Carlsberg Sees Fiscal Year Operating Profit Down 10%-15%; Stops Buyback Program

August 13 2020 - 2:17AM

Dow Jones News

By Dominic Chopping

Carlsberg AS said Thursday that it expects full-year organic

operating profit to fall 10%-15%, and that it has decided not to

start the second tranche of its buyback program.

The Danish brewer suspended full-year guidance in April but said

Thursday that it is well into the peak summer season and can base

guidance on the first-half, July figures and the current Covid-19

situation in its markets.

Carlsberg prereleased headline first-half figures, expecting an

11.6% fall in organic revenue, an 8.9% decline in organic operating

profit and a 7.7% decline in organic volumes. These figures were

all confirmed Thursday.

Revenue fell to 28.83 billion Danish kroner ($4.55 billion) in

the half, from DKK32.99 billion a year earlier, and overall

beverage volumes fell to 62.8 million hectoliters from 68.1 million

hectoliters. Analysts polled by FactSet had expected revenue of

DKK29.55 billion.

Adjusted net profit attributable to shareholders fell to DKK2.87

billion, in line with estimates of DKK2.88 billion.

"To mitigate the impact of weaker volumes and mix, we've

reinforced our focus on costs, cash and liquidity," said Chief

Executive Cees 't Hart.

"Recognizing that we're faced with a new market reality,

including changed consumer preferences and a reduced level of

on-trade activity, we're taking measures to adapt our business

accordingly.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

August 13, 2020 02:02 ET (06:02 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

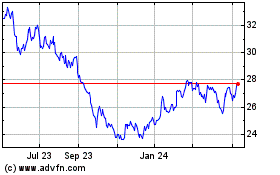

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

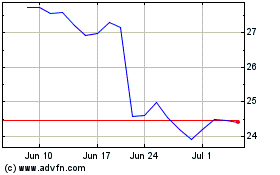

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Apr 2023 to Apr 2024