As filed with the Securities and Exchange Commission on October 11, 2019

Registration No.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

EOS INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

2844

|

|

30-0873246

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

7F.-1, No. 162, Sec. 2, Zhongshan N. Rd., Zhongshan District

Taipei City 10452, Taiwan

+886-2-2586-8300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

He-Siang Yang

Chief Executive Officer and Chief Financial Officer

7F.-1, No. 162, Sec. 2, Zhongshan N. Rd., Zhongshan District

Taipei City 10452, Taiwan

+886-2-2586-8300- telephone

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

|

Jay Kaplowitz, Esq.

|

|

Huan Lou, Esq.

|

|

Sichenzia Ross Ference LLP

|

|

1185 Avenue of Americas, 37th Floor

|

|

New York, NY 10036

|

|

(212) 930-9700 – telephone

|

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated filer x

|

Smaller reporting company x

|

Emerging growth company x

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount

to be

Registered(1)

|

|

Proposed

Maximum

Offering

Price Per

Share(2)

|

|

Proposed

Maximum

Aggregate

Offering

Price(3)

|

|

|

Amount of

Registration

Fee(3)

|

|

|

Shares of Common Stock, par value $0.001 per share

|

|

|

|

$

|

|

$

|

20,000,000

|

|

|

$

|

2,596.00

|

|

|

Total Registration Fee

|

|

|

|

|

|

$

|

20,000,000

|

|

|

$

|

2,596.00

|

*

|

_________

|

(1)

|

Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this Registration Statement also covers any additional shares of Common Stock which may become issuable to prevent dilution from stock splits, stock dividends and similar events.

|

|

(2)

|

Pursuant to Rule 457(c) of the Securities Act of 1933, as amended, calculated on the basis of the proposed maximum aggregate offering price.

|

|

(3)

|

The registration fee for securities to be offered by the Registrant is based on an estimate of the proposed maximum aggregate offering price of the securities and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o).

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED October 11, 2019

PRELIMINARY PROSPECTUS

Minimum Offering: [ ]Shares of

Common Stock

Maximum Offering: [ ]

Shares of Common Stock

This is a “best efforts” public offering of securities of EOS Inc. (referred to herein as “we”, “us”, “our”, “EOS”, “Registrant”, or the “Company”) conducted by the Company without any investment bank. We may engage a placement agent for this offering in the future. We are selling a minimum of [ ] and a maximum of [ ] shares of common stock of the Company (the “Common Stock”), par value $0.001 per share for an aggregate of $8,000,000 at minimum and $20,000,000 at maximum.

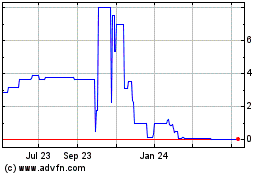

Our Common Stock is quoted on the OTC Markets under the symbol “EOSS.” On September 30, 2019, the last reported sale price per share of our Common Stock was $1.50. The recent market price of our Common Stock set forth herein will not be used to determine the offering price of our Common Stock. There is no active public market for the Common Stock and the prices quoted on the OTCQB may not be indicative of the market price of our Common Stock. The offering price of the Common Stock will be arbitrarily determined and will not necessarily bear any relationship to our assets, results of operations, or book value, or to any other generally accepted criteria of valuation. The offering price is determined through negotiations with the Company and investors. The investors and the Company have set $[ ] per share for the offering price, which will be finalized prior to closing of the offering. We intend to list our Common Stock on the Nasdaq Stock Market (“Nasdaq”) and we will not close this offering until we are approved to list our Common Stock on a national stock exchange market. The Common Stock will be traded under the symbol [] after the closing of this public offering. If the application to Nasdaq is approved, trading of our Common Stock on Nasdaq is expected to begin within five (5) days after the date of issuance of the Common Stock registered herein. We cannot assure you that either our application to list the Common Stock will be approved or we can raise the minimum offering amount of $8,000,000; however, we will not complete this offering without raising the minimum offering amount or receive approval of listing our Common Stock on a national stock exchange market.

The offering will terminate at the earlier of (i) the date at which $20,000,000 of our Common Stock has been sold; (ii) the date on which this offering is terminated by the Company in its sole discretion; or (iii) one hundred and eighty (180) days from the effectiveness of this Registration Statement. Until the offering terminates, the proceeds of the offering will be held in the offering deposit account (“Offering Deposit Account”) and [*] will serve as the Deposit Account Agent.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” starting on page 11 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Number of

Shares of

Common

Stock

Offered by Us

|

|

Public

Offering

Price per

Share

|

|

Total

Initial

Public

Offering

Price

|

|

|

Underwriting Commissions (1)

|

|

|

Proceeds to

Our

Company

Before

Expenses

|

|

|

Minimum

|

|

|

|

$

|

|

$

|

8,000,000

|

|

|

$

|

N/A

|

|

|

$

|

8,000,000

|

|

|

Maximum

|

|

|

|

|

|

$

|

20,000,000

|

|

|

$

|

N/A

|

|

|

|

20,000,000

|

|

Delivery of the shares of our Common Stock is expected to be made on or about ___, 2019.

The date of this prospectus is ______, 2019

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

Unless the context otherwise requires, the terms “EOS,” “EOSS,” “we,” “us” and “our” in this prospectus refer to EOS Inc., and “this offering” refers to the offering contemplated in this prospectus.

PROSPECTUS CONVENTIONS

Except where the context otherwise requires and for purposes of this prospectus only:

“Common Stock” is the common stock of EOS Inc., par value US$0.001 per share;

“APR” or “annual percentage rate” refers to the annual rate that is charged to borrowers, including a fixed interest rate and a transaction fee rate, expressed as a single percentage number that represents the actual yearly cost of borrowing over the life of a loan;

The terms “we,” “us,” “our,” “the Company,” “our Company,” “EOS” or “EOSS” refers to EOS Inc., a Nevada corporation, and all of the Subsidiaries as defined herein unless the context specifies;

The “Board” or “Board of Directors” refers to the board of directors of the Company;

“Subsidiary” or “Subsidiaries,” refer to Emperor Star International Trade Co., LTD, EOS International Inc., A-Best Wire Harness & Components Co., Ltd., and Shanghai Maosong Trading Co., Ltd.;

Emperor Star International Trade Co., LTD or “Emperor Star” refers to a corporation formed under the laws of Taiwan and wholly-owned subsidiary of EOS;

EOS BVI means EOS International Inc., a British Virgin Islands corporation and a wholly-owned subsidiary of EOS;

Maosong Trading means Shanghai Maosong Trading Co., Ltd., a corporation formed under the laws of People’s Republic of China and wholly-owned subsidiary of EOS BVI;

A-Best refers to A-Best Wire Harness & Components Co., Ltd., a corporation formed under the laws of Taiwan, 51% of which will be held by EOS upon the completion of the Stock Purchase Agreement;

“China”, “mainland China” and “P.R.C.” refer to the People’s Republic of China, excluding Taiwan, Hong Kong or Macau for purposes of this prospectus;

“R.O.C.” or “Taiwan” refers to Taiwan, the Republic of China;

All references to “NTD” and “New Taiwan Dollars” are to the legal currency of R.O.C.; and

All references to “U.S. dollars”, “dollars”, and “$” are to the legal currency of the U.S.

This prospectus specifies certain NTD amounts and in parenthesis the approximate U.S. dollar amounts at the exchange rate on the date of this prospectus. The conversion rates regarding NTD and U.S. dollars are subject to change and, therefore, we can provide no assurance that U.S. dollar amounts specified in this prospectus will not change.

For clarification, this prospectus follows English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English.

INDUSTRY AND MARKET DATA

This prospectus includes information with respect to market and industry conditions and market share from third-party sources or based upon estimates using such sources when available. We have not, directly or indirectly, sponsored or participated in the publication of any of such materials. We believe that such information and estimates are reasonable and reliable. We also assume the information extracted from publications of third-party sources has been accurately reproduced. We understand that the Company would be liable for the information included in this prospectus if any part of the information was incorrect, misleading or imprecise to a material extent.

A-BEST ACQUISITION

As disclosed in a current report on Form 8-k filed with the Securities and Exchange Commission (the “SEC”) on August 13, 2019, the Company, A-Best, and Mr. Ing-Ming Lai, the principal shareholder and Chief Executive Officer of A-Best, entered into a purchase agreement (“Stock Purchase Agreement”) dated August 7, 2019, pursuant to which the Company shall acquire 31% of the issued and outstanding equity interest in A-Best (the “Acquisition”) and as consideration issue ten million (10,000,000) shares (the “Stock Consideration”) of its Common Stock to Mr. Ing-Ming Lai and pay Mr. Ing-Ming Lai fifty-five million (55,000,000) new Taiwanese dollars (“NTD”) (the “Cash Consideration”), subject to the terms of the Stock Purchase Agreement. The Company currently owns 20% of the issued and outstanding equity interest in A-Best as of the date of this prospectus.

The parties to the Stock Purchase Agreement are in the process of completing the stock issuance process and closing the Stock Purchase Agreement as of the date of this Prospectus. Upon consummation of the Stock Purchase Agreement, the Company shall hold a sum of 51% of the issued and outstanding equity interest in A-Best. However, we cannot provide any assurance that we will consummate the transactions set forth in the Stock Purchase Agreement as expected or at all.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Company Overview

EOS Inc. markets and distributes a variety of consumer products selected based on its understanding of the demand for each of its products. EOS conducts its business primarily in Asia, including the People’s Republic of China (“PRC”), Taiwan, Singapore and Malaysia. The principal products that EOS markets and sells through its subsidiaries include Nine Layer Transformation Hair Cream, Deep Seawater Mineral Extract, and Lifegenes & Youthgenes.

Nine Layer Transformation Hair Cream is hair-coloring product that darkens the user’s hair color to brown or black while nourishing the hair. Deep Seawater Mineral Extract is a dietary supplement that is designed to enhance the overall health and appearance of the consumer. Both Lifegenes and Youthgenes are dietary supplements designed to improve the consumer’s health. The sales of Nine Layer Transformation Hair Cream and Deep Seawater Mineral Extract accounted for approximately 3% of our gross revenue during the year ended December 31, 2018 and 27% during the six months ended June 30, 2019, respectively. The sales of Lifegenes & Youthgenes accounted for approximately 20% of our gross revenue during the year ended December 31, 2018 and 25% during the six months ended June 30, 2019, respectively. The sales of household water purifying machines contributed to approximately one third of our revenue during the year ended December 31, 2018 and 18% during the six months ended June 30, 2019, respectively. The rest of our revenue came from sales of other dietary supplements and management software for those periods. EOS, through one of its wholly-owned subsidiaries, entered into a product supply agreement (“Fortune King Product Supply Agreement”) with Fortune King (HK) Trading Limited (“Fortune King”), a company formed under the laws of Hong Kong, to provide and sell any products that Fortune King orders from EOS and its subsidiaries. Pursuant to the Fortune King Product Supply Agreement, we agreed to provide products ordered by Fortune King within five business days from the order date and the products we sell should not expire within the next one year from the supply time. The Fortune King Product Supply Agreement became effective on October 1, 2018 and was extended to September 30, 2021. We provide marketing information on the products we sell and training services to Fortune King. During the year ended December 31, 2018 and six months ended June 30, 2019, the majority of EOS’ sales of Nine Layer Transformation Hair Cream, Deep Seawater Mineral Extract, Lifegenes, Youthgenes, and household water purifying machines were to Fortune King. As of June 30, 2019, Fortune King was a related party of us because the founder and officer of Fortune King was a shareholder of EOS. On or about June 30, 2019, the founder and officer of Fortune King transferred her equity interest in the Company and therefore Fortune King is no longer a related party to the Company. Fortune King distributes the products it purchases from us to representatives and retail stores primarily in mainland China and Hong Kong. In the year of 2018 and first half of 2019, Fortune King rented stores in Quanzhou, China and Singapore to sell house water purifying machines. We generally do not maintain large inventories of products because we do not order products for the wholesale customers until the wholesale clients place orders with us. All payments for products we sell through our wholesale channel must be paid in advance in cash. None of the products we distribute is seasonal.

In addition, EOS has recently formed an exclusive distribution relationship with A-Best Wire Harness & Components Co., Ltd. (“A-Best”) to market and distribute ceramic speakers globally and is acquiring the majority equity interest in A-Best pursuant to the Stock Purchase Agreement as described below. A-Best, a Taiwanese corporation and a 20% owned Subsidiary of the Company, is in the business of designing and developing high-performance ceramic speakers, primarily to be used as part of electronic devices. A-Best is currently focused on improving the speaker’s bass sound range to meet the requirements of the potential purchasers. Compal, Inc., an original design manufacturer for electronic devices of certain well-known brands, such as Sony, has tested A-Best speakers and requested A-Best to improve the bass of the speakers before it putting large orders. Meanwhile, EOS has invited two leading cell phone manufacturers to conduct preliminary testing on the module of the current generation A-Best ceramic speakers. EOS and A-Best plan to continue working with the potential purchasers to improve the sound quality and make adjustments to meet the specific requirements of each potential purchaser. A-Best and EOS did not receive any order for the current generation of the ceramic speakers as of the date of this prospectus.

In the past, EOS sold house water purifying machines through two of its wholly-owned subsidiaries, which generated substantial income for the Company. However, because our previous supplier could not provide the updated generation of the house water purifying machines, in April 2019 we decided not to renew the agreement with our supplier of the water purifying machines and therefore temporarily ceased this line of business. The Company still believes that the PRC and greater Asia region have need for clean water and that there is high demands for water purifying machines in the region. In the next six to twelve months, the Company hopes to reengage in reselling industrial and residential water purifying machines with a new distribution model. The Company is currently reviewing the PRC market to find a different distribution method to sell water purifying machines. It plans to form strategic relationship with a real estate company to sell water purifying machines to high-end apartment complexes and office buildings such real estate company builds in China. As of the date of this prospectus, EOS was in discussions with a local engineering company and a real estate company in Shanghai, China with the intent to provide comprehensive water purifying solutions to the apartment complexes and office buildings that the real estate company constructs in the future; however, no binding agreements have been reached and there can be no assurance that we will enter into any definitive agreements in the future on commercially reasonable terms or at all.

Upon closing of the Acquisition, the Company shall have four wholly-owned subsidiaries and one majority-owned subsidiary. The following chart illustrates the corporate structure of EOS upon closing of the Acquisition.

Recent Developments

A-Best Acquisition and Ceramic Speaker Business Development

On August 7, 2019, EOS, A-Best and Ing-Ming Lai, a Taiwanese individual and the majority shareholder of A-Best, entered into a purchase agreement (the “Stock Purchase Agreement”), pursuant to which, subject to the terms and conditions therein, the Company shall purchase thirty-one percent (31%) of the issued and outstanding equity interest in A-Best and as consideration, issue ten million (10,000,000) shares (the “Stock Consideration”) of its common stock (the “Common Stock”) to Ing-Ming Lai and pay Ing-Ming Lai fifty-five million (55,000,000) new Taiwanese dollars (“NTD”) (the “Cash Consideration”). The Company currently owns twenty percent (20%) of equity securities in A-Best, and will subsequently own a total of fifty-one percent (51%) of issued and outstanding A-Best shares when Ing-Ming Lai completes transferring his 31% of A-Best’s equity to the Company in accordance with the Stock Purchase Agreement. In addition, pursuant to the Purchase Agreement, the Company shall pay the Cash Consideration to Ing-Ming Lai if and only if the Company successfully completes an initial public offering (the “IPO”) of its common stock, with gross proceeds of no less than $5,000,000 USD.

In connection with the Stock Purchase Agreement, on August 7, 2019, the Company, A-Best, and Ing Ming Lai entered into an exclusive sales agreement (the “Exclusive Sales Agreement”), pursuant to which the Company is granted the right as the exclusive distributor to sell all of A-Best’s products, including its Micro-ceramic magnetic resonance speakers in the world, and the right to use A-Best’s trademarks and copyrights in connection with the sale of such products. The term of the Exclusive Sales Agreement shall be three (3) years from execution and be automatically renewed for another term of three (3) years unless one party gives the other parties a written notice of termination three (3) months before the end of the term.

In connection with the Stock Purchase Agreement, on August 7, 2019, the Company and Ing-Ming Lai entered into a management agreement (the “Management Agreement”), pursuant to which the Company has agreed to maintain A-Best’s existing operations and Ing-Ming Lai’s positions as A-Best’s President and Chief Executive Officer, until A-Best’s board of directors decides to terminate the terms of his positions. Pursuant to the Management Agreement, the Company shall also designate one individual to A-Best’s board of directors, and A-Best’s board of directors shall continue to maintain two director seats, where at least one of the two directors is designated by the Company until the Parties either reach a shareholder agreement or A-Best receives additional capital investment in equity or debt. The Management Agreement became effective upon execution. There can be no assurance that we and A-Best will consummate the transactions as contemplated in the Stock Purchase Agreement, Exclusive Sales Agreement and Management Agreement as expected or at all.

Strategy

Key elements of our business strategy include:

|

|

·

|

Focusing on marketing and distributing A-Best ceramic speakers;

|

|

|

|

|

|

|

·

|

Focusing on developing the wholesale strategy to distribute industrial and residential water purifying machines in mainland China; and

|

|

|

|

|

|

|

·

|

Continuing distributing dietary supplements and cosmetics in Asia.

|

Our management team has extensive experiences across a wide range of marketing, sales, and product development and we have purchased selective products based on the needs of the consumers in Asia. Our current sales efforts focus on health-improvement products, such as mineral water and dietary supplements and our management targets health-conscious consumers. We expect to continue this strategy, which we believe has been effective for the past several years of our operations.

Material Risks and Challenges

We face substantial competition from a great many established and emerging trading, marketing and distributing companies that develop, distribute or sell health-enhancement products and speakers. Our current and potential competitors include large and specialty distribution and trading companies. Many of our current and potential competitors have substantially greater financial, technical and human resources than we do and significantly more experience in the marketing, development and distribution of products, which could place us at a significant competitive disadvantage or reduce our market share. Typically, our competitors will most likely have more capital resources to support their products than we do. In addition, you should carefully consider the risks described under the “Risk Factors” section beginning on page 11 before investing in us. Some of these risks are:

|

|

·

|

Risk associated with our profitability including, but not limited to:

|

|

|

|

○

|

We may not become profitable in the foreseeable future.

|

|

|

|

·

|

Risk associated with the development, marketing, and distribution of our products, including but not limited to:

|

|

|

·

|

Risks associated with intellectual property including but not limited to:

|

|

|

|

○

|

We or A-Best may not be successful in obtaining or maintaining patents or other relating rights necessary to the development of A-best speakers;

|

|

|

|

|

|

|

|

|

○

|

The intellectual property rights underlying our products may expire or be terminated due to lack of maintenance;

|

|

|

·

|

Risks associated with our business model including, but not limited to:

|

|

|

|

○

|

We face competition from entities that sell and distribute merchandise similar to the products we distribute for A.C., including dietary supplements and skincare products; and

|

|

|

|

|

|

|

|

|

○

|

We depend primarily upon a sole wholesale customer for our sales and our revenue may be significantly impaired if our major customer terminates the distribution agreement with us and we are unable to promptly find a replacement for such customer.

|

|

|

|

|

|

|

|

|

○

|

Our Acquisition of A-Best may not be consummated as expected or at all.

|

|

|

|

|

|

|

|

|

○

|

We and A-Best may not able to sell A-Best speakers as expected or at all.

|

|

|

|

|

|

|

|

|

○

|

Our proposal to develop a business line to distribute household water purifying machines in Shanghai, China may not be successful.

|

|

|

·

|

Risk associated with our Common Stock and this Offering including without limitation:

|

|

|

|

○

|

The market prices and trading volumes of the Common Stock may be volatile and may be affected by economic conditions beyond our control;

|

|

|

|

|

|

|

|

|

○

|

There is no established trading market for either our Common Stock and such market may never develop;

|

|

|

|

|

|

|

|

|

○

|

Investors purchasing shares of our Common Stock will suffer immediate and substantial dilution; and

|

|

|

|

○

|

Currency fluctuations may adversely affect the prices of our Common Stock.

|

These and other risks described in this prospectus could materially and adversely impact our business, financial condition, operating results and cash flow, which could cause the trading price of our Common Stock to decline and could result in a loss of your investment.

Corporate Information

EOS was incorporated under the laws of the State of Nevada on April 3, 2015. EOS BVI was incorporated under the laws of British Virgin Islands on September 20, 2018. Maosong Trading was incorporated under the laws of PRC on March 1, 2019. A-Best was incorporated under the laws of Taiwan on March 1, 1994. Emperor Star was formed under the laws of Taiwan on November 16, 2015. Emperor Star, A-Best, Maosong Trading and EOS BVI are four operating Subsidiaries of the Company.

Our principal executive office is located at 7F.-1, No. 162, Sec. 2, Zhongshan N. Rd., Zhongshan District, Taipei City 10452, Taiwan. Our telephone number at our principal executive office is +886-2-2586-8300. Our corporate website is http://eosinc999.us/. The information on our corporate website is not part of, and is not incorporated by reference into, this prospectus.

THE OFFERING

|

Assumed offering price per share of Common Stock

|

|

We currently estimate that the public offering price will be US$[ ] per share (“Public Offering Price”).

|

|

|

|

|

|

Shares of Common Stock offered by us

|

|

A minimum of [ ] shares of Common Stock on a “best-efforts” basis up to a maximum of [ ] shares of Common Stock on a “best efforts” basis at an anticipated offering price of $[ ] per share. If we do not raise the aggregate minimum offering amount of $8,000,000 (the “Minimum Amount”), we will not conduct a closing of our offering and will return to investors all amounts previously deposited by them in escrow, without interest or deduction. Prior to the closing of our offering, all funds delivered as payment for the securities offering hereby shall be deposited in a non-interest bearing escrow account (“Escrow Account”) at [ ] Bank maintained by [ ] (the “Deposit Account Agent”) as deposit account agent for the investors in the offering.

|

|

|

|

|

|

Shares of Common Stock outstanding immediately before this offering

|

|

74,122,997 shares of Common Stock as of October 1, 2019, without giving effect to the A-Best Acquisition.

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock outstanding immediately after this offering

|

|

[ ] shares at minimum, and [ ] shares at maximum.

|

|

|

|

|

|

Gross Proceeds

|

|

US$8,000,000 at minimum, and $20,000,000 at maximum.

|

|

|

|

|

|

Term of Our Offering

|

|

The Common Stock is being offered by the Company for a period of one hundred and eighty (180) days commencing on the date of this prospectus. If the minimum amount of the Company’s offering is not raised within such period, all subscription funds in the Offering Deposit Account will be returned to the investors promptly without interest or deduction of any fees. The Company’s offering may close or terminate, as the case may be, on the earlier of (i) the date at which the Maximum Amount of Common Stock has been sold; (ii) the date on which this offering is terminated by the Company in its sole discretion; or (iii) one hundred and eighty (180) days from the effective date of this prospectus, or the expiration date.

|

|

|

|

|

|

Offering Deposit Account

|

|

The gross proceeds from the sale of the shares of our Common Stock in this offering will be deposited in a non-interest bearing escrow account maintained by the deposit account agent, [ ] (the “Deposit Account Agent”). All checks will be deposited directly into the Offering Deposit Account and all wire transfers will be wired directly to the Offering Deposit Account at [ *] Bank. The funds will be held in escrow until the Deposit Account Agent has advised us that it has received a minimum of $8,000,000, the minimum offering, in cleared funds. If we do not receive the Minimum Amount by [●], 2019, all funds will be returned to purchasers in this offering on the next business day after the termination of the offering, without charge, deduction or interest. Prior to [●], 2019, in no event will funds be returned to you unless the offering is terminated. You will only be entitled to receive a refund of your subscription price if we do not raise the Minimum Amount by [●], 2019. No interest will be paid either to us or to you. See “Deposit Account Agent and Deposit of Offering Proceeds.”

|

|

|

|

|

|

Use of proceeds

|

|

We plan to use the net proceeds we will receive from this offering for general corporate purposes, including without limitation, the production of water purifying systems, establishing an office in Shanghai, China and recruiting a sales and customer service team in Shanghai, China. See “Use of Proceeds” on page 28 for more information.

|

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” and other information included in this prospectus for a discussion of the risks relating to investing in our Common Stock. You should carefully consider these risks before deciding to invest in our Common Stock.

|

|

|

|

|

|

Listing

|

|

We intend to apply to list the Common Stock on the Nasdaq. However, we cannot assure you that our Common Stock will be listed on the Nasdaq. We will not close this offering without receiving a listing approval letter of our Common Stock from a national stock exchange.

|

SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following unaudited pro forma condensed consolidated balance sheet at June 30, 2019 of EOS and its subsidiaries (collectively “EOS”) gives effect to the acquisition of an aggregate of fifty-one percent (51%) equity securities in A-Best pursuant to the Investment Cooperation Agreement dated on January 15, 2019 and the Stock Purchase Agreement dated on August 7, 2019 (collectively “Purchase”) as if the Purchase had occurred on January 1, 2019. The following unaudited pro forma condensed consolidated statement of operations for the year ended December 31, 2018 and for the six months ended June 30, 2019 were prepared assuming that the transactions described above were consummated as of the beginning of the periods presented.

Such unaudited pro forma financial information is based on the historical consolidated financial statements of EOS and A-Best and certain adjustments which EOS believes to be reasonable, to give effect of the Purchase, which are described in the notes to the statements below.

The unaudited pro forma financial information:

|

|

·

|

does not purport to represent what the consolidated results of operations actually would have been if the acquisition of 51% equity securities in A-Best had occurred on the beginning of the periods presented or what those results will be for any future periods or what the consolidated balance sheet would have been if the acquisition of 51% equity securities in the A-Best had occurred on January 1, 2019.

|

|

|

|

|

|

|

·

|

has not been adjusted to reflect any matters not directly attributable to implementing the acquisition of A-Best. No adjustment, therefore, has been made for actions which may be taken once the acquisition was completed, such as any of our integration plans related to A-Best. As a result, the actual amounts recorded in the consolidated financial statements of EOS will differ from the amounts reflected in the unaudited pro forma condensed consolidated financial statements, and the differences may be material.

|

|

|

|

|

SELECTED UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

|

|

|

As of June 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Historical

|

|

|

Historical

|

|

|

Pro Forma

|

|

|

|

|

Consolidated

|

|

|

|

|

EOS

|

|

|

A-Best

|

|

|

Adjustments

|

|

|

Note

|

|

Pro Forma

|

|

|

Assets

|

|

|

Current Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

7,622

|

|

|

$

|

212

|

|

|

$

|

-

|

|

|

|

|

$

|

7,834

|

|

|

Accounts receivable, net

|

|

|

351,268

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

351,268

|

|

|

Accounts receivable, net – related parties

|

|

|

1,146,045

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

1,146,045

|

|

|

Inventory, net

|

|

|

2,084

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

2,084

|

|

|

Advance to suppliers

|

|

|

76,541

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

76,541

|

|

|

Prepaid expenses and other current assets

|

|

|

28,162

|

|

|

|

24,420

|

|

|

|

-

|

|

|

|

|

|

52,582

|

|

|

Operating lease right-of-use assets – current

|

|

|

-

|

|

|

|

8,622

|

|

|

|

-

|

|

|

|

|

|

8,622

|

|

|

Total current assets

|

|

|

1,611,722

|

|

|

|

33,254

|

|

|

|

-

|

|

|

|

|

|

1,644,976

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

7,574

|

|

|

|

1,004

|

|

|

|

-

|

|

|

|

|

|

8,578

|

|

|

Operating lease right-of-use assets

|

|

|

41,778

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

41,778

|

|

|

Security deposit

|

|

|

6,615

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

6,615

|

|

|

Long-term investment

|

|

|

30,000

|

|

|

|

-

|

|

|

|

(30,000

|

)

|

|

(a), (b), (c)

|

|

|

-

|

|

|

Goodwill, net

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

(b)

|

|

|

-

|

|

|

Total Assets

|

|

$

|

1,697,689

|

|

|

$

|

34,258

|

|

|

$

|

(30,000

|

)

|

|

|

|

$

|

1,701,947

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

715

|

|

|

$

|

505

|

|

|

$

|

-

|

|

|

|

|

$

|

1,220

|

|

|

Accrued expenses and other current liabilities

|

|

|

56,660

|

|

|

|

6,666

|

|

|

|

-

|

|

|

|

|

|

63,326

|

|

|

Due to related parties

|

|

|

76,435

|

|

|

|

1,253,557

|

|

|

|

1,743,500

|

|

|

(a)

|

|

|

3,073,492

|

|

|

Income tax payable

|

|

|

30,262

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

30,262

|

|

|

Operating lease liabilities – current

|

|

|

21,398

|

|

|

|

8,622

|

|

|

|

-

|

|

|

|

|

|

30,020

|

|

|

Total current liabilities

|

|

|

185,470

|

|

|

|

1,269,350

|

|

|

|

1,743,500

|

|

|

|

|

|

3,198,320

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities – noncurrent

|

|

|

20,380

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

20,380

|

|

|

Total liabilities

|

|

|

205,850

|

|

|

|

1,269,350

|

|

|

|

1,743,500

|

|

|

|

|

|

3,218,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity (Deficit)

|

|

|

1,491,839

|

|

|

|

(1,235,092

|

)

|

|

|

(1,773,500

|

)

|

|

|

|

|

(1,516,753

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity

|

|

$

|

1,697,689

|

|

|

$

|

34,258

|

|

|

$

|

(30,000

|

)

|

|

|

|

$

|

1,701,947

|

|

|

|

|

SELECTED UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

|

|

For the Six Months Ended June 30, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Historical

|

|

|

Historical

|

|

|

Pro Forma

|

|

|

|

|

Consolidated

|

|

|

|

|

EOS

|

|

|

A-Best

|

|

|

Adjustment

|

|

|

Note

|

|

Pro Forma

|

|

|

Net sales

|

|

$

|

57,805

|

|

|

$

|

8,555

|

|

|

$

|

-

|

|

|

|

|

$

|

66,360

|

|

|

Net sales – related parties

|

|

|

180,367

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

180,367

|

|

|

Total

|

|

|

238,172

|

|

|

|

8,555

|

|

|

|

-

|

|

|

|

|

|

246,727

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

44,821

|

|

|

|

7,656

|

|

|

|

-

|

|

|

|

|

|

52,477

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

193,351

|

|

|

|

899

|

|

|

|

-

|

|

|

|

|

|

194,250

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

373,930

|

|

|

|

37,225

|

|

|

|

-

|

|

|

|

|

|

411,155

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(180,579

|

)

|

|

|

(36,326

|

)

|

|

|

-

|

|

|

|

|

|

(216,905

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

48

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

48

|

|

|

Other income

|

|

|

-

|

|

|

|

71

|

|

|

|

-

|

|

|

|

|

|

71

|

|

|

Gain (loss) on foreign currency exchange

|

|

|

12,525

|

|

|

|

147

|

|

|

|

-

|

|

|

|

|

|

12,672

|

|

|

Gain (loss) on investment in equity securities

|

|

|

(2,426

|

)

|

|

|

-

|

|

|

|

2,426

|

|

|

(c)

|

|

|

-

|

|

|

Total other income (expense)

|

|

|

10,147

|

|

|

|

218

|

|

|

|

2,426

|

|

|

|

|

|

12,791

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax provision

|

|

|

(170,432

|

)

|

|

|

(36,108

|

)

|

|

|

2,426

|

|

|

|

|

|

(204,114

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(170,432

|

)

|

|

|

(36,108

|

)

|

|

|

2,426

|

|

|

|

|

|

(204,114

|

)

|

|

Comprehensive Income (Loss)

|

|

$

|

(179,375

|

)

|

|

$

|

(17,378

|

)

|

|

$

|

20,119

|

|

|

|

|

$

|

(176,634

|

)

|

|

SELECTED UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

|

|

For the Year Ended December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Historical

|

|

|

Historical

|

|

|

Pro Forma

|

|

|

|

|

Consolidated

|

|

|

|

|

EOS

|

|

|

A-Best

|

|

|

Adjustment

|

|

|

Note

|

|

Pro Forma

|

|

|

Net sales

|

|

$

|

536,616

|

|

|

$

|

30,446

|

|

|

$

|

-

|

|

|

|

|

$

|

567,062

|

|

|

Net sales – related parties

|

|

|

1,241,329

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

1,241,329

|

|

|

Total

|

|

|

1,777,945

|

|

|

|

30,446

|

|

|

|

-

|

|

|

|

|

|

1,808,391

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

216,505

|

|

|

|

24,468

|

|

|

|

-

|

|

|

|

|

|

240,973

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

1,561,440

|

|

|

|

5,978

|

|

|

|

-

|

|

|

|

|

|

1,567,418

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

547,680

|

|

|

|

69,057

|

|

|

|

-

|

|

|

|

|

|

616,737

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

1,013,760

|

|

|

|

(63,079

|

)

|

|

|

-

|

|

|

|

|

|

950,681

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

81

|

|

|

|

3

|

|

|

|

-

|

|

|

|

|

|

84

|

|

|

Other income

|

|

|

1,991

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

1,991

|

|

|

Sublease income – related parties

|

|

|

-

|

|

|

|

1,992

|

|

|

|

-

|

|

|

|

|

|

1,992

|

|

|

Gain (loss) on foreign currency exchange

|

|

|

31,288

|

|

|

|

6

|

|

|

|

-

|

|

|

|

|

|

31,294

|

|

|

Total other income

|

|

|

33,360

|

|

|

|

2,001

|

|

|

|

-

|

|

|

|

|

|

35,361

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income tax provision

|

|

|

1,047,120

|

|

|

|

(61,078

|

)

|

|

|

-

|

|

|

|

|

|

986,042

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision

|

|

|

17,795

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

17,795

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

1,029,325

|

|

|

|

(61,078

|

)

|

|

|

-

|

|

|

|

|

|

968,247

|

|

|

Comprehensive Income (Loss)

|

|

$

|

1,005,306

|

|

|

$

|

(24,757

|

)

|

|

|

-

|

|

|

|

|

$

|

980,549

|

|

RISK FACTORS

Investing in our securities includes a high degree of risk. Prior to making a decision about investing in our securities, you should consider carefully the specific factors discussed below, together with all of the other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. This could cause the market price of our Common Stock to decline and could cause you to lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We have only a limited history upon which an evaluation of our prospects and future performance can be made, and have incurred losses in recent periods. Since we have a limited operating history, it may be difficult to predict our future operating results.

We were incorporated in the State of Nevada on April 3, 2015, and as a result, we have only a limited history upon which an evaluation of our prospects and future performance can be made, and have no history of profitable operations on a consolidated basis. We may continue to sustain losses in the future as we implement our business plan. There can be no assurance that we will ever regain profitability. Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. Our business is dependent upon the implementation of our business plan. We may not be successful in implementing such plan, and cannot guarantee that, if implemented, we will ultimately be able to attain profitability.

We will need to obtain additional financing to fund our operations.

We will need additional capital in the future to continue to execute our business plan. In that case, we would be dependent upon additional capital in the form of either debt or equity to continue our operations and commercialize our products. We may not be able to arrange enough investment within the time the investment is required, or, if it is arranged, that it will be on favorable terms.

Failure to raise the necessary capital could restrict our growth, limit our development of new products, and hinder our ability to compete.

Any of these aforementioned consequences would have a materially adverse effect on our business, operations, and financial position. If we cannot obtain the needed capital, we may not be able to become profitable, and may have to curtail or cease our operations.

We have incurred losses, and we anticipate that we will continue to incur losses in the future.

For the three and six months ended June 30, 2019, our net losses were $153,460, and $170,432, respectively, compared to net income of $178,033 and $116,175, respectively, for the corresponding periods in the preceding year. We anticipate continuing to incur substantial additional losses over at least the next twelve months due to, among other factors, our business development of the water purifying machine project in Shanghai, China. We may never regain profitability, and, even if we do, we may not be able to sustain being profitable.

We currently have no customers for the ceramic speakers we plan to sell and no rights to the technology.

Although certain potential purchasers of the ceramic speakers A-Best is developing have tested the product, we need to make certain technical improvements potential purchasers have requested, and we have no commitments to purchase any speakers. While some technologies of the A-Best speakers are protected by certain patents, neither we nor A-Best currently has a license of or rights to such patents. Our failure to make the required technical improvements to and/or to find customers for the A-Best speakers will materially adversely impact our business plan to increase our revenues. In addition, failure to obtain enforceable rights to the technology, we would not be able to sell the speakers without potentially infringing on the rights of the patent holders.

Our acquisition of A-Best may never be consummated.

Although we have entered into a stock purchase agreement pursuant to which we would acquire 31% of the outstanding equity interests in A-Best (the “Acquisition”) and thereupon own 51% of the outstanding equity interests in A-Best, there can be no assurance this acquisition will ever be consummated as expected or at all. In particular, we need to obtain shareholder approval to amend our articles of incorporation to increase the number of authorized shares of our Common Stock to issue 10,000,000 shares as the Stock Consideration under the Stock Purchase Agreement.

Our proposal to develop a business of distributing household water purifying machines may not be successful.

Although we had marketed and distributed household water purifying machines in the past and have experience in this market, currently we have not identified a water purification product we would sell in the future, and have no commitments from either potential suppliers or purchasers. We are actively negotiating with a real estate company based in Shanghai, China, to install and maintain water purifying systems in commercial and office buildings that it develops in the future; however, there can be no assurance that such negotiations will result in any agreement or commitment. In addition, even if we are able to implement the business plan as expected, we cannot assure you that the water purification project will generate income and gross profits as projected above. Failure to find both sources and customers for water purifying machines will materially adversely impact our business plan to increase our revenues.

We may not be successful in identifying new products to market and distribute.

While we constantly seek new products to market and distribute in the Asia market, there can be no assurance that we will be able to identify, obtain, market or sell any new products on a profitable basis, or at all. Even if we are able to select new products that are deemed appealing to the consumers in certain regions, we may not be able to purchase the new products from the suppliers at competitive prices or find reliable wholesale distribution channel.

We are subject to import and export regulations in Taiwan, and any adverse regulatory action may materially adversely affect our financial condition and business operations.

We import dietary supplements and skin care merchandise from the U.S. and export dietary supplements and skin care products outside Taiwan to Hong Kong and mainland China. Our business is subject to Import and export regulations in Taiwan and other jurisdictions where our products come from or are transported to. Any change in import and export laws and regulations in the pertinent jurisdictions may impose administrative and financial burdens to our operations. In addition, any adverse regulatory actions may delay our business transactions, divert our management attention to ordinary operations and therefore materially and adversely affect our financial condition and performance results.

Instability in international markets, or foreign currency fluctuations could adversely affect our results of operations.

We generate a significant amount of our revenue from outside the United States. As a result, we face currency and other risks associated with our international sales. We are exposed to foreign currency exchange rate fluctuations due to transactions denominated primarily in [NTD], which may potentially reduce the U.S. dollars we receive for sales denominated in any of these foreign currencies, and/or increase the U.S. dollars we report as expenses in these currencies, thereby affecting our consolidated results of operations. Fluctuations between the currencies in which we do business have caused and will continue to cause foreign currency transaction gains and losses. We cannot predict the effects of currency exchange rate fluctuations upon our future operating results because of the number of currencies involved, the variability of currency exposures, and the volatility of currency exchange rates.

In addition to foreign currency exchange rate fluctuations, there are a number of additional risks associated with our international operations, including those related to:

|

|

·

|

The imposition of or increase in import or export duties, surtaxes, tariffs, or customs duties;

|

|

|

|

|

|

|

·

|

The imposition of import or export quotas or other trade restrictions;

|

|

|

|

|

|

|

·

|

Foreign tax laws and potential increased costs associated with overlapping tax structures;

|

|

|

|

|

|

|

·

|

Compliance with various U.S. and foreign laws, including the Foreign Corrupt Practices Act, and import/export laws;

|

|

|

|

|

|

|

·

|

Longer accounts receivable cycles in certain foreign countries, whether due to cultural, economic, or other factors;

|

|

|

|

|

|

|

·

|

Changes in regulatory requirements in international markets in which we operate; and

|

|

|

|

|

|

|

·

|

Economic and political instability in international markets, including concerns over excessive levels of sovereign debt and budget deficits in countries where we market our products that could result in an inability to pay or timely pay outstanding payables.

|

We are subject to anti-bribery, anti-corruption, and anti-money laundering laws, including the U.S. Foreign Corrupt Practices Act, as well as export control laws, customs laws, sanctions laws, and other laws governing our operations. If we fail to comply with these laws, we could be subject to civil or criminal penalties, other remedial measures, and legal expenses, which could adversely affect our business, results of operations, and financial condition.

With our international operations, we will be exposed to trade and economic sanctions and other restrictions imposed by the United States, the European Union, and other governments and organizations. The U.S. Departments of Justice, Commerce, State, and Treasury, and other federal agencies and authorities have a broad range of civil and criminal penalties they may seek to impose against corporations and individuals for violations of economic sanctions laws, export control laws, the U.S. Foreign Corrupt Practices Act (FCPA), and other federal statutes and regulations, including those established by the Office of Foreign Assets Control (OFAC). Under these laws and regulations, as well as other anti-corruption laws, anti-money laundering laws, export control laws, customs laws, sanctions laws, and other laws governing our operations, various government agencies may require export licenses, may seek to impose modifications to business practices (including cessation of business activities in sanctioned countries or with sanctioned persons or entities, and modifications to compliance programs) that may increase compliance costs, and may subject us to fines, penalties, and other sanctions. A violation of these laws or regulations would negatively affect our business, financial condition, and results of operations.

We do not have any policies and procedures designed to ensure compliance by us and our directors, officers, employees, representatives, consultants, and agents with the FCPA, OFAC restrictions, and other export control, anti-corruption, anti-money-laundering, and anti-terrorism laws and regulations. We may implement any policies or procedures regarding these issues in the near future. We cannot assure you, however, that our policies and procedures are or will be sufficient, or that directors, officers, employees, representatives, consultants, and agents have not engaged and will not engage in conduct for which we may be held responsible; nor can we assure you that our business partners have not engaged and will not engage in conduct that could materially affect their ability to perform their contractual obligations to us, or even result in our being held liable for such conduct. Violations of the FCPA, OFAC restrictions, or other export control, anti-corruption, anti-money laundering, and anti-terrorism laws or regulations may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could have a materially adverse effect on our business, financial condition, and results of operations.

We may not be able to compete effectively with larger companies in the resale and distribution space with greater resources and market recognition.

The resale and distribution industry in Taiwan is highly competitive and evolves from time to time as the technologies and consumer trends change. Significant competitive factors in our industry include exclusive and diversified wholesale channels, well-trained sales personnel, competitive pricing, and appealing products.

We are a very small distribution company compared to other companies that we are competing against. Many of our current and potential competitors have substantially greater financial, technical and human resources than we do and significantly more experienced in the marketing, discovery and development of products, which could place us at a significant competitive disadvantage or deny us marketing exclusivity rights. Typically, our competitors will most likely have more capital resources to support their products than we do.

We anticipate that we will face intense and increasing competition when and as A-Best speakers enter the markets, as advanced technologies become available. We consider companies that sell and distribute speakers for consumers, households and industries our competitors.

We are dependent on one significant customer for our businesses, and the loss of this customer could have an adverse effect on our business, results of operations, and financial condition.

We sell the majority of the products we purchase to Fortune King and substantially rely on Fortune King’s distribution channel. Fortune King and we have renewed the Fortune King Product Supply Agreement, which remains in full force and effect until September 30, 2021. However, the Fortune King Product Supply Agreement does not provide us any right to sell any products to Fortune King in a certain volume or at a certain price. If Fortune King decides to make purchases from another source or Fortune King’s customers reduce their orders of the products we sell, our sales volume will decline significantly. From time to time, we may have to reduce our resale prices to Fortune King on a case-by-case basis and therefore our revenue would be adversely affected with the assumption of the same volume.

We do not manufacture the products we sell, and we rely on third-party manufacturers and suppliers to produce our products.

We do not own or operate manufacturing facilities for the production of the products we sell, and we lack the resources and the capabilities—and have no intention—to do so. We currently rely on and expect to do so for the foreseeable future third-party manufacturers and/or suppliers to supply our products. Reliance on third-party manufacturers and suppliers entails risks to which we would not be subject if we manufactured our products ourselves, including:

|

|

·

|

Reliance on third-parties for manufacturing process, development, regulatory compliance, and quality assurance;

|

|

|

|

|

|

|

·

|

Limitations on supply availability resulting from capacity and scheduling constraints of third-parties;

|

|

|

|

|

|

|

·

|

The possible breach of manufacturing or supply agreements by third-parties because of factors beyond our control; and

|

|

|

|

|

|

|

·

|

The possible termination or non-renewal of the manufacturing or supply agreements by the third party, at a time that is costly or inconvenient to us.

|

If we do not maintain our key manufacturing and/or supplier relationships, we may fail to find replacement manufacturers or suppliers, and we do not intend to develop our own manufacturing capabilities. If we do find replacement manufacturers or suppliers, we may not be able to enter into agreements with them on terms and conditions favorable to us, and there could be a substantial delay before we could find other sources or other products to sell. The FDA and other foreign regulatory authorities require manufacturers of our A.C. Products at the facilities with the certified good manufacturing practice (“cGMP”). The FDA and corresponding foreign regulators also inspect these facilities to confirm compliance with current standards. Contract manufacturers may face manufacturing or quality control problems causing drug substance production and shipment delays, or a situation where the contractor may not be able to maintain compliance with the applicable good manufacturing practice requirements. Any failure to comply with such requirements, or other FDA and comparable foreign regulatory requirements, could adversely affect our ability to obtain and sell our products.

We depend on single-source suppliers for some of the products we sell.