Danske Bank Compliance Chief Steps Down Amid Scandal -- Update

July 11 2018 - 6:12PM

Dow Jones News

By Samuel Rubenfeld

The head of compliance for Danske Bank is resigning as the

Denmark's largest bank continues to confront a money-laundering

scandal in Estonia.

Danske Bank launched an internal investigation last year

following reports in Danish media alleging that its Estonian branch

was used to launder money from 2007 to 2015. The bank on Wednesday

said it expects to complete the investigation in September.

Management at the bank also said on Wednesday it was aware for a

while of Anders Meinert Jørgensen's plans to step down as

compliance chief and expects to replace him soon. "For a while now

I have thought about doing something else -- possibly not even in

the financial sector, " Mr. Jørgensen said.

He has led the compliance group at the bank since 2014, and Mr.

Jørgensen said the resignation is unrelated to the money-laundering

scandal.

Danske Bank has declined to comment on the specifics of the

money-laundering allegations until the investigation concludes. It

has, however, found there were insufficient controls to prevent

money laundering at the Estonian branch, and has acknowledged that

foreigners took advantage of the lack of controls, potentially

using the bank for money-laundering purposes.

"Only the authorities can decide whether money laundering did in

fact take place," the bank said on its website.

Danske Bank also faces other accusations concerning potential

money laundering through its Estonian branch.

Hedge-fund manager Bill Browder has alleged that Russians have

laundered more than $8 billion through the bank, and said he plans

to submit his findings to Danish authorities. Mr. Browder has said

the laundered money was connected to a tax fraud discovered by his

attorney, Sergei Magnitsky, who died in Russian custody after

authorities there accused him of carrying out the fraud.

"I would expect there to be legal consequences, not just career

consequences, for those who either played a role in the money

laundering that led to the murder of Sergei Magnitsky, or turned a

blind eye to allow it to happen," said Mr. Browder in an interview

on Wednesday.

A Danske Bank spokesman declined to respond to Mr. Browder's

comments.

The bank has known about the issues surrounding its Estonian

branch for years, according to a timeline posted on its website.

The bank received an email in December 2013 from an internal

whistleblower who pointed to a lack of controls at the Estonian

branch. The bank's internal audit department initiated a probe in

February 2014, and within two months determined that the controls

at the branch were lacking. It shut down its "nonresident

portfolio" at the Estonian branch by 2015, but widened its probes

last year following the media reports.

The bank was reprimanded in May by Danish regulatory

authorities, who said there were serious deficiencies in its

governance and it acted too late on the information concerning the

lack of anti-money-laundering measures.

"On the basis of the knowledge we have today about the extent of

suspicious activities, it is clear than we should have acted faster

and more forcefully. Among other things, we should back then have

launched a thorough investigation into the activities in that

portfolio," the bank has said.

Write to Samuel Rubenfeld at samuel.rubenfeld@wsj.com

(END) Dow Jones Newswires

July 11, 2018 17:57 ET (21:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

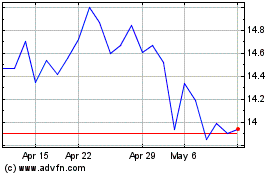

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

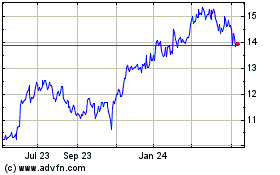

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Apr 2023 to Apr 2024