UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section

14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

[X]

|

Preliminary Information Statement

|

|

|

|

|

[_]

|

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

[_]

|

Definitive Information Statement

|

|

CANNAPHARMARX, INC.

|

|

(Name of Registrant As Specified In Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

[X]

|

No fee required.

|

|

|

|

|

|

[_]

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

[_]

|

Fee paid previously with preliminary materials.

|

|

|

|

|

[_]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

Cannapharmarx, Inc.

NOTICE OF ACTION BY WRITTEN CONSENT

TO THE STOCKHOLDERS OF CANNAPHARMARX,

INC.:

NOTICE IS HEREBY GIVEN

that on December 5, 2018, Cannapharmarx, Inc., a Delaware corporation (the “Company,” “we,” “us,”

or “our”), obtained written consent from stockholders holding a majority of the outstanding shares of voting securities

of the Company entitled to vote on the following action:

To amend our Certificate of Incorporation

to increase or authorized capital stock

from 100,000,000 shares of Common Stock, par value $.0001

per share

, to 300,000,000 shares of Common Stock having a par value of $.0001 per share.

The details of the

foregoing action and other important information are set forth in the accompanying Information Statement. The board of directors

of the Company (“Board of Directors”) has unanimously approved the above amendment to our Certificate of Incorporation

(the “Amendment”).

Under Section 228 of

the Delaware General Corporation Act (“DGCA”), unless otherwise provided in the Certificate of Incorporation, action

by stockholders may be taken without a meeting, without prior notice, by written consent of the holders of outstanding capital

stock having not less than the minimum number of votes that would be necessary to authorize the action at a meeting at which all

shares entitled to vote thereon were present and voted. There is no limitation in our Certificate of Incorporation that limits

this right. On that basis, the stockholders holding a majority of the outstanding shares of capital stock entitled to vote approved

the foregoing actions. No other vote or stockholder action is required. Under Delaware law, no dissenters’ or appraisal rights

are afforded to our stockholders as a result of the prior stockholder approval of the actions described above which are described

in detail in the accompanying Information Statement.

Please read this Information

Statement carefully and in its entirety. Although you will not have an opportunity to vote on the approval of amendment to the

Certificate of Incorporation to increase the authorized capital stock of the Company, this Information Statement contains important

information about these actions.

We

Are Not Asking You For A Proxy

And

You Are Requested Not To Send Us A Proxy.

This information statement

is being mailed on or about _____________, 201__ to all stockholders of record as of December 5, 2018.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

James Samuelson, Chief Executive Officer

|

CANNAPHARMARX, INC.

2 Park Plaza

Suite 1200-B

Irvine, CA 92614

949-652-6838

INFORMATION STATEMENT

We

Are Not Asking You For A Proxy And

You

Are Requested Not To Send Us A Proxy.

General

Information

This Information Statement

is being furnished to our stockholders in connection with the actions taken by our Board of Directors and the written consent of

the holders of a majority of our outstanding voting securities with respect to the actions described below. On December 5, 2018,

pursuant to Section 141(f) of the Delaware General Corporation Act, our Board of Directors unanimously approved these actions,

subject to stockholder approval. In accordance with Section 228(a) of the DGCA, on or about December 5, 2018, we received written

consents in lieu of a meeting from three stockholders beneficially holding an aggregate of 76,166,000 of our voting shares (“Majority

Stockholders”), representing approximately 81.9% of the total shares eligible to vote as of December 5, 2018 (the “Record

Date”), to approve an amendment to our Certificate of Incorporation, as amended, substantially in the form attached as Exhibit

"A" to this Information Statement (the "

Amendment

"). The purpose of the Amendment is to increase our

authorized capital stock from 100,000,000 shares of Common Stock having a par value of $0.0001 per share, to 300,000,000 shares

of Common Stock. We also have 10,000,000 shares of Preferred Stock authorized, that will remain unchanged. This Information Statement

is being sent to our stockholders to comply with the requirements of Section 14(c) of the Securities Exchange Act of 1934, as amended

(“Exchange Act”), and shall constitute notice to our stockholders of action taken by written stockholder consent.

We have elected not

to call a special meeting of our shareholders in order to eliminate the costs of and time involved in holding a special meeting.

Our management has concluded that it is in the best interests of our Company to address this matter in the manner stated herein.

Shareholders of record

at the close of business on December 5, 2018 (the "

Record Date

") are entitled to receive this Information Statement.

As the Amendment has been duly approved by shareholders holding a majority of our voting capital stock, approval or consent of

the remaining shareholders is not required and is not being solicited hereby or by any other means.

The Amendment will

become effective when filed with the Secretary of State of the State of Delaware. We anticipate that the filing of the Amendment

will occur after dissemination of this Information Statement to our shareholders, which is expected to occur on or about January

__, 2019.

We

Are Not Asking You For A Proxy And You

Are

Requested Not To Send Us A Proxy

The date of this Information Statement is

January __, 2019

Amendment

to Certificate of Incorporation

On December 5, 2018,

our Board of Directors, by written unanimous consent, authorized and recommended that our shareholders approve the Amendment. Also

on December 5, 2018, shareholders representing a majority of our voting capital stock outstanding consented in writing to the Amendment.

The purpose of the Amendment is to increase the number of authorized Common Shares from 100,000,000 shares, to 300,000,000 shares,

par value $0.0001 per share. We are not amending the number of authorized Preferred Shares.

The Amendment will

become effective upon filing of Certificate of Amendment to the Certificate of Incorporation (the “

Certificate of Amendment

”),

attached hereto as Exhibit “A,” with the Secretary of State of the State of Delaware, but our Board of Directors reserves

the right to not make such filing if it deems it appropriate not to do so.

Purpose

and Effect of the Increase in Authorized Capitalization

(

the

“

Increase in Authorized Capitalization”)

As of the date of

this Information Statement we have 1,814,259 shares of our authorized Common Stock available for issuance, not including up

to 1.1 million shares that may be issued if the shareholders of a company we recently acquired elect to take their

consideration in stock rather than cash. The Board of Directors does not believe this is an adequate number of shares to

assure that there will be sufficient shares available for issuance in connection with possible future financings, possible

future acquisition transactions, possible future awards under employee benefit plans, stock dividends, stock splits and other

corporate purposes. Therefore, the Board of Directors approved the Increase in Authorized Capitalization as a means of

providing it with the flexibility to act with respect to the issuance of Common Stock or securities exercisable for, or

convertible into, Common Stock in circumstances which it believes will advance the interests of the Company and its

stockholders without the delay of seeking an amendment to the Certificate of Incorporation at that time.

The Increase in Authorized

Capitalization will not have any immediate effect on the rights of existing stockholders. However, under the laws of the State

of Delaware, authorized, unissued and unreserved shares may be issued for such consideration (not less than par value) and for

such purposes as the Board of Directors may determine without further action by the stockholders. The issuance of such additional

shares may under certain circumstances result in the dilution of the equity or earnings per share of the existing stockholders.

While there are no

assurances, our Board of Directors expects to undertake additional acquisitions in the near future, as well as corresponding private

equity offering of our securities in the near future for the primary purpose of providing capital to allow the Company for such

acquisitions and for working capital for the businesses to be acquired. The Board of Directors has no other current plans to authorize

the issuance of additional shares of Common Stock or Preferred Stock or securities exercisable for, or convertible into, Common

Stock or Preferred Stock. The approval of the Increase in Authorized Capitalization will give the Board of Directors more flexibility

to pursue opportunities to engage in possible future acquisitions and financing transactions involving Common Stock or securities

convertible into Common Stock. However, at this time there are no definitive agreements in place relating to any such transactions

and no determination as to the type or amount of securities that might be offered has been made, should possible future transactions

be pursued.

Certain Effects of the Increase in Authorized

Capitalization

The Increase in Authorized

Capitalization was not approved as a means of preventing or dissuading a change in control or a takeover of the Company. However,

use of these shares for such a purpose is possible. For example, shares of authorized but unissued Common Stock or authorized but

unissued Preferred Stock could be issued in an effort to dilute the stock ownership and voting power of persons seeking to obtain

control of the Company or could be issued to purchasers who would support the Board of Directors in opposing a takeover proposal.

In addition, the Increase in Authorized Capitalization may have the effect of discouraging a challenge for control or make it less

likely that such a challenge, if attempted, would be successful. The Board of Directors and executive officers of the Company have

no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of capital stock of the Company.

The holders of Common

Stock are not entitled to preemptive rights with respect to the issuance of additional shares of Common Stock or securities convertible

into or exercisable for Common Stock. Accordingly, the issuance of additional shares of Common Stock or such other securities might

dilute the ownership and voting rights of stockholders. The Increase in Authorized Capitalization does not change the terms of

the Common Stock or Preferred Stock as set forth in the Company’s Certificate of Incorporation, as amended. The additional

shares of Common Stock authorized by the Increase in Authorized Capitalization Stock will have the same voting rights, the same

rights to dividends and distributions, and will be identical in all other respects to the shares of Common Stock now authorized.

For this reason our

Board of Directors has chosen to adopt and recommend the Increase in Authorized Capitalization.

Manner

of Effecting the Amendments

The Amendment will

be effected by the filing of Certificate of Amendment to our Certificate of Incorporation, as amended, with the Secretary of State

of the State of Delaware. The Amendment will become effective on the date of filing of the Certificate of Amendment unless we specify

otherwise (the "

Effective Date

").

Shareholders ARE NOT

REQUIRED to return their certificates to have them re-issued by the Transfer Agent. All certificates heretofore issued will continue

to represent fully paid and non-assessable shares of the Common Stock and/or Preferred Stock of the Company. The Amendment will

not change any of the terms of our Common Stock or Preferred Stock and holders thereof will have the same voting rights and rights

to dividends and distributions and each shareholder's percentage ownership of Company will not be altered.

A copy of the Certificate

of Amendment to our Certificate of Incorporation is attached to this Information Statement as Exhibit “A.”

Appraisal Rights and

Vote Required

No Rights of Appraisal

Under the laws of the

State of Delaware, shareholders are not entitled to appraisal rights with respect to approval of the Amendment and we will not

independently provide shareholders with any such right.

Vote Required

The Amendment requires

the approval of the holders of a majority of the shares entitled to vote at a shareholder meeting on the Record Date of December

5, 2018. Holders of our Common Stock are entitled to one vote per share and holders of our Series “A” Convertible

Preferred Stock are entitled to 1,250 votes per share on all matters submitted to a vote. There were 17,960,741 shares of our Common

Stock and 60,000 shares of Series “A” Convertible Preferred Stock issued and outstanding as of the Record Date. Each

share of Series “A” Convertible Preferred Stock is convertible into 1,250 shares of Common Stock. On December 5, 2018,

shareholders representing 75,166,000 shares (81.9%) entitled to vote at a meeting, which is a majority of the shares outstanding,

consented in writing to the Amendment.

Security

Ownership Of Certain

Beneficial

Owners And Management

The following table

sets forth certain information regarding ownership of our Company's Common Stock as of December 5, 2018, the Record Date by (i)

each person known to the Company to own beneficially more than 5% of our Common Stock, (ii) each director, (iii) each executive

officer, and (iv) all directors and executive officers as a group. Share ownership is deemed to include all shares that may be

acquired through the exercise or conversion of any other security immediately or within the next sixty days. Such shares that may

be so acquired are also deemed outstanding for purposes of calculating the percentage of ownership for that individual or any group

of which that individual is a member. Unless otherwise indicated, the shareholders listed possess sole voting and investment power

with respect to the shares shown.

|

Title of Class

|

|

Name of Beneficial Owner

|

|

Amount and Nature Of Beneficial Ownership

|

|

|

Percent Of Class

|

|

|

Common and Series A Preferred

|

|

Gary Herick

(1)

2 Park Plaza

Suite 1200B

Irvine, CA 92614

|

|

|

26,166,000

|

|

|

|

28.1%

|

|

|

Series A Preferred

|

|

James Samuelson

(1)

2 Park Plaza

Suite 1200B

Irvine, CA 92614

|

|

|

25,000,000

|

|

|

|

26.9%

|

|

|

Series A Preferred

|

|

Matt Nicosia

(1)

2 Park Plaza

Suite 1200B

Irvine, CA 92614

|

|

|

25,000,000

|

|

|

|

26.9%

|

|

|

Common and Series A Preferred

|

|

All Officers and Directors as a Group (3 person)

|

|

|

76,166,000

|

|

|

|

81.9%

|

|

_______________________

|

|

(1)

|

Officer and/or Director of our Company.

|

|

|

(2)

|

Includes 20,000 shares of Series A Convertible Preferred Share will entitle the holder thereof to 1,250 votes on all matters submitted to a vote of the shareholders.

|

|

|

(3)

|

Includes 826,000 shares of our Common Stock owned by companies owned and controlled by Mr. Herick, as well as family members. Mr. Herick disclaims ownership of 300,000 of these shares.

|

Other

Matters

No matters other than those discussed in

this Information Statement are contained in the written consent signed by the holders of a majority of the voting power of the

Company.

Interests

Of Certain Persons In Or Opposition To Matters Acted Upon

No officer or director

of the Company has any substantial interest in the matters acted upon, other than his or her role as an officer or director of

the Company. No director of the Company opposed the action taken by the Company set forth in this Information Statement.

Proposal

By Security Holders

No security holder

has requested the Company to include any proposal in this Information Statement.

Additional

Information

The Company is subject

to the informational requirements of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), and

in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form 10-K

and Form 10-Q (the “1934 Act filings”) with the Securities and Exchange Commission (the “

Commission

”).

Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at

the Commission at 100 F Street NW, Washington, D.C. 20549. Copies of such material can be obtained upon written request addressed

to the Commission, Public Reference Section, 100 F Street NW, Washington D.C. 20549, at prescribed rates. The Commission maintains

a website on the Internet (http://www.sec.gov) that contains the 1934 Act Filings of issuers that file electronically with the

Commission through the Electronic Data Gathering, Analysis and Retrieval System (“

EDGAR

”).

Expense of Information

Statement

The expenses of mailing

this Information Statement will be borne by the Company, including expenses in connection with the preparation and mailing of this

Information Statement and all documents that now accompany or may hereafter supplement it. It is contemplated that brokerage houses,

custodians, nominees and fiduciaries will be requested to forward the Information Statement to the beneficial owners of our Common

Stock held of record by such persons and that our Company will reimburse them for their reasonable expenses incurred in connection

therewith.

Delivery of Documents

to Security Holders Sharing an Address

Only one Information

Statement is being delivered to multiple security holders sharing an address unless the Company has received contrary instructions

from one or more of the security holders. The Company shall deliver promptly upon written or oral request a separate copy of the

Information Statement to a security holder at a shared address to which a single copy of the documents was delivered. A security

holder can notify the Company that the security holder wishes to receive a separate copy of the Information Statement by sending

a written request to the Company at the address below or by calling the Company at the number below and requesting a copy of the

Information Statement. A security holder may utilize the same address and telephone number to request either separate copies or

a single copy for a single address for all future information statements and annual reports.

Company Contact Information

All inquiries regarding

our Company should be addressed to our Company’s principal executive office:

Cannapharmarx, Inc.

2 Park Plaza

Suite 1200B

Irvine, CA 92614

BY ORDER OF THE BOARD OF

DIRECTORS

_______________________________________

James Samuelson, Chief Executive Officer

EXHIBIT “A’

CANNPHARMARX, INC.

AMENDMENT TO CERTIFICATE OF INCORPORATION

ARTICLE IV OF THE CANNAPHARMARX, INC.

CERTIFICATE OF INCORPORATION IS HEREBY AMENDED TO READ AS FOLLOWS:

CAPITAL STOCK

A. The

amount of the total authorized capital stock of the corporation shall be three hundred ten million (310,000,000) shares consisting

of Three Hundred Million (300,000,000) shares of Common Stock, $0.0001 par value per share, and Ten Million (10,000,000) shares

of Preferred Stock, par value $0.0001 per share, the designations, preferences, limitations and relative rights of the shares of

each such class are as follows:

1.

Common Shares.

(a)

The rights of holders of the Common Shares to receive dividends or share in the distribution of assets in the event of liquidation,

dissolution or winding up of the affairs of the Corporation shall be subject to the preferences, limitations and relative rights

of the Preferred Shares fixed in the resolution or resolutions which may be adopted from time to time by the Board of Directors

of the corporation providing for the issuance of one or more series of the Preferred Shares.

(b) The holders of the Common

Shares shall have unlimited voting rights and shall constitute the sole voting group of the corporation, except to the extent any

additional voting groups or groups may hereafter be established in accordance with the Colorado Business Corporation Act, and shall

be entitled to one vote for each share of Common Shares held by them of record at the time for determining the holders thereof

entitled to vote.

The

balance of the Certificate of Incorporation shall remain as previously stated.

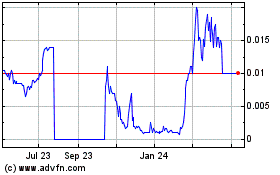

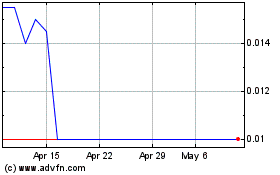

Cannapharmarx (PK) (USOTC:CPMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cannapharmarx (PK) (USOTC:CPMD)

Historical Stock Chart

From Apr 2023 to Apr 2024