BNP Paribas Targets Higher Shareholder Returns Through 2025

February 08 2022 - 2:04AM

Dow Jones News

By Mauro Orru

BNP Paribas SA plans to raise the proportion of earnings it pays

to shareholders through 2025, joining a cohort of European lenders

in increasing shareholder returns after the European Central Bank

lifted the restrictions on payouts it had imposed at the onset of

the coronavirus pandemic.

The French bank said Tuesday that it is targeting a payout ratio

of 60% as part of its new plan from 2022 to 2025, including a

minimum cash payout of 50%.

For 2021, it is proposing a dividend of 3.67 euros ($4.20) in

cash, representing a 50% payout ratio that rises to 60% when

factoring in a EUR900 million share-buyback program that BNP

Paribas completed in December. The bank will be distributing EUR5.4

billion in total for 2021 if shareholders back its proposal at the

annual general meeting on May 17.

Major European banks are planning higher returns to shareholders

after the ECB lifted restrictions that curbed lenders' dividend

payments and share buybacks. The central bank had imposed the

restrictions in March 2020 when the pandemic hit markets, in an aim

to boost banks' capacity to absorb losses.

The curbs have been particularly contentious for lenders since

dividend payments are among the most effective tools to attract and

retain investors. Now, banks in the continent are playing

catch-up.

UniCredit SpA said it would return at least EUR16 billion by

2024, Intesa Sanpaolo SpA plans EUR22 billion by 2025, and UBS

Group AG said it would buy back up to $5 billion worth of shares

this year.

BNP Paribas's plan to raise its payout ratio comes as the bank

targets average annual growth in net income of more than 7%

throughout the period from 2022 to 2025, with revenue growth of

more than 3.5% annually.

It also expects a common equity Tier 1 ratio--a key measure of

capital strength--of 12% in 2025. The return on tangible equity--a

key metric of profitability--should be more than 11%, the bank

said.

BNP Paribas ended 2021 with a net profit of EUR9.49 billion, up

34% from 2020 and 16% from 2019. In the fourth quarter, the lender

posted net profit of EUR2.31 billion up from EUR1.59 billion a year

earlier. Revenue rose to EUR11.23 billion from EUR10.83

billion.

Analysts polled by FactSet had forecast net profit of EUR2.01

billion on revenue of EUR11.40 billion for the last three months of

the year.

Loan-loss provisions fell to EUR510 million compared with

EUR1.60 billion a year ago, when banks were still preparing for

potentially large losses on loans to consumers and businesses due

to the pandemic.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

February 08, 2022 01:49 ET (06:49 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

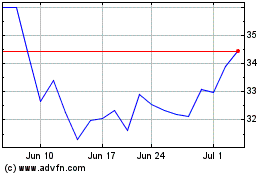

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Mar 2024 to Apr 2024

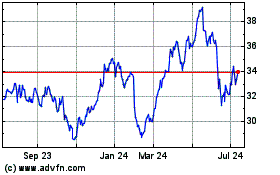

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Apr 2023 to Apr 2024