Statement of Beneficial Ownership (sc 13d)

December 16 2021 - 1:24PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

RULE 13d-2(a)

BESPOKE EXTRACTS, INC.

(Name of Issuer)

COMMON STOCK, PAR VALUE $0.001 PER SHARE

(Title of Class of Securities)

08634Q109

(CUSIP Number)

Hunter Garth

c/o Bespoke Extracts, Inc.

2590 Walnut St.

Denver, CO 80205

855-633-3738

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

12/14/2021

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box ☐.

Note. Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies

are to be sent.

(Continued on following pages)

|

1

|

NAME OF REPORTING PERSONS

Hunter Garth

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF MEMBER OF A GROUP

|

|

|

|

|

(a) ☐

|

|

|

|

(b) ☐

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

OO

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

United States

|

|

|

|

7

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

22,500,000

|

|

NUMBER OF

|

8

|

SHARED VOTING POWER

|

|

SHARES

|

|

|

|

BENEFICIALLY

|

|

0

|

|

OWNED BY

|

9

|

SOLE DISPOSITIVE POWER

|

EACH

REPORTING

|

|

|

|

PERSON WITH

|

|

22,500,000

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

22,500,000

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

7.1% *

|

|

|

14

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

IN

|

|

|

|

*

|

Based on 318,839,621 shares of common stock issued and outstanding

as of December 16, 2021. Beneficial ownership is determined in accordance with Securities and Exchange Commission rules and generally

includes voting or investment power with respect to securities, which are deemed outstanding and beneficially owned by such person for

purposes of computing his or her percentage ownership.

|

Item 1. Security and Issuer

This Schedule 13D relates to the common stock,

par value $0.001 per share of Bespoke Extracts, Inc., a Nevada corporation (the “Issuer”), whose principal executive offices

are located at 2590 Walnut St., Denver, CO 80205.

Item 2. Identity and Background.

This statement is being filed by Hunter Garth.

Mr. Garth is a natural person with a business

address of 2590 Walnut St., Denver, CO 80205.

Mr. Garth’s present principal occupation

is as president and director of the Issuer.

During the last five years, Mr. Garth has not

been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

During the last five years, Mr. Garth has not

been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which Mr. Garth was

or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to,

federal or state securities laws or finding of any violation with respect to such laws.

Mr. Garth is a United States citizen.

Item 3. Source and Amount of Funds or Other

Consideration.

On December 14, 2021, Mr. Garth received a grant

of 22,500,000 restricted shares of common stock of the Issuer. The shares will vest one year from the date of grant. Mr. Garth also received

options to purchase 15,000,000 shares of common stock of the Issuer at an exercise price of $0.06. One-third of the options vest on each

yearly anniversary of the grant date of December 14, 2021. Mr. Garth received the shares and options as compensation.

Item 4. Purpose of Transaction.

Mr. Garth received the shares and options as compensation.

In his capacity as president and a member of the

Issuer’s Board of Directors, Mr. Garth is actively involved in the management and operations of the Issuer and is, and will continue

to be, involved in deliberations and decisions regarding various issues affecting the Company, which could include, from time to time,

matters set forth in subsections (b) through (j) of Item 4 to Schedule 13D.

Item 5. Interest in Securities of the Issuer.

Mr. Garth beneficially owns 22,500,000 shares

of common stock of the Issuer, which represents 7.1% of the Issuer’s outstanding common stock based on 318,839,621 shares issued

and outstanding as of December 16, 2021. Mr. Garth also owns options to purchase 15,000,000 shares of common stock of the Issuer

at an exercise price of $0.06. One-third of the options vest on each yearly anniversary of the grant date of December 14, 2021.

Except as set out above, Mr. Garth has not effected

any other transaction in any securities of the Issuer in the past sixty days.

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

Other than as described herein, there are no contracts,

arrangements, understandings or relationships (legal or otherwise) between Mr. Garth and any other person with respect to the shares.

Item 7. Material to be Filed as Exhibits.

None.

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and accurate.

December 16, 2021

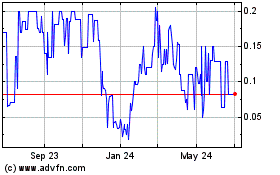

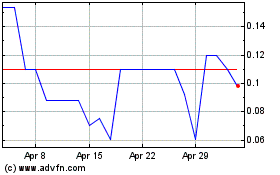

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bespoke Extracts (QB) (USOTC:BSPK)

Historical Stock Chart

From Apr 2023 to Apr 2024