the Company believes that there

are numerous potential targets that it could acquire, the Company’s ability to compete in acquiring certain sizable targets will

be limited by the Company’s limited financial resources and the fact that the Company may use its common stock to acquire an operating

business. This inherent competitive limitation gives others an advantage in pursuing the acquisition of certain target businesses.

The

Company may be unable to obtain additional financing, if required, to complete an acquisition or to sustain the target(s), which

could compel the Company to restructure a potential business transaction or abandon a particular acquisition.

We

may be required to seek additional financing. We cannot assure you that such financing would be available on acceptable terms,

if at all. If additional financing proves to be unavailable, we would be compelled to restructure the transaction or abandon that

particular acquisition and seek an alternative target(s). In addition, if we consummate an acquisition, we may require additional

financing to sustain the target. The failure to secure additional financing could have a material adverse effect on the Company.

Financing

requirements to fund operations associated with reporting obligations under the Exchange Act.

The

Company has no revenues and is dependent upon the willingness of the Company’s Management to fund the costs associated with the

reporting obligations under the Exchange Act, other administrative costs associated with the Company’s corporate existence

and expenses related to the Company’s business objective. The Company is not likely to generate any revenues until the consummation

of an acquisition, at the earliest. The Company believes that it will have available sufficient financial resources available

from its Management to continue to pay accounting and other professional fees and other miscellaneous expenses that may be required

until the Company commences business operations following an acquisition.

We

are dependent upon interim funding provided by Management or an affiliated party to pay professional fees and expenses. Our Management

has provided funding, without formal agreement, as has been required to pay for accounting fees and other administrative expenses

of the Company.

The

Company does not currently engage in any business activities that provide cash flow. The costs of investigating and analyzing

potential acquisition candidates and preparing and filing Exchange Act reports for what may be an unlimited period of time will

be paid by our sole officer and director, or an affiliated party notwithstanding the fact that there is no written agreement to

pay such costs. Mr. Napolitano and/or an affiliated party have informally agreed to pay the Company’s expenses in the form of

advances that are unsecured, non-interest bearing. The Company intends to repay these advances when it has the cash resources

to do so.

Based

on Mr. Napolitano’s resource commitment to fund our operations, we believe that we will be able to continue as a going concern

until such time as we conclude an acquisition. During the next 12 months we anticipate incurring costs related to:

|

|

●

|

filing

of Exchange Act reports.

|

|

|

●

|

franchise

fees, registered agent fees, legal fees and accounting fees, and

|

|

|

●

|

investigating,

analyzing and consummating an acquisition or acquisition(s).

|

We

estimate that these costs will range from five to six thousand dollars per year, and that we will be able to meet these costs

as necessary through loans/advances from Management or affiliated parties until we enter into an acquisition.

The

Company’s sole officer and director has a 99% voting interest in the Company and thus is in a position to influence certain actions

requiring stockholder vote.

Management

has no present intention to call for an annual meeting of stockholders to elect new directors prior to the consummation of an

acquisition. As a result, our current director will continue in office at least until the consummation of the acquisition. If

there is an annual meeting of stockholders for any reason, the Company’s Management has broad discretion regarding proposals submitted

to a vote by shareholders as a consequence of Management’s significant equity interest. Accordingly, the Company’s Management

will continue to exert substantial control at least until the consummation of an acquisition.

Broad

discretion of Management

Any

person who invests in the Company’s common stock will do so without an opportunity to evaluate the specific merits or risks of

any prospective acquisition. As a result, investors will be entirely dependent on the broad discretion and judgment of Management

in connection with the selection of a prospective acquisition. There can be no assurance that determinations made by the Company’s

Management will permit us to achieve the Company’s business objectives.

Reporting

requirements may delay or preclude an acquisition

Pursuant

to the requirements of Section 13 of the Exchange Act, the Company is required to provide certain information about significant

acquisitions and other material events. The Company will continue to be required to file quarterly reports on Form 10-Q and annual

reports on Form 10-K, which annual report must contain the Company’s audited financial statements. As a reporting company under

the Exchange Act, following any acquisition, we will be required to file a report on Form 8-K.

If

the Company is deemed to be an investment company, the Company may be required to institute burdensome compliance requirements

and the Company’s activities may be restricted, which may make it difficult for the Company to enter into an acquisition.

|

|

●

|

restrictions

on the nature of the Company’s investments; and

|

|

|

●

|

restrictions

on the issuance of securities, which may make it difficult for us to complete an acquisition.

|

In

addition, we may have imposed upon us burdensome requirements, including:

|

|

●

|

registration

as an investment company;

|

|

|

●

|

adoption

of a specific form of corporate structure; and

|

|

|

●

|

reporting,

record keeping, voting, proxy and disclosure requirements and other rules and regulations.

|

The

Company does not believe that its anticipated principal activities will subject it to the Investment Company Act of 1940.

The

Company has no “Independent Director”, so actions taken and expenses incurred by our officer and director on behalf

of the Company will generally not be subject to “Independent Review”.

Although

no compensation will be paid to our director for services rendered prior to or in connection with an acquisition, he may receive

reimbursement for out-of-pocket expenses incurred by him in connection with activities on the Company’s behalf such as identifying

potential targets and performing due diligence on suitable acquisitions. There is no limit on the amount of these out-of-pocket

expenses and there will be no review of the reasonableness of the expenses by anyone other than our board of director, which consist

of two directors who may seek reimbursement. If our directors will not be deemed “independent,” they will generally

not have the benefit of independent director examining the propriety of expenses incurred on our behalf and subject to reimbursement.

Although the Company believes that all actions taken by our directors on the Company’s behalf will be in the Company’s best interests,

the Company cannot assure the investor that this will actually be the case. If actions are taken, or expenses are incurred that

are actually not in the Company’s best interests, it could have a material adverse effect on our business and plan of operation

and the price of our stock held by the public stockholders.

General

Economic Risks.

The

Company’s current and future business objectives and plan of operation are likely dependent, in large part, on the state of the

general economy. Adverse changes in economic conditions may adversely affect the Company’s business objective and plan of operation.

These conditions and other factors beyond the Company’s control include also, but are not limited to regulatory changes.

Risks

Related to Our Common Stock

The

Company’s shares of common stock are traded from time to time on the OTC Pink Sheet Market.

Our

common stock is traded on the OTC Pink Sheet Market from time to time. There can be no assurance that there will be a liquid trading

market for the Company’s common stock following an acquisition. In the event that a liquid trading market commences, there can

be no assurance as to the market price of the Company’s shares of common stock, whether any trading market will provide liquidity

to investors, or whether any trading market will be sustained.

Our common stock is subject to the Penny Stock Rules of

the SEC and the trading market in our common stock is limited, which makes transactions in our stock cumbersome and may reduce

the value of an investment in our common stock.

The Securities and Exchange Commission

has adopted Rule 3a51-1 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any

equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject

to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 require:

|

|

●

|

that a broker or dealer approve a person’s account for

transactions in penny stocks; and

|

|

|

●

|

the broker or dealer receive from the investor a written

agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions