Current Report Filing (8-k)

November 23 2020 - 12:42PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 23, 2020

|

BrewBilt Manufacturing, Inc.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Florida

|

|

000-55787

|

|

47-0990750

|

(State

or other

jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification Number)

|

|

|

|

|

|

|

|

110 Spring Hill Road, Grass Valley, CA 95945

|

|

(Address of principal executive offices)

|

|

|

|

(530) 802-5023

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item

8.01. Other Events.

BrewBilt

Manufacturing, Inc. (the “Company”) has commenced a share repurchase program on September 15, 2020 to purchase up to

$5,000,000 of common stock through December 31, 2021. The share repurchase program is intended to reduce liability for the

company (and its affiliated purchasers). The company is relying on Rule 10B-18 as a safe harbor provision to reduce or eliminate

legal or regulatory liability in certain situations as long as certain conditions are met. The company has abided by the conditions

of Rule 10B-18 inclusive of conducting all transactions from a single broker or deal during a single day. The company recognizes

certain requirements for the timing of the purchase, whereas an issuer with an average daily trading volume (ADTV) that

is less than $1 million per day or that has a public float value below $150 million cannot trade within the last 30

minutes of trading. Companies with higher average trading volume or public float value can trade until the last 10 minutes. The

issuer must repurchase at a price that does not exceed the highest independent bid or the last transaction price quoted. Finally,

the issuer cannot purchase over 25% of the average daily volume.

On

November 20, 2020 the Company returned to treasury 70,025,000 common shares of stock in value of $140,050 at a price of $.002.

On

November 20, 2020 the company has agreed to allocate 10% of all purchase orders towards the repurchase of stock, up to $5,000,000

during the term of the share repurchase program through December 31, 2021.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

BrewBilt

Manufacturing, Inc.

|

|

|

|

|

|

|

Date: November 23, 2020

|

By:

|

/s/

Jef Lewis

|

|

|

|

|

Jef

Lewis, Chairman and CEO

|

|

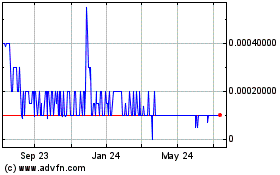

BrewBilt Manufacturing (PK) (USOTC:BBRW)

Historical Stock Chart

From Mar 2024 to Apr 2024

BrewBilt Manufacturing (PK) (USOTC:BBRW)

Historical Stock Chart

From Apr 2023 to Apr 2024