Challenge to the Sprint, T-Mobile deal precedes antitrust ruling

by the Justice Department

By Drew FitzGerald and Brent Kendall

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 12, 2019).

A group of state attorneys general filed a lawsuit on Tuesday to

block the proposed merger of T-Mobile US Inc. and Sprint Corp., a

highly unusual challenge that comes as federal antitrust officials

are still reviewing the more than $26 billion deal.

The suit alleges that the union of the third- and fourth-largest

wireless carriers in the U.S. would drive up prices for cellphone

services. It was filed in a federal court in New York and was led

by the attorneys general of New York and California.

The proposed merger would result in lost jobs, price increases

and less improvement in services, New York Attorney General Letitia

James said at a news conference. "The deal is bad for consumers,

it's bad for innovation, it's bad for workers," she said.

Shares of Sprint fell 6%, while T-Mobile slipped 1.6% Tuesday.

Officials for the two companies didn't respond to requests for

comment.

The agreement T-Mobile struck with Sprint in April 2018 was the

culmination of years of on-again, off-again talks between the

rivals, which are seeking economies of scale in a mature U.S.

wireless market dominated by Verizon Communications Inc. and

AT&T Inc. The smaller companies have tried more than once to

strike a deal, only to founder on terms or fears that the Justice

Department would object to their merging.

Tuesday's pre-emptive attack by the states comes as their

federal counterparts at the U.S. Department of Justice, which must

also pass judgment on the transaction, continue to review the

wireless merger.

"There's no rule or regulation that says we have to wait for

DOJ," Ms. James said.

The states didn't give the Justice Department advance notice

before filing their lawsuit, according to people familiar with the

matter.

News of the state-led complaint broke as high-level company

representatives continued discussions on the merger with Justice

Department lawyers on Tuesday, according to people familiar with

the talks.

Although the Justice Department and Federal Trade Commission are

the principal merger authorities, state attorneys general have the

authority to challenge acquisitions under antitrust laws. But they

usually do so only in partnership with federal counterparts. When a

state has gone it alone, it has typically been to challenge a deal

with deep local connections, such as a hospital-industry

merger.

Wayne State University law professor Stephen Calkins said he

couldn't recall state attorneys general ever challenging a merger

of this size and prominence on their own, adding it was even more

unusual for the states to act while the Justice Department review

was pending.

"It's really quite remarkable," Mr. Calkins said.

Attorneys general from Colorado, the District of Columbia,

Maryland, Michigan, Mississippi, Connecticut, Virginia and

Wisconsin joined the lawsuit filed Tuesday. The state and District

of Columbia officials are all Democrats.

If the wireless firms win formal approval from federal

regulators, including the Federal Communications Commission, they

could proceed to close their merger without waiting on the states'

litigation -- unless a federal judge blocks them from doing so.

Xavier Becerra, California's attorney general, said the states

would seek a preliminary injunction to keep the companies

separate.

The litigation could create months of legal uncertainty for the

deal's prospects.

The companies got a leg up last month when FCC Chairman Ajit

Pai, a Republican, unilaterally threw his support behind the deal

in exchange for their commitment to invest in 5G infrastructure

covering rural areas. The companies also promised to shed Sprint's

Boost Mobile prepaid cellphone service.

The Justice Department has yet to publicly comment on those

concessions, though The Wall Street Journal previously reported

that department officials believed the FCC package wasn't enough to

protect competition in the wireless industry.

A Justice Department spokesman declined to comment.

Mr. Becerra said Mr. Pai's actions at the FCC were one of the

triggers for the states' decision to move forward. State officials

had substantive conversations with their Justice Department

counterparts, though "they don't tell us what to do" and "we don't

tell them what to do," Mr. Becerra said.

The Obama-era Justice Department made clear that further

wireless consolidation was a non-starter. But T-Mobile and Sprint

executives last year decided to make their case to the Trump

administration, saying that without a merger they risked falling

behind Verizon and AT&T as the industry upgrades to 5G

networks. Combining the smaller companies would arm them with a

swath of wireless-spectrum licenses considered ideal for 5G, they

said.

Sprint is controlled by Japan's SoftBank Group Corp., whose

chairman, Masayoshi Son, has long sought to combine the U.S.

wireless company with T-Mobile, whose largest shareholder is

Deutsche Telekom AG. Sprint has been struggling to hold on to

customers, while T-Mobile has been gaining market share.

The recent flurry of regulatory developments has worked to box

in Justice Department antitrust chief Makan Delrahim on both his

left and his right. While the states' lawsuit could put heat on Mr.

Delrahim's antitrust division to file its own challenge, the

department's review has been complicated by the pronouncement by

the FCC's Republican majority that the merger is in the public's

interest.

The Justice Department has never litigated a challenge against a

merger that the FCC has found to be good for consumers, so any such

court case could place the department in uncharted waters.

Wireless operators have tried different combinations to shrink

the number of national U.S. players down to three, but so far they

have all been foiled. In 2011, the Justice Department and FCC

opposed AT&T's plan to buy T-Mobile, warning the merger would

"significantly diminish competition."

--Corinne Ramey contributed to this article.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Brent

Kendall at brent.kendall@wsj.com

(END) Dow Jones Newswires

June 12, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

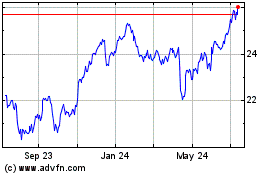

Deutsche Telekom (QX) (USOTC:DTEGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

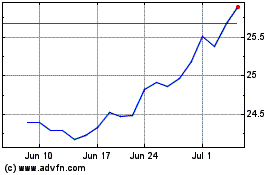

Deutsche Telekom (QX) (USOTC:DTEGY)

Historical Stock Chart

From Apr 2023 to Apr 2024