BNP Paribas to Sell Bank of the West to Bank of Montreal for $16.3 Billion

December 20 2021 - 2:48AM

Dow Jones News

By Cristina Roca

BNP Paribas SA said Monday that it has agreed to sell Bank of

the West to Bank of Montreal for a total consideration of $16.3

billion in cash.

The French lender said the deal will generate a one-off capital

gain, net of taxes, of about 2.9 billion euros ($3.26 billion), and

boost its common equity Tier 1 ratio by about 170 basis points.

The sale represents all of BNP Paribas's retail and

commercial-banking activities in the U.S.

BNP Paribas said it intends to implement an extraordinary share

buyback to compensate the expected earnings-per-share dilution from

the deal. Indicatively, about EUR4 billion would fully neutralize

the dilution, it said.

The rest of the proceeds of the deal, estimated at about EUR7

billion, should be redeployed to accelerate organic growth,

especially in Europe, make targeted investments and acquire

value-added businesses.

The deal is expected to close in 2022.

Write to Cristina Roca at cristina.roca@wsj.com

(END) Dow Jones Newswires

December 20, 2021 02:33 ET (07:33 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

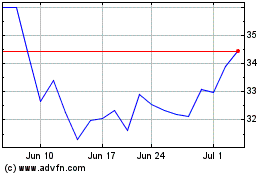

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Mar 2024 to Apr 2024

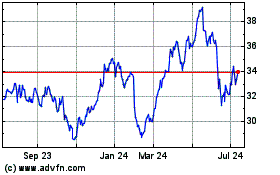

BNP Paribas (QX) (USOTC:BNPQY)

Historical Stock Chart

From Apr 2023 to Apr 2024