Asset Sales, Cost Cuts Pose Challenge for New Bayer CFO

November 30 2018 - 10:55AM

Dow Jones News

By Nina Trentmann

Bayer AG's program of asset sales and cost-cutting is one of the

first big tasks for new finance chief Wolfgang Nickl as the drugs

and chemicals giant battles a decline in investor confidence

following its acquisition of Monsanto Co.

Leverkusen, Germany-based Bayer on Thursday announced it would

cut 12,000 jobs -- around 10% of its 118,200 strong global

workforce -- and dispose of its animal-health business, some

consumer brands and a 60% stake in chemical park operator Currenta.

Cost savings are forecast to amount to EUR2.6 billion ($3.0

billion) by 2022, Chief Executive Werner Baumann said during a call

with journalists.

Mr. Nickl -- who took on the role of Chief Financial Officer on

June 1 after a stint as CFO of ASML NV, a Dutch supplier of

machines for making computer chips -- will be involved with

executing the program and delivering synergies from the Monsanto

transaction, according to analysts.

Bayer hopes to generate around EUR1.0 billion in annual cost

savings through the integration of the U.S. pesticides maker, which

it agreed to buy in September 2016.

"This is a big challenge for the CFO," said Markus Mayer, an

analyst at Baader Bank AG. The tasks ahead for Mr. Nickl include

finding potential buyers for unwanted assets, reducing costs and

managing the integration of Monsanto, Mr. Mayer said.

Shares of Bayer have lost roughly a third of their value since

Aug. 10, when a San Francisco jury verdict found a Monsanto weed

killer responsible for a man's cancer. Bayer faced lawsuits from

9,300 plaintiffs at the end of the October, up from 8,700 at the

end of August, and is increasingly under pressure to justify the

benefits of the $63 billion transaction that was completed in early

June.

Some of the cut: announced job cuts will affect corporate and

support functions, business services and various country platforms,

a Bayer spokesman said. The company on Thursday said it will cut

5,500 to 6,000 jobs in this area.

While the divestment and restructuring initiative is spearheaded

by CEO Mr. Baumann, CFO Mr. Nickl will be key to its success, said

Daniel Wendorff, an analyst at Commerzbank AG.

Debt reduction should be a priority for Mr. Nickl as he reshapes

the 155-year old company, Mr. Wendorff added. Bayer has guided that

its debt pile will total EUR36 billion at the end of the year,

according to analysts at Jefferies International Ltd.

Bayer needs to pay off debt so that it can tap the capital

markets to finance the acquisition of smaller and medium-size

companies to boost its pharmaceuticals business, Mr. Wendorff

said.

Mr. Wendorff said such transactions could be worth between

EUR500 million and EUR5 billion.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

November 30, 2018 10:40 ET (15:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

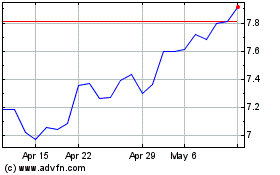

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

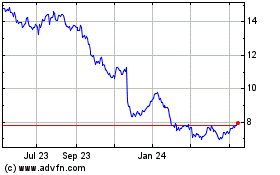

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024