BNP Paribas to Sell US Unit to Bank of Montreal for $16.3 Billion -- Update

December 20 2021 - 3:12AM

Dow Jones News

By Cristina Roca

BNP Paribas SA said Monday that it has agreed to sell Bank of

the West to Bank of Montreal's BMO Financial Group for a total

consideration of $16.3 billion in cash.

The sale represents all of BNP Paribas's retail and

commercial-banking activities in the U.S. Some 70% of Bank of the

West's deposits are in California.

The Wall Street Journal reported that the two companies were in

advanced talks earlier Monday.

The French lender said the deal will generate a one-off capital

gain, net of taxes, of about 2.9 billion euros ($3.26 billion), and

boost its common equity Tier 1 ratio by about 170 basis points.

Separately on Monday, BMO said the deal should be accretive to

its earnings per share immediately after closing, and more than 10%

accretive in 2024 including cost synergies.

The deal will be funded mainly through excess capital on the

combined entities' balance sheet at closing, BMO said. It backed

its target capital ratios and target payout range.

BNP Paribas said it intends to implement an extraordinary share

buyback to compensate the expected earnings-per-share dilution from

the deal. Indicatively, about EUR4 billion would fully neutralize

the dilution, it said.

The rest of the proceeds of the deal, estimated at about EUR7

billion, should be redeployed to accelerate organic growth,

especially in Europe, make targeted investments and acquire

value-added businesses, BNP Paribas said.

The deal is expected to close in 2022.

Write to Cristina Roca at cristina.roca@wsj.com

(END) Dow Jones Newswires

December 20, 2021 02:57 ET (07:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

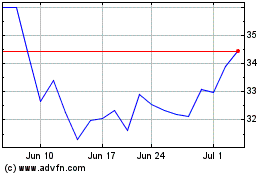

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Mar 2024 to Apr 2024

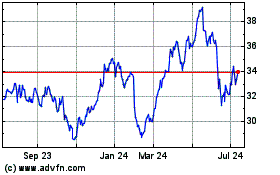

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Apr 2023 to Apr 2024