Alstom Reaches Preliminary Deal to Buy Bombardier Train Unit -- Update

February 16 2020 - 12:59PM

Dow Jones News

By Jacquie McNish and Ben Dummett

French train giant Alstom SA has reached a preliminary deal to

acquire Bombardier Inc.'s train business for more that $7 billion,

according to people familiar with the matter.

If terms are completed, the deal could be announced as early as

Monday, according to these people.

Paris-based Alstom is expected to acquire the business from

Montreal-based Bombardier using mostly cash and some stock,

according to these people.

Quebec pension giant Caisse de dépôt et placement, which owns a

32.5% stake in Bombardier's train unit, has agreed to sell its

stake to Alstom and acquire a minority stake in the combined train

company, according to people familiar with the matter.

The planned deal is the latest effort by Alstom to join forces

with a rival to gain scale amid the prospect of increased

competition from China's state-owned CRRC, the world's largest rail

supplier.

In 2017, Alstom unsuccessfully tried to merge with the

train-making business of German industrial giant Siemens AG. But

the European Commission, the European Union's antitrust authority,

blocked that proposed tie-up in 2019, arguing that it would lead to

higher prices for signaling systems and the next generation of very

high-speed trains in the bloc.

The Alstom-Bombardier deal would also likely face intense

scrutiny from the EU among other antitrust regulators. Bombardier's

train business has a big presence in Europe with headquarters in

Germany. Siemens could have reason to oppose the deal following

Bombardier's opposition to the German company's previous deal with

Alstom.

The planned sale would more than halve Bombardier's current debt

of $9 billion and reduce the once-sprawling global transportation

manufacturer to a business jet manufacturer of such brands as the

Challenger, Learjet and Global aircraft.

Bombardier is dramatically shrinking its business after

production problems and order delays in its core train unit and

rising costs in some of its aviation units threatened its ability

to pay more than $1.5 billion debt coming due next year. In the

past year it has agreed to sell a variety of divisions including

its commercial airline, turboprop and aerostructure units.

Several weeks ago it initiated talks to sell its business jet

division to Textron Inc. because of concerns that negotiations to

sell the train division to Alstom were bogged down. The talks with

Textron are expected to be terminated once the agreement with

Alstom is completed, the people familiar with the matter said.

Write to Jacquie McNish at Jacquie.McNish@wsj.com and Ben

Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

February 16, 2020 12:44 ET (17:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

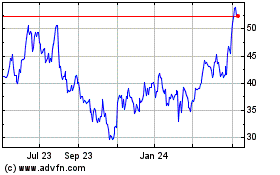

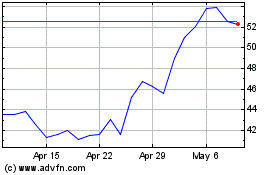

Bombardier (QX) (USOTC:BDRBF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bombardier (QX) (USOTC:BDRBF)

Historical Stock Chart

From Apr 2023 to Apr 2024