Chinese Bottled-Water Giant Taps Hong Kong IPO Market

September 07 2020 - 9:40AM

Dow Jones News

By Joanne Chiu

Shares in China's top bottled-water company surged in

gray-market trading ahead of its Hong Kong debut, after investors

thirsty for new stock sales placed nearly $150 billion of orders

for a $1.1 billion deal.

The warm reception for Nongfu Spring Co. shows Hong Kong

investors remain eager for ways to bet on China's increasingly

affluent consumers. That is a good omen for Yum China Holdings

Inc., the operator of KFC and Pizza Hut in China, whose new Hong

Kong stock starts trading on Thursday.

The initial public offering price gave Nongfu Spring a market

value of $31 billion, making it roughly two-thirds as big as Danone

SA, the French company behind Evian and Volvic.

Gray-market pricing from two Hong Kong brokers suggested Nongfu

Spring could surge in value after it starts trading officially on

Tuesday, potentially overtaking Danone. Nongfu Spring shares were

quoted at 44.05 Hong Kong dollars ($5.68), more than double its IPO

offer price of 21.50 Hong Kong dollars, on a platform operated by

Futu Securities. The stock was quoted up 92% on a platform run by

Bright Smart Securities.

Based in the eastern province of Zhejiang, Nongfu Spring was

founded in 1996 by businessman Zhong Shanshan, and uses the slogan

"Nongfu Spring tastes a bit sweet."

The company ranked top in China's packaged drinking-water market

last year, with nearly 21% market share, according to Frost &

Sullivan research cited in its prospectus. It also sells tea-based

drinks, juices and energy drinks.

Net profit rose 37% to 4.9 billion yuan ($716 million) last

year, although sales and profit suffered in early 2020 as the

pandemic disrupted supply chains and everyday life.

Hong Kong's IPO market lures many mom-and-pop investors, who

often rush to subscribe to offerings before flipping shares for

short-term gains, but in this case big institutions also laid out

huge orders for Nongfu Spring.

Individuals placed nearly $87 billion of orders, or nearly 1,050

times the small portion of the deal reserved for them, according to

a filing. That triggered an adjustment boosting their slice of the

deal to 27% from 7%. Institutional buyers made 60 times more orders

than shares on offer, implying they placed about $61 billion of

orders.

Five cornerstone investors, including Singapore sovereign-wealth

fund GIC Private Ltd., Fidelity International and U.S.-based

hedge-fund manager Coatue Management LLC, had endorsed the deal by

committing to buy a total $320 million of stock wherever the deal

priced.

The IPO valued Nongfu Spring at nearly 29 times next year's

forecast earnings, according to Arun George, an analyst who

publishes on the independent research platform Smartkarma. That is

nearly twice Danone's equivalent price-to-earnings multiple of 15

times and above Coca-Cola Co.'s roughly 23 times.

The IPO was led by China International Capital Corp. and Morgan

Stanley. The deal's size could increase by 15% if underwriters

exercise what is called a greenshoe option.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

September 07, 2020 09:25 ET (13:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

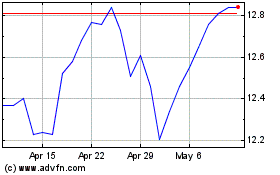

Danone (QX) (USOTC:DANOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danone (QX) (USOTC:DANOY)

Historical Stock Chart

From Apr 2023 to Apr 2024