Current Report Filing (8-k)

June 24 2021 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 24, 2021

BIOSTAGE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-35853

|

45-5210462

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

84 October Hill Road, Suite 11, Holliston, MA

|

01746

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code:

(774) 233-7300

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act: None

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

As previously disclosed in by Biostage, Inc. (the

“Company”, “we,” “our,” and “us”) in its periodic filings with the Securities and Exchange

Commission, on April 14, 2017, representatives for the estate of an individual plaintiff filed a wrongful death complaint with the Suffolk

Superior Court, in the County of Suffolk, Massachusetts (the “Court”), against us and other defendants, including Harvard

Bioscience, Inc. (“Harvard Bioscience”), our former parent entity prior to the spin-off of the Company in 2013, as well as

another third party. The complaint seeks payment for an unspecified amount of damages and alleges that the plaintiff sustained terminal

injuries allegedly caused by products, including one synthetic trachea scaffold and two bioreactors, provided by certain of the named

defendants and utilized in connection with surgeries performed by third parties in Europe in 2012 and 2013. This lawsuit relates to the

Company’s first-generation trachea scaffold technology for which the Company discontinued development in 2014, and not to the Company’s

current CellframeTM technology nor to its lead development CellspanTM Esophageal Implant product candidate.

On October 1, 2019, the Court entered an order

granting plaintiffs’ motion to compel the defendants to produce discovery. Subsequently, the plaintiff filed a motion for sanctions

against us on January 6, 2020 claiming failure to produce. Our counsel at the time, which had been selected for the case by our liability

insurance carrier, never notified us of plaintiffs’ motion and never responded to plaintiff’ motion. As a result of the failure

of our former counsel to respond, on January 29, 2020, the Court entered an order allowing plaintiffs’ sanctions against us and

the other defendants, which establishes a sanction of admitted liability. In June 2021, we were informed of these 2019 and 2020 court

actions by new defense counsel appointed by our liability insurance carrier. On June 9, 2021, we, together with the other defendants,

filed a motion to vacate the Court’s order allowing plaintiff’s motion for sanctions. We are also actively fighting the damages

in the case.

While we believe that claims made in this lawsuit

are without merit and that there are strong grounds to vacate the sanctions, unless the sanctions award is vacated we could face a trial

on damages. If the sanctions award is vacated, we will have the opportunity to contest the underlying claims at trial and, while

there can be no assurance of prevailing, we believe those claims lack merit. If we face a trial on damages, whether as a result

of the sanctions or following a loss on the merits, we do not know the exact amount of compensatory and, potentially, punitive damages

that could be awarded. In all events, we believe that available product liability insurance coverage will reimburse us for all or

a significant portion of such damages, although there can be no assurance that the damages awarded will be within the limits of our insurance. The

Company is also evaluating possible malpractice claims as an additional source of recovery. We cannot provide assurance that our

losses will not exceed such recoveries. Further, in accordance with a separation and distribution agreement between Harvard Bioscience

and the Company relating to the spin-off, the Company would be required to indemnify Harvard Bioscience against losses that Harvard Bioscience

may suffer as a result of this litigation.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

BIOSTAGE, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

June 24, 2021

|

|

/s/ Hong Yu

|

|

(Date)

|

|

Hong Yu

|

|

|

|

President

|

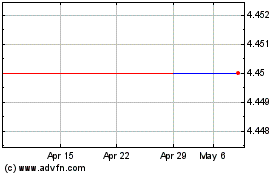

Biostage (QB) (USOTC:BSTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

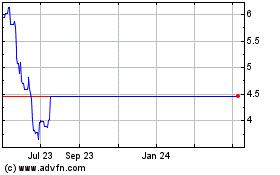

Biostage (QB) (USOTC:BSTG)

Historical Stock Chart

From Apr 2023 to Apr 2024