Additional Proxy Soliciting Materials (definitive) (defa14a)

June 23 2022 - 3:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

☑

Filed by the Registrant

☐

Filed by a Party other than the Registrant

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☑

Definitive Additional Materials

☐

Soliciting Material Pursuant to Section 240.14a-12

CREDITRISKMONITOR.COM, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑

No fee required

☐

Fee paid previously with preliminary materials

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

On June 15, 2022, CreditRiskMomitor.com, Inc. (the “Company”) filed its Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) for the Company’s

2022 Annual Meeting of Stockholders with the Securities and Exchange Commission. The Proxy Statement was filed in connection with the Company’s 2022 Annual Meeting of Stockholders to be held on July 13, 2022 (the “Annual Meeting”). This

supplement to the Proxy Statement and a revised proxy card are being filed on this Amendment 1 to Schedule 14A to add a new Proposal 3 that is soliciting a non-binding, advisory vote from Company Stockholders on the compensation paid to our named

executive officers as described in the Proxy Statement (also referred to as “Say-on-Pay” or “Proposal 3”). Other than the changes described in this supplement, which adds Proposal 3, makes other conforming changes to the Proxy Statement and

updates the Notice of Annual Meeting, no other changes have been made to the Proxy Statement, and the Proxy Statement and Notice continue to be in full force and effect as originally prepared and continue to seek the vote of Company Stockholders

for the proposals to be voted on at the Annual Meeting. A form of the revised proxy card has also been included in this filing.

Capitalized terms used but not otherwise defined in this supplement have the meanings ascribed to them in the Proxy Statement. This supplement should be read

together with the Proxy Statement, which should be read in its entirety.

CREDITRISKMONITOR.COM, INC.

704 Executive Boulevard, Suite A

Valley Cottage, New York 10989

SUPPLEMENT TO PROXY STATEMENT

FOR

2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, JULY 13, 2022

This Proxy Statement Supplement (the “Supplement”) supplements and amends the original definitive proxy statement of CreditRiskMomitor.com, Inc. ( the

“Company”, “we”, or “our”), dated June 10, 2022 (the “Proxy Statement”) for the Company’s 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to (i) add a new Proposal 3 to the Proxy Statement that provides for a non-binding, advisory vote

of Company stockholders on the compensation paid to our named executive officers as described in the Proxy Statement (also referred to as “Say-on-Pay” or “Proposal 3”), (ii) update the Notice of Annual Meeting to add the new Proposal 3 (the

“Updated Notice”), and (iii) make additional changes to the Proxy Statement resulting from the addition of new Proposal 3. As previously disclosed in the Proxy Statement, the Annual Meeting will be held on July 13, 2022 at 9:00 a.m., local time,

or any adjournment thereof, at 704 Executive Boulevard, Suite A, Valley Cottage, New York 10989.

This Supplement relates to the new Proposal 3 to be considered by stockholders at the Annual

Meeting and does not provide all of the information that is important to your decisions with respect to voting on all of the proposals that are being presented to stockholders for their vote at the Annual Meeting. Additional information is

contained in the Proxy Statement. To the extent that the information in this Supplement differs from, updates or conflicts with the information contained in the Proxy Statement, the information in this Supplement shall amend and supersede the

information in the Proxy Statement. Except as so amended or superseded, all information set forth in the Proxy Statement remains unchanged and important for you to review. Accordingly, we urge you to read this Supplement carefully and in its

entirety together with the Proxy Statement. If you would like to receive another copy of the Proxy Statement, please contact the Company with a written request to: 704 Executive Boulevard, Suite A, Valley Cottage, New York 10989, Attention:

Corporate Secretary.

This Supplement relates to the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual

Meeting. This Proxy Statement Supplement, the Updated Notice of Annual Meeting attached hereto as Appendix A and a revised proxy card (the “Revised Proxy Card”) are being made available on or about June 23, 2022 to all stockholders entitled to

vote at the Annual Meeting.

We urge stockholders

of record to vote on proposals 1 through 3 by submitting a Revised Proxy Card. If you return an executed Revised Proxy Card without marking your instructions with regard to the matters to be acted upon, the proxy holders will vote “FOR” the

election of director nominees set forth in the Proxy Statement, and “FOR” the approval of Proposals 2 and 3. Those voting by internet or by telephone may also revoke their proxy by

voting in person at the meeting or by voting and submitting their proxy at a later time by internet or by telephone.

If you have already voted and do not submit a Revised Proxy Card, your previously submitted proxy

will be voted at the Annual Meeting with respect to Proposals 1 and 2 but will not be counted in determining the outcome of Proposal 3.

PLEASE NOTE THAT IF YOU SUBMIT A REVISED PROXY CARD IT WILL REVOKE ALL PROXY

CARDS PREVIOUSLY SUBMITTED, SO IT IS IMPORTANT TO INDICATE YOUR VOTE

ON EACH PROPOSAL ON THE REVISED PROXY CARD.

PROPOSALS TO BE VOTED UPON BY STOCKHOLDERS

Information contained in this Supplement relates to Proposal 3 that will be presented to stockholders at the

Annual Meeting. Information regarding Proposals 1 and 2 that will be presented to stockholders at the Annual Meeting can be found in the Proxy Statement as originally filed with the SEC on June 15, 2022.

Please note that we strongly encourage you to read this Supplement and to vote on Proposal 3.

Vote Required; Effect of Abstentions and Broker Non-Votes.

A majority of votes cast will be used to determine the results of the non-binding advisory vote on Proposal 3.

Brokers cannot vote on their customers’ behalf on “non-routine” proposals such as Proposal 3. Because brokers require their customers’ direction to vote on such non-routine matters, it is critical that stockholders provide their brokers with

voting instructions. If you hold your shares in street name and do not provide voting instructions to your bank, broker or other custodian, your shares will not be voted on Proposal 1 or Proposal 3 (a “broker non-vote”). A broker non-vote on

any of the proposals presented at the Annual Meeting will have no effect on the outcome of the proposal. Because a majority of votes cast will be used to determine the results of the non-binding advisory vote, abstentions will have no effect on

the outcome of the vote on Proposal 3. These abstentions, however, are counted towards establishing a quorum for the Annual Meeting.

Revocation of Proxies/Voting of Shares.

Any stockholder giving a proxy may revoke it at any time before the votes are counted at the Annual Meeting

by (i) submission of a later dated proxy, (ii) providing a written notice of revocation to the Company’s Corporate Secretary at CreditRiskMonitor.com, Inc., 704 Executive Boulevard, Suite

A, Valley Cottage, New York 10989, prior to your shares being voted, or (iii) attending the Annual Meeting and voting in person. Unless so revoked, the shares represented by such proxies or voting instructions will be voted at the

Annual Meeting and all adjournments or postponements of the Annual Meeting. Proxies solicited on behalf of the Board will be voted in accordance with the directions given.

PROPOSAL 3 — ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, requires us to hold an advisory vote on the compensation of our named

executive officers, as disclosed in this proxy statement in accordance with the rules of the Securities and Exchange Commission, or SEC. As described elsewhere in this Proxy Statement, we try to design our named executive officer compensation

programs to attract, motivate and retain the key executives who will drive the creation of stockholder value.

Please read the “Executive Compensation”

section of the Proxy Statement, beginning on page 3. That section of the proxy statement, which includes our named executive officer compensation tables and related narrative discussion, provides details on our compensation programs and

policies for our named executive officers. We believe that the Company’s compensation policies and procedures do not create undue risk nor

are they excessive in an amount or nature.

We are requesting stockholder approval of the compensation of our executive officers as disclosed in this Proxy Statement. This proposal, commonly known as a

“say-on-pay” proposal, gives our stockholders the opportunity to express their views on our executive officers’ compensation. The vote is not intended to address any specific item of compensation, but rather the overall compensation of our

executive officers and the philosophy, policies and practices described in this Proxy Statement.

We are asking our stockholders to indicate their support for our named executive officer compensation through the following resolution:

“RESOLVED, that the stockholders approve the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item

402 of Regulation S-K, including the compensation tables and narrative discussion in the Company’s proxy statement for its 2022 annual meeting.”

As provided in the Securities Exchange Act, the vote is not binding on the Board and may not be construed as overruling a decision by the Board, nor creating or

implying any additional fiduciary duty by the Board, nor be construed to restrict or limit the ability of stockholders to make proposals for inclusion in proxy materials related to executive compensation.

The affirmative vote, in person or by proxy, of the majority of the votes cast by the holders of the Company’s common

stock at the Annual Meeting is required for approval of executive compensation. However, this advisory vote is not binding on us, our board of directors, or management. Abstentions will not be voted, although they

will be counted as present and entitled to vote for purposes of the Proposal. Accordingly, an abstention will have the effect of a vote against this Proposal. Broker non-votes will have no effect on the outcome of this Proposal.

The Board recommends that you vote “FOR” the approval of the compensation of our named executive officers as described in the Proxy Statement.

IF YOU HAVE ALREADY VOTED, YOUR VOTES WILL BE COUNTED WITH RESPECT TO THE ELECTION OF DIRECTORS IN PROPOSAL 1 AND

PROPOSAL 2. HOWEVER, WE URGE YOU TO CAST YOUR VOTE ON ALL THREE PROPOSALS USING THE REVISED PROXY CARD EVEN IF YOU HAVE PREVIOUSLY CAST YOUR VOTE ON PROPOSALS 1 AND 2 AS DESCRIBED IN OUR PROXY STATEMENT DATED JUNE 10, 2022.

CREDITRISKMONITOR.COM, INC.

704 Executive Boulevard, Suite A

Valley Cottage, New York 10989

UPDATED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 13, 2022

To the Stockholders of CreditRiskMonitor.com, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of CreditRiskMonitor.com, Inc., a Nevada corporation (the “Company”), will be held on July 13, 2022 at

704 Executive Boulevard, Suite A, Valley Cottage, NY 10989, at 9:00 a.m., for the following purposes:

|

1. |

To elect four directors for the coming year;

|

|

2. |

To ratify the selection of CohnReznick LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022;

|

|

3. |

To hold an advisory, non-binding vote on the compensation of our named executive officers as described in the Proxy Statement; and

|

|

4. |

To transact such other business as may properly come before the meeting.

|

Only stockholders of record at the close of business on June 10, 2022 are entitled to notice of and to vote at the meeting or

at any adjournment thereof.

Important notice regarding the

availability of Proxy Materials: The proxy statement, including any amendments and supplements, and the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 are available electronically at www.proxyvote.com.

| |

Jerome S. Flum

|

| |

|

| |

Chief Executive Officer

|

| |

|

|

Valley Cottage, New York

|

|

|

|

|

|

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. FOR SPECIFIC INSTRUCTIONS ON HOW TO VOTE YOUR SHARES, PLEASE REFER TO THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD.

ANY STOCKHOLDER MAY REVOKE A SUBMITTED PROXY AT ANY TIME BEFORE THE MEETING BY WRITTEN NOTICE TO SUCH EFFECT, BY SUBMITTING A SUBSEQUENTLY DATED PROXY OR BY ATTENDING THE MEETING AND VOTING IN PERSON. THOSE VOTING BY INTERNET OR BY

TELEPHONE MAY ALSO REVOKE THEIR PROXY BY VOTING IN PERSON AT THE MEETING OR BY VOTING AND SUBMITTING THEIR PROXY AT A LATER TIME BY INTERNET OR BY TELEPHONE.

|

| |

VOTE BY INTERNET - www.proxyvote.com

|

| |

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on July 12, 2022. Have your proxy card

in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

|

| |

|

| |

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

|

| |

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual

reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials

electronically in future years.

|

| |

|

| |

VOTE BY PHONE - 1-800-690-6903

|

| |

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on July 12, 2022. Have your proxy card in hand when you call and then

follow the instructions.

|

| |

|

| |

VOTE BY MAIL

|

| |

Mark, sign and date your proxy card and return it in the postage- paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way,

Edgewood, NY 11717.

|

|

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS

FOLLOWS: ☒

|

KEEP THIS PORTION FOR YOUR RECORDS

|

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

| The Board of Directors recommends you vote FOR the following: |

|

Withhold

All

|

For All

Except

|

To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below.

|

|

|

|

|

| 1. |

Election of Directors

Nominees:

|

☐ |

☐

|

☐ |

|

|

01) Jerome S. Flum 02) Andrew J. Melnick 03) Richard Lippe 04) Joshua M. Flum

|

|

|

|

|

|

The Board of Directors recommends you vote FOR proposals 2. and 3.:

|

For |

Against |

Abstain |

|

| 2. |

To ratify the selection of CohnReznick LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. |

| |

|

|

☐ |

☐ |

☐ |

| |

|

| 3. |

To approve the compensation of our named executive officers as described in the Proxy Statement.

|

| |

|

|

☐ |

☐ |

☐ |

NOTE: Such other business as may properly come before the meeting or any adjournment thereof.

| |

Yes

|

No

|

|

Please indicate if you plan to attend this meeting

|

☐

|

☐

|

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give

full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer.

| |

|

|

|

|

|

|

|

| |

Signature [PLEASE SIGN WITHIN BOX] |

|

Date

|

|

Signature (Joint Owners) |

|

Date |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice & Proxy Statement and Form 10-K are available at www.proxyvote.com.

CREDITRISKMONITOR.COM, INC.

Annual Meeting of Stockholders July 13, 2022

This proxy is solicited by the Board of Directors

The stockholder(s) hereby appoint(s) Steven Gargano, as proxy, with the power to appoint his substitute, and hereby authorize him to

represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of CREDITRISKMONITOR.COM, INC. that the stockholder(s) is/are entitled to vote at the Annual Meeting of Stockholders to be held at 9:00 AM,

EST on July 13, 2022 at 704 Executive Boulevard, Suite A, Valley Cottage, New York, and any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in

accordance with the Board of Directors’ recommendations.

Continued and to be signed on reverse side

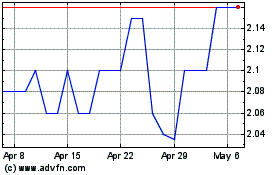

Credit Risk Monitor Com (QX) (USOTC:CRMZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Credit Risk Monitor Com (QX) (USOTC:CRMZ)

Historical Stock Chart

From Apr 2023 to Apr 2024