UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2019

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to ______________

Commission file number 333-192387

|

BALLY, CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

80-0917804

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

986 Dongfang Rd., One Hundred Shanshan Bldg 25th

Fl Pudong Shainghai China

|

|

200122

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (86) 138 1833 3008

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

None

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Act:

N/A

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

x

|

Smaller reporting company

|

x

|

|

|

|

Emerging Growth Company

|

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

The aggregate market value of Common Stock held by non-affiliates of the Registrant on March 29, 2019, was $52,400 based on a $1 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

|

9,850,000 shares of common stock issued and outstanding as of December 5, 2019.

|

EXPLANATORY NOTE

Bally, Corp. (the Company ) is filing this Amendment No. 1 on Form 10-K/A (this Amendment ) to its Annual Report on Form 10-K for the period ended September 30, 2019, which was originally filed on December 17, 2019 (the Original Filing ). The purpose of this Amendment is to amend the Report of Independent Registered Public Accounting Firm.

Except as described above, this Amendment does not modify or update the disclosure in, or exhibits to, the Original Filing in any way, and the parts or exhibits of the Original Filing which have not been modified or updated are not included in this Amendment. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the filing date of the Original Filing. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original Filing was filed. This Amendment continues to speak as of the date of the Original Filing, and the Company has not updated the disclosure contained herein to reflect events that have occurred since the filing of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Company s other filings made with the Securities and Exchange Commission since the filing of the Original Filing, including amendments to those filings, if any.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this current report and unless otherwise indicated, the terms “we”, “us” and “our” mean Bally, Corp., unless otherwise indicated.

PART I

General Overview

We were incorporated under the laws of the State of Nevada on March 13, 2013. From inception, it was our intent to import small farming, household gardening and general small tools directly from manufacturers and market to consumers in the Republic of India. Management of our company is currently evaluating our future strategic business plans.

On June 24, 2016, Katiuska Moran our former CEO and Director and Surjeet Singh, our former secretary and a substantial shareholder cancelled any and all loans they made to our company.

On June 24, 2016, in connection with the sale of a controlling interest our company, Katiuska Moran our former CEO and Director and Surjeet Singh (individually and collectively the “Seller(s)”) our company, entered into and closed on certain Share Purchase Agreements (the “Agreements”) with Aureas Capital Co., Ltd., whereby Aureas purchased from the Sellers a total of 6,918,800 shares of our company’s common stock (the “Shares”) for an aggregate price of $100,000.00. The Shares acquired represented approximately 70.6% of the issued and outstanding shares of common stock of our company.

Concurrently with the closing of the Agreements, Ming Chun Lung was appointed a director, Chief Executive Officer, President and Secretary and Katiuska Moran and Surjeet Singh resigned from all positions held as an officer and director of our company.

On June 8, 2017, Ming Chun Lung resigned as Chief Executive Officer, President, Secretary, and as a director of our company and Kong Nguan Hong was appointed Chief Executive Officer, President, Secretary, Chief Financial Officer, Treasurer, and as a director.

Pursuant to a stock purchase agreement (the “Agreement”), effective as of April 4, 2018, by and among Aureas Capital Co Ltd, Chen Yi-Dou, Ming-Chun Lung, NYJJ Investments, Ti-Jung Chen, Yi-Fang Lin and Zhiqing Wu (together, the “Sellers”) and Haiping Hu (the “Purchaser”), the Sellers sold an aggregate of 9,797,600 shares of Common Stock of our company, to the Purchaser for cash consideration of $360,000 from personal funds of the Purchaser (the “Transaction”). Of the net proceeds, $7,500 have been held back in escrow for the payment of past due taxes. Following consummation of the Transaction on April 4, 2018, the Purchaser holds 99.5% of the voting securities of our company, based on 9,850,000 shares issued and outstanding as at that date. The Transaction resulted in a change in control of our Company.

In connection with the Transaction, Kong Nguan Hong, the sole officer and director of the Company, resigned from all of his officer positions with our company, including Chief Executive Officer, Chief Financial Officer and Secretary, effective immediately upon the consummation of the Transaction, and remained a director of our company until April 16, 2018, which date was ten (10) days following the date on which our company filed a Schedule 14F-1 with the SEC and mailed same to the holders of record of our company, in connection with the Transaction.

Our address is 986 Dongfang Rd., One Hundred Shanshan Bldg 25th Fl, Pudong, Shanghai, China 200122. Our telephone number is +86 136 1833 3008.

We do not have any subsidiaries. We do not have a corporate website.

We have not ever declared bankruptcy, been in receivership, or involved in any kind of legal proceeding.

Our Current Business

We are currently seeking new business opportunities with established business entities for merger with or acquisition of a target business. In certain instances, a target business may wish to become our subsidiary or may wish to contribute assets to us rather than merge. We have not yet begun negotiations or entered into any definitive agreements for potential new business opportunities, and there can be no assurance that we will be able to enter into any definitive agreements.

Any new acquisition or business opportunities that we may acquire will require additional financing. There can be no assurance, however, that we will be able to acquire the financing necessary to enable us to pursue our plan of operation. If our company requires additional financing and we are unable to acquire such funds, our business may fail.

Management of our company believes that there are benefits to being a reporting company with a class of securities quoted on the OTCMarkets, such as: (i) the ability to use registered securities to acquire assets or businesses; (ii) increased visibility in the financial community; (iii) the facilitation of borrowing from financial institutions; (iv) potentially improved trading efficiency; (v) potential stockholder liquidity; (vi) potentially greater ease in raising capital subsequent to an acquisition; (vii) potential compensation of key employees through stock awards or options; (viii) potentially enhanced corporate image; and (ix) a presence in the United States’ capital market.

We may seek a business opportunity with entities that have recently commenced operations, or entities who wish to utilize the public marketplace in order to raise additional capital in order to expand business development activities, to develop a new product or service, or for other corporate purposes. We may acquire assets and establish wholly-owned subsidiaries in various businesses or acquire existing businesses as subsidiaries.

In implementing a structure for a particular business acquisition or opportunity, we may become a party to a merger, consolidation, reorganization, joint venture, or licensing agreement with another corporation or entity. We may also acquire stock or assets of an existing business. Upon the consummation of a transaction, it is anticipated that our sole officer and two directors will continue to manage the Company.

As of the date hereof, we have not entered into any formal written agreements for a business combination or opportunity. When any such agreement is reached, we intend to disclose such an agreement by filing a current report on Form 8-K.

We anticipate that the selection of a business opportunity in which to participate will be complex and without certainty of success. Business opportunities may be available in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex. Business opportunities that we believe are in the best interests of our company may be scarce, or we may be unable to obtain the ones that we want. We can provide no assurance that we will be able to locate compatible business opportunities.

Currently, we do not have a source of revenue. We are not able to fund our cash requirements through our current operations. We have been reliant on loans by affiliated and non-affiliated parties to provide financial contributions and services to keep our company operating. Further, we believe that our company may have difficulties raising capital from other sources until we locate a prospective merger candidate through which we can pursue our plan of operation. If we are unable to secure adequate capital to continue our acquisition efforts, our shareholders may lose some or all of their investment and our business may fail. We currently have no written or oral agreement from our majority shareholder to continue to provide financial contributions.

Research and Development

We have incurred $Nil in research and development expenditures over the last two fiscal years.

Intellectual Property

We do not currently have any intellectual property.

Employees

Our company has no employees. Our sole director and officer is donating their time to the development of our company, and intends to do whatever work is necessary to bring us to the point of earning revenues. We estimate that our sole officer and director will be able to complete his required work and complete whatever work is necessary by spending 20 hours per week without lending our company additional funds. If this is not the case and additional time and funds will be require then he is willing to commit additional time funds although he has no commitment or contractual obligation to do so. We have no other employees, and do not foresee hiring any additional employees in the near future. We will be engaging independent contractors to design and develop our website and manage our internet marketing efforts.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Our address is 986 Dongfang Rd., One Hundred Shanshan Bldg 25th Fl, Pudong, Shanghai, China 200122. Our offices are provided at no cost to our company

From time to time, we may become involved in litigation relating to claims arising out of our operations in the normal course of business. We are not involved in any pending legal proceeding or litigation and, to the best of our knowledge, no governmental authority is contemplating any proceeding to which we are a party and which would reasonably be likely to have a material adverse effect on our company. To date, our company has never been involved in litigation, as either a party or a witness, nor has our company been involved in any legal proceedings commenced by any regulatory agency against our company.

Not Applicable.

PART II

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

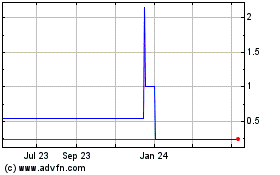

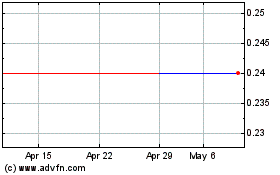

Our common stock is quoted on the OTC Markets, under the symbol “BLYQ”. Our stock was approved for quotation on the OTC Markets on November 20, 2014. However, our stock only started trading on October 22, 2018.

There is no established current public market for the shares of our common stock. There can be no assurance that a liquid market for our securities will ever develop. Transfer of our common stock may also be restricted under the securities or blue sky laws of various states and foreign jurisdictions. Consequently, investors may not be able to liquidate their investments and should be prepared to hold the common stock for an indefinite period of time.

Our shares are issued in registered form. Globex Transfer, LLC, 780 Deltona Blvd., Suite 202, Deltona, FL 32725 (Telephone: (813) 34-4490) is the registrar and transfer agent for our common shares.

On December 5, 2019, the shareholders’ list showed 26 registered shareholders with 9,850,000 shares of common stock outstanding.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Equity Compensation Plan Information

We do not have any equity compensation plans.

Recent Sales of unregistered securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended September 30, 2019 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended September 30, 2019

Issuer Purchases of Equity Securities

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended September 30, 2019.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

The following discussion should be read in conjunction with our financial statements, including the notes thereto, appearing elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this Annual Report. Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Results of Operations

Years ended September 30, 2019 and 2018

The following summary of our results of operations should be read in conjunction with our financial statements for the years ended September 30, 2019 and 2018, which are included herein.

Our operating results for the year ended September 30, 2019 and 2018, and the changes between those periods for the respective items are summarized as follows:

|

|

|

Year Ended

|

|

|

|

|

|

|

|

September 30,

|

|

|

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Change

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

General and administrative

|

|

|

24,878

|

|

|

|

22,245

|

|

|

|

2,633

|

|

|

Net loss

|

|

$

|

24,878

|

|

|

$

|

22,245

|

|

|

$

|

2,633

|

|

During the years ended September 30, 2019 and 2018 no revenue was recorded.

Net loss, all from operating expenses, was $24,878 for year ended September 30, 2019 and $22,245 for the year ended September 30, 2018. The increase in expenses was primarily due to an increase in professional fees.

Operating expenses for the year ended September 30, 2019 and 2018 were $24,878 and $22,245 respectively. Expenses were primarily attributed to professional fees. Professional fees for the year ended September 30, 2019, was $24,878 compared to $22,245 for the year ended September 30, 2018.

Liquidity and Capital

|

Working Capital

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Changes

|

|

|

Current Assets

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Current Liabilities

|

|

|

35,349

|

|

|

|

10,471

|

|

|

|

24,878

|

|

|

Working Capital Deficiency

|

|

$

|

35,349

|

|

|

$

|

10,471

|

|

|

$

|

24,878

|

|

As at September 30, 2019 and September 30, 2018, our total current assets were $0.

As at September 30, 2019, our current liabilities were $35,349 compared to $10,471 at September 30, 2018. Stockholders’ deficit was $35,349 as of September 30, 2019 compared to stockholders’ deficit of $10,471 as of September 30, 2018. The increase in current liabilities is primarily due to an increase in due to an officer for payments made for operating expenses.

|

Cash Flows

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Net cash used in operating activities

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Net cash used in investing activities

|

|

|

-

|

|

|

|

-

|

|

|

Net cash provided by financing activities

|

|

|

-

|

|

|

|

-

|

|

|

Net change in cash and cash equivalents

|

|

$

|

-

|

|

|

$

|

-

|

|

Operating Activities

The Company did not use any funds for operating activities during the years ended September 30, 2019 and 2018. During the years ended September 30, 2019 and 2018, the Company’s sole officer paid $24,689 and $31,143, respectively, on behalf of the Company for operating expenses. In addition, there was an increase in accounts payable of $189 and a decrease of $8,898 in 2019 and 2018 respectively.

Investing Activities

The Company did not use any funds for investing activities during the years ended September 30, 2019 and 2018.

Financing Activities

The Company did not have any funds provided by financing activities during the years ended September 30, 2019 and 2018.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us on which to base an evaluation of our performance. We have generated no revenues from operations. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in developing our website, and possible cost overruns due to the price and cost increases in supplies and services.

At present, we do not have enough cash on hand to cover operating costs for the next 12 months.

If we are unable to meet our needs for cash from either our operations, or possible alternative sources, then we may be unable to continue, develop, or expand our operations.

We have no plans to undertake any product research and development during the next twelve months. There are also no plans or expectations to acquire or sell any plant or plant equipment in the first year of operations.

Liquidity and Capital Resources

As of September 30, 2019, we had no cash. As of September 30, 2019, our current liabilities and stockholders’ deficit was $35,349. We do not have sufficient funds to operate for the next twelve months. We have to issue debt or equity or enter into a strategic arrangement with a third party in order to finance our operations. There can be no assurance that additional capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

As of September 30, 2019, our company had a net loss of $24,878 and has earned no revenues. Our company intends to fund operations through equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital and other cash requirements for the year ending September 30, 2020. The ability of our company to emerge from the development stage is dependent upon, among other things, obtaining additional financing to continue operations, and development of our business plan. In response to these problems, management intends to raise additional funds through public or private placement offerings. These factors, among others, raise substantial doubt about our company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

As a “smaller reporting company”, we are not required to provide the information required by this Item.

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

BALLY, CORP.

INDEX TO AUDITED FINANCIAL STATEMENTS

FOR THE YEARS ENDED SEPTEMBER 30, 2019 AND 2018

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Bally, Corp.

Opinion on the Financial Statements

We have audited the accompanying balance sheet of Bally, Corp. (the “Company”) as of September 30, 2019 and 2018, and the related statements of operations, statement of stockholders’ deficit and cash flows for the year then ended, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2019 and 2018, and the results of its operations and its cash flows for years then ended, in conformity with accounting principles generally accepted in the United States of America.

Emphasis of a matter

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As disclosed in Note 3 to the financial statement the Company has not generated any revenues since inception. The Company has a net loss of $24,878, a working capital deficiency of $35,349, and an accumulated deficit of $214,729 for the year ended September 30, 2019. These factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern. Management plans regarding these matters are also disclosed in note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

|

/s/ Prager Metis CPAs, LLC

|

|

|

|

|

We have served as the Company’s auditor since 2018.

|

|

|

|

|

Hackensack, NJ

|

|

|

|

|

December 16, 2019

|

|

|

|

|

BALLY, CORP.

Balance Sheets

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Total Current Assets

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

1,089

|

|

|

$

|

900

|

|

|

Due to shareholder

|

|

|

34,260

|

|

|

|

9,571

|

|

|

Total Current Liabilities and Total Liabilities

|

|

|

35,349

|

|

|

|

10,471

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 20,000,000 shares authorized 0 shares issued and outstanding;

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, $0.0001 par value, 100,000,000 shares authorized 9,850,000 shares issued and outstanding

|

|

|

985

|

|

|

|

985

|

|

|

Additional paid-in capital

|

|

|

178,395

|

|

|

|

178,395

|

|

|

Accumulated deficit

|

|

|

(214,729

|

)

|

|

|

(189,851

|

)

|

|

Total Stockholders’ Deficit

|

|

|

(35,349

|

)

|

|

|

(10,471

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit

|

|

$

|

-

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of these audited financial statements

BALLY, CORP.

Statements of Operations

|

|

|

Year Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

24,878

|

|

|

|

22,245

|

|

|

Total expenses

|

|

|

24,878

|

|

|

|

22,245

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income tax

|

|

|

(24,878

|

)

|

|

|

(22,245

|

)

|

|

Income tax provision

|

|

|

-

|

|

|

|

-

|

|

|

Net loss

|

|

$

|

(24,878

|

)

|

|

$

|

(22,245

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Loss per Common Share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Weighted Average Number of Common Shares Outstanding

|

|

|

9,850,000

|

|

|

|

9,850,000

|

|

The accompanying notes are an integral part of these audited financial statements

BALLY, CORP.

Statement of Stockholders’ Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

Total

|

|

|

|

|

Preferred Stock

|

|

|

Common Shares

|

|

|

Paid-In

|

|

|

Accumulated

|

|

|

Stockholders’

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – September 30, 2017

|

|

|

-

|

|

|

$

|

-

|

|

|

|

9,850,000

|

|

|

$

|

985

|

|

|

$

|

111,269

|

|

|

$

|

(167,606

|

)

|

|

$

|

(55,352

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Related party debt forgiven

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

67,126

|

|

|

|

-

|

|

|

|

67,126

|

|

|

Net loss for the year

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(22,245

|

)

|

|

|

(22,245

|

)

|

|

Balance – September 30, 2018

|

|

|

-

|

|

|

$

|

-

|

|

|

|

9,850,000

|

|

|

$

|

985

|

|

|

$

|

178,395

|

|

|

$

|

(189,851

|

)

|

|

$

|

(10,471

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(24,878

|

)

|

|

|

(24,878

|

)

|

|

Balance – September 30, 2019

|

|

|

-

|

|

|

$

|

-

|

|

|

|

9,850,000

|

|

|

$

|

985

|

|

|

$

|

178,395

|

|

|

$

|

(214,729

|

)

|

|

$

|

(35,349

|

)

|

The accompanying notes are an integral part of these audited financial statements

BALLY, CORP.

Statements of Cash Flows

|

|

|

Year Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Operating Activities:

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(24,878

|

)

|

|

$

|

(22,245

|

)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Shareholder advances funding operations

|

|

|

24,689

|

|

|

|

31,143

|

|

|

Accounts payable and accrued liabilities

|

|

|

189

|

|

|

|

(8,898

|

)

|

|

Net Cash Used in Operating Activities

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in cash

|

|

|

-

|

|

|

|

-

|

|

|

Cash - beginning of year

|

|

|

-

|

|

|

|

-

|

|

|

Cash - end of year

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow Disclosure:

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Taxes paid

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash Investing and Financing Activities:

|

|

|

|

|

|

|

|

|

|

Related party debt forgiven recorded as additional paid in capital

|

|

$

|

-

|

|

|

$

|

67,126

|

|

The accompanying notes are an integral part of these audited financial statements

BALLY, CORP

Notes to the Financial Statements

For the years ended September 30, 2019 and 2018

NOTE 1 - ORGANIZATION AND DESCRIPTION OF BUSINESS

BALLY, CORP. (the “Company”) was incorporated in the State of Nevada on March 13, 2013. The Company is currently seeking new business opportunities with established business entities for merger with or acquisition of a target business. To date, the Company’s activities have been limited to its formation and the raising of equity capital.

The Company fiscal year end is September 30.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The Financial Statements and related disclosures have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). The Financial Statements have been prepared using the accrual basis of accounting in accordance with Generally Accepted Accounting Principles (“GAAP”) of the United States.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents include cash in banks, money market funds, and certificates of term deposits with maturities of less than three months from inception, which are readily convertible to known amounts of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value.

Financial Instruments

The Company follows ASC 820, “Fair Value Measurements and Disclosures”, which defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The three levels of the fair value hierarchy are described below:

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The fair value of accounts payable and accrued expenses and due to shareholder approximates their carrying amounts because of their immediate or short-term maturity.

Concentrations of Credit Risks

The Company’s financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and related party payables it will likely incur in the near future. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash with a particular financial institution may exceed any applicable government insurance limits. The Company’s management plans to assess the financial strength and credit worthiness of any parties to which it extends funds, and as such, it believes that any associated credit risk exposures are limited.

Share-based Expenses

ASC 718 “Compensation – Stock Compensation” prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, “Equity – Based Payments to Non-Employees.” Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

Income Taxes

The Company accounts for income taxes using the asset and liability method in accordance with ASC 740, “Accounting for Income Taxes”. The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities and for operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized.

As of September 30, 2019 and 2018, the Company did not have any amounts recorded pertaining to uncertain tax positions.

Loss per Share

The Company has adopted ASC 260, “Earnings Per Share,” (“EPS”) which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures, and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period.

The Company has no potentially dilutive securities, such as options or warrants, currently issued and outstanding.

Recent Accounting Pronouncements

Management has considered all recent accounting pronouncements issued since the last audit of its financial statements. The Company’s management believes that these recent pronouncements will not have a material effect on the Company’s financial statements.

NOTE 3 - GOING CONCERN

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has not generated any revenues since inception. The Company has a net loss of $24,878, for the year ended September 30, 2019, working capital deficiency of $35,349 and an accumulated deficit of $214,729 at September 30, 2019. These factors among others raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period of time. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The continuing operations of the Company are dependent upon its ability to continue to raise adequate financing, shareholder loans and to commence profitable operations in the future and repay its liabilities arising from normal business operations as they become due. The Company intends to fund operations through equity financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for future periods.

NOTE 4 - INCOME TAXES

The Company follows ASC 740. Deferred income taxes reflect the net effect of (a) temporary difference between carrying amounts of assets and liabilities for financial purposes and the amounts used for income tax reporting purposes, and (b) net operating loss carry-forwards. No net provision for refundable Federal income tax has been made in the accompanying statement of loss because no recoverable taxes were paid previously. Similarly, no deferred tax asset attributable to the net operating loss carry-forward has been recognized, as it is not deemed likely to be realized.

On December 22, 2017, the United States enacted the Tax Cuts and Jobs Act (the “Act”) resulting in significant modifications to existing law. The Company’s financial statements for the year ended September 30, 2019 and 2018 reflect certain effects of the Act which includes a reduction in the corporate tax rate from 34% to 21% as well as other changes.

The provisions for federal income tax, consist of the following:

|

|

|

Year Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Income tax expense (benefit) at statutory rate

|

|

$

|

(5,224

|

)

|

|

$

|

(5,750

|

)

|

|

Change in valuation allowance

|

|

|

5,224

|

|

|

|

5,750

|

|

|

Income tax expense

|

|

$

|

-

|

|

|

$

|

-

|

|

The tax effects of temporary differences that give rise to the Company’s net deferred tax assets are as follows:

|

|

|

September 30,

|

|

|

September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

Net Operating Loss carryforward

|

|

$

|

7,234

|

|

|

$

|

2,010

|

|

|

Valuation allowance

|

|

|

(7,234

|

)

|

|

|

(2,010

|

)

|

|

Net deferred tax asset

|

|

$

|

-

|

|

|

$

|

-

|

|

At September 30, 2019, the Company had approximately $34,449 of net operating losses (“NOL”) generated from April 4, 2018 to September 30, 2019 carried forward to offset taxable income in future years which expire commencing in fiscal 2033. NOLs generated in tax years prior to September 30, 2018, can be carryforward for twenty years, whereas NOLs generated after September 30, 2018 can be carryforward indefinitely

Due to change of control, the Company will not be able to carryover $180,280 of NOL generated before April 4, 2018 to offset future income.

A valuation allowance has been established for our tax assets as their use is dependent on the generation of sufficient future taxable income, which cannot be predicted at this time. As of September 30, 2019, we had no material unrecognized tax benefits and no adjustments to liabilities or operations were required. No interest and penalties have been recognized by us to date. Our net operating loss carryforwards are subject to review and possible adjustment by the Internal Revenue Service and are subject to certain limitations in the event of cumulative changes in the ownership interest of significant stockholders over a three-year period in excess of 50%. In April 2018, there was a change in ownership that was in excess of 50%.

NOTE 5 - RELATED PARTIES TRANSACTIONS

In support of the Company’s efforts and cash requirements, it may rely on advances from related parties until such time that the company can support its operations or attains adequate financing through sales of its equity or traditional debt financing. There is no formal written commitment for continued support by shareholders or directors. Amounts represent advances or amounts paid in satisfaction of liabilities. The advances were considered temporary in nature and were not formalized by a promissory note.

During the year ended September 30, 2019 and 2018, the Company’s sole officer advanced to the Company an amount of $24,689 and $9,571 by the way of loan. As of September 30, 2019, the Company was obligated to the officer, for an unsecured, non-interest bearing demand loan with a balance of $34,260.

As of September 30, 2019 and 2018, the company's former sole officer advanced the Company $0 and $21,572, respectively. The advance was non-interest bearing and due on demand. This advance was forgiven to the former officer and no amount is due as of September 30,2019.

As of September 30, 2019 and 2018, the Company owed $34,260 and $9,571 to a related party, respectively.

Pursuant to a stock purchase agreement (the “Agreement”), effective as of April 4, 2018, by and among certain shareholders of the Company (the “Sellers”) and Haiping Hu (the “Purchaser”), the Sellers sold an aggregate of 9,797,600 shares of Common Stock of the Company, to the Purchaser for cash consideration of $360,000 from personal funds of the Purchaser (the “Transaction”). Following consummation of the Transaction, the Purchaser holds 99.5% of the voting securities of the Company, based on 9,850,000 shares issued and outstanding as of the date hereof. The Transaction has resulted in a change in control of the Company from the Seller to the Purchaser.

In conjunction with the stock purchase agreement and change of control, the outstanding accounts payable were fully paid off by the former sole officer and director. All amounts owing to the former officer, which aggregated to $67,126, were forgiven and recorded as additional paid in capital.

NOTE 6 - EQUITY

Preferred Stock

The Company has 20,000,000 authorized preferred shares with a par value of $0.0001 per share.

There were no shares of preferred shares issued and outstanding as of September 30, 2019 and September 30,, 2018.

Common Stock

The Company has 100,000,000 authorized common shares with a par value of $0.0001 per share.

As of September 30, 2019 and 2018, there were 9,850,000 shares of common stock issued and outstanding, respectively.

NOTE 7 - SUBSEQUENT EVENTS

Management has evaluated subsequent events through the date these financial statements were available to be issued. Based on our evaluation no material events have occurred that require disclosure.

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

There were no disagreements related to accounting principles or practices, financial statement disclosure, internal controls or auditing scope or procedure during the two fiscal years and interim periods.

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are designed to ensure that information required to be disclosed in the reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time period specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in the reports filed under the Exchange Act is accumulated and communicated to management, including our chief executive officer and chief financial officer (our principal executive officer, principal financial officer and principal accounting officer). We carried out an evaluation, under the supervision and with the participation of our management, including our president (our principal executive officer, principal financial officer and principal accounting officer), of the effectiveness of the design and operation of our disclosure controls and procedures as of September 30, 2019. Based upon the evaluation of our disclosure controls and procedures as of the September 30, 2019, our management concluded that our disclosure controls and procedures were not effective because of the identification of a material weakness in our internal control over financial reporting which is identified below, and we view as an integral part of our disclosure controls and procedures.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Rule 13a-15(f). Our internal control over financial reporting is a process designed to provide reasonable assurance to our management and board of directors regarding the reliability of financial reporting and the preparation of the financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America.

Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America, and our receipts and expenditures of are being made only in accordance with authorizations of our management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of our assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. All internal control systems, no matter how well designed, have inherent limitations, including the possibility of human error and the circumvention of overriding controls. Accordingly, even effective internal control over financial reporting can provide only reasonable assurance with respect to financial statement preparation. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

The material weakness relates to the lack of segregation of duties in our financial reporting process and our utilization of outside third party consultants. We do not have a separately designated audit committee. This weakness is due to our lack of sufficient working capital to hire additional staff. To remedy this material weakness, we intend to engage an internal accounting staff to assist with financial reporting as soon as our finances will allow.

Changes in Internal Control Over Financial Reporting

There have been no changes in our internal controls over financial reporting that occurred during the year ended September 30, 2019 that have materially or are reasonably likely to materially affect, our internal controls over financial reporting.

None.

PART III

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

All directors of our company hold office until the next annual meeting of the security holders or until their successors have been elected and qualified. The officers of our company are appointed by our board of directors and hold office until their death, resignation or removal from office. Our directors and executive officers, their ages, positions held, and duration as such, are as follows:

|

Name

|

|

Position Held with the Company

|

|

Age

|

|

Date First Elected or Appointed

|

|

Haiping Hu

|

|

Chief Executive Officer, Chief Financial Officer,

Secretary and Director

|

|

52

|

|

April 4, 2018

|

Business Experience

The following is a brief account of the education and business experience during at least the past five years of each director, executive officer and key employee of our company, indicating the person’s principal occupation during that period, and the name and principal business of the organization in which such occupation and employment were carried out.

Haiping Hu - Chief Executive Officer, Chief Financial Officer, Secretary and director.

Mr. Hu has been serving as president of Global Mentor Board (Beijing) IT Co. Ltd since 2015. In addition, from 2012 until 2015, Mr. Hu served as the president and CEO of Shanshan Commodities Group Corporation. Mr. Hu obtained his bachelor degree in process automation and his master degree in chemical engineering from Zhejiang University.

Our company believes that Mr. Hu’s professional background experience gives him the qualifications and skills necessary to serve as a director of our company.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our stockholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

All officers and directors listed above will remain in office until the next annual meeting of our stockholders, and until their successors have been duly elected and qualified. There are no agreements with respect to the election of Directors. We have not compensated our Directors for service on our Board of Directors, any committee thereof, or reimbursed for expenses incurred for attendance at meetings of our Board of Directors and/or any committee of our Board of Directors. Officers are appointed annually by our Board of Directors and each Executive Officer serves at the discretion of our Board of Directors. We do not have any standing committees. Our Board of Directors may in the future determine to pay Directors’ fees and reimburse Directors for expenses related to their activities.

Employment Agreements

There are no formal employment agreements with our officers and directors.

Family Relationships

There are no family relationships between any of our directors, executive officers and proposed directors or executive officers.

Involvement in certain legal proceedings.

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

|

1.

|

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

|

|

|

|

|

2.

|

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

|

|

|

|

|

3.

|

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

|

|

|

|

|

4.

|

been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

|

|

|

|

|

5.

|

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

|

|

6.

|

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26)), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29)), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

Section 16(a) Beneficial Ownership Reporting Compliance

Our common stock is not registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, our executive officers and directors and persons who own more than 10% of a registered class of our equity securities are not subject to the beneficial ownership reporting requirements of Section 16(1) of the Exchange Act.

Code of Ethics

We have not adopted a Code of Business Conduct and Ethics.

Board and Committee Meetings

Our board of directors held no formal meetings during the year ended September 30, 2019. All proceedings of the board of directors were conducted by resolutions consented to in writing by all the directors and filed with the minutes of the proceedings of the directors. Such resolutions consented to in writing by the directors entitled to vote on that resolution at a meeting of the directors are, according to the Nevada General Corporate Law and our Bylaws, as valid and effective as if they had been passed at a meeting of the directors duly called and held.

Nomination Process

As of September 30, 2019, we did not effect any material changes to the procedures by which our shareholders may recommend nominees to our board of directors. Our board of directors does not have a policy with regards to the consideration of any director candidates recommended by our shareholders. Our board of directors has determined that it is in the best position to evaluate our company’s requirements as well as the qualifications of each candidate when the board considers a nominee for a position on our board of directors. If shareholders wish to recommend candidates directly to our board, they may do so by sending communications to the president of our company at the address on the cover of this annual report.

Audit Committee

Currently our audit committee consists of our entire board of directors. We do not have a standing audit committee as we currently have limited working capital and minimal revenues. Should we be able to raise sufficient funding to execute our business plan, we will form an audit, compensation committee and other applicable committees utilizing our directors’ expertise.

Audit Committee Financial Expert

Currently our audit committee consists of our entire board of directors. We do not currently have a director who is qualified to act as the head of the audit committee.

The particulars of the compensation paid to the following persons:

|

|

(a)

|

our principal executive officer;

|

|

|

|

|

|

|

(b)

|

each of our two most highly compensated executive officers who were serving as executive officers at the end of the years ended September 30, 2019 and 2018 and

|

|

|

|

|

|

|

(c)

|

up to two additional individuals for whom disclosure would have been provided under (b) but for the fact that the individual was not serving as our executive officer at the end of the years ended September 30, 2019 and 2018, who we will collectively refer to as the named executive officers of our company, are set out in the following summary compensation table, except that no disclosure is provided for any named executive officer, other than our principal executive officers, whose total compensation did not exceed $100,000 for the respective fiscal year:

|

|

SUMMARY COMPENSATION TABLE

|

|

Name and Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards

($)

|

Option

Awards

($)

|

Non-Equity

Incentive Plan Compensa-tion($)

|

Change in

PensionValue

and Nonqualified

Deferred

Compensa-tion

Earnings

($)

|

All Other

Compensa-tion

($)

|

Total

($)

|

|

Haiping Hu(1)

CEO, CFO, Secretary, and Director

|

2019

2018

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

|

Kong Nguan Hong(2)

Former President, CEO, CFO, Secretary, Treasurer and Director

|

2019

2018

|

N/A

-

|

N/A

-

|

N/A

-

|

N/A

-

|

N/A

-

|

N/A

-

|

N/A

-

|

N/A

-

|

(1) Mr. Hu was appointed CEO, CFO, Secretary and as a director on April 4, 2018.

(2) Mr. Hong was appointed President, CEO, CFO, Secretary, Treasurer and as a director on June 8, 2017. Mr. Hong resigned all officer positions on April 4, 2018 and as a director on April 16, 2018.

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. Our directors and executive officers may receive share options at the discretion of our board of directors in the future. We do not have any material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that share options may be granted at the discretion of our board of directors.

Grants of Plan-Based Awards

During the fiscal year ended September 30, 2019 we did not grant any stock options.

Option Exercises and Stock Vested

During our fiscal year ended September 30, 2019 there were no options exercised by our named officers.

Compensation of Directors

We do not have any agreements for compensating our directors for their services in their capacity as directors, although such directors are expected in the future to receive stock options to purchase shares of our common stock as awarded by our board of directors.

No compensation was paid to non-employee directors for the year ended September 30, 2019.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the board of directors or a committee thereof.

Indebtedness of Directors, Senior Officers, Executive Officers and Other Management

None of our directors or executive officers or any associate or affiliate of our company during the last two fiscal years, is or has been indebted to our company by way of guarantee, support agreement, letter of credit or other similar agreement or understanding currently outstanding.

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

The following table sets forth, as of December 5, 2019, certain information with respect to the beneficial ownership of our common and preferred shares by each shareholder known by us to be the beneficial owner of more than 5% of our common and preferred shares, as well as by each of our current directors and executive officers as a group. Each person has sole voting and investment power with respect to the shares of common and preferred stock, except as otherwise indicated. Beneficial ownership consists of a direct interest in the shares of common and preferred stock, except as otherwise indicated.

|

Name and Address of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percentage of Class(1)

|

|

Haiping Hu

986 Dongfang Rd., One Hundred Shanshan Bldg 25th Fl

Pudong, Shanghai, China 200122

|

9,797,600 Common / Direct

|

99.5%

|

|

Directors and Executive Officers as a Group

|

9,797,600 Common

|

99.5%

|

|

(1)

|