Current Report Filing (8-k)

August 13 2019 - 11:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2019 (August 7, 2019)

|

EOS INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

333-206853

|

|

30-0873246

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

7F.-1, No. 162, Sec. 2, Zhongshan N. Rd., Zhongshan District

Taipei City, Taiwan 10452

(Address of Principal Executive Offices)

Registrant’s telephone number:

+886-2-2586-8300

Room 519, 5F., No. 372, Linsen N. Road,

Zhongshan District,

Taipei City 104, Taiwan (R.O.C.)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On August 7, 2019, EOS Inc. (the “Company”), A-Best Wire Harness & Components Co., Ltd (“A-Best”), a company formed under the laws of Taiwan, and Ing-Ming Lai, a Taiwanese individual and the majority shareholder of A-Best, entered into a purchase agreement (the “Purchase Agreement”), pursuant to which, subject to the terms and conditions therein, the Company shall purchase thirty-one percent (31%) of the issued and outstanding equity interest in A-Best and as consideration, issue ten million (10,000,000) shares (the “Stock Consideration”) of its common stock (the “Common Stock”) to Ing-Ming Lai and pay Ing-Ming Lai fifty-five million (55,000,000) new Taiwanese dollars (“NTD”) (the “Cash Consideration”). The Company currently owns twenty percent (20%) of equity securities in A-Best, and will subsequently own a total of fifty-one percent (51%) of issued and outstanding A-Best shares when Ing-Ming Lai completes transferring his 31% of A-Best’s equity to the Company in accordance with the Purchase Agreement. Pursuant to the Purchase Agreement, the Company shall use its best efforts to obtain its shareholder approval to increase the number of authorized common stock to allow legal issuance of the Stock Consideration to Ing-Ming Lai no later than December 31, 2019. In addition, pursuant to the Purchase Agreement, the Company shall pay the Cash Consideration to Ing-Ming Lai if and only if the Company successfully completes an Initial Public Offering (the “IPO”) of its common stock, with gross proceeds of no less than $5,000,000 USD. The Purchase Agreement contains the customary confidentiality provision, representations and warranties. The Purchase Agreement also provides for mutual indemnification clauses. A-Best is a Taipei-based company that designs magnetic resonance speakers.

In connection with the Purchase Agreement, on August 7, 2019, the Company, A-Best, and Ing Ming Lai entered into an Exclusive Sales Agreement (the “Exclusive Sales Agreement”), pursuant to which the Company is granted the right as the exclusive distributor to sell all of A-Best’s products, including its Micro-ceramic magnetic resonance speakers in the world, and the right to use A-Best’s trademarks and copyrights in connection with the sale of such products. The term of the Exclusive Sales Agreement shall be three (3) years from execution and be automatically renewed for another term of three (3) years unless one party gives the other parties a written notice of termination three (3) months before the end of the term.

In connection with the Purchase Agreement, on August 7, 2019, the Company and Ing-Ming Lai entered into a management agreement (the “Management Agreement”), pursuant to which the Company has agreed to maintain A-Best’s existing operations and Ing-Ming Lai’s positions as A-Best’s President and Chief Executive Officer of A-Best, until A-Best’s board of directors decides to terminate the terms of his positions. Pursuant to the Management Agreement, the Company shall also designate one individual to A-Best’s board of directors, and A-Best’s board of directors shall continue to maintain two director seats, where at least one of the two directors is designated by the Company until the Parties either reach a shareholder agreement or A-Best receives additional capital investment in equity or debt. The Management Agreement became effective upon execution.

The foregoing description of the Purchase Agreement, Exclusive Sales Agreement, and Management Agreement is not purported to be complete and qualified in its entirety by reference to the full texts of the three Agreements, a copy of which are attached hereto as Exhibits 10.1, 10.2 and 10.3 and hereby incorporated by reference into this Item 1.01.

|

Item 3.02

Unregistered Sales of Equity Securities

|

The disclosures set forth in Item 1.01 of this Current Report are incorporated by reference herein. Subject to the shareholder approval of the company and pursuant to the Purchase Agreement, the issuance of Stock Consideration of 10,000,000 shares of the Company’s common stock shall be made in reliance on exemption from registration pursuant to Section 4(a)(2) under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are furnished herewith:

(d) Exhibits.

|

Exhibit 10.1

|

|

The Purchase Agreement dated August 7, 2019, by and among EOS Inc., A-Best Wire Harness & Components Co., Ltd., and Ing-Ming Lai

|

|

Exhibit 10.2

|

|

The Exclusive Sales Agreement dated August 7, 2019, by and among EOS Inc., A-Best Wire Harness & Components Co., Ltd., and Ing-Ming Lai

|

|

Exhibit 10.3

|

|

The Management Agreement dated August 7, 2019, between EOS Inc. and Ing-Ming Lai

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EOS Inc.

|

|

|

|

|

|

|

Date: August 13, 2019

|

/s/ He-Siang Yang

|

|

|

|

Name: He-Siang Yang

|

|

|

|

Title: Chief Executive Officer

|

|

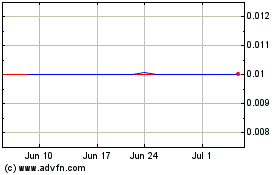

EOS (PK) (USOTC:EOSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

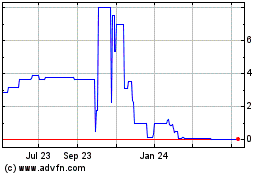

EOS (PK) (USOTC:EOSS)

Historical Stock Chart

From Apr 2023 to Apr 2024