DHL's Appel Won't Enter Logistics M&A Market

March 17 2019 - 7:29AM

Dow Jones News

By Jennifer Smith

The world's largest logistics provider is steering clear of the

sector's increasingly active mergers-and-acquisitions market.

Frank Appel, chief executive of DHL parent company Deutsche Post

AG, said in an interview that the scale of the DHL's forwarding,

express and supply-chain business means there are few opportunities

for significant combinations that would also pass muster with

antitrust regulators.

This leaves the company looking for growth and service expansion

within its own operations.

"In global forwarding...there is a lot of M&A activity going

on, but we are still the largest," Mr. Appel said. "So we think

it's better to focus on ourselves."

The German postal and logistics group reported $69.83 billion in

revenue for 2018, up 1.8% from the year before, with the strongest

growth in its express and global freight-forwarding divisions.

Operating profit fell 15.5% for the full year, but DHL forecast

that should rise to between $4.42 billion and $4.88 billion in

2019.

The company's freight-forwarding and logistics operation is

among a small group of businesses at the top of a highly fragmented

world-wide market. The largest players, including Switzerland-based

Kuehne + Nagel International AG and DB Schenker of Germany, compete

for global contracts handling and shipping goods for the world's

biggest industrial manufacturers and retailers.

Kuehne + Nagel, second to DHL in forwarding and supply-chain

revenue, according to market analysts Armstrong & Associates

Inc., has made several small acquisitions in recent years to bring

in new services, including the November 2018 purchase of U.S.

time-critical business Quick International Courier.

In recent months, logistics operators in Denmark and Kuwait have

been competing for control of Swiss freight forwarder Panalpina

Welttransport Holding AG in an effort to gain market share and

operations in more international markets.

Mr. Appel said DHL was rolling out technology and software

improvements and is focusing on that instead of mergers, "because

we think it's better to grow organically."

Buying a technology-focused logistics startup would be

expensive, Mr. Appel said, because of the high valuations for

companies such as Flexport Inc., which last month announced a $1

billion round of investment led by SoftBank Group Corp.'s Vision

Fund.

"The prices are high," Mr. Appel said. "That's the reason why we

would rather develop it ourselves," adding that it "doesn't mean

that we won't change our mind in the future."

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

March 17, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

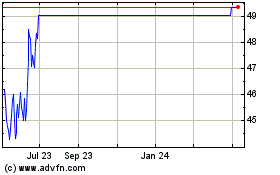

Deutsche Post (PK) (USOTC:DPSGY)

Historical Stock Chart

From Apr 2023 to Apr 2024