Current Report Filing (8-k)

October 09 2019 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of

1934

Date of Report

(Date of earliest event reported): October

4, 2019

PREMIER BIOMEDICAL, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-54563

|

|

27-2635666

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

P.O. Box 25

Jackson Center, PA 16133

(Address

of principal executive offices) (zip code)

(814) 786-8849

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[_]

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[_]

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[_]

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

Emerging growth

company [_]

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

[_]

Section 1 – Registrant’s Business and

Operations

Item 1.01

Entry into a Material Definitive Agreement.

Equity Purchase Agreement

On

October 4, 2019, we entered into an Equity Purchase Agreement dated

October 3, 2019 with Green Coast Capital International SA, a Panama

corporation, pursuant to which we agreed to sell, and Green Coast,

or its assigns, agreed to purchase, up to Five Million Dollars

($5,000,000) of our common stock. Pursuant to the terms of the

Purchase Agreement, we may issue a Put Notice directing Green Coast

to purchase our common stock at a 10% discount to the lowest trade

price of our common stock during the five (5) Trading Days

immediately following the Clearing Date associated with our Put

Notice and in an amount of the lesser of (i) $1,000,000 or (ii)

200% of the average daily trading volume of our common stock in the

ten (10) Trading Days immediately preceding the date we give notice

to Green Coast. We may issue multiple Put Notices to Green Coast,

subject to these limitations, but we may not issue a Put Notice to

Green Coast within ten (10) Trading Days of a prior Put Notice. We

must have a registration statement in effect under the Securities

Act that covers the resale of any shares of common stock sold to

Green Coast pursuant to the Purchase Agreement.

This

description of the Purchase Agreement contained in this report is

qualified in its entirety by reference to the full text of the

Purchase Agreement. The Purchase Agreement has been filed as

Exhibit 10.1 to this report.

Registration Rights Agreement

On

October 4, 2019, in connection with the Purchase Agreement, we

entered into a Registration Rights Agreement with Green Coast (the

“Rights Agreement”), pursuant to which we agreed to

register the resale of shares to be issued under the Purchase

Agreement (as defined below).

This

description of the Rights Agreement contained in this report is

qualified in its entirety by reference to the full text of the

Rights Agreement. The Rights Agreement has been filed as Exhibit

10.2 to this report.

Section 3 – Securities and Trading Markets

Item

3.02 Unregistered Sale of Equity

Securities.

The disclosure in

Item 1.01 above regarding the Equity Purchase Agreement is

incorporated herein by reference.

Convertible Promissory Note

On

October 3, 2019, we issued a Convertible Promissory Note in the

face amount of One Hundred Fifty Thousand Dollars ($150,000) (the

“Note”), to Green Coast Capital International SA, a

Panama corporation. The Note has a maturity date of October 3,

2020. The Note bears interest at the rate of twelve percent (12%)

per annum and is convertible at any time into our common stock at a

conversion price equal to the lowest Trading Price of our common

stock during the fifteen (15) Trading Days prior to the conversion

date. The shares of common stock issuable upon conversion of the

Note will be restricted securities as defined in Rule 144 of the

Securities Act of 1933, as amended. The Note can be prepaid by us

at any time during the first 180 days following the Issue Date upon

ten (10) days written notice to Green Coast for a cash amount equal

to the sum of the then outstanding principal amount of the Note and

interest.

The

issuance of the Note was exempt from registration pursuant to Rule

506 of Regulation D and Section 4(a)(2) under the Securities Act of

1933, as amended. The purchaser was an accredited and sophisticated

investor, familiar with our operations, and there was no

solicitation.

This

description of the Note contained in this report is qualified in

its entirety by reference to the full text of the Note. The Note

has been filed as Exhibit 10.3 to this report.

Section 9 – Financial Statements and Exhibits.

Item 9.01 Financial Statements and Exhibits.

|

|

|

Equity

Purchase Agreement dated October 3, 2019 with Green Coast Capital

International SA

|

|

|

|

|

|

|

|

Registration

Rights Agreement dated October 3, 2019 with Green Coast Capital

International SA

|

|

|

|

|

|

|

|

Convertible

Promissory Note dated October 3, 2019 with Green Coast Capital

International SA

|

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

Premier Biomedical, Inc.

|

|

|

|

|

|

|

|

Dated:

October 9, 2019

|

/s/

William Hartman

|

|

|

By:

William Hartman

|

|

|

Its: Chief

Executive Officer

|

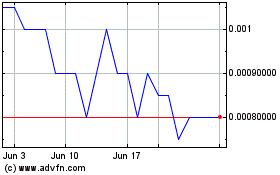

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

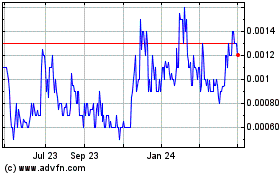

Premier Biomedical (PK) (USOTC:BIEI)

Historical Stock Chart

From Apr 2023 to Apr 2024