As filed with the Securities and Exchange Commission on September 23, 2022

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

EVOFEM BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 2834 | | 20-8527075 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

12400 High Bluff Drive, Suite 600

San Diego, CA 92130

(858) 550-1900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Saundra Pelletier

President and Chief Executive Officer

Evofem Biosciences, Inc.

12400 High Bluff Drive, Suite 600

San Diego, CA 92130

(858) 550-1900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | | | | | | |

| | | | |

Adam C. Lenain, Esq.

Melanie Ruthrauff Levy, Esq.

Mintz, Levin, Cohn, Ferris,

Glovsky and Popeo, P.C.

3580 Carmel Mountain Road, Suite 300

San Diego, CA 92130

Tel: (858) 314-1500 | | Alexander A. Fitzpatrick, Esq.

General Counsel

Evofem Biosciences, Inc.

12400 High Bluff Drive, Suite 600

San Diego, CA 92130

Tel: (858) 550-1900 | | |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☐ | | Accelerated filer ☐ |

Non-accelerated filer x | | Smaller reporting company x |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 23, 2022

PRELIMINARY PROSPECTUS

73,202,299 Shares of Common Stock

Issuable upon Exercise of Outstanding Warrants

This prospectus relates to the resale from time to time, by the selling securityholders identified in this prospectus under the caption “Selling Securityholders” of up to 73,202,299 shares of our common stock which are issuable upon the exercise of outstanding warrants (the Warrants). We previously issued the Warrants to the Selling Securityholders in a private placement, pursuant to a Securities Purchase Agreement, dated April 23, 2020, as amended from time to time.

The Selling Securityholders may, from time to time, sell, transfer or otherwise dispose of any or all of their common stock or interests in their common stock on any stock exchange, market or trading facility on which the common stock is traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. See “Plan of Distribution” in this prospectus for more information. We will not receive any proceeds from the resale or other disposition of the common stock by the Selling Securityholders. However, Evofem will receive the proceeds of any cash exercise of the Warrants. See “Use of Proceeds” beginning on page 9 and “Plan of Distribution” beginning on page 13 of this prospectus for more information.

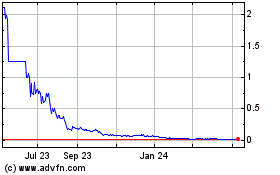

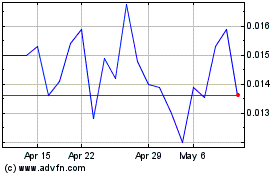

Our common stock is traded on the OTC Pink Market under the symbol “EVFM.” While our common stock is listed on the Nasdaq Capital Market under the symbol “EVFM”, on August 9, 2022, our common stock was suspended from trading on the Nasdaq Capital Market and commenced trading on the OTC Pink Market. On September 22, 2022, the last reported sale price of our common stock as reported on the OTC Pink Market was $0.204 per share.

You should read this prospectus, together with additional information described under the headings “Incorporation of Documents by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk Factors” contained herein and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the Securities and Exchange Commission (the SEC) on March 10, 2022 and our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2022 filed with the SEC on August 12, 2022 and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2022

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should read this prospectus, including the information incorporated by reference herein.

You should rely only on the information we have included or incorporated by reference into this prospectus. Neither we nor the Selling Securityholders have authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference into this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You should not assume the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference herein or therein is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered, or securities are sold, on a later date.

This prospectus contains or incorporates by reference summaries of provisions contained in certain documents and agreements described herein. All the summaries are qualified in their entirety by the actual documents. Copies of some of the documents and/or agreements referred to herein have been filed or have been incorporated by reference as exhibits to the registration statement of which this prospectus forms a part, and you may obtain copies of those documents and/or agreements as described in this prospectus under the heading “Where You Can Find More Information.”

SUMMARY

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all the information you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus . You should read all such documents carefully, especially the risk factors included herein and incorporated by reference herein and our audited consolidated financial statements and the related notes incorporated by reference herein, before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to “Evofem,” “Company,” “we,” “us” and “our” refer to Evofem Biosciences, Inc. and our subsidiaries following the closing of the Merger (as defined below) on the closing date.

Company Overview

We are a San Diego-based commercial-stage biopharmaceutical company committed to developing and commercializing innovative products to address unmet needs in women’s sexual and reproductive health, including hormone-free, woman-controlled contraception and protection from certain sexually transmitted infections (STIs).

Our first commercial product, Phexxi, was approved by the U.S. Food and Drug Administration (FDA) on May 22, 2020 and is the first and only FDA-approved, hormone-free, woman-controlled, on-demand prescription contraceptive gel for women. We commercially launched Phexxi in September 2020 in the United States. We intend to commercialize Phexxi in all other global markets through partnerships or licensing agreements.

We are evaluating Phexxi for two potential new indications: the prevention of chlamydia and the prevention of gonorrhea in women. These are two of the most pervasive STIs in the United States.

Currently, there are no FDA-approved prescription products for the prevention of either of these dangerous infections. In October 2020, we initiated our confirmatory Phase 3 clinical trial of Phexxi for these potential indications (EVOGUARD). We expect top-line results from EVOGUARD by October 31, 2022.

The FDA has designated Phexxi, using the investigational name EVO100 (EVO100), as a Qualified Infectious Disease Product (QIDP) for the prevention of urogenital chlamydia infection and the prevention of urogenital gonorrhea infection in women. The FDA has also granted Fast Track designations to EVO100 for both potential new indications.

EVO200 vaginal gel (EVO200), our investigational candidate for the reduction of recurrent bacterial vaginosis, uses the same proprietary vaginal pH modulator platform as Phexxi. EVO200 has been designated a QIDP by the FDA for this indication. In a Phase 1 dose-finding trial for this indication, the highest dose formulation of the study drug demonstrated reduced vaginal pH for up to seven days following a single administration. We may decide to pursue further development of EVO200 in the future.

Phexxi, EVO200, and other product candidates in development share similar non-hormonal, acid-buffering, bioadhesive properties. However, they are designed differently to target viral and bacterial pathogens while playing an integral role to the survival of healthy bacteria in the vagina, enabling women to achieve better sexual and reproductive health.

Baker Bros. Securities

On April 23, 2020, we entered into a Securities Purchase and Security Agreement (the Baker Purchase Agreement) with certain affiliates of the Selling Securityholders, and Baker Bros. Advisors LP, as designated agent (the Designated Agent), pursuant to which we agreed to issue and sell to the Selling Securityholders (i) convertible senior secured promissory notes (the Baker Notes) in an aggregate principal amount of up to $25.0 million and (ii) warrants to purchase shares of common stock (the Baker Warrants) in a private placement.

At the initial closing date of April 24, 2020 (the Baker Initial Closing), we issued and sold Baker Notes with an aggregate principal amount of $15.0 million (the Baker First Closing Notes) and Baker Warrants exercisable for 204,918 shares of common stock.

Following the Baker Initial Closing, the Selling Securityholders had an option to purchase from us up to $10.0 million of Baker Notes (the Baker Purchase Rights) at the Baker Purchasers’ discretion at any time prior to us receiving at least $100.0 million in aggregate gross proceeds from one or more sales of equity securities.

On June 5, 2020 (the Exercise Date), the Selling Securityholders exercised the Baker Purchase Rights. At the second closing date of June 9, 2020 (the Baker Second Closing), the Selling Securityholders acquired the remaining Baker Notes with an aggregate principal amount of $10.0 million and Baker Warrants exercisable for 136,612 shares of common stock. Upon the completion of our underwritten public offering in June 2020, the exercise price of the Baker Warrants was $36.60 per share. The Baker Warrants have a five-year term with a cashless exercise provision and are immediately exercisable at any time from their respective issuance date.

The gross proceeds from the offering, prior to deducting offering expenses and placement agent fees and expenses payable by us, were approximately $25.0 million.

On November 20, 2021, we entered into the first amendment to the Baker Purchase Agreement (the First Baker Amendment). Under the First Baker Amendment, each Baker Purchaser had the right to convert all or any portion of the Baker Notes into common stock at a conversion price equal to the lesser of (a) $36.60 and (b) 115% of the lowest price per share of common stock (or, as applicable with respect to any equity securities convertible into common stock, 115% of the applicable conversion price) sold in one or more equity financings until we had met a qualified financing threshold. This was defined as one or more equity financings resulting in aggregate gross proceeds to Evofem of at least $50 million (the Financing Threshold).

The First Baker Amendment also extended, effective upon our achievement of the Financing Threshold, the affirmative covenant to achieve $100.0 million in cumulative net sales of Phexxi by June 30, 2022 to June 30, 2023. Additionally per the First Baker Amendment, if in any equity financing closing on or prior to the date on which we met the Financing Threshold, we were required to issue warrants to purchase our common stock (or other similar consideration), then we were also required to issue to the Selling Securityholders an equivalent coverage of warrants (or other similar consideration) on the same terms as if the Selling Securityholders had participated in the financing in an amount equal to the then outstanding principal of the Baker Notes held by the Selling Securityholders. To satisfy this requirement, in connection with the closing of our public offering in May 2022, we issued to the Selling Securityholders warrants to purchase 72,860,769 shares of our common stock at an exercise price of $0.75 per share (the June 2022 Baker Warrants).

On March 21, 2022, we entered into the second amendment to the Baker Purchase Agreement (the Second Baker Amendment), pursuant to which each Baker Purchaser had the right to convert all or any portion of the Baker Notes into common stock at a conversion price equal to the lesser of (a) $5.8065 or (b) 100% of the lowest price per share of common stock (or as applicable with respect to any equity securities convertible into common stock, 100% of the applicable conversion price) sold in any equity financing until we had (i) met the qualified financing threshold by June 30, 2022, defined as a single underwritten financing resulting in aggregate gross proceeds to Evofem of at least $20 million (Qualified Financing Threshold) and (ii) the disclosure of our top-line results from our EVOGUARD clinical trial (the Clinical Trial Milestone) by October 31, 2022. The Second Baker Amendment also provided that the exercise price of the Baker Warrants would equal the conversion price of the Baker Notes. We met the Qualified Financing Threshold upon the closing of our public offering in May 2022, and as of June 30, 2022, the conversion price and exercise price of the Baker Warrants was reset to $0.75.

The Second Baker Amendment also extended, effective upon our achievement of the Qualified Financing Threshold, the affirmative covenant to achieve $100.0 million in cumulative net sales of Phexxi by June 30, 2022 to October 31, 2022, which we achieved in May 2022. The Second Baker Amendment further extends, effective upon achievement of the Clinical Trial Milestone by October 31, 2022, the affirmative covenant to achieve $100.0 million in cumulative net sales of Phexxi to June 30, 2023. We currently anticipate disclosing our top-line results from our EVOGUARD clinical trial in October 2022.

On September 15, 2022, we entered into the Third Baker Amendment. Pursuant to the Third Baker Amendment, among other things, the conversion price of the Baker Notes was amended to equal $0.21, subject to adjustment for certain dilutive equity issuance adjustments for a two-year period, removal of an interest make-whole payment due in certain circumstances, and certain change of control and liquidation payment amounts were reduced from three times the outstanding amounts of the Baker Notes to two times the outstanding amounts of the Baker Notes. In addition, the Third Baker Amendment provides that we may make future interest payments to the Selling Securityholders in kind or in cash, at our option.

This prospectus covers the resale or other disposition by the Selling Securityholders of the shares of common stock issuable upon the exercise of the Baker Warrants and June 2022 Baker Warrants.

Recent Developments

Forbearance Agreements

On September 15, 2022, we entered into agreements as described below, pursuant to which we exchanged approximately $24.7 million of our outstanding unsecured debt obligations into rights to acquire 117,760,093 shares of our common stock and entered into forbearance arrangements with all our remaining lenders for existing defaults.

On September 15, 2022, we entered into (i) a Forbearance Agreement (the Baker Forbearance Agreement) with the Selling Securityholders and Designated Agent, and (ii) a Forbearance Agreement (the Adjuvant Forbearance Agreement, and together with the Baker Forbearance Agreement, the Forbearance Agreements) with Adjuvant Global Health Technology Fund, L.P. and Adjuvant Global Health Technology Fund DE, L.P. (together, the Adjuvant Purchasers). Pursuant to the Forbearance Agreements, the Selling Securityholders and Adjuvant Purchasers agreed, among other things, to forbear from exercising any of their rights and remedies during the Forbearance Period (as defined below), but solely with respect to the specified events of default provided under the Forbearance Agreements. In exchange for the forbearances and the amendments to the Baker Purchase Agreement described below, Evofem agreed to adjust the aggregate balance of the Baker Notes to $44.1 million, which principal amount includes delinquent interest payments that the Selling Securityholders agreed to forego in cash, as well as certain expenses incurred by the Designated Agent.

The “Forbearance Period” means the period from September 15, 2022 to the date on which a Forbearance Termination Event first occurs, and the term “Forbearance Termination Event” shall mean the earliest of: the first date after December 31, 2022 on which our total cash balance falls below $1.0 million, the occurrence of any event of default other than the specified defaults which is not timely cured in accordance with the governing provisions, if any, of the Baker Purchase Agreement or Adjuvant Purchase Agreement (as defined below), as applicable, the failure of us to timely comply with any term or agreement set forth in the Forbearance Agreements in any material respect, an acceleration by the requisite purchasers or investors, as applicable, under and in accordance with (x) the Adjuvant Purchase Agreement or Baker Purchase Agreement, (y) the Securities Purchase Agreement, dated as of March 1, 2022, by and among us and each investor listed therein, or (z) any other indebtedness for borrowed money incurred or guaranteed by any loan party (collectively, the Other Note Agreements), as applicable, the date that we enter into any forbearance or similar agreement with the purchasers or investors, as applicable, under any Other Note Agreement solely to the extent such forbearance or similar agreement requires us to make any payment to such purchasers or investors in cash (excluding, for the avoidance of doubt, (i) permitted payment of regularly scheduled principal and interest and reimbursement of fees and expenses in the ordinary course of business, (ii) the Baker Forbearance Agreement or Adjuvant Forbearance Agreement, as applicable, and the Exchange Agreements (as defined below)), or, the date that we first challenge the validity or enforceability of the actions contemplated under the Forbearance Agreements or the validity or enforceability of the rights of the Selling Securityholders, Adjuvant Purchasers, or Designated Agent under the Baker Purchase Agreement or Adjuvant Purchase Agreement, as applicable (and the ancillary agreements thereunder), or in the case of the Baker Forbearance Agreement, the warrants issued in connection with that certain Underwriting Agreement, dated as of May 20, 2022, by and between the Company and Piper Sandler & Co.

In addition, on September 15, 2022, the Selling Securityholders and Adjuvant Purchasers entered into a Subordination Agreement (the Subordination Agreement), which was accepted and agreed to by us, for the purposes of subordinating the Adjuvant Purchasers’ right of payment under the Existing Adjuvant Notes (as defined below) to the security interest and right of payment of the Selling Securityholders.

Note Exchange Agreements and Common Stock Rights

We previously entered into Amendment and Exchange Agreements (the Amendment and Exchange Agreements) with certain institutional Investors (the Investors), pursuant to which the Investors were issued 5.0% senior subordinated notes with an aggregate principal amount of $22.3 million (the Existing Investor Notes) in exchange for certain securities and senior subordinated notes previously held by the Investors. In addition, we previously entered into a Securities Purchase Agreement (the Adjuvant Purchase Agreement) with the Adjuvant Purchasers, pursuant to which we sold unsecured convertible promissory notes in aggregate principal amount of $25 million of (the Existing Adjuvant Notes) in a private placement.

On September 15, 2022, we entered into Amendment and Exchange Agreements (the Exchange Agreements) with (i) each of the Investors (the Investor Exchange Agreements), pursuant to which the Investors agreed to exchange the Existing Investor Notes for prepaid rights to receive 104,029,723 shares of common stock (such prepaid right, the Rights and such underlying shares of common stock, the Right Shares, collectively with the Rights, the Securities) (the Investor Exchange) and (ii) the Adjuvant Purchasers (the Adjuvant Exchange Agreement), pursuant to which the Adjuvant Purchasers agreed to exchange approximately 10% of the outstanding amount of the Existing Adjuvant Notes for a Right to receive 13,730,370

shares of common stock (the Adjuvant Exchange, and together with the Investor Exchange, the Exchanges). The Investors also waived certain anti-dilution share adjustment provisions with respect to shares underlying warrants held by the Investors.

The Rights obligate us to issue to the Investors or Adjuvant Purchasers, as applicable, upon request (without the payment of additional consideration) an aggregate of 117,760,093 shares of common stock. The number of Right Shares for each Right is initially fixed, but is subject to certain customary adjustments, and, until September 15, 2024, adjustments for certain dilutive equity issuances. The Rights expire on June 28, 2027.

The Investors and Adjuvant Purchasers will not be able to exercise the Rights and receive Right Shares if the Investors or Adjuvant Purchasers (together with the Investors’ or Adjuvant Purchasers’ affiliates, as applicable) would beneficially own more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon exercise of the Right. The Investors and Adjuvant Purchasers may increase the 4.99% ownership limitation, upon no less than 61 days’ prior notice to Evofem, provided that the beneficial ownership limitation may in no event exceed 9.99% of the common stock outstanding immediately after giving effect to the issuance of shares of common stock upon exercise of the Right.

As provided under the Investor Exchange Agreements, following the initial delivery of the Rights to the Investors, the Existing Investor Notes will be exchanged, with us owing no further obligations thereunder. Evofem will not receive any cash proceeds from the issuance of the Securities.

The Exchanges are exempt from registration under Section 3(a)(9) of the Securities Act of 1933, as amended. The Exchange Agreements contain customary representations, warranties, covenants, and other agreements by us, the Investors, and the Adjuvant Purchasers. The representations, warranties, covenants, and other agreements made in the Exchange Agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

Amendment to Adjuvant Purchase Agreements

On September 15, 2022, we also entered into a second amendment (the Second Adjuvant Amendment) to the Adjuvant Purchase Agreement. Pursuant to the Second Adjuvant Amendment, among other things, the conversion price of the Adjuvant Notes was amended to equal $0.21, subject to adjustment for certain dilutive equity issuance adjustments for a two-year period.

As set forth in the Third Baker Amendment and Second Adjuvant Amendment, our obligation to reserve shares of our common stock for issuance pursuant to the Baker Notes and Adjuvant Notes was waived until January 31, 2023 and the holders of warrants to purchase shares of common stock waived certain anti-dilution share adjustment provisions.

Following the completion of the above transactions on September 15, 2022, approximately $44.1 million remained outstanding pursuant to the Baker Notes, approximately $26.0 million remained outstanding pursuant to the Adjuvant Notes and no amounts remained outstanding pursuant to the Investor Notes. The first tranche of the Baker Notes is due on April 24, 2025, and the second tranche is due on June 9, 2025. The Adjuvant Notes are due on October 14, 2025.

Our Corporate Information

We were originally incorporated in Delaware in February 2007 as “Lipothera, Inc.” In September 2008, we changed our name to “Lithera, Inc.” and in August 2014, we changed our name to “Neothetics, Inc.” On January 17, 2018, upon completion of the business combination in accordance with the terms of an Agreement and Plan of Merger and Reorganization, dated as of October 17, 2017, by and among us, Nobelli Merger Sub, Inc., our wholly owned subsidiary (Merger Sub) and Evofem Biosciences Operations, Inc. and its subsidiaries prior to the closing of the Merger (Private Evofem), pursuant to which the Merger Sub merged with and into Private Evofem, with Private Evofem surviving as our wholly owned subsidiary, or the Merger, we changed our name to “Evofem Biosciences, Inc.” Our principal corporate offices are located at 12400 High Bluff Drive, Suite 600, San Diego, California 92130 and our telephone number is (858) 550-1900. Our website is located at www.evofem.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act, will be made available free of charge on our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus supplement solely as an inactive textual reference.

The Offering

| | | | | |

| Common stock offered by the Selling Securityholders | Up to 73,202,299 shares of common stock issuable upon exercise of the Warrants. |

| | | | | |

| Common stock outstanding after this offering | 166,710,718 shares, assuming the exercise in full of the Warrants. |

| | | | | |

| Use of proceeds | We will not receive any proceeds from the sale of shares of common stock offered by the Selling Securityholders under this prospectus. However, Evofem will receive the proceeds of any cash exercise of the Warrants. If we receive proceeds, we currently intend to use the proceeds for the continuation of commercialization activities related to Phexxi; the continuation of our late-stage clinical program developing Phexxi for two potential new indications, the prevention of chlamydia and gonorrhea in women, and related development activities; and other general corporate purposes and other capital expenditures. |

| | | | | |

| Offering Price | The Selling Securityholders may sell all or a portion of their shares through public or private transactions at prevailing market prices or privately negotiated prices. |

| | | | | |

| Listing Information | Our common stock is traded on the OTC Pink Market under the symbol “EVFM.” While our common stock is listed on the Nasdaq Capital Market under the symbol “EVFM”, on August 9, 2022, our common stock was suspended from trading on the Nasdaq Capital Market and commenced trading on the OTC Pink Market. |

| | | | | |

| Risk Factors | An investment in our securities involves a high degree of risk. See the section entitled “Risk Factors” of this prospectus and the similarly titled sections in the documents incorporated by reference into this prospectus. |

The number of shares of our common stock to be outstanding after this offering is based on 79,057,255 shares of common stock outstanding as of June 30, 2022 and excludes as of such date:

•4,420,164 shares of common stock issued pursuant to a consulting arrangement after June 30, 2022 and 666 shares of common stock repurchased after June 30, 2022;

•857,153 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2022, at a weighted-average exercise price of $59.32 per share; 33,372 shares of stock options were forfeited after June 30, 2022, at a weighted-average exercise price of $49.90 per share;

•5,400 shares of common stock issuable upon the exercise of stock options granted after June 30, 2022, with a weighted-average exercise price of $0.88 per share;

•194,257,378 shares of common stock issuable upon the exercise of warrants outstanding as of September 20, 2022, at a weighted-average exercise price of $0.76 per share; 6,281,666 shares of common stock issued in connection with the exercise of warrants after June 30, 2022, at a weighted-average exercise price of $0.62 per share;

•333,907,473 shares of common stock issuable upon conversion of principal and accrued interest underlying issued and outstanding convertible promissory notes assuming a weighted-average conversion price of $0.21 per share, assuming a conversion date of September 20, 2022;

•114,010,093 shares of common stock issuable upon the exercise of rights to receive common stock issued after June 30, 2022; 3,750,000 shares of common stock issued in connection with the exercise of rights after June 30, 2022;

•206,184 shares of common stock reserved for future awards under the Amended and Restated Evofem Biosciences, Inc. 2014 Equity Incentive Plan;

•60,105 shares of common stock reserved for future awards under the Amended 2018 Inducement Equity Incentive Plan; and

•63,703 shares of common stock reserved for future awards under the 2019 Employee Stock Purchase Plan.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks and uncertainties described below and in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC on March 10, 2022 and our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2022 and June 30, 2022, filed with the SEC on May 10, 2022 and August 12, 2012, respectively, and other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could suffer materially. In such event, the trading price of our common stock could decline, and you might lose all or part of your investment.

We have certain obligations pursuant to our issued and outstanding convertible notes and related note purchase agreements, and are currently in Forbearance Agreements with the holders of our convertible notes. Our failure to comply with these terms and the terms of our Forbearance Agreements could have a material adverse effect on our business, financial condition or results of operations. Our stockholders may not receive any value for their investment.

On September 15, 2022, we entered into the Forbearance Agreements with the holders of our issued and outstanding convertible notes. Pursuant to the Forbearance Agreements, the Selling Securityholders and Adjuvant Purchasers, among other things, agreed to forbear from exercising any of their rights and remedies during the Forbearance Period with respect to certain specified events of default provided under the Forbearance Agreements, but only with respect to those specified events of defaults. In exchange for the forbearances and the amendments to the Baker Purchase Agreement and Adjuvant Purchase Agreement, we agreed to adjust the aggregate balance of the Baker Notes to $44.1 million.

The Baker Purchase Agreement, as amended, contains an affirmative covenant requiring us to achieve $100.0 million in cumulative net sales of Phexxi by October 31, 2022. If we achieve the Clinical Trial Milestone by October 31, 2022, this covenant will be extended to June 30, 2023.

The Adjuvant Purchase Agreement, as amended, contains an affirmative covenant for us to achieve $100.0 million in cumulative net sales of Phexxi by June 30, 2023, which was extended from June 30, 2022 upon completion of our public offering in May 2022. While the last subject completed her last visit in EVOGUARD in July 2022 and we continue to expect top-line data from EVOGUARD in October 2022, there can also be no assurance that we will achieve the Clinical Trial Milestone, or that we will achieve $100.0 million in cumulative net sales of Phexxi by any of the relevant deadlines under the Adjuvant Notes and the Baker Notes or at all.

By their terms, these debt arrangements limit our ability to incur debt, merge, or declare dividends. We may also encounter other events of default or potential events of default in the future. Our failure to comply with the terms of our debt arrangements and Forbearance Agreements could have a material adverse effect on our business, financial condition or results of operations. Should amounts owned pursuant to these debt arrangements be accelerated, by redemption or otherwise, at the option of these holders, we will not have sufficient cash resources to make required payments. Any required redemption or acceleration of amounts owed would materially and adversely impact our business, results of operations and financial condition, as well as increase our need to raise additional capital and could cause us to cease our operations entirely. The holders of our debt have rights senior to holders of common stock to make claims on our assets, and, in particular, the Baker Notes are also secured by substantially all of our assets. In the event of a liquidation or other sale event, the holders of our common stock may not receive any value for their investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this prospectus, including statements regarding our strategy, future operations, future financial position, projected costs, prospects, plans and objectives of management, are forward-looking statements. Words such as, but not limited to, “anticipate,” “aim,” “believe,” “contemplate,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “suggest,” “strategy,” “target,” “will,” “would,” and similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus and incorporated by reference into this prospectus, we caution you that these statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. These forward-looking statements include, among other things, statements about:

•our ability to raise additional capital to fund our operations;

•our ability to achieve and sustain profitability;

•our estimates regarding our future performance, including without limitation, any estimates of potential future revenues;

•estimates regarding market size;

•our estimates regarding expenses, revenues, financial performance and capital requirements, including the length of time our capital resources will sustain our operations;

•our ability to continue as a going concern;

•our ability to comply with the provisions and requirements of our debt and forbearance arrangements;

•estimates regarding health care providers’ (HCPs) recommendations of Phexxi® (lactic acid, citric acid, and potassium bitartrate) vaginal gel (Phexxi) to patients;

•the rate and degree of market acceptance of Phexxi;

•our ability to successfully commercialize Phexxi and continue to develop our sales and marketing capabilities;

•our top-line or initial clinical trial data, which are subject to adjustment and revision;

•the results of EVOGUARD, our clinical trial for the prevention of urogenital transmission of Chlamydia trachomatis infection (chlamydia) and Neisseria gonorrhoeae infection (gonorrhea) in women;

•our estimates regarding the effectiveness of our marketing campaigns;

•our strategic plans for our business, including the commercialization of Phexxi;

•the impacts of the ongoing COVID-19 pandemic, including, without limitation, its impact on our business and the commercialization of Phexxi;

•the potential for changes to current regulatory mandates requiring health insurance plans to cover FDA-cleared or -approved contraceptive products without cost sharing;

•our ability to obtain or maintain third-party payer coverage and adequate reimbursement, and our reliance on the willingness of patients to pay out-of-pocket for Phexxi absent full or partial third-party payer reimbursement;

•our ability to obtain the necessary regulatory approvals to market and commercialize Phexxi for prevention of chlamydia and gonorrhea in women, and any other product candidate we may seek to develop;

•the success, cost and timing of our clinical trials;

•our ability to protect and defend our intellectual property position and our reliance on third party licensors;

•our ability to obtain additional patent protection for our product and product candidates;

•our dependence on third parties in the conduct of our clinical trials and for the manufacture of Phexxi and our product candidates;

•our ability to expand our organization to accommodate potential growth; and

•our ability to retain and attract key personnel.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement. Forward-looking statements should be regarded solely as our current plans, estimates and beliefs. You should read this prospectus and the documents that we have filed as exhibits to this prospectus and incorporated by reference herein completely and with the understanding that our actual results may be materially different from the plans, intentions and expectations disclosed in the forward-looking statements we make. Moreover, we operate in a very competitive and rapidly changing environment and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. The

forward-looking statements contained in this prospectus are made as of the date of this prospectus, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise except as required by applicable law.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of common stock offered by the Selling Securityholders under this prospectus. However, Evofem will receive the proceeds of any cash exercise of the Warrants. If all of the Warrants were exercised for cash, we would receive aggregate proceeds of approximately $15.4 million. If we receive proceeds, we currently intend to use the proceeds for the continuation of commercialization activities related to Phexxi; the continuation of our late-stage clinical program developing Phexxi for two potential new indications, the prevention of chlamydia and gonorrhea in women, and related development activities; and other general corporate purposes and other capital expenditures.

SELLING SECURITYHOLDERS

This prospectus covers the resale or other disposition by the Selling Securityholders identified in the table below of up to 73,202,299 shares of common stock issuable upon the exercise of the Warrants.

We are registering the shares of common stock in order to permit the Selling Securityholders to offer the shares of common stock for resale from time to time. The registration of such common stock does not necessarily mean, however, that any of the shares of common stock will be offered or sold by the Selling Securityholders. We will not receive any proceeds from the sale of the common stock by the Selling Securityholders, and we have borne and will continue to bear the costs relating to the registration of these shares of common stock, other than commissions and discounts of agents or broker-dealers and transfer taxes, if any.

The Warrants held by the Selling Securityholders contain limitations which prevent the holder from exercising those Warrants if such exercise would cause the Selling Securityholders, together with certain related parties, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination, common stock issuable upon exercise of the Warrants which have not been exercised.

The table below sets forth, as of September 20, 2022, the following information regarding the Selling Securityholders:

•the name of the Selling Securityholders;

•the number of shares of common stock owned by the Selling Securityholders prior to this offering, without regard to any beneficial ownership limitations contained in the Warrants;

•the number of shares of common stock to be offered by the Selling Securityholders in this offering;

•the number of shares of common stock to be owned by the Selling Securityholders assuming the sale of all of the shares of common stock covered by this prospectus; and

•the percentage of our issued and outstanding shares of common stock to be owned by the Selling Securityholders assuming the sale of all of the common stock covered by this prospectus based on the number of shares of common stock issued and outstanding as of September 20, 2022.

Except as described above, the number of shares of common stock beneficially owned by the Selling Securityholders have been determined in accordance with Rule 13d-3 under the Exchange Act and includes, for such purpose, shares of common stock that the Selling Securityholders have the right to acquire within 60 days after September 20, 2022.

Because the Selling Securityholders identified in the table may sell some or all of the shares of common stock beneficially owned and covered by this prospectus, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares of common stock, no estimate can be given as to the number of shares of common stock available for resale hereby that will be held by the Selling Securityholders upon termination of this offering. In addition, the Selling Securityholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of common stock they beneficially own in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the information set forth in the table below. We have, therefore, assumed for the purposes of the following table, that the Selling Securityholders will sell all of the shares of common stock owned beneficially that are covered by this prospectus, but will not sell any other shares of common stock that they presently own. The Selling Securityholders have not held any position or office, or otherwise had a material relationship, with us or any of our subsidiaries within the past three years other than as a result of the ownership of our common stock or other securities.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Selling Securityholder | | Shares of Common Stock Beneficially Owned prior to the Offering | | Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus | | Shares of Common Stock Beneficially Owned after Offering | | Percentage of Shares Beneficially Owned after Offering(1) |

| Baker Bros. Advisors LP | | 75,785,915 | | 73,202,299 (2) | | 2,583,616 (3) | | 1.55 | % |

(1) Percentage is based on 93,508,419 shares of common stock outstanding as of September 20, 2022, assuming the resale of all of the shares of common stock covered by this prospectus and giving effect to the 4.99% beneficial ownership blockers in the Warrants.

(2) Consists of 67,052,142 shares of common stock underlying Warrants held by Baker Brothers Life Sciences, L.P (BBLS) and 6,150,157 shares of common stock underlying Warrants held by 667, L.P. (667; together with BBLS, the BBA Funds). Baker Bros. Advisors LP (“the Adviser”) is the investment adviser to the BBA Funds and has the sole voting and investment power with respect to the securities held by the BBA Funds and thus may be deemed to beneficially own such securities. Baker Bros. Advisors (GP) LLC (the “Adviser GP”) is the sole general partner of the Adviser and thus may be deemed to beneficially own the securities held by the BBA Funds. The managing members of the Adviser GP are Julian C. Baker and Felix J. Baker, who may be deemed to beneficially own the securities held by the BBA Funds. Julian C. Baker, Felix J. Baker, the Adviser and the Adviser GP disclaim beneficial ownership of all shares held by the Funds, except to the extent of their indirect pecuniary interest therein. The business address of the Adviser, the Adviser GP, Julian C. Baker and Felix J. Baker is 860 Washington Street, 3rd Floor, New York, NY 10014.

(3) Common stock holdings as per Form 13F filed with the SEC on August 15, 2022.

DESCRIPTION OF SECURITIES

Capital Stock

For a description of our capital stock, please see the Description of Securities included as Exhibit 4.22 to our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 10, 2022, which is incorporated by reference herein. See “Incorporation of Documents by Reference” and “Where You Can Find More Information.”

Common Stock

We are registering for resale the shares of common stock issuable upon exercise of the Warrants.

The material terms and provisions of our common stock and each other class of our securities which qualifies or limits our common stock are described in the Description of Securities included as Exhibit 4.22 to our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 10, 2022.

Common Warrants

The following summary of certain terms and provisions of the Warrants to purchase common stock (the Common Warrants) is not complete and is subject to, and qualified in its entirety by, the provisions of the Common Warrant, the form of which is filed as an exhibit to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and incorporated by reference into the registration statement of which this prospectus supplement forms a part. Prospective investors should carefully review the terms and provisions of the form of Common Warrant for a complete description of the terms and conditions of the Common Warrants.

Warrants to purchase up to an aggregate of 341,530 shares of common stock were issued on April 23, 2020 and warrants to purchase up to an aggregate of 72,860,769 shares of common stock were issued on June 28, 2022. As of September 20, 2022, the Warrants were exercisable for an aggregate of 73,202,299 shares of common stock.

Duration and Exercise Price

Each Common Warrant has an exercise price per share equal to $0.21. The Common Warrants are immediately exercisable and will expire on the fifth anniversary of their respective original issuance dates. The exercise price is subject to adjustment for certain dilutive issuances with respect to the Warrants issued in June 2022 and the exercise price and number of shares of common stock issuable upon exercise of the Common Warrants is subject to adjustment in the event of stock dividends, stock splits, reorganizations or similar events.

Exercisability

The Common Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s Common Warrant to the extent that the holder would own more than 4.99% of the outstanding shares of common stock immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the amount of ownership of outstanding shares of common stock after exercising the holder’s Common Warrants up to 19.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Common Warrants. No fractional shares of common stock will be issued in connection with the exercise of a Common Warrant. In lieu of fractional shares, we will either pay the holder an amount in cash equal to the fractional amount multiplied by the exercise price or round up to the next whole share.

Cashless Exercise

A holder may elect to receive upon exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the Common Warrants in lieu of making the cash payment otherwise contemplated upon such exercise in payment of the aggregate exercise price; provided that, with respect to the Warrants issued in June 2022, such election shall only be applicable if, at the time a holder exercises its Common Warrants, a registration statement registering the issuance of the shares of common stock underlying the Common Warrants under the Securities Act is not then effective or available.

Fundamental Transaction

In the event of any fundamental transaction, as described in the Common Warrants issued in June 2022 and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock, then upon any subsequent exercise of a Common Warrant issued in June 2022, the holder of the Common Warrants issued in June 2022 will have the right to receive as alternative consideration, for each

share of common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of common stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of common stock for which the Common Warrant is exercisable immediately prior to such event. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the Common Warrants issued in June 2022 have the right to require us or a successor entity to redeem the Common Warrants for cash in the amount of the Black-Scholes Value (as defined in each Common Warrant) of the unexercised portion of the Common Warrants concurrently with or within 30 days following the consummation of a fundamental transaction. However, in the event of a fundamental transaction which is not in our control, including a fundamental transaction not approved by our board of directors, the holders of these Common Warrants issued in June 2022 will only be entitled to receive from us or our successor entity, as of the date of consummation of such fundamental transaction the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Common Warrant that is being offered and paid to the holders of our common stock in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination of cash and stock, or whether the holders of our common stock are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

In the event of any fundamental transaction as described in the Common Warrants issued in April 2020, and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of common stock for which the consideration of is payable to the holders of our common stock solely in cash, the holder will be eligible to receive a share of this consideration as if the holder had fully exercised the Common Warrant prior to such fundamental transaction. If the Company completes a fundamental transaction where the consideration payable to the holders of its common stock is not comprised solely of cash, then the Common Warrants issued in April 2020 will be assumed by the acquirer or surviving entity and the holder will have the right to receive the consideration for each underlying share of common stock the consideration that would have been issuable upon exercise immediately prior to the closing of the fundamental transaction. If the holders of our common stock are given a choice as to the securities, cash or property to be received in the fundamental transaction, the holders of the Common Warrants issued in April 2020 will have the same choice of consideration.

Transferability

Subject to applicable laws, a Common Warrant may be transferred at the option of the holder upon surrender of the Common Warrant to us together with the appropriate instruments of transfer, opinions and payment of funds sufficient to pay any transfer taxes (if applicable).

Exchange Listing

There is no trading market available for the Common Warrants on any securities exchange or nationally recognized trading system. We do not intend to list the Common Warrants on any securities exchange or nationally recognized trading system.

Right as a Stockholder

Except as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Common Warrants do not have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their Common Warrants.

PLAN OF DISTRIBUTION

The Selling Securityholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from the Selling Securityholders as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Securityholders may use any one or more of the following methods when disposing of shares or interests therein:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the securities as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•broker-dealers may agree with the Selling Securityholders to sell a specified number of such shares at a stipulated price per share;

•a combination of any such methods of sale; and

•any other method permitted pursuant to applicable law.

The Selling Securityholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by it and, if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of Selling Securityholders to include the pledgee, transferee or other successors in interest as Selling Securityholders under this prospectus. The Selling Securityholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the Selling Securityholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The Selling Securityholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The Selling Securityholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Securityholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. The Selling Securityholders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the warrants by payment of cash, however, we will receive the exercise price of the warrants.

The Selling Securityholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that it meets the criteria and conforms to the requirements of that rule.

The Selling Securityholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Any Selling Securityholder who is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the name of the Selling Securityholder, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, and any applicable

commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of certain states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states, the common stock may not be sold unless (i) it has been registered or qualified for sale or (ii) an exemption from registration or qualification requirements is available and is complied with.

We have advised the Selling Securityholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the Selling Securityholders and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the Selling Securityholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Securityholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the Selling Securityholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration of the shares offered by this prospectus.

We have agreed with the Selling Securityholders to keep the registration statement of which this prospectus constitutes a part effective until the earlier of (1) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with such registration statement or (2) the date on which all of the shares may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 of the Securities Act and without the requirement for the Company to be in compliance with the current public information requirement under Rule 144.

LEGAL MATTERS

The validity of the securities being offered by this prospectus supplement will be passed upon for us by Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., San Diego, California.

EXPERTS

The financial statements of Evofem Biosciences, Inc. as of December 31, 2021 and 2020, and for each of the two years in the period ended December 31, 2021 incorporated by reference in this prospectus, have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and auditing.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The documents incorporated by reference into this prospectus supplement contain important information that you should read about us.

The following documents are incorporated by reference into this prospectus supplement:

•our Current Reports on Form 8-K, filed with the SEC on January 13, 2022, February 16, 2022 (as amended by the Current Report Form 8-K/A filed with the SEC on February 16, 2022), February 28, 2022, March 1, 2022, March 21, 2022, March 24, 2022, April 7, 2022 (two filings), May 5, 2022, May 20, 2022, May 23, 2022, May 31, 2022, June 14, 2022, August 3, 2022, August 10, 2022, and September 16, 2022 (except for the information furnished under Items 2.02 or 7.01); and

We also incorporate by reference into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of this prospectus supplement, or (ii) after the date of this prospectus supplement but prior to the termination of the offering. These documents include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits which are specifically incorporated by reference into such documents. Requests should be directed to: Evofem Biosciences, Inc., 12400 High Bluff Drive, Suite 600, San Diego, California 92130, (858) 550-1900.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference into this document will be deemed to be modified or superseded for purposes of the document to the extent that a statement contained in this document or any other subsequently filed document that is deemed to be incorporated by reference into this document modifies or supersedes the statement.

WHERE YOU CAN FIND MORE INFORMATION

The SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. You may access the registration statement, of which this prospectus form is a part, at the SEC’s Internet website. Our reports on Forms 10-K, 10‑Q and 8-K, and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act, are also available for download, free of charge, as soon as reasonably practicable after these reports are filed with the SEC, at our website at www.evofem.com. The content contained in, or that can be accessed through, our website is not a part of this prospectus. In addition, our common stock was listed for trading on The Nasdaq Capital Market under the symbol “EVFM” through August 9, 2022. On August 9, 2022, our common stock was suspended from trading on the Nasdaq Capital Market and commenced trading on the OTC Pink Marketplace under the symbol “EVFM.”

This prospectus is only part of a Registration Statement on Form S-1 that we have filed with the SEC under the Securities Act, and therefore omits certain information contained in the Registration Statement. We have also filed exhibits and schedules with the Registration Statement that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document. You may obtain a copy of these documents and contracts from the SEC’s web site or our web site.

73,202,299 Shares of Common Stock

Issuable upon Exercise of Outstanding Warrants

PROSPECTUS

, 2022

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses, payable by the Company in connection with the registration of the securities being registered. All amounts are estimates except the SEC registration fee.

| | | | | |

| | Amount |

| SEC registration fee | $ | 1,441.99 | |

| Accounting fees and expenses | 30,000.00 | |

| Legal fees and expenses | 40,000.00 | |

| Total expenses | 71,441.99 | |

Item 14. Indemnification of Directors and Officers

Our amended and restated certificate of incorporation and amended and restated bylaws provide that each person who was or is made a party or is threatened to be made a party to or is otherwise involved (including, without limitation, as a witness) in any action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that he or she is or was one of our directors or officers or is or was serving at our request as a director, officer, or trustee of another corporation, or of a partnership, joint venture, trust, or other enterprise, including service with respect to an employee benefit plan, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, or trustee or in any other capacity while serving as a director, officer, or trustee, shall be indemnified and held harmless by us to the fullest extent authorized by the DGCL against all expense, liability, and loss (including attorneys’ fees, judgments, fines, Employment Retirement Income Security Act of 1974 excise taxes or penalties, and amounts paid in settlement) reasonably incurred or suffered by such.

Section 145 of the DGCL permits a corporation to indemnify any director or officer of the corporation against expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with any action, suit, or proceeding brought by reason of the fact that such person is or was a director or officer of the corporation, if such person acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, and, with respect to any criminal action or proceeding, if he or she had no reason to believe his or her conduct was unlawful. In a derivative action, or an action brought by or on behalf of the corporation, indemnification may be provided only for expenses actually and reasonably incurred by any director or officer in connection with the defense or settlement of such an action or suit if such person acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, except that no indemnification shall be provided if such person shall have been adjudged to be liable to the corporation, unless and only to the extent that the court in which the action or suit was brought shall determine that the defendant is fairly and reasonably entitled to indemnity for such expenses despite such adjudication of liability.

Pursuant to Section 102(b)(7) of the DGCL, Article 12 of our amended and restated certificate of incorporation eliminates the liability of a director to us or our stockholders for monetary damages for such a breach of fiduciary duty as a director, except for liabilities arising:

•from any breach of the director’s duty of loyalty to us or our stockholders;

•from acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

•under Section 174 of the DGCL; and

•from any transaction from which the director derived an improper personal benefit.

The foregoing discussion of our amended and restated certificate of incorporation, amended and restated bylaws, indemnification agreements, and Delaware law is not intended to be exhaustive and is qualified in its entirety by such certificate of incorporation, bylaws, indemnification agreements, or law.

We have entered into indemnification agreements with each of our directors and officers. These indemnification agreements may require us, among other things, to indemnify our directors and officers for some expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by a director or officer in any action or proceeding arising out of his or her service as one of our directors or officers, or any of our subsidiaries or any other company or enterprise to which the person provides services at our request.

Insofar as the foregoing provisions permit indemnification of directors, executive officers, or persons controlling us for liability arising under the Securities Act, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 15. Recent Sales of Unregistered Securities

Baker Bros. Notes and Warrants

On April 23, 2020, we entered into the Baker Purchase Agreement with the Selling Securityholders, pursuant to which we agreed to issue and sell to the Selling Securityholders the Baker Notes and the Baker Warrants in a private placement.

At the Baker Initial Closing, we issued and sold the Baker First Closing Notes and Baker Warrants exercisable for 204,918 shares of common stock.

Following the Baker Initial Closing, the Selling Securityholders had an option to purchase from us the Baker Purchase Rights at the Selling Securityholders’ discretion at any time prior to us receiving at least $100.0 million in aggregate gross proceeds from one or more sales of equity securities.

On the Exercise Date, the Selling Securityholders exercised the Baker Purchase Rights. At the Baker Second Closing, the Selling Securityholders acquired the remaining Baker Notes with an aggregate principal amount of $10.0 million and Baker Warrants exercisable for 136,612 shares of common stock.

The Baker Notes, Baker Warrants, June 2022 Baker Warrants, the shares of common stock issuable upon conversion of the Baker Notes, the shares of common stock issuable upon conversion of the Baker Warrants and June 2022 Baker Warrants were issued and sold in reliance upon the exemption from registration contained in Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder.

Adjuvant Notes

On October 14, 2020, we entered into the Adjuvant Purchase Agreement with the Adjuvant Purchasers, pursuant to which we sold the Adjuvant Notes in aggregate principal amount of $25.0 million.

The Adjuvant Notes and the shares of common stock issuable upon conversion of the Adjuvant Notes were issued and sold in reliance upon the exemption from registration contained in Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder.

Series B-2 Preferred Stock Exchange Agreement