As filed with the Securities and

Exchange Commission on January 7, 2019

Registration No. 333-228044

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

BIONIK LABORATORIES CORP.

(Exact name of Registrant as specified in

its charter)

|

Delaware

|

|

3842

|

|

27-1340346

|

|

(State or Other Jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Classification Code Number)

|

|

Identification No.)

|

483 Bay Street, N105

Toronto, ON M5G 2C9

(416) 640-7887

(Address, including zip code, and telephone

number, including area code, of Registrant’s executive offices)

Eric Dusseux, CEO

Bionik Laboratories Corp.

483 Bay Street, N105

Toronto, ON M5G 2C9

(416) 640-7887

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

|

Stephen E. Fox, Esq.

Michael S. Williams, Esq.

Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza

Uniondale, New York 11556

(516) 663-6600

(516) 663-6601 (Facsimile)

|

Ralph V. De Martino, Esq.

Cavas S. Pavri, Esq.

Schiff Hardin LLP

901 K Street, NW, Suite 700

Washington, DC 20001

(202) 724-6848

|

Approximate date of commencement of proposed

sale to the public:

As soon as practicable after the effective

date of this Registration Statement.

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box.

þ

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement number for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

|

Non-accelerated filer

þ

|

Smaller reporting company

þ

|

|

|

Emerging growth company

¨

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided to Section 7(a)(2)(B) of the Securities Act.

¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered (1)

|

|

Proposed

Maximum

Offering

Price

(2)(3)

|

|

|

|

|

Amount of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $.001 par value

|

$

|

11,500,000

|

|

|

|

$

|

1,393.80

|

|

|

Representative’s Warrant

|

$

|

(4)

|

|

|

|

$

|

(4)

|

|

|

Common Stock, $.001 par value, underlying Representative’s

Warrant

|

$

|

960,000

|

|

|

|

$

|

116.35

|

|

|

Total

|

$

|

12,460,000

|

|

|

|

$

|

1,510.15(5)

|

|

|

|

(1)

|

Pursuant to Rule 416 under

the Securities Act, the shares of common stock being registered hereunder include such indeterminate number of shares as may be

issuable as a result of stock splits, stock dividends or similar transactions.

|

|

|

(2)

|

Estimated solely for purposes

of determining the registration fee pursuant to Rule 457(o) under the Securities Act

|

|

|

(3)

|

Includes the offering price of additional

securities that the underwriters have the option to purchase.

|

|

|

(4)

|

No fee pursuant to Rule

457(g) under the Securities Act.

|

The Registrant hereby

amends this Registration Statement on Form S-1 on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such

date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is subject to completion, is not an offer to sell these securities,

and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED January 7,

2019

|

Up to $10,000,000 of Common Stock

BIONIK LABORATORIES CORP.

We are offering up to 1,470,588 shares of our

common stock.

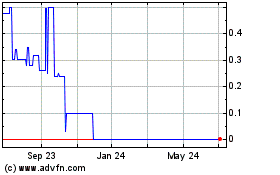

Our common stock trades on the OTCQB marketplace under the

symbol “BNKL.” We have assumed a public offering price of $6.80 per share, the closing price of our common stock on

January 7, 2019. After pricing of the offering, we expect that the stock will trade on the Nasdaq Capital Market under the symbol

“BNKL”. The actual public offering price per share of common stock will be determined between us and the underwriters

at the time of pricing, and may be at a discount to the current market price.

|

|

|

Per Share

|

|

|

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

6.80

|

|

|

$

|

|

|

|

$

|

10,000,000

|

|

|

Underwriting discounts and commissions(1)

|

|

$

|

0.54

|

|

|

$

|

|

|

|

$

|

800,000

|

|

|

Proceeds, before expenses, to us

|

|

$

|

6.26

|

|

|

$

|

|

|

|

$

|

9,200,000

|

|

(1) The underwriters

will receive compensation in addition to the underwriting discounts and commissions. See “Underwriting” beginning

on page 58 of this prospectus for additional information.

Investing in our securities involves

a high degree of risk. See the section entitled “Risk Factors” beginning on page 7 of this prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense. The securities are not being offered in any

jurisdiction where the offer is not permitted.

We have granted the underwriters an

option for a period of 45 days after the closing of the offering to purchase up to an additional 15% of the total number of shares

of our common stock to be offered in the offering at the public offering price, less the underwriting discounts and commissions,

to cover over-allotments, if any.

The underwriters expect to deliver

the shares of common stock to purchasers on or about , 2019.

Joint Book-Running

Managers

|

ThinkEquity

a

division of Fordham

Financial Management, Inc.

|

WestPark Capital, Inc.

|

The Date of this Prospectus is

, 2019.

TABLE OF CONTENTS

You should rely only on the information

contained in this prospectus filed by us with the Securities and Exchange Commission, or the SEC. We have not, and the underwriters

and their affiliates have not, authorized anyone to provide you with any information or to make any representation not contained

in this prospectus. We do not, and the underwriters and their affiliates do not, take any responsibility for, and can provide

no assurance as to the reliability of, any information that others may provide to you. This prospectus is not an offer to sell

or an offer to buy securities in any jurisdiction where offers and sales are not permitted. The information in this prospectus

is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of securities. You should also

read and consider the information in the documents to which we have referred you under the caption “Where You Can Find More

Information” in the prospectus. In addition, this prospectus contains summaries of certain provisions contained in some

of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries

are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will

be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and

you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

You should assume that the information

in this prospectus is accurate only as of the date on the front of this document and that any information we have incorporated

by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this

prospectus, or any sale of a security registered under the registration statement of which this prospectus is a part.

For investors outside the United

States, neither we nor the underwriters have done anything that would permit a public offering of the securities or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus outside of the United States.

As used in this prospectus, unless the

context indicates or otherwise requires, the “Company,” “we,” “us,”, “our” or “Bionik”

refer to Bionik Laboratories Corp., a Delaware corporation, and its subsidiaries.

This prospectus contains and incorporates

by reference market data and industry statistics and forecasts that are based on our own internal estimates as well as independent

industry publications and other publicly-available information. Although we believe these sources are reliable, we do not guarantee

the accuracy or completeness of this information and we have not independently verified this information. Although we are not aware

of any misstatements regarding the market and industry data presented in this prospectus or the documents incorporated herein by

reference, these estimates involve risks and uncertainties and are subject to change based on various factors, including those

discussed under the headings “Risk Factors” in this prospectus, and under similar headings in the other documents that

are incorporated herein by reference. Accordingly, investors should not place undue reliance on this information.

PROSPECTUS SUMMARY

This summary highlights information contained

elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read

the entire prospectus carefully together with our financial statements and the related notes appearing elsewhere in this prospectus

and incorporated by reference before you decide to invest in our common stock. This prospectus contains forward-looking statements,

which involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking

statements as a result of certain factors, including those discussed under the heading “Risk Factors” and other sections

of this prospectus.

Company Overview

Bionik Laboratories Corp. is a healthcare

company focused on improving the quality of life of millions of people with neurological or mobility impairments by combining artificial

intelligence and innovative robotics technology to help individuals from hospital to home to regain mobility, enhance autonomy,

and regain self-esteem.

The Company uses artificial intelligence

and machine learning technologies to make rehabilitation methods and processes smarter and more intuitive to deliver greater recovery

for patients with neurological or mobility impairments. These technologies allow large amounts of data to be collected and processed

in real-time, enabling appropriately challenging and individualized therapy during every treatment session. This is the foundation

of the InMotion therapy. The Company’s rehabilitation therapy products are built on an artificial intelligence platform,

measuring the position, the speed and the acceleration of the patient 200 times per second. The artificial intelligence platform

is designed to adapt in real time to the patient’s needs and progress while providing quantifiable feedback of a patient’s

progress and performance, in a way that the Company believes a trained clinician cannot.

Based on this foundational work, the Company

has a portfolio of products focused on upper and lower extremity rehabilitation for stroke and other mobility-impaired individuals,

including three InMotion robots currently in the market and two products in varying stages of development.

The InMotion therapy uses the Company’s

robots to assist patients to rewire a segment of their brains after injury, also known as neuroplasticity. The InMotion Robots

- the InMotion ARM, InMotion Wrist and the InMotion ARM/HAND – are designed to provide intelligent, adaptive therapy in a

manner that has been clinically shown to maximize neurorecovery. The Company is also developing a home version of the InMotion

upper-body rehabilitation technology, as well as a lower-body wearable assistive product based on the Company’s existing

ARKE lower body exoskeleton technology, which could allow certain mobility impaired individuals to walk better. The Company intends

to launch this mobility assistance solution into the consumer market.

The InMotion ARM, InMotion ARM/HAND, and

InMotion Wrist are robotic therapies for the upper limbs. InMotion robotic therapies have been characterized as Class II medical

devices by the U.S. Food and Drug Administration, or FDA, and are listed with the FDA to market and sell in the United States.

More than 250 of our clinical robotic products for stroke rehabilitation have been sold in over 20 countries, including the United

States. In addition to these fully developed, clinical rehabilitation solutions, we are also developing “InMotion Home”,

which is an upper extremity product that allows the patient to extend their therapy for as long as needed while rehabilitating

at home. This rehabilitation solution is being developed on the same design platform as the InMotion clinical products.

We believe recent payment changes in the

US marketplace proposed and finalized by the Centers for Medicare and Medicaid Services create a favorable environment for greater

clinical adoption of our robotic technology. For instance, the Improving Medicare Post-Acute Care Transformation Act of 2014, or

the Impact Act of 2014, began the shift toward standardizing patient assessment data for quality measures. The updated Prospective

Payment System (PPS), SNF QRP (Quality Reporting Program) and SNF VBP (Value Based Purchasing) programs have further shifted reimbursement

toward the needs of the patient and away from volume of services provided in the skilled nursing setting. Other programs have caused

a similar shift in the Inpatient Rehabilitation Facility setting, as well. We expect that in the next 12-18 months, further incentives

toward quality based care will be implemented, resulting in providers being publicly ranked, as well as financially rewarded, for

quality reporting and better outcomes.

We have a growing body of clinical data

for our products. More than 1,500 patients participated in trials using our InMotion robots, the results of which have been published

in peer-reviewed medical journals (including the New England Journal of Medicine, Nature and Stroke). Of note, our InMotion robots

are being used in an ongoing, multicenter randomized controlled phase III interventional trial, funded by the National Institute

for Health Research Health Technology Assessment Program in the United Kingdom. The study includes the enrollment of 720 stroke

patients in a multi-center, randomized controlled research trial to evaluate the clinical and cost effectiveness of robot-assisted

training in post-stroke care that is expected to be completed before the end of 2018 with results to be published in 2019.

In addition to our proprietary in-house

products, we have the exclusive right to market and sell the Morning Walk lower body rehabilitation technology owned by Curexo

Inc., a South Korean company, within the United States. The Morning Walk is a gait assistance product for rehabilitation. We plan

to develop other biomechatronic solutions, including consumer-level medical assistive and rehabilitative products, through internal

research and development. We may in the future further augment our product portfolio through technology acquisition opportunities

should they come available and if we are sufficiently capitalized to undertake these investments.

We have worked with industry leaders

in manufacturing and design and have also expanded our development team through partnerships with researchers and academia. Most

recently, on May 17, 2017, we entered into a Co-operative Joint Venture Contract with Ginger Capital Investment Holding Ltd.,

pursuant to which the Company has a 25% interest and Ginger Capital has a 75% interest. As of the date of this prospectus, Ginger

Capital is obligated to contribute $290,000 to the joint venture and is required to contribute an additional $435,000 by May 22,

2019 and $725,000 by May 22, 2023. Three InMotion robots have been delivered from us to the joint venture, which will be used

for product demonstration and for quality assessment by Chinese authorities.

On June 20, 2017 we entered into a joint

development and manufacturing agreement with Wistron Medical Tech Holding Company of Taiwan to jointly develop a lower body assistive

robotic product based on the ARKE technology for the consumer home market.

We have also entered into an agreement with

Cogmedix Inc., a wholly owned subsidiary of Coghlin Companies, a medical device development and manufacturing company located in

Worchester, MA, for the production of our InMotion robots. The initial agreement is for turnkey, compliant manufacturing with the

capability of scaling faster production to meet increased volume as the Company grows. In addition, our Massachusetts-based manufacturing

facility is compliant with ISO- 13485 and FDA regulations.

We currently hold an intellectual property

portfolio that includes 4 U.S. patents and 1 U.S. pending patent, all 5 of which are pending internationally, as well as other

patents under development. We may file provisional patents from time to time, which may expire if we do not pursue full patents

within 12 months of the filing date. The provisional patents may not be filed as full patents and new provisional patents may

be filed as the technology evolves or changes. Additionally, we hold exclusive licenses to three additional patents of which one

is currently being used for the InMotion Wrist and is licensed to us from the Massachusetts Institute of Technology.

We currently sell our products directly

or can introduce customers to a third party finance company to lease at a monthly fee over the term or other fee structure for

our products to hospitals, clinics, distribution companies and/or buying groups that supply those rehabilitation facilities.

We introduced our new enhanced commercial

version of the InMotion product line in December 2017. We sold six InMotion robots in the year ended March 31, 2017, eleven InMotion

robots in the year ended March 31, 2018, and twelve InMotion robots in the six month period ended September 30, 2018.

We have a history of net losses. At

September 30, 2018 the Company had an accumulated deficit of $40,526,427 (March 31, 2018 — $35,776,340). The Company incurred

a comprehensive loss of $4,743,803 for the six month period ended September 30, 2018 (September 30, 2017 – $5,855,877). The

Company had $987,431 of revenue for the year ended March 31, 2018 (March 31, 2017 – $571,945), and revenue for the six month

period ended September 30, 2018 of $1,048,418 (September 30, 2017 – $309,367). As of September 30, 2018, the Company had

a working capital deficit of $116,551 (March 31, 2018 – $6,711,941).

History; Recent Developments

Bionik Laboratories Corp. was incorporated

on January 8, 2010 in the State of Colorado. At the time of our incorporation the name of our company was Strategic Dental Management

Corp. On July 16, 2013, we changed our name from Strategic Dental Management Corp. to Drywave Technologies, Inc. and changed our

state of incorporation from Colorado to Delaware. Effective February 13, 2015, we changed our name to Bionik Laboratories Corp.

Bionik Laboratories Inc., which we refer

to in this prospectus as Bionik Canada, was incorporated on March 24, 2011 under the Canada Business Corporations Act.

On February 26, 2015, we entered into an

Investment Agreement with Bionik Acquisition Inc., a company existing under the laws of Canada and our wholly owned subsidiary,

and Bionik Canada whereby we acquired 100 Class 1 common shares of Bionik Canada representing 100% of the outstanding Class 1 common

shares of Bionik Canada. After giving effect to this and related transactions, we commenced operations through Bionik Canada. Subsequently,

on April 21, 2016, we acquired Interactive Motion Technologies, Inc., or IMT,, a Boston, Massachusetts-based provider of effective

robotic products for neurorehabilitation, including all of its owned and licensed products both commercialized and in development.

Between March 31, 2018 and June 2018, an

aggregate of approximately $9.1 million of our outstanding indebtedness converted in accordance with their terms, as amended, into

an aggregate of 1,249,008 of our common stock.

From June through July 2018, the Company

issued short-term convertible promissory notes in the aggregate principal amount of $4,708,306 to existing investors, which includes

affiliates of the Company. As of July 20, 2018, the notes converted in accordance with their terms into an aggregate of 683,396

shares of the Company’s common stock.

Our Board of Directors approved a convertible

note financing for gross proceeds of up to $5 million in September 2018, of which an aggregate principal amount of $3.15 million

has been subscribed for as of January 7, 2019. These convertible notes bear interest at a fixed rate of 1% per month. Upon the

consummation of this offering, the outstanding principal and accrued and unpaid interest on the convertible notes shall automatically

convert into our common stock at a price per share equal to a 20% discount to the offering price of our common stock in this offering.

The convertible notes are unsecured. In the event that this offering is not consummated, we will be required to repay the principal

and accrued and unpaid interest on the convertible notes on March 28, 2019.

We effected a one-for-one hundred fifty

reverse stock split on October 29, 2018. As a result of the reverse stock split, each one hundred fifty shares of our common stock

automatically combined into and became one share of our common stock. Accordingly, as of October 29, 2018, there were 2,337,964

shares of our common stock issued and outstanding. Any fractional shares which would otherwise be due as a result of the reverse

stock split were rounded up to the nearest whole share. The reverse stock split automatically and proportionately adjusted, based

on the one-for-one hundred fifty reverse stock split ratio, all issued and outstanding shares of our common stock and exchangeable

shares, as well as common stock underlying stock options, warrants and other derivative securities outstanding at the time of

the effectiveness of the reverse stock split. The exercise price on outstanding equity based-grants was proportionately increased,

while the number of shares available under our equity-based plans was also proportionately reduced. Share and per share data (except

par value) for the periods presented reflect the effects of this reverse stock split. References to numbers of shares of common

stock and per share data in the accompanying financial statements and notes thereto have been adjusted to reflect the reverse

stock split on a retroactive basis.

On December 14, 2018, we entered into a Sale of Goods Agreement (the

“Agreement”) with CHC Management Services, LLC, or Kindred, pursuant to which, among other things, Kindred agreed

to purchase from us in a first phase a minimum of 21 of the Company’s InMotion ARM Interactive Therapy Systems –

a minimum of one for each of Kindred’s existing and soon-to-open affiliated inpatient rehabilitation hospitals and

similar facilities described in the Agreement, and in a second phase a minimum of one InMotion ARM Interactive Therapy System

for each future facilities of Kindred, during the four-year minimum term of the Agreement. Kindred entered into an initial

purchase order for nine units of the InMotion ARM Interactive Therapy System for shipment on or before December 31,

2018.

Corporate Information

Our principal executive office is located

at 483 Bay Street, N105, Toronto, ON, Canada M5G 2C9 and our main corporate telephone number is (416) 640-7887 x 508. Our principal

US office is located at 80 Coolidge Hill Road, Watertown, MA, USA 02472. Our website is www.bioniklabs.com. Information on our

website does not constitute a part of this prospectus.

Available Information

We file electronically

with the Securities and Exchange Commission, or SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). We make available on our website at www.bioniklabs.com, free of charge, copies of these reports, as soon as reasonably

practicable after we electronically file such material with, or furnish it to, the SEC.

The public may read

or copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549.

The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains

a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically

with the SEC. The address of that website is

www.sec.gov

.

The information in or accessible through

the websites referred to above are not incorporated into, and are not considered part of, this prospectus. Further, our references

to the URLs for these websites are intended to be inactive textual references only.

The Offering

|

Common stock offered by us in this offering

|

Up to 1,470,588 shares of our common stock at an assumed public

offering price of $6.80 per share (the closing price of our common stock on January 7, 2019). The actual public offering

price per share will be determined between us and the underwriters at the time of pricing, and may be at a discount to

the current market price.

|

|

|

|

|

Common stock to be outstanding after the offering

|

4,082,126 shares of common stock and exchangeable shares, based on our issued and outstanding shares of common stock and exchangeable shares as of January 7, 2019. This does not include shares of common stock underlying any options or warrants that may be outstanding, or the conversion of any of our existing convertible promissory notes. Assuming conversion of our existing convertible promissory notes upon closing of this offering and existing anti-dilution provisions held by certain investors, including members of our Board of Directors, we would have 4,688,409 shares of common stock and exchangeable shares outstanding after the offering.

|

|

|

|

|

Option to purchase additional shares

|

The underwriters have a 45-day option to purchase up to an additional 15% of the total

number of shares of our common stock to cover over-allotments, if any.

|

|

|

|

|

Use of proceeds

|

We estimate that the net proceeds to us from this offering will be approximately $8.555 million, based upon the assumed public offering price of $6.80 per share (the closing price of our common stock on January 7, 2019), after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from the sale of the securities for our working capital, development of our technologies or acquisition of new technologies, and/or general corporate purposes. See "Use of Proceeds" on page 22 of this prospectus.

|

|

|

|

|

Risk factors

|

You should carefully read and consider the information set forth under “Risk

Factors” on page 7 of this prospectus before deciding to invest in our securities.

|

|

Lock-up agreements

|

We and all of our executive officers and directors, as well as any other

5% or greater holder of outstanding shares of our common stock, will enter into lock-up agreements

with the underwriters pursuant to which such persons and entities will agree, for a period of six months

from the date of the offering in the case of our directors and officers and three months from the date

of the offering in the case of any other 5% or greater holder of outstanding shares, that they will

neither offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise

dispose of any of our securities without the prior written consent of the underwriters. Additionally,

each of us and any of our successors will agree, for a period of three months from the closing of the

offering, that each will not (a) offer, pledge, sell, contract to sell, sell any option or contract

to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase,

lend, or otherwise transfer or dispose of, directly or indirectly, any shares of our capital stock

or any securities convertible into or exercisable or exchangeable for shares of our capital stock,

other than as may be required pursuant to existing options, warrants or other convertible securities;

(b) file or caused to be filed any registration statement with the SEC relating to the offering of

any shares of our capital stock or any securities convertible into or exercisable or exchangeable for

shares of our capital stock, other than pursuant to existing registration rights in favor of our stockholders

or our affiliates; (c) complete any offering of debt securities, other than entering into a line of

credit with a traditional bank or (d) enter into any swap or other arrangement that transfers to another,

in whole or in part, any of the economic consequences of ownership of our capital stock, whether any

such transaction described in clause (a), (b), (c) or (d) above is to be settled by delivery of shares

of our capital stock or such other securities, in cash or otherwise. For more information, see “Underwriting”

on page 58 of this prospectus.

|

|

|

|

|

OTCQB marketplace symbol

|

BNKL

|

|

|

|

|

Proposed Nasdaq Capital Markets symbol

|

BNKL

|

SUMMARY

FINANCIAL DATA

The following tables presents summary condensed

consolidated statements of comprehensive income (loss) for the periods indicated. The information is only a summary and should

be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

elsewhere in this prospectus and the financial information and related notes incorporated by reference in this prospectus. We have

derived the following summary financial data for the (i) years ended March 31, 2018 and March 31, 2017 from our audited consolidated

financial statements included elsewhere in this prospectus and (ii) quarters ended September 30, 2018 and September 30, 2017 from

our unaudited consolidated financial statements included elsewhere in this prospectus, as adjusted to reflect the one-for-one hundred

fifty reverse stock split.

Consolidated Statements of Operations and Comprehensive

Loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2018

|

|

|

March 31,

2017

|

|

|

September

30,

2018

|

|

|

September

30,

2017

|

|

|

|

|

|

(Audited)

|

|

|

|

(Audited)

|

|

|

|

(Unaudited)

|

|

|

|

(Unaudited)

|

|

|

Sales

|

|

|

987,431

|

|

|

|

571,945

|

|

|

|

1,048,418

|

|

|

|

309,376

|

|

|

Cost of Sales

|

|

|

402,665

|

|

|

|

388,756

|

|

|

|

637,236

|

|

|

|

89,125

|

|

|

Gross Margin

|

|

|

584,766

|

|

|

|

183,189

|

|

|

|

411,182

|

|

|

|

220,242

|

|

|

Operating Expenses

|

|

|

10,354,032

|

|

|

|

8,829,481

|

|

|

|

5,446,061

|

|

|

|

5,646,822

|

|

|

Other expenses (income)

|

|

|

4,856,524

|

|

|

|

(576,890

|

)

|

|

|

(291,076

|

)

|

|

|

429,297

|

|

|

Net loss and comprehensive loss for the year

|

|

|

(14,625,790

|

)

|

|

|

(8,069,402

|

)

|

|

|

(4,743,803

|

)

|

|

|

(5,855,877

|

)

|

|

Loss per share basic and diluted

|

|

$

|

(21.73

|

)

|

|

$

|

(13.19

|

)

|

|

$

|

(2.02

|

)

|

|

$

|

(8.84

|

)

|

RISK FACTORS

An investment in

our securities involves a high degree of risk. You should carefully consider the risks described below and all of the other information

contained in this prospectus, including “Management’s Discussion and Analysis of Financial Condition and Results of

Operation” and our financial statements and related notes, before investing in our securities. If any of the possible events

described in those sections or below actually occur, our business, business prospects, cash flow, results of operations or financial

condition could be harmed. In this case, the trading price of our common stock could decline, and you might lose all or part of

your investment.

The following is a discussion of the

risk factors that we believe are material to us at this time. These risks and uncertainties are not the only ones facing us and

there may be additional matters that we are unaware of or that we currently consider immaterial. All of these could adversely affect

our business, business prospects, results of operations, financial condition and cash flows.

RISKS RELATING TO OUR BUSINESS

We have a limited operating history upon which investors

can evaluate our future prospects.

We have a limited operating history based

on our current business plan of commercializing and selling the InMotion robots, upon which an evaluation of our business plan

or performance and prospects can be made.

The business and prospects of the Company

must be considered in the light of the potential problems, delays, uncertainties and complications encountered in connection with

a relatively new business and creating a new industry. The risks include, but are not limited to, the possibility that we will

not be able to develop functional and scalable products and services, or that although functional and scalable, our products and

services will not be economical to market; that our competitors hold proprietary rights that preclude us from marketing such products;

that our competitors market a superior or equivalent product; that we are not able to upgrade and enhance our technologies and

products to accommodate new features and expanded service offerings; or the failure to receive necessary regulatory clearances

for our products. To successfully introduce and market our products at a profit, we must establish brand name recognition and competitive

advantages for our products. There are no assurances that we can successfully address these challenges. If it is unsuccessful,

we and our business, financial condition and operating results could be materially and adversely affected.

The current and future expense levels are

based largely on estimates of planned operations and future revenues. It is difficult to accurately forecast future revenues because

the robotics market has not been fully developed, and we can give no assurance that our products will continue to fuel revenue

growth. If our forecasts prove incorrect, the business, operating results and financial condition of the Company will be materially

and adversely affected. Moreover, we may be unable to adjust our spending in a timely manner to compensate for any unanticipated

reduction in revenue we expect to generate as a result of our products. As a result, the failure to generate revenues would immediately

and adversely affect the business, financial condition and operating results of the Company.

We cannot predict when we will achieve profitability.

We have not been profitable and cannot

predict when we will achieve profitability. We have experienced net losses since our inception in 2010. We began generating

revenues after April 21, 2016 as a result of the acquisition of IMT and the sale of the InMotion robots, however, we do not

anticipate generating significant revenues from other technologies in development until we successfully develop,

commercialize and sell products derived from those technologies, of which we can give no assurance. Although we sold 11

InMotion robots during the year ended March 31, 2018 and twelve InMotion robots for the six month period ended September 30,

2018, we are unable to determine when we will generate significant recurring revenues, if any, from the future sale of any of

our products, or generate increased recurring revenues from the sale of our commercialized InMotion robots.

We cannot predict when we will achieve profitability,

if ever. Our inability to become profitable may force us to curtail or temporarily discontinue our research and development programs

and our day-to-day operations. Furthermore, there can be no assurance that profitability, if achieved, can be sustained on an ongoing

basis. As of September 30, 2018, we had an accumulated deficit of $40,526,427.

There is substantial doubt on our ability to continue

as a going concern.

Our independent registered public accounting

firm has issued a going concern qualification as part of its audit report that accompanies our 2018 audited financial statements

included herein. As stated in the notes to our audited financial statements for the fiscal year ended March 31, 2018, we have

a negative working capital deficiency and have accumulated a significant deficit. Our continued existence is dependent upon our

ability to continue to execute our operating plan and to obtain additional debt or equity financing. Our Board of Directors approved

a convertible note financing for gross proceeds of up to $5 million in September 2018, of which an aggregate principal amount

of $3.15 million has been subscribed for as of January 7, 2019. There can be no assurance that the additional necessary debt or

equity financing will be available, or will be available on terms acceptable to us, in which case we may be unable to meet our

obligations or fully implement our business plan, if at all. Additionally, should we be unable to realize our assets and discharge

our liabilities in the normal course of business, the net realizable value of our assets may be materially less than the amounts

recorded in our financial statements.

We are subject to significant accounts payable and other

current liabilities.

We have accounts payable and other liabilities

of approximately $5.15 million. Our operations are not currently able to generate sufficient cash flows to meet our payable and

other liabilities, which could reduce our financial flexibility, increase interest expenses and adversely impact our operations.

We may not generate sufficient cash flow from operations to enable us to repay this indebtedness and to fund other liquidity needs,

including capital expenditure requirements. Such indebtedness could affect our operations in several ways, including the following:

|

|

·

|

a significant portion of our cash flows could be required to be used to service such indebtedness;

|

|

|

·

|

a high level of indebtedness could increase our vulnerability to general adverse economic and industry conditions;

|

|

|

·

|

any covenants contained in the agreements governing such outstanding indebtedness could limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments;

|

|

|

·

|

a high level of indebtedness may place us at a competitive disadvantage compared to our competitors that are less leveraged and, therefore, our competitors may be able to take advantage of opportunities that our indebtedness may prevent us from pursuing;

|

|

|

·

|

debt covenants may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry, if any; and

|

|

|

|

|

|

|

·

|

any ability to convert or exchange such indebtedness for equity in the Company can cause substantial dilution to existing stockholders of the Company

|

We may need to refinance or restructure all or a portion

of our indebtedness and other liabilities on or before maturity. We may not be able to refinance any of our indebtedness or other

liabilities on commercially reasonable terms, or at all.

A high level of indebtedness and other

liabilities increases the risk that we may default on our debt obligations and other liabilities. We may not be able to generate

sufficient cash flows to pay the principal or interest on our debt. If we cannot service or refinance our indebtedness and other

liabilities or convert or exchange indebtedness for equity in the Company, we may have to take actions such as selling significant

assets, seeking additional equity financing (which will result in additional dilution to stockholders) or reducing or delaying

capital expenditures or our research and development programs, any of which could have a material adverse effect on our operations

and financial condition. In particular, we have outstanding indebtedness in excess of $5.15 million to third parties, which includes

some of our affiliates, $3.15 million of which shall automatically convert upon the consummation of this offering into our common

stock at a price per share equal to a 20% discount to the offering price of our common stock in this offering. In the event that

this offering is not consummated, we will be required to repay the principal and accrued and unpaid interest on the convertible

notes on March 28, 2019. Although such $3.15 million principal amount of this indebtedness in the form of promissory notes convert

into equity upon events specified in the notes, in the event the conversion features are not triggered, if we do not have sufficient

funds and are otherwise unable to arrange financing to repay such indebtedness, our assets may be foreclosed upon, among other

damages to lenders, which could have a material adverse effect on our business, financial condition and results of operation.

Our acquisition of companies or technologies could prove

difficult to integrate and may disrupt our business and harm our operating results and prospects.

Potential acquisitions will likely involve

risks associated with our assumption of some or all of the liabilities of an acquired company, which may be liabilities that we

were or are unaware of at the time of the acquisition, potential write-offs of acquired assets and potential loss of the acquired

company’s key employees or customers.

We may encounter difficulties in successfully

integrating our operations, technologies, services and personnel with that of the acquired company, and our financial and management

resources may be diverted from our existing operations. For instance, we diverted some resources from our existing technologies

under development to focus on the InMotion robots acquired from IMT in April 2016. Offices outside of Canada or in multiple states

or provinces, including our offices in Massachusetts have created a strain on our ability to effectively manage our operations

and key personnel. We have consolidated accounting, finance and administration in Toronto. If we elect to further consolidate our

facilities, we may lose key personnel unwilling to relocate to the consolidated facility, may have difficulty hiring appropriate

personnel at the consolidated facility and may have difficulty providing continuity of service through the consolidation.

End-user satisfaction or performance problems

with any acquired business, technology, service or device, including the InMotion robots, could also have a material adverse effect

on our reputation. Additionally, potential disputes with the seller of an acquired business or its employees, suppliers or customers

and amortization expenses related to intangible assets could adversely affect our business, operating results and financial condition.

If we fail to properly evaluate and execute acquisitions, our business may be disrupted and our operating results and prospects

may be harmed.

We will require additional capital to support our present

business plan and our anticipated business growth, and such capital may not be available on acceptable terms, or at all, which

would adversely affect our ability to operate; and such capital may substantially dilute the interests of existing stockholders.

We will require additional funds to further

develop our business plan and have been relying on convertible and term debt financing to fund the operation of our business. Based

on our current operating plans, our resources are currently not sufficient to fund our planned operations, including those necessary

to introduce development-stage products into the rehabilitation and mobility markets. Since it is unlikely that we will generate

sufficient revenues from our operating activities to fund all of our operating and development plans, we will need to raise additional

funds through debt, equity or equity-linked offerings or otherwise in order to meet our expected future liquidity requirements,

including development of existing products, introducing other products or pursuing new product opportunities. Any such financing

that we undertake will likely be dilutive to current stockholders or may require that we relinquish rights to certain of our technologies

or products. For instance, as of March 31, 2018 and June 2018, we converted approximately $9.1 million of convertible promissory

notes into approximately 1.25 million shares of common stock. As of July 20, 2018, we also converted approximately $4.7 million

of convertible promissory notes into approximately 680,000 shares of common stock. In the event we consummate a firm commitment,

underwritten offering of our common stock by March 27, 2019, and the offering price per share is less than the conversion price

of the convertible promissory notes that were converted in July 2018, then in such event we shall issue to the holders of such

convertible promissory notes additional shares of common stock pursuant to the terms of such notes. We are evaluating other financing

arrangements, as well.

We intend to continue to make investments

to support our business growth through introducing new products, including patent or other intellectual property asset creation,

the acquisition of other businesses or strategic assets and licensing of technology or other assets. To fully execute on our business

plan, we will need additional funds to respond to business opportunities and challenges, including ongoing operating expenses,

protecting our intellectual property, satisfying debt payment obligations, developing new lines of business and enhancing our operating

infrastructure. While we will need to seek additional funding for such purposes, we may not be able to obtain financing on acceptable

terms, or at all. In addition, the terms of our financings may be dilutive to, or otherwise adversely affect, holders of our common

stock or common stock equivalents. We have previously and may again seek additional funds through arrangements with collaborators

or other third parties. We may not be able to negotiate any such arrangements on acceptable terms, if at all. If we are unable

to obtain additional funding on a timely basis, we may be required to curtail or terminate some or all of our business plans.

We may never complete the development of any of our proposed

products into marketable products.

We do not know when or whether we will successfully

complete the development of the planned development-stage InMotion robots, or any other proposed, developmental or contemplated

product, for any of our target markets. We continue to seek to improve our technologies before we are able to produce a commercially

viable product. Failure to improve on any of our technologies could delay or prevent their successful development for any of our

target markets.

Developing any technology into a marketable

product is a risky, time consuming and expensive process. You should anticipate that we will encounter setbacks, discrepancies

requiring time consuming and costly redesigns and changes and that there is the possibility of outright failure. We may not meet

our product development, manufacturing, regulatory, commercialization and other milestones.

We have established milestones, based upon

our expectations regarding our technologies at that time, which we use to assess our progress toward developing our products. These

milestones relate to product roll-outs, technology and design improvements as well as to dates for achieving development goals

and regulatory approvals, among other things. If our products exhibit technical defects or are unable to meet cost or performance

goals or for any other reason, our commercialization schedule could be delayed and potential purchasers of our initial commercial

products, may decline to purchase such products or may opt to pursue alternative products. In light of our current budgeting constraints

and evolving timelines on our products in development, we are changing or delaying some of the timelines and milestones for our

other technologies being developed.

We can give no assurance that our commercialization

schedule will be met as we concentrate our efforts as we continue to develop our products.

Customers will be unlikely to buy any of our proposed,

developmental or contemplated products unless we can demonstrate that they can be produced for sale to consumers at attractive

prices.

During the past year, we retained a third-party

manufacturer to manufacture our products, in addition to our Boston-based manufacturing facility now used primarily for research

and development purposes but may continue to be used to manufacture and assemble some or all of our products as needed. We can

offer no assurance that either we or our manufacturing partners will continue to develop efficient, automated, low-cost manufacturing

capabilities and processes to meet the quality, price, engineering, design and production standards or production volumes required

to successfully mass market any of our existing or contemplated products. Even if we or our manufacturing partners are successful

in developing such manufacturing capability and processes, we do not know whether we or they will be timely in meeting our product

commercialization schedule or the production and delivery requirements of potential customers. A failure to develop such manufacturing

processes and capabilities could have a material adverse effect on our business and financial results.

The price of our existing or contemplated

products is in part dependent on material and other manufacturing costs. We are unable to offer any assurance that either we or

a manufacturing partner from time to time will be able to reduce costs to a level which will allow production of a competitive

product or that any product produced using lower cost materials and manufacturing processes will not suffer from a reduction in

performance, reliability and longevity. Furthermore, although we have implemented a pricing structure for our existing products,

we can give no assurance that this pricing structure will not require changes in the future that could affect the attractiveness

of our pricing.

Our products may not be accepted in the market.

We cannot be certain that our current products

or any other products we may develop or market will achieve or maintain market acceptance. Market acceptance of our products depends

on many factors, including our ability to convince key opinion leaders to provide recommendations regarding our products, convince

distributors and customers that our technology is an attractive alternative to other technologies, demonstrate that our products

are reliable and supported by us in the field, supply and service sufficient quantities of products directly or through marketing

alliances, and price products competitively in light of the current macroeconomic environment, which, particularly in the case

of the medical device industry, are becoming increasingly price sensitive.

We are subject to extensive governmental regulations relating

to the manufacturing, labeling and marketing of our products.

Our medical technology products and operations

are or are expected to be subject to regulation by the FDA, Health Canada and other governmental authorities both inside and outside

of the United States. These agencies enforce laws and regulations that govern the development, testing, manufacturing, labeling,

advertising, marketing and distribution, and market surveillance of our medical products.

Under the United States Federal Food, Drug,

and Cosmetic Act, medical devices are classified into one of three classes — Class I, Class II or Class III — depending

on the degree of risk associated with each medical device and the extent of control needed to ensure safety and effectiveness.

Class II devices require a 510(k) premarket submission to the US FDA. The Company’s InMotion robots have been characterized

as Class II devices by the FDA.

In addition to regulations in the United

States, we will be subject to a variety of foreign regulations governing clinical trials and commercial sales and distribution

of our products in foreign countries. Whether or not we obtain FDA approval for a product, we must obtain approval of a product

by the comparable regulatory authorities of foreign countries before we can market the product in those countries. The approval

process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements

governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country.

The policies of the FDA and foreign regulatory

authorities may change and additional government regulations may be enacted which could prevent or delay regulatory approval of

our products and could also increase the cost of regulatory compliance. We cannot predict the likelihood, nature or extent of adverse

governmental regulation that might arise from future legislative or administrative action, either in the United States or abroad.

Following the introduction of a product,

these agencies will also periodically review our manufacturing processes and product performance. The process of complying with

the applicable good manufacturing practices, adverse event reporting, clinical trial and other requirements can be costly and time

consuming, and could delay or prevent the production, manufacturing or sale of our products. In addition, if we fail to comply

with applicable regulatory requirements, it could result in fines, delays or suspensions of regulatory clearances, closure of manufacturing

sites, seizures or recalls of products and damage to our reputation. Recent changes in enforcement practice by the FDA and other

agencies have resulted in increased enforcement activity, which increases the compliance risk for the Company and other companies

in our industry. In addition, governmental agencies may impose new requirements regarding registration, labeling or prohibited

materials that may require us to modify or re-register products already on the market or otherwise impact our ability to market

our products in those countries. Once clearance or approval has been obtained for a product, there is an obligation to ensure that

all applicable FDA, Health Canada and other regulatory requirements continue to be met.

We may be subject to penalties and may be precluded from

marketing our products if we fail to comply with extensive governmental regulations.

We believe that the InMotion robots for

hospitals and certain other products under development will be categorized as a Class II device in the U.S. Class II devices require

a 510(k) premarket submission to the US FDA. However, the FDA has not made any determination about whether our proposed medical

products are Class II medical devices and, from time to time, the FDA may disagree with the classification of a new Class II medical

device and require the manufacturer of that device to apply for approval as a Class III medical device. In the event that the FDA

determines that our medical products should be reclassified as a Class III medical device, we could be precluded from marketing

the devices for clinical use within the United States for months, years or longer, depending on the specific changes to the classification.

Reclassification of our products as Class III medical devices could significantly increase our regulatory costs, including the

timing and expense associated with required clinical trials and other costs.

The FDA and non-U.S. regulatory authorities

require that our products be manufactured according to rigorous standards. These regulatory requirements may significantly increase

our production costs and may even prevent us from making our products in amounts sufficient to meet market demand. If we change

our manufacturing process, regulatory authorities may need to review the process before it may be used. Failure to comply with

applicable regulatory requirements discussed could subject us to enforcement actions, including warning letters, fines, injunctions

and civil penalties, recall or seizure of our products, operating restrictions, partial suspension or total shutdown of our production

and criminal prosecution.

Federal, state and non-U.S. regulations

regarding the manufacture and sale of medical devices are subject to future changes. The complexity, timeframes and costs associated

with obtaining marketing clearances are unknown. Although we cannot predict the impact, if any, these changes might have on our

business, the impact could be material.

If we are not able to both obtain and maintain adequate

levels of third-party reimbursement for our products, it would have a material adverse effect on our business.

Healthcare providers and related facilities

are generally reimbursed for their services through payment systems managed by various governmental agencies worldwide, private

insurance companies, and managed care organizations. The manner and level of reimbursement in any given case may depend on the

site of care, the procedure(s) performed, the final patient diagnosis, the device(s) utilized, available budget, or a combination

of these factors, and coverage and payment levels are determined at each payer’s discretion. The coverage policies and reimbursement

levels of these third-party payers may impact the decisions of healthcare providers and facilities regarding which medical products

they purchase and the prices they are willing to pay for those products. Thus, changes in reimbursement levels or methods may either

positively or negatively impact sales of our products.

We have no direct control over payer decision-making

with respect to coverage and payment levels for our medical device products. Additionally, we expect many payers to continue to

explore cost-containment strategies (e.g., comparative and cost-effectiveness analyses, so-called “pay-for-performance”

programs implemented by various public and private payers, and expansion of payment bundling schemes such as Accountable Care Organizations,

and other such methods that shift medical cost risk to providers) that may potentially impact coverage and/or payment levels for

our current products or products we develop.

As our product offerings are expected to

be diverse across healthcare settings, they will likely be affected to varying degrees by the many payment systems. Therefore,

individual countries, product lines or product classes may be impacted by changes to these systems.

Product defects could adversely affect the results of

our operations.

The design, manufacture and marketing of

our products involves certain inherent risks. Manufacturing or design defects, unanticipated use of our products, or inadequate

disclosure of risks relating to the use of our products can lead to injury or other adverse events. These events could lead to

recalls or safety alerts relating to our products (either voluntary or required by the FDA, Health Canada or similar governmental

authorities in other countries), and could result, in certain cases, in the removal of a product from the market. A recall could

result in significant costs, as well as negative publicity and damage to our reputation that could reduce demand for our products.

Personal injuries relating to the use of our products could also result in product liability claims being brought against us. The

Company maintains product liability insurance to mitigate this risk. In some circumstances, such adverse events could also cause

delays in new product approvals.

Changes in reimbursement practices of third-party payers

could affect the demand for our products and the prices at which they are sold.

The sales of our clinical and proposed products

could depend, in part, on the extent to which healthcare providers and facilities or individual users are reimbursed by government

authorities, private insurers and other third-party payers for the costs of our products or the services performed with our products.

The coverage policies and reimbursement levels of third-party payers, which can vary among public and private sources and by country,

may affect which products are purchased by customers and the prices they are willing to pay for those products in a particular

jurisdiction. Reimbursement rates can also affect the acceptance rate of new technologies. Legislative or administrative reforms

to reimbursement systems in the United States or abroad, or changes in reimbursement rates by private payers, could significantly

reduce reimbursement for procedures using the Company’s products or result in denial of reimbursement for those products,

which would adversely affect customer demand or the price customers may be willing to pay for such products.

We could be exposed to significant liability claims if

we are unable to obtain insurance at acceptable costs and adequate levels or otherwise protect ourselves against potential product

liability claims.

The testing, manufacturing, marketing and

sale of medical devices entail the inherent risk of liability claims or product recalls. The Company currently maintains product

liability insurance; however, product liability insurance is expensive and may not be available on acceptable terms in the future,

if at all. A successful product liability claim or product recall could inhibit or prevent the successful commercialization of

our products, cause a significant financial burden on the Company, or both, which in either case could have a material adverse

effect on our business and financial condition. Although we carry product liability insurance, there is no guarantee that our insurance

will adequately cover us against potential liability. If not, the results of our operations could be materially and adversely affected.

In addition, any product liability claims brought in connection with any alleged defect of our products, whether with or without

merit, could increase our product liability insurance rates or prevent us from securing continuing coverage at rates we could afford.

The results of our research and development efforts are

uncertain and there can be no assurance of the commercial success of our products.

We believe that we will need to incur additional

research and development expenditures to continue development of our existing and proposed products as well as research and development

expenditures to develop new products and services. The products and services we are developing and may develop in the future may

not be technologically successful. In addition, the length of our product and service development cycle may be greater than we

originally expected and we may experience delays in product development. If our resulting products and services are not technologically

successful, they may not achieve market acceptance or compete effectively with our competitors’ products and services.

If we fail to retain certain of our key personnel and

attract and retain additional qualified personnel, we might not be able to pursue our growth strategy.

Our future success will depend upon the

continued service of Eric Dusseux, our Chief Executive Officer, and his executive team or any qualified replacement

of those individuals. There can be no assurance that the services of any of these individuals will continue to be available to

us in the future. We do not carry any key man life insurance policies on any of our executive officers. The failure to retain,

or attract replacement, qualified personnel could have a material adverse effect on our business and our ability to pursue our

growth strategy.

Recent executive and legislative actions to amend or impede

the implementation of the Affordable Care Act and ongoing efforts to repeal, replace or further modify the Affordable Care Act

may adversely affect our business, financial condition and results of operations.

Recent executive and legislative actions

to amend or impede the implementation of the Affordable Care Act and ongoing efforts to repeal, replace or further modify the Affordable

Care Act may adversely affect our business, financial condition and results of operations.

Since its adoption into law in 2010, the

Affordable Care Act has been challenged before the U.S. Supreme Court, and several bills have been and continue to be introduced

in Congress to delay, defund, or repeal implementation of or amend significant provisions of the Affordable Care Act. In addition,

there continues to be ongoing litigation over the interpretation and implementation of certain provisions of the law. The net effect

of the Affordable Care Act, as currently in effect, on our business is subject to a number of variables, including the law’s

complexity, lack of complete implementing regulations and interpretive guidance, and the sporadic implementation of the numerous

programs designed to improve access to and the quality of healthcare services. Additional variables of the Affordable Care Act

impacting our business will be how states, providers, insurance companies, employers, and other market participants respond during

this period of uncertainty surrounding the future of the Affordable Care Act.

On January 20, 2017, President Trump issued

an executive order that, among other things, stated that it was the intent of his administration to repeal the Affordable Care

Act and, pending that repeal, instructed the executive branch of the federal government to defer or delay the implementation of

any provision or requirement of the Affordable Care Act that would impose a fiscal burden on any state or a cost, fee, tax or penalty

on any individual, family, health care provider, or health insurer. Additionally, on October 12, 2017, President Trump issued another

executive order requiring the Secretaries of the Departments of Health and Human Services, Labor and the Treasury to consider proposing

regulations or revising existing guidance to allow more employers to form association health plans that would be allowed to provide

coverage across state lines, increase the availability of short-term, limited duration health insurance plans, which are generally

not subject to the requirements of the Affordable Care Act, and increase the availability and permitted use of health reimbursement

arrangements. On October 13, 2017, the DOJ announced that HHS was immediately stopping its cost sharing reduction payments to insurance

companies based on the determination that those payments had not been appropriated by Congress. Furthermore, on December 22, 2017,

President Trump signed tax reform legislation into law that, in addition to overhauling the federal tax system, also, effective

as of January 1, 2019, repeals the penalties associated with the individual mandate.

We cannot predict the impact that the President’s

executive order will have on the implementation and enforcement of the provisions of the Affordable Care Act or the current or

pending regulations adopted to implement the law. In addition, we cannot predict the impact that the repeal of the penalties associated

with the individual mandate and the cessation of cost sharing reduction payments to insurers will have on the availability and

cost of health insurance and the overall number of uninsured. We also cannot predict whether the Affordable Care Act will be repealed,

replaced, or modified, and, if the Affordable Care Act is repealed, replaced or modified, what the replacement plan or modifications

would be, when the replacement plan or modifications would become effective, or whether any of the existing provisions of the Affordable

Care Act would remain in place.

Our operations in international markets involve inherent

risks that we may not be able to control.

Our business plan includes the marketing

and sale of our existing and proposed products in international markets. Accordingly, our results could be materially and adversely

affected by a variety of uncontrollable and changing factors relating to international business operations, including:

|

|

·

|

macroeconomic conditions adversely affecting geographies where we intend to do business;

|

|

|

·

|

foreign currency exchange rates;

|

|

|

·

|

political or social unrest or economic instability in a specific country or region;

|

|

|

·

|

higher costs of doing business in foreign countries;

|

|

|

·

|

infringement claims on foreign patents, copyrights or trademark rights;

|

|

|

·

|

difficulties in staffing and managing operations across disparate geographic areas;

|

|

|

·

|

difficulties associated with enforcing agreements and intellectual property rights through foreign legal systems;

|

|

|

·

|

trade protection measures and other regulatory requirements, which affect our ability to import or export our products from or to various countries;

|

|

|

·

|

adverse tax consequences;

|

|

|

·

|

unexpected changes in legal and regulatory requirements;

|

|

|

·

|

military conflict, terrorist activities, natural disasters and medical epidemics; and

|

|

|

·

|

our ability to recruit and retain channel partners in foreign jurisdictions.

|

Our financial results may be affected by fluctuations

in exchange rates.

Our financial statements are presented in

U.S. dollars, while a portion of our business is conducted, and a portion of our operating expenses are payable, in Canadian dollars.

Due to possible substantial volatility of currency exchange rates, exchange rate fluctuations may have an adverse impact on our