Current Report Filing (8-k)

November 25 2019 - 5:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): November 19, 2019

CARDIFF LEXINGTON CORP.

(Exact name of registrant as specified

in its charter)

|

Florida

|

|

000-49709

|

|

84-1044583

|

|

(State or other

jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

401 E. Las Olas Blvd., Suite 1400

Ft. Lauderdale, FL 33301

(Address of principal executive offices)

(zip code)

|

|

|

|

(844)-628-2100

(Registrant’s telephone number, including

area code)

|

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Securities Purchase Agreement

On November 20, 2019, Cardiff Lexington

Corp., a Florida corporation (the “Company”), entered into a Securities Purchase Agreement (the “Securities Purchase

Agreement”) whereby an investor (the “Investor”) agreed to purchase from the Company, up to 1,065 shares of Series

R Convertible Preferred Stock (“Series R Preferred”), deliverable in multiple closings with a maximum of 100 shares

deliverable at each closing, for a purchase price of $1,000 per share, subject to the satisfaction of certain closing conditions

being met. The first closing under the Securities Purchase Agreement occurred on November 20, 2019, whereby 165 shares of Series

R Preferred, including 50 shares representing a commitment fee, were issued to the Investor and $115,000 was funded to the Company,

in accordance with the Securities Purchase Agreement. The aggregate maximum purchase price of the unissued Series R Preferred is

$900,000.

Pursuant to the Securities Purchase Agreement,

the Company will register with the Securities and Exchange Commission for resale the shares of common stock underlying the Series

R Preferred, with the second closing pursuant to the Securities Purchase Agreement to occur no later than the first business day

following the date of effectiveness of such registration statement, and subsequent closings to occur in 30-day increments thereafter.

The Company utilized the services of Kraft

Capital Management, a FINRA-registered finder, for the Securities Purchase Agreement. In connection with the first closing pursuant

to the Securities Purchase Agreement, the Company paid such finder an aggregate cash fee of $6,000.

The Securities Purchase Agreement contains

such representations, warranties and covenants as are typical for a transaction of this nature.

The foregoing provides only a brief description

of the material terms of the Securities Purchase Agreement, and does not purport to be a complete description of the rights and

obligations of the parties thereunder, and such descriptions are qualified in their entirety by reference to the full text of

the forms of Securities Purchase Agreement, filed as an exhibit to this Current Report on Form 8-K, and are incorporated herein

by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The applicable information set forth in

Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02. The issuance of the securities set

forth herein (the “Securities”) was made in reliance on the exemption provided by Section 4(a)(2) of the Securities

Act for the offer and sale of securities not involving a public offering. The Company’s reliance upon Section 4(a)(2) of

the Securities Act in issuing the securities was based upon the following factors: (a) the issuance of the Securities was an isolated

private transaction by us which did not involve a public offering; (b) there were a small number of recipients; (c) there were

no subsequent or contemporaneous public offerings of the Securities by the Company; (d) the Securities were not broken down into

smaller denominations; (e) the negotiations for the issuance of the Securities took place directly between the individuals and

the Company; and (f) each recipient of the Securities is an accredited investor.

|

Item 5.03.

|

Amendments to Articles of Incorporations or Bylaws; Change in Fiscal Year

|

On November 19, 2019, the Company received

confirmation from the Secretary of State of the State of Florida of the acceptance of the Amendment to the Company’s Articles

of Incorporation (the “Amendment to Articles”), which established the Series R Preferred and set forth the designations,

rights and preferences thereof, as determined by the Company’s Board of Directors in its sole discretion, in accordance with

the Company’s Articles of Incorporation and bylaws (the “Certificate of Designations”).

The Certificate of Designations authorizes

1,015 shares of Series R Preferred. Each share of the Series R Preferred has a stated value of $1,200, and is convertible into

shares of the Company’s common stock in an amount to be calculated by dividing the stated value of such share of Preferred

Stock by the lower of (a) $0.001, or (b) the lowest daily VWAP for the Company’s common stock for the twenty (20) Trading

Days immediately preceding the date of such conversion (subject to adjustment as provided in the Certificate of Designations) at

any time at the option of the holder, provided that the holder will be prohibited from converting Series R Preferred Stock into

shares of the Company's common stock if, as a result of such conversion, the holder, together with its affiliates, would own more

than 9.99% of the total number of shares of the Company's common stock then issued and outstanding. Each share of Preferred Stock

shall be entitled to receive cumulative dividends 12% per annum, payable quarterly, beginning on the date of issuance and ending

on the date that such share of Preferred Share has been converted or redeemed. The Series R Preferred will vote together with the

common stock on an as-converted basis. Pursuant to a “most favored nation” clause, subject to certain terms and conditions,

the holder of Series R Preferred will be entitled to exchange shares of Series R Preferred for securities in a new financing on

a $1.00 for $1.00 basis.

The foregoing description of the terms

of the Certificate of Designations does not purport to be complete and is qualified in its entirety by reference to such exhibit.

The Certificate of Designations is filed as Exhibit 3.1 to this report and is incorporated herein

|

Item 9.01.

|

Financial Statements and Exhibits.

|

___________________

* filed herewith

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

CARDIFF LEXINGTON CORP.

|

|

|

|

|

|

Date: November 25, 2019

|

By:

|

/s/ Daniel R Thompson

|

|

|

|

Daniel R Thompson

|

|

|

|

Chairman

|

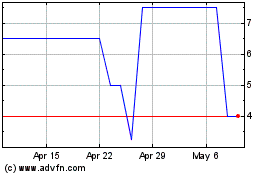

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

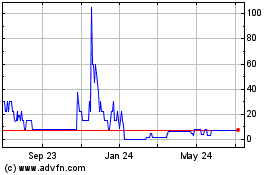

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024