Locus Robotics Raises $26 Million in New Funding Round

April 22 2019 - 7:14AM

Dow Jones News

By Paul Page

Locus Robotics Corp. raised $26 million in a Series C funding

round that will help the warehouse automation company expand the

reach of its robots, which help speed up the fulfillment of

e-commerce orders, into international markets.

The round increased to $66 million the funding the Wilmington,

Mass.-based company has raised since the business was spun out in

2015 from Quiet Logistics Inc. The new funding came from investors

including Zebra Ventures, the strategic investment arm of logistics

technology firm Zebra Technologies Corp., and Scale Venture

Partners, which led the company's last funding round in 2017.

Locus Chief Executive Rick Faulk said the company would use the

new funding to extend the company's business, which has placed

robots with customers in the U.S. including Deutsche Post AG's DHL

and France-based logistics provider Geodis, into Europe and develop

"next-generation robots."

"We will launch in Europe by midyear," said Mr. Faulk. "We're

effectively being pulled over there by our big accounts. And later

on we have opportunities in Asia. It's just a massive worldwide

market, with significant growth."

The Locus robots resemble motorized stools with shelving and

touchscreens. They operate in groups and use sensors to navigate

through warehouses as workers pick items and move on.

The robots are part of a new generation of automated tools known

as collaborative robots because they work with human staffers. They

come equipped with software that ties together inventory management

data and warehouse management systems to help the robots quickly

locate products in vast warehouses and figure out the fastest, most

efficient path to the goods. Locus says the robots can double the

efficiency of human workers by cutting the time workers spend

walking between shelves.

"We do that by surrounding a human with the robots, and we have

algorithms that dramatically decrease the walking time in a

building," Mr. Faulk said. "Instead of walking up and down aisles,

the human will work a zone and the robots will come to you."

Most warehouses still rely largely on people who pull carts

through the aisles, and even automated facilities like some of

Amazon.com Inc.'s vast fulfillment centers require hundreds of

workers to pick and pack goods for shipping.

But the market for logistics robots is growing as online sales

surge, pushing companies to fulfill orders faster for rapid

delivery, and a tight labor supply makes it harder and more

expensive to hire warehouse workers.

U.K.-based ABI Research said in a report last month that heavily

automated warehouses worldwide would grow from 4,000 last year to

50,000 by 2023 and would put some 4 million commercial robots to

work.

ABI Senior Analyst Nick Finill said in the report that the

automation helps companies that are coping with "volatile product

demand, seasonal peaks, and rising consumer delivery

expectations."

"Robots enable warehouses to scale operations up or down as

required while offering major efficiency gains and mitigating

inherent challenges associated with labor and staffing," Mr. Finill

said.

Amazon, which helped spur greater warehouse automation with its

purchase in 2012 of warehouse robotics company Kiva Systems,

stepped up its automation investment this month with the

acquisition of Boulder, Colo.-based Canvas Technology. The startup

also makes autonomous carts for warehouses.

The investment by Zebra adds potential new openings in the

automation sector for Locus.

Tony Palcheck, managing director of Zebra Ventures, said the

company was looking at how Locus robots can mesh in warehouse

operations with the scanners, industrial mobile computers, printers

and technology that Zebra provides.

"This is not only a financial investment for us, it is a

strategic investment," said Mr. Palcheck. "We see great

opportunities here to provide solutions for third-party logistics

companies and retailers. This is a perfect alignment with where

Zebra is going."

-- Jennifer Smith contributed to this article.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

April 22, 2019 06:59 ET (10:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

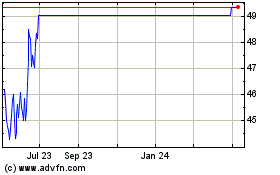

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Apr 2023 to Apr 2024