As filed with the Securities and Exchange Commission on June

14, 2019

File No. 333-230003

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST EFFECTIVE AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

BANTEK, INC.

|

Delaware

|

|

|

|

30-0967943

|

|

(State or jurisdiction of

Incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code)

|

|

(I.R.S. Employer

Identification No.)

|

330 Changebridge Road, Pine Brook, NJ

07058

(203) 220-2296

(Address, including

zip code, and telephone number, including area code,

of registrant’s principle executive

offices)

VCorp Services,

LLC

1013 Centre Road, Suite 403-B

Wilmington, DE 19805

(888) 528-2677

(Name, address, including

zip code, and telephone number, including area code,

of agent for service)

Approximate date of commencement of proposed

sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box: ☐

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check

the following box. ☐

If this Form is a post-effective amendment

to a registration statement filed to register additional securities or additional classes of securities pursuant to Rule 413(b)

under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

|

Smaller reporting company

|

☒

|

|

|

|

|

Emerging growth company

|

☒

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Calculation of Registration Fee

|

Title of

each Class of Securities To be Registered

|

|

Amount

to be

registered

(1)

|

|

|

Proposed

maximum

Offering price

per share

(2)(3)(4)(5)

|

|

|

Proposed

maximum

aggregate

Offering price

|

|

|

Amount

of

registration

fee

|

|

|

Common Stock, $0.0001 par value per

share, to be offered by the issuer

|

|

|

2,500,000,000

|

|

|

$

|

0.0002

|

|

|

$

|

500,000

|

|

|

$

|

61

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

2,500,000,000

|

|

|

|

0.0002

|

|

|

$

|

500,000

|

|

|

$

|

61

|

|

|

|

(1)

|

In

the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered

shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities

Act of 1933, as amended.

|

|

|

(2)

|

Estimated

solely for the purpose of computing the registration fee pursuant to Rule 457 of the Securities Act.

|

|

|

(3)

|

Offering

price has been arbitrarily determined by the Board of Directors.

|

|

|

(4)

|

The

offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule

457(o).

|

|

(5)

|

The

offering price has been calculated as the exercise price solely for the purpose of computing the amount of the registration fee

in accordance with Rule 457(g).

|

|

(6)

|

The registration

fee presented in the original filing was $757.50, which was calculated based on the original number of shares to be offered

(2,500,000,000) and the expected proposed maximum offering price of $0.0025. The amended filing had disclosed a fee of $169.68

based on the offering as then amended.

|

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

Explanatory

Note

This

registration statement is a post-effective amendment to the registration statement on Form S-1 (File No. 333-230003) of

Bantek, Inc. (the “Registrant”) filed with the Securities and Exchange Commission (the “SEC”) on March

1, 2019 (the “Registration Statement”). This Post-Effective Amendment No. 5 to the Registration Statement is being

filed for the purpose of correcting a scrivener’s error which occurred during the Edgarization process to the consent of

Salberg & Company, P.A. in Exhibit 23.2.

PRELIMINARY PROSPECTUS

BANTEK, INC.

2,500,000,000

Shares of Common Stock Offered by the Company

$0.0002 per share

This is the initial

public offering of our common stock, par value $0.0001 per share. We are selling 2,500,000,000 shares of our common stock.

This offering will

terminate on the date which is 180 days from the effective date of this prospectus, although we may close the offering on any date

prior if the offering is fully subscribed or upon the vote of our board of directors.

We currently expect

the initial public offering price of the shares we are offering to be $0.0002 per share of our common stock.

The Company is quoted

on the OTC Pink market there is a limited established market for our stock. The offering price of the shares has been determined

arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria

for valuing a privately held company. In determining the number of shares to be offered and the offering price, we took into consideration

our capital structure and the amount of money we would need to implement our business plans. Accordingly, the offering price should

not be considered an indication of the actual value of our securities.

Investing in our

common stock involves a high degree of risk. See “Risk Factors” for certain risks you should consider before purchasing

any shares in this offering.

This prospectus is not an offer to sell these securities and it is not the solicitation of an

offer to buy these securities in any state where the offeror sale is not permitted.

The offering is being

conducted on a self-underwritten, best efforts basis, which means our management will attempt to sell the shares being offered

hereby on behalf of the Company. There is no underwriter for this offering.

Completion of this

offering is not subject to us raising a minimum offering amount. We do not have an arrangement to place the proceeds from this

offering in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our

immediate use.

Any purchaser of

common stock in the offering may be the only purchaser, given the lack of a minimum offering amount.

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Company does

not plan to use this offering prospectus before the effective date.

Proceeds to Company in Offering

|

|

|

Number

of

Shares

|

|

|

Offering

Price

(1)

|

|

|

Gross

Proceeds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

|

|

|

|

|

|

|

|

25% of Offering Sold

|

|

|

625,000,000

|

|

|

$

|

0.0002

|

|

|

$

|

125,000

|

|

|

50% of Offering sold

|

|

|

1,250,000,000

|

|

|

$

|

0.0002

|

|

|

$

|

250,000

|

|

|

75% of Offering Sold

|

|

|

1,875,000,000

|

|

|

$

|

0.0002

|

|

|

$

|

375,000

|

|

|

Maximum Offering sold

|

|

|

2,500,000,000

|

|

|

$

|

0.0002

|

|

|

$

|

500,000

|

|

|

|

(1)

|

Assuming

an initial public offering price of $0.0002 per share, as set forth on the cover page

of this prospectus.

|

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

In making your investment

decision, you should only rely on the information contained in this prospectus. We have not authorized anyone to provide you with

any other or different information. If anyone provides you with information that is different from, or inconsistent with, the information

in this prospectus, you should not rely on it. We believe the information in this prospectus is materially complete and correct

as of the date on the front cover. We cannot, however, guarantee that the information will remain correct after that date. For

that reason, you should assume that the information in this prospectus is accurate only as of the date on the front cover and that

it may not still be accurate on a later date. This document may only be used where it is legal to sell these securities. The information

contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sales

of our shares of common stock.

You should not interpret

the contents of this prospectus to be legal, business, investment or tax advice. You should consult with your own advisors for

that type of advice and consult with them about the legal, tax, business, financial and other issues that you should consider before

investing in our common stock.

This prospectus does

not offer to sell, or ask for offers to buy, any shares of our common stock in any state or other jurisdiction in which such offer

or solicitation would be unlawful or where the person making the offer is not qualified to do so.

No action is being

taken in any jurisdictions outside the United States to permit a public offering of our common stock or possession or distribution

of this prospectus in those jurisdictions. Persons who come into possession of this prospectus in jurisdictions outside the United

States are required to inform themselves about, and to observe, any restrictions that apply in those jurisdictions to this offering

or the distribution of this prospectus. In this prospectus, unless the context otherwise denotes, references to “we,”

“us,” “our,” and the “Company” refer to Bantek, Inc. f/k/a Drone USA, Inc.

SUMMARY

The following summary

highlights material information in this prospectus. It may not contain all the information that is important to you. For additional

information, you should read this entire prospectus carefully, including “Risk Factors” the financial statements and

the notes to the financial statements.

Organizational History

We were formed in Delaware

on June 26, 1972 as OCR Corporation, underwent a series of name changes and businesses and on April 25, 2008 changed our name to

Texas Wyoming Drilling, Inc. On January 26, 2016, we entered into an Equity Exchange Agreement (the “EEA”) whereby

we acquired all of the issued and outstanding membership interests in Drone USA, LLC in exchange for 440,425,388 shares of our

common stock and 250 shares of Series A preferred stock, subsequent and pursuant to our completing a 1-for-150 share reverse stock

split on all issued and outstanding common stock which resulted in total issued and outstanding shares of common stock of 6,368,224

immediately prior to this issuance. In connection with the EEA, 1,253,202 shares of common stock were relinquished and an additional

44,042,539 shares of common stock were issued pursuant to a previous settlement agreement. In connection with the EEA, effective

January 26, 2016, we accepted the resignation of Margaret Cadena, the former Chief Executive Officer and Board member, and Richard

Kugelman, Dr. Robert Michet, and Dr. David Durkin, the remaining former officers and Board members, and appointed Michael Bannon

as Chief Executive Officer, President, Chairman and Board member and Dennis Antonelos as Chief Financial Officer, Secretary, Treasurer,

and Board member. Dennis Antonelos resigned as our CFO and as a member of our Board on July 10, 2017 and Michael Bannon was appointed

as CFO. On May 19, 2016, we changed our name to Drone USA, Inc., we changed our ticker symbol to DRUS, and we completed a 1-for-12

share reverse stock split on all issued and outstanding common stock, with a record date of May 24, 2016, which resulted in total

issued and outstanding shares of common stock of 40,841,517 on June 17, 2016 when all round lot issuances were completed.

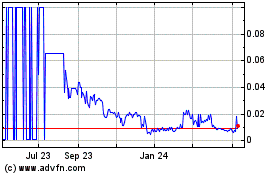

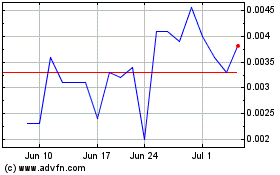

We are currently traded

on the OTC Pink market under the symbol BANT

On June 1, 2016,

we entered into an agreement with BRVANT Technologic Solutions (“BRVANT”), a company in Brazil that develops and manufactures

UAV systems, embedded systems and simulators for commercial and military customers. We acquired exclusive rights to BRVANT’s

UAV technology and intellectual property relating to its UAV technology. As consideration for the agreement, Dr. Rodrigo Kuntz

Rangel, BRVANT’s CEO, was appointed to the position of Chief Technology Officer (CTO) and issued a stock option grant for

2,000,000 shares of common stock in Bantek. We have the option to acquire ownership of all outstanding capital stock of BRVANT

for additional consideration of $1 million, but we have not made a decision to make that purchase at this time.

On September 9,

2016, Howco became a wholly owned subsidiary of Bantek, Inc. We acquired all of its issued and outstanding shares held by Paul

Charles (“Chuck”) Joy and Kathryn B. Joy, the founders and officers of Howco, for $3,500,000, a warrant for 500,000

shares of Bantek, Inc. common stock with an exercise price of $0.01 per share, and earn out consideration, the funds for which

were received from the TCA loan discussed below. We paid $2,600,000 in cash and issued a note to the sellers for $900,000. Howco

is a supplier of spare and replacement parts to the United States Federal Government and commercial customers worldwide with expertise

in Defense Logistics Agency, TACOM, NECO and other Department of Defense acquisition groups. Howco understands the entire contract

and administration management process for Federal Government contracts and supply chain logistics for its Federal Government customers

as well as prime contractors with Federal Government contracts. Chuck Joy and Kathryn Joy were retained under contract for a term

of two years, a salary of $125,000 and a tiered bonus-structure that is dependent on the gross margin performance of Howco in

the subsequent 12 and 24 month periods immediately following the acquisition. Prior to the acquisition, Howco reported revenues

of approximately $18.78 million and $24.86 million, and net income of approximately $903,000 and $1,013,000, for the period from

October 1, 2015 through September 9, 2016 and the year ended September 30, 2015, respectively. For the year ended September 30,

2018, three customers accounted for approximately 52%, 17% and 10% of Howco’s total sales. The customers are the Defense

Logistics Agency-Columbus, Defense Logistics Agency-Richmond and the Defense Logistics Agency-Philadelphia, respectively. Howco’s

dependence on three significant customers, all part of the Federal Government, is a risk for its ability to maintain or increase

its future revenues since the loss of one or both could have significant adverse financial consequences for Howco and Bantek,

Inc.

On November 17, 2016,

we entered into a sublease with ESAero for a period of two years commencing February 1, 2017, of office space and engineering

design space of approximately 10,000 square feet at a monthly cost of $15,000. The sublease is at 3580 Sueldo Street, San Luis

Obispo, CA 93401. We have not made any lease payments since inception of this sublease and do not intend to use this facility

since it was based, in large part, on the relationship that we had with a former employee with whom we have reached a settlement

on November 17, 2018 for $600,000 arising from our termination of him. We could be found to be in default of our obligations under

the lease and have accrued on our consolidated financial statements all $360,000 that we would owe under the lease through its

full term.

On March 28, 2017,

we entered into an agreement with TCA Global Credit Master Fund, LP (“TCA”) to receive a range of advisory services,

particularly assistance with preparation of a business plan and financing strategies, for a total of $1,200,000. If we are quoted

on a listed exchange, TCA will accept a single preferred share convertible into common stock never to exceed 4.99% of the total

issued and outstanding shares of our common stock. The number of shares issued will be set at 100% of the amount due up to availability

and subject to a make-whole provision. We have expensed this fee and recorded this as an accrued liability – advisory fee

as of March 31, 2017. On January 3, 2018 the TCA advisory fee was added to the principal balance due of convertible notes.

In June 2017, we entered

into an agreement with an investment bank to provide placement agent services on an exclusive basis as it relates to a private

placement (“the placement”). The agreement calls for the investment bank to receive 9% of the gross proceeds of the

placement and 2.5% warrant coverage of the amount of raised. The warrants shall entitle the investment bank to purchase securities

of the Company at a purchase price equal to 110% of the implied price per share of the placement or 100% of the public market closing

price of the Company’s common stock on the date of the placement, whichever is lower. The warrants shall have a term of five

years after the closing of the placement. The agreement expired on September 30, 2017, but we have continued to rely on them for

sources of capital and have paid them in accordance with the terms of the prior agreement.

On November 15, 2017,

we executed a Liability Purchase Term Sheet with Livingston Asset Management (“Livingston”) under which Livingston

agreed to purchase up to $10,000,000 that we owe to our creditors through direct purchase of the debts from our creditors in return

for (i) a convertible note issued by the Company in the principal amount of $50,000 bearing interest of 10% per year to cover certain

legal fees and other expenses of Livingston that matures in six months and is convertible into shares of our common stock at a

30% reduction off the lowest closing bid price for 20 trading days prior to the date of conversion, (ii) a convertible note subject

to these same terms as the convertible note issued to Livingston, payable to Scottsdale Capital Advisors in the principal amount

of $15,000 as a placement agent fee and (iii) the right of Livingston to retain 30% of any negotiated reduction off the face amount

of the liability we owe to such creditors. Following a court judgment (March 2018) for the liabilities purchased by Livingston,

we have been issuing free trading shares of our common stock under section 3(a)(10) of the Securities Act to Livingston in the

amount of such judgment in a series of tranches so that Livingston will not own more than 9.99% of our outstanding shares per tranche.

Growth Strategy

Our parent company

intends to focus on primary drone sales, counter-drone technology sales, drone training and piloted licensed services.

Drone Sales

When we walk into

a police station, a firehouse or a business our primary goal is to match the perfect drone or drones to that customer. To accomplish

this, we have aligned with several drone manufacturers, so we can offer a whole line card of drones. We desire to be the “DroneRUS”

of the drone world offering a wide variety of drones at different price points from simple surveillance drones that can fly between

20 minutes and up to one hour, follow a speeding car, avoid obstacles while chasing the speed car such as trees and buildings

and re acquire the car if lost. We desire to be our customers’ one-stop shop for all their drone needs.

Counter-Drone Technology

Sales

Unfortunately, we will

all witness the inevitable increase of illegal drone use by drug dealers, terrorists and other unsavory people. For this reason,

we have partnered with two counter-drone technology companies to offer drone detection, drone signal jamming and drone system takeover

technology that will ultimately aid law enforcement, U.S. industry and our U.S. Government and state governments in combating illegal

drones. The market for counter-drone technology could possibly rival the drone market in the not too distant future.

Drone Operator Training

We have

partnered with DARTDrones to offer drone training throughout the continental United States. In February 2017, DARTDrones

received an investment offer on Shark Tank from Mark Cuban.

https://www.dartdrones.com./.

When signing up for a class,

our customers present the coupon “DRONEUSA15” and they will receive a 15% discount on all DARTDrones training.

The in-person training includes basic flight training, aerial mapping and modeling, FAA 107 remote pilot test prep and aerial

roof inspection training. The online training includes drones for beginners, aerial photography, starting a drone business,

Part 107 remote pilot test prep.

Licensed Piloted

Services

We understand that

some police departments and businesses will not want to establish drone programs, employ FAA Part 107 pilots or own their own drones.

For this reason, we provide a number of services such search and rescue, utility inspection, real estate marketing, construction,

engineering and agriculture. When a service call is received, we respond immediately with a licensed pilot equipped with drones

and charged batteries ready to perform the mission requested.

Acquisitions

Acquisitions also are

an important pillar to our overall growth strategy, providing revenue, earnings, infrastructure and synergies. We seek opportunities

with innovative and commercially proven technologies primarily in the UAV industry. We seek profitable firms that complement our

overall strategy. We are currently evaluating companies worldwide.

An important element

of our mergers and acquisitions strategy is to acquire companies with complementary capabilities/technologies and an established

customer base in our target markets. We believe that the customer base of each potential acquisition will present an opportunity

to cross-sell solutions to the customer base of other acquired companies. We are looking to expand our public sector clients beyond

what the Howco acquisition has brought us. Public sector customers provide very large multi-year contracts that we believe can

provide secure revenue visibility typically for three to five years. Based on our experience in government contracting, we

have a core competency in bidding on government requests for proposals (RFPs). We are actively seeking companies that have built

a backlog with various government agencies that can complement our existing contracts through Howco.

Bantek, Inc’s Products and Services

We have reseller agreements

in place with the following companies that will allow us to sell the following drones:

Company: Yuneec USA

Drone: H520

Company: ATI

Drones: Patrolbot,

Patrolbot XL and Agbot

Company: Draganfly

Drones: Commander,

Guardian, X4-P

Company: Aero Surveillance

Drones: ASF15, ASF

50 ASF 300

Company: DJI

Drones: Mavic Pro Platinum,Phantom

Pro +, Inspire 2, Spark

Bantek’s Markets

The market for commercial

drones has grown significantly over the last several years and is expected to continue doing so following the release of recent

rules by the FAA for commercial drone use. The FAA in its discussion of the new rules governing commercial drones stated that that

the drone rules could generate more than $82 billion and create more than 100,000 jobs over the next 10 years. The Teal Group estimated

that the global commercial UAV marketplace reached $387 million in 2016 and projects the market to reach $6.5 billion by 2025 with

a CAGR of 32.6%.

The military has transformed

into a smaller, more agile fighting force in need of a network of technologies to provide improved observation, communication and

precision targeting of combat troop locations, which are often embedded in dense population centers or dispersed in remote locations.

According to the Teal Group, the global military UAV marketplace reached $2.8 billion in 2016 and is expected to generate more

than $9.8 billion in UAV purchases by 2025 with a CAGR of 14.4%.

The markets for our

systems on a stand-alone basis and/or combined with other payloads relates to the following applications, among others:

Government Markets

:

|

|

1.

|

International

and U.S. federal, state and local governments as well as U.S. and foreign government agencies, including the U.S. Department of

Defense (“DoD”), U.S. Drug Enforcement Agency (“DEA”), U.S. Homeland Security, U.S. Customs and Border Patrol,

U.S. Environmental Protection Agency (“EPA”), U.S. Department of State, U.S. Federal Emergency Management Agency (“FEMA”),

U.S. and state departments of transportation, penitentiaries, and police forces;

|

|

|

2.

|

Military, including U.S. Army Space and Missile Defense Agency (“SMDC”) and U.S. Air Force installations;

|

|

|

3.

|

ISR including Joint Improvised Explosive Device Defeat Organization (“JIEDDO”);

|

|

|

4.

|

Border security monitoring, including U.S. Homeland Security, to deter and detect illegal entry;

|

|

|

5.

|

Drug enforcement along U.S. borders;

|

|

|

6.

|

Monitoring environmental pollution and sampling air emissions; and

|

|

|

7.

|

Vehicle traffic monitoring, including aerial speed enforcement by state and local law enforcement agencies.

|

Commercial Markets

:

|

|

2.

|

Agriculture monitoring, including monitoring crop health, field monitoring to reduce costs and increase yields;

|

|

|

3.

|

Security for large events, including crowd management;

|

|

|

4.

|

Natural disaster instant infrastructure to support first responders;

|

|

|

5.

|

Oil pipeline monitoring and exploration; and

|

|

|

6.

|

Atmospheric and climate research.

|

|

|

7.

|

TV and media production mobile communications systems, expanding on-site reporting capabilities to include aerial videography and photography;

|

|

|

8.

|

Surveying, mapping and photogrammetry;

|

|

|

9.

|

Biological control for agriculture;

|

|

|

10.

|

Utilities inspection.

|

Market research media

analysts have found that there is a widening gap between growing a UAV fleet and UAV infrastructure development, especially in

such sectors as training; service, support and maintenance and data management. This gap creates a number of market opportunities

for UAV vendors, both large defense contractors and small technology companies. According to UAV Market Research, military procurement

of UAVs, including unmanned aircrafts and payloads, makes the Department of Defense the single largest consumer of UAV technology

in the world. We believe that the U.S. Government will continue to invest in UAVs as much as needed to keep its dominance, both

technologically and to demonstrate its power, in the next decades.

Given the growth and

demand in this market, we believe that UAV’s will be a universal tool for government bodies and agencies, particularly focused

on law enforcement. Police departments have spent hundreds of millions of dollars to buy firearms, armored cars and electronic

surveillance gear, according to the annual reports submitted by local and state agencies to the Justice Department’s Equitable

Sharing Program. Police and law enforcement agencies purchase an expensive mix of high-tech military products, in particular electronic

surveillance equipment, for both their technological innovations for supporting their efforts to promote public and citizen confidence

by demonstrating their receptiveness to new practices of upholding the law and protecting the public well-being.

Howco’s Business

Howco is a premier

supplier of spare and replacement parts to a wide variety of Federal Government agencies, U.S. military prime contractors and commercial

customers worldwide. Founded in 1990 and located in Vancouver, Washington, Howco’s services encompass bid solicitation, contract

management, packaging and logistics for construction, transportation, mining and heavy equipment spare and replacement parts to

customers worldwide utilizing a wide variety of supply chain solutions. Howco was the winner of the 2012 United States’ Department

of Defense Logistics Agency’s Bronze Supplier Award. Howco reported revenues of approximately $18.4 million and $24.5 million,

and net income of approximately $164,000 and $252, 000, for the year ended September 30, 2018 and 2017.

Howco’s Government

Services Contracts

Howco enters into various

types of contracts with our customers, such as Indefinite Delivery, Indefinite Quantity (IDIQ), Cost-Plus-Fixed-Fee (CPFF) Level

of Effort (LOE), Cost-Plus-Fixed-Fee (CPFF) Completion, Cost-reimbursement (CR), Firm-Fixed-Price (FFP), Fixed-Price Incentive

(FPI) and Time-and-Materials (T&M). Approximately 91% of Howco’s revenues are FFP and approximately 11% of its revenues

are IDIQ.

IDIQ contracts provide

for an indefinite quantity of services or stated limits of supplies for a fixed period. They are used when the customer cannot

determine, above a specified minimum, the precise quantities of supplies or services that the government will require during the

contract period. IDIQs help streamline the contract process and speed service delivery. IDIQ contracts are most often used for

service contracts and architect-engineering services. Awards are usually for base years and option years. The customer places delivery

orders (for supplies) or task orders (for services) against a basic contract for individual requirements. Minimum and maximum quantity

limits are specified in the basic contract as either a number of units (for supplies) or as dollar values (for services).

CPFF LOE contracts

will be issued when the scope of work is defined in general terms requiring only that the contractor devote a specified LOE for

a stated time period. A CPFF completion contract will be issued when the scope of work defines a definite goal or target

which leads to an end product deliverable (e.g., a final report of research accomplishing the goal or target).

CR contracts provide

for payment of allowable incurred costs, to the extent prescribed in the contract. These contracts establish an estimate of total

cost for the purpose of obligating funds and establishing a ceiling that the contractor may not exceed (except at its own risk)

without the approval of the contracting officer and are suitable for use only when uncertainties involved in contract performance

do not permit costs to be estimated with sufficient accuracy to use any type of fixed-price contract.

FFP contract will be

issued when acquiring supplies or services on the basis of definite or detailed specifications and fair and reasonable prices can

be established at the outset.

FPI target delivery

contract will be issued when acquiring supplies or services on the basis of reasonably definite or detailed specifications and

cost can be reasonably predicted at the outset wherein the cost risk will be shared. A firm target cost, target profit, and profit

adjustment formula will be negotiated to provide a fair and reasonable incentive and a ceiling that provides for the contractor

to assume an appropriate share of the risk.

T&M contracts provide

for acquiring supplies or services on the basis of (i) direct labor hours at specified fixed hourly rates that include wages, overhead,

general and administrative expenses, and profit; and (ii) actual cost for materials. A customer may use this contract when it is

not possible at the time of placing the contract to estimate accurately the extent or duration of the work or to anticipate costs

with any reasonable degree of confidence.

Market Size

According to Todd Harrison,

author of “Analysis of the FY 2017 Budget,” one-third of the DoD budget request, $184.4 billion, is for procurement

and research, development, test, and evaluation (“RDT&E”). The U.S. Government spends a portion of this budget

on the shipping of replacement parts annually.

Insulation Jackets

We are a reseller of

Thermaxx Jackets. Thermaxx Jackets are used to cover mechanical system components such as valves, steam traps, heat exchangers,

flanges and other mechanical system components. We are targeting hospitals, manufacturers and universities. We are currently focusing

our efforts on the New Jersey market. In the near future, we are looking to target the New York, Maryland and Pennsylvania markets.

Intellectual Property

We review each of our

intellectual properties and make a determination as to the best means to protect such property, by trademark, by copyright, by

patent, by trade secret, or otherwise. We believe that we have taken appropriate steps to protect our intellectual properties,

based on our evaluation of the factors unique to each such property, but cannot guarantee that this is the case.

Regulatory Matters

The use of unmanned

aerial vehicles for commercial purposes is governed by the Federal Aviation Administration (“FAA”). On August 29, 2016, the

new FAA rules took effect for commercial use of small drones. Under the FAA rules commercial drones must be under 55 pounds and

be registered with the FAA. The rules require a new “remote pilot certificate”, daylight-only operations 30 minutes

before official sunrise and 30 minutes after official sunset, a requirement that all flights travel at a maximum groundspeed of

100 miles per hour remain, below 400 feet or within 400 feet of a structure and yield the right of way to other aircraft. Under

the FAA rules, drone pilots must be at least 16 years old or be supervised by an adult with a remote pilot certificate. The pilot

must also maintain “visual line of sight” with the drone at all times, among other requirements. The new rules also

require that any drone-related incident that results in at least $500 worth of damage or causes serious injury be reported to

the FAA within 10 days. The new restrictions can be waived, but pilots will need to apply directly to the FAA for an exemption

and/or a waiver.

Competition

Bantek

We believe that the

principal competitive factors in the markets for UAVs include product performance, features, acquisition cost, lifetime operating

cost, ease of use, integration with existing equipment, size, mobility, quality, reliability, customer support, brand and reputation.

We intend to acquire companies that give us a competitive advantage with our prospective government and commercial customers.

The market leaders

in UAV manufacturing are mostly international and are located in tech hubs. Asia has the most UAV manufacturers currently in operation.

Chinese manufacturer DJI is the market leader in the mid to high end recreational platform, followed by French based Parrot with

a mid-market recreational platform, and several companies such as XAircraft American based in the United States, with low to mid-market

recreational platforms. In addition, in the United States there are large defense contractors, among them Boeing, Northrup Grumman,

TCOM, Raytheon, Lockheed Martin, ISL, ILC Dover, Compass Systems, Raven Aerostar and American Blimp Corporation offering military

grade free flying drones to the U.S. Government. There is also potential competition from commercial grade tethered drone systems

which remain tethered to the ground via a high strength armored tether, such as offered by Elistair located in Lyon, France and

Cyphy Works Inc. located in Danvers, Massachusetts.

Howco

The business of supplying

spare and replacement parts to Federal Government agencies, U.S. military prime contractors and commercial customers is very competitive.

Among our U.S. based competitors are JGILS that supplies parts manufactured by Fairbanks Morse/Coltec and other brands, Ohio Cat

that supplies Caterpillar parts, and Kampi Components and Brighton Cromwell, both of which compete with us in several brands.

Employees

We have 15 full-time

employees, one with Bantek and 14 are with Howco, and one part-time employee with Howco. We have no labor union contracts and believe

relations with our employees are satisfactory.

Debt Instruments

The Company has

a revolving line of credit with a financial institution, which balance is due on demand and principal payments are due monthly

at 1/60

th

of the outstanding principal balance. This revolving line of credit is in the amount of $50,000, and is personally

guaranteed by the Company’s Chief Executive Officer (“CEO”). The line bears interest at a fluctuating rate equal

to the prime rate plus 4.25%, which at December 31, 2018 was 9.75% and 8.50%, respectively. As of December 31, 2018, the balance

of the line of credit was $45,915 with $4,085 available.

We have an $840,000

convertible note dated December 11, 2015, payable with Abatement Industries Group, Inc. (“AIG”), an entity controlled

by our CEO. The Note bears interest at an annual rate of 7% with a maturity date of June 11, 2017, at which time all unpaid principal

and interest is due. In August 2018, the maturity date of the note was extended to June 11, 2022. In conjunction with the amendment

the note was assumed by Pike Falls LLC which is also controlled by our CEO. The holder of the note has the option to convert the

outstanding principal and accrued interest, in whole or in part, into shares of common stock at a conversion price equal to the

volume weighted average price per share of common stock for the 30-day period prior to conversion. As of December 31, 2018, the

note payable has not been converted and the balance of the note is approximately $688,000, and accrued interest was approximately

$138,115.

We issued a convertible

note dated July 1, 2016, payable to our CEO for $117,000. The note bears interest at an annual rate of 7% with a maturity rate

of January 1, 2018. The holder of the note has the option to convert the outstanding principal and accrued interest, in whole or

in part, into shares of common stock at a conversion price equal to the volume weighted average price per share of common stock

for the 30-day period prior to conversion. As of December 31, 2018, the note payable has not been converted and the balance of

the note is approximately $46,670, and accrued interest was approximately $11,845. The Company and our CEO extended the maturity

of this note until June 30, 2019.

In connection with

the acquisition of Howco on September 9, 2016, we issued a note payable to the sellers in the amount of $900,000. The note bears

an interest of 5.5% and all unpaid principal and accrued interest is due on September 9, 2017. The note is in default and is accruing

interest at 8% per year. The Company is in discussion with the sellers over the asserted claim that the sellers withdrew excessive

amounts of cash from the business prior to the acquisition. The note is subordinated to the TCA loan described below.

As of December 31, 2018, the note payable has a balance of approximately $900,000 with accrued interest of approximately $144,027.

Senior Secured Credit Facility Note

Effective September 13, 2016 (“Effective

Date”), the Company entered into a senior secured credit facility note (the “Agreement”) with an investment fund

to provide capital for the acquisition of Howco. The Company can borrow up to $6,500,000, subject to lender approval, with an initial

convertible promissory note at closing of $3,500,000 (the “Convertible Note”). The Convertible Note bears interest

at a rate of 18% per annum, required monthly payments of $52,500 which is interest only starting on October 13, 2016 through February

13, 2017, and monthly payments, including interest and principal, of $298,341 starting on March 13, 2017 through maturity on March

13, 2018. Events of default are defined in the Agreement and Convertible Note. In the event of default the Convertible Note balance

will bear interest at 25% per annum. In connection with this Agreement, the Company was obligated to pay additional advisory fees

of $850,000 payable in the form of cash or common stock in accordance with the terms of the Agreement. The Company was also required

to reserve 7,000,000 shares of common stock related to this transaction. The reserved shares will be released upon the satisfaction

of the loan.

In the event the lender makes additional

loans under the Agreement, the Company agreed to pay additional advisory fees under similar terms as the $850,000 fee. As of September

30, 2018, the Company had issued 539,204 shares of common stock in satisfaction of the $850,000 advisory fee in accordance with

the terms of the agreement, such shares being issued in September 2016. The proceeds from the sale of the 539,204 shares were supposed

to be applied towards the $850,000 advisory fee due. Based upon the value of the shares, at the time the lender sells the shares,

the Company may be required to redeem unsold shares for the difference between the $850,000 and the lender’s sales proceeds.

Accordingly, the $850,000 was reflected as a current liability through December 31, 2017. In January 2018, in connection with a

settlement agreement (see below), the accrued advisory fee was reclassified to the principal balance of the replacement Convertible

Note. Through the date of the settlement agreement and through September 30, 2018, the lender had not reported any proceeds from

the sale of these shares (see below). Prior to the settlement agreement in January 2018, notwithstanding anything contained in

the Agreement to the contrary, in the event the Lender has not realized net proceeds from the sale of Advisory Fee Shares equal

to at least the Advisory Fee by the earlier to occur of: (A) the twelve (12) month anniversary of the Effective Date; (B) the occurrence

of an Event of Default; or (C) the Maturity Date, then at any time thereafter, the Lender shall have the right, upon written notice

to the Borrower, to require that the Borrower redeem all Advisory Fee Shares then in Lender’s possession for cash equal to

the Advisory Fee, less any cash proceeds received by the Lender from any previous sales of Advisory Fee Shares, if any. In the

event such redemption notice is given by the Lender, the Borrower shall redeem the then remaining Advisory Fee Shares in Lender’s

possession for an amount of Dollars equal to the Advisory Fee, less any cash proceeds received by the Lender from any previous

sales of Advisory Fee Shares, if any, payable by wire transfer to an account designated by Lender within five (5) Business Days

from the date the Lender delivers such redemption notice to the Borrower.

The Convertible Note is only convertible

upon default or mutual agreement by both parties at a conversion rate of 85% of the lowest of the daily volume weighted average

price of the Company’s common stock during the 5 business days immediately prior to the conversion date. At any time and

from time to time while this Note is outstanding, but only upon: (i) the occurrence of an Event of Default under any of the Loan

Documents; or (ii) mutual agreement between the Company and the Holder, this Note may be, at the sole option of the Holder, convertible

into shares of the Company’s common stock, in accordance with the terms and conditions set forth below. At any time while

this Note is outstanding, but only upon: (i) the occurrence of an Event of Default under any of the Loan Documents; or (ii) mutual

agreement between the Company and the Holder, the Holder may convert all or any portion of the outstanding principal, accrued and

unpaid interest, and any other sums due and payable hereunder or under any other Loan Documents (such total amount, the “Conversion

Amount”) into shares of common stock of the Company (the “Conversion Shares”) at a price equal to: (i) the Conversion

Amount (the numerator);

divided by

(ii) 85% of the lowest of the daily volume weighted average price of the Company’s

common stock during the five business days immediately prior to the conversion date, which price shall be indicated in the conversion

notice (the denominator) (the “Conversion Price”). Upon liquidation by the Holder of Conversion Shares issued pursuant

to a Conversion Notice, provided that the Holder realizes a net amount from such liquidation equal to less than the Conversion

Amount specified in the relevant conversion notice (such net realized amount, the “Realized Amount”), the Company shall

issue to the Holder additional shares of the Company’s common stock equal to: (i) the Conversion Amount specified in the

relevant conversion notice;

minus

(ii) the Realized Amount, as evidenced by a reconciliation statement from the Holder (a

“Sale Reconciliation”) showing the Realized Amount from the sale of the Conversion Shares;

divided by

(iii)

the average volume weighted average price of the Company’s common stock during the five business days immediately prior to

the date upon which the Holder delivers notice (the “Make-Whole Notice”) to the Company that such additional shares

are requested by the Holder (such number of additional shares to be issued, the “Make-Whole Shares”).

Once a default occurs the Convertible Note

will be accounted for as stock settled debt at its fixed monetary value and any shares issued upon conversion are also subject

to a make whole provision similar to that described above for the $850,000 advisory fee payable. On March 13, 2017 the Company

defaulted on the monthly principal and interest payment of $298,341. Due to this default, as of June 30, 2017, the Company has

accounted for the embedded conversion option as stock settled debt and recorded a debt premium of $617,647 with a charge to interest

expense, and the interest rate increased to 25% (default rate). The Company has paid interest-only totaling $279,940 since September

30, 2017.

On March 28, 2017, the Company entered

into an agreement with the above senior secured credit facility lender to receive a range of advisory services for a total of $1,200,000

with no definitive terms or length of service which was expensed in fiscal 2017 and had been recorded as an accrued liability –

advisory fees through December 31, 2017. In connection with the settlement agreement discussed below, in January 2018, the advisory

services fee payable was reclassified to the principal balance of the replacement Convertible Note.

On January 3, 2018, the Company entered

into a settlement agreement (the “Settlement Agreement”) and replacement note agreements with the investment fund

related to a senior secured credit facility note dated September 13, 2016. On the effective date of the Settlement Agreement,

all amounts owed to the investment fund aggregated $5,788,642 and consisted of a convertible promissory note of $3,500,000, accrued

interest payable of $238,642, and accrued advisory fees payable of $2,050,000. Additionally, on the effective date, the amount

due of $5,788,642 was split and apportioned into 2 separate and distinct replacement notes (“Replacement Note A” and

“Replacement Note B”). Replacement Note A shall have a principal amount of $1,000,000 and Replacement Note B shall

have a principal balance of $4,788,642, both of which shall be and remained secured by the original security agreements, the pledge

agreements, the guarantee agreement and other applicable loan documents and both shall bear interest at 18% per annum. The default

was not waived by this settlement agreement. The Company originally recorded a premium on stock settled debt of $617,647 on the

$3,500,000, and subsequent to the settlement agreement recorded an additional premium on stock settled debt of $403,878 on the

additional $2,288,642. The interest rate was amended to 12% effective June 12, 2018.

On October 30, 2018

TCA the Company’s senior lender amended its credit facility which had been restructured in January 2018 when fees due for

advisory and other matters along with accrued but unpaid interest were capitalized and separated into two notes, Note A having

$1,000,000 principal and Note B having $4,788,642 both having the same maturity terms, interest rates and conversion rights. Under

the current amendment total amounts outstanding under the notes along with accrued interest have been capitalized with the principal

amount due of $6,018,192.42. The new note accrues interest on the principal balance at 12% per annum, includes amortization to

the new maturity of December 15, 2020. The amortization payments credited toward the principal amount and accrued interest vary

and include payments made under the settlement agreement with a third party related to Note A. Economically the total principal

and accrued interest outstanding remain unchanged as reported in the consolidated balance sheet. All other terms including conversion

rights and a make-whole provision in the case of a conversion shortfall remain the same as stated above.

In June 2016, we opened

a credit card account with American Express Bank. Payment of the entire balance is due monthly upon receipt of the statement. The

card has been cancelled and as of December 31, 2018 has a current unpaid balance of approximately $81,850. We are in compliance

with payment plan established in December 2017 with American Express to retire this debt obligation.

On August 18, 2016,

we entered into a Settlement Agreement with Rockwell Capital Partners, Inc. (“Rockwell”) in connection with a section

3(a)(10) transaction under the Securities Act where we issued to Rockwell a convertible note in the principal amount of $102,102.74.

To limit the number of our shares that Rockwell would have to sell and thus limit the potential pressure on the trading price of

our common stock in August 2016 we issued 68,500 shares of our common stock to Rockwell, of which 11,500 were a settlement fee

and the balance were for payment of $58,105 of the convertible note, and in the first quarter of fiscal 2017 issued an additional

460,200 shares for the remaining balance of the note as part of the Settlement Agreement for a total of 528,700 shares issued to

Rockwell.

In October 2016, we

opened a revolving credit card account with Capital One Financial Corporation. The credit card has a limit of $7,000. As of December

31, 2018, the credit card is active and the balance of the credit card was approximately $4,891.

In November 2016,

we opened a credit card account with Bank of America. Minimum payment calculated by Bank of America is due monthly upon receipt

of the statement. The credit card has a limit of $100,000 and as of December 31, 2018, the credit card is active, and the balance

was approximately $26,750.

On October 5, 2017,

the Company entered into a Securities Purchase Agreement with Power Up Lending Group Ltd. (“Power Up”) under which

the Company received $78,500, net of $21,500 in fees and expenses to be recorded as a debt discount and amortized to interest

expense over the Note term, in return for issuing a convertible promissory note (the “Note”) in the principal amount

of $100,000. Power Up received a right of first refusal for the first nine months from the date of the Note to provide any debt

or equity financing less than $150,000. The Note bears interest at 10% per annum and has a maturity date of July 15, 2018. The

Note may be prepaid at a premium ranging from 112% to 137% depending on the length of time following the date of the Note. The

Note is convertible after 180 days into shares of the Company’s common stock at a discount of 35% of the average of the

two lowest closing bid prices of Bantek’s common stock 15 days prior to the date of conversion and the maximum number of

shares issued to Power Up may not exceed 4.99% of the issued and outstanding shares of the Company’s common stock. The Note

is subject to customary default provisions, including a cross default provision. The Company’s CEO entered into a confession

of judgment in the principal amount of the Note. The Company has accounted for the convertible promissory note as stock settled

debt under ASC 480 and recorded a debt premium of $53,846 with a charge to interest expense. The note and all accrued interest

were fully converted into common shares as of June 19, 2018. The note holder’s legal counsel has returned the note marked

as paid. The debt premium was recognized as $53,846 as additional paid in capital.

On November 9, 2017,

the Company received a first tranche payment of $75,500 under the terms of a Securities Purchase Agreement dated October 25, 2017,

with Crown Bridge Partners, LLC (“Crown Bridge”) under which the Company issued to Crown Bridge a convertible note

in the principal amount of $105,000 and a five-year warrant to purchase 100,000 shares of the Company’s common stock at an

exercise price of $0.35 as a commitment fee which is equal to the product of one-third of the face value of each tranche divided

by $0.35. Under the terms of the note Crown Bridge was to receive “right of first refusal” for any subsequent loans

or notes to fund the Company. The Company violated this covenant when funding was received from other sources without offering

Crown Bridge the opportunity to participate. On December 20, 2017 the Company cured this covenant violation by issuing 200,000

additional warrants which have the same exercise price and terms of the original warrants. The warrants have full ratchet price

protection and cashless exercise rights).

The convertible note

(the “Note”) issued to Crown Bridge in the principal amount of $105,000, has an original issue discount of $10,500

and issue costs of $19,000 both of which are recorded as debt discount along with the warrant relative fair value of $12,507 for

the original 100,000 warrants and $31,529 for the penalty warrants to be amortized over the twelve month term of this tranche,

bears interest of 10% (12% default rate) per annum, and has a maturity date of 12 months from the date of each tranche of payments

under the Note with future tranches being at the discretion of Crown Bridge. The conversion rate for any conversion of unpaid principal

and interest under the Notes is at a 35% discount to the lowest market price of the shares of the Company’s common stock

within a 20 day trading period prior to the date of conversion to which an additional 10% discount will be added if the conversion

price of the Company’s common stock is less than $0.05 per share and no shares of the Company’s common stock can be

issued to the extent Crown Bridge would own more than 4.99% of the outstanding shares of the Company’s common stock and the

conversion shares contain piggy-back registration rights. The Note is subject to customary default provisions including an event

of default if the bid price of the Company’s common stock is less than its par value of $.0001 per share. The Company is

entitled to prepay the Note between 30 days after its issuance until 180 days from its issuance at amounts that increase from 112%

of the prepayment amount to 137% of the prepayment amount depending on the length of time when prepayments are made. The Company

has accounted for the convertible promissory note as stock settled debt under ASC 480 and recorded a debt premium of $56,538 with

a charge to interest expense. As of September 30, 2018 the note holder fully converted principal and accrued interest into common

shares. The debt premium on stock settled debt was fully recognized as additional paid in capital.

On November 15, 2017,

we executed a Liability Purchase Term Sheet with Livingston Asset Management (“Livingston”) under which Livingston

agreed to purchase up to $10,000,000 that we owe to our creditors through direct purchase of the debts from our creditors in return

for (i) a convertible note issued by the Company in the principal amount of $50,000 bearing interest of 10% per year to cover certain

legal fees and other expenses of Livingston that matures in six months and is convertible into shares of our common stock at a

30% reduction off the lowest closing bid price for 20 trading days prior to the date of conversion, (ii) a convertible note subject

to the same terms as the convertible note issued to Livingston payable to Scottsdale Capital Advisors in the principal amount of

$15,000 as a placement agent fee.

On November 28,

2017, the Company received a payment of $84,000, net of issue costs of $23,500 which was recorded as a debt discount and is being

amortized to interest expense over the Note term, under the terms of a Securities Purchase Agreement dated November 20, 2017,

with Labrys Fund, LP (“Labrys”) under which Bantek issued to Labrys (i) a convertible note (the “Note”)

in the principal amount of $107,500 that bears interest of 10% (24% default rate) per annum and (ii) 335,938 shares of the Company’s

common stock as a commitment fee which were to be returned to the Company in the event that it pays all unpaid principal and interest

under the Note within 180 days of November 20, 2017. Pursuant to ASC 260, as of December 31, 2017, the 335,938 contingent shares

issued under the Financial Consulting Agreement are not considered outstanding and are not included in basic net loss per share

or as potentially dilutive shares in calculating the diluted EPS. The Note has a maturity date of August 28, 2018 and a conversion

rate for any unpaid principal and interest at a 35% discount to the market price which is defined as the average of the two lowest

trading prices (defined as the lower of the trading price or closing bid price) for the Company’s common stock during the

fifteen (15) trading day period ending on the latest complete trading day prior to the date of conversion. The conversion rate

is further reduced if the Company enters into any section 3(a)(9) or 3(a)(10) transactions under the Securities Act of 1933, as

amended, if the terms of those transactions offer greater discounts on conversion prices or a longer look back period for determining

the conversion rate and under certain other enumerated events, including if the conversion price is less than $.01 per share or

if the Company loses the “bid” price for its common stock ($0.0001 on the “ask” with zero market makers

on the “bid” per Level 2 and/or a market such as OTC Pink). In addition, if the Company issues any shares of its common

stock at less than the conversion price Labrys is entitled to full ratchet anti-dilution in such event. No shares of the Company’s

common stock can be issued to the extent Labrys would own more than 4.99% of the outstanding shares of the Company’s common

stock unless Labrys agrees to increase the ownership to 9.99%. The Company is required at all times to have authorized and reserved

six times the number of shares that is actually issuable upon full conversion of the Note (based on the conversion price of the

Note in effect from time to time). Initially, the Company must instruct its transfer agent to reserve 6,198,049 shares of its

common stock. The Note is subject to customary default provisions and also includes a cross-default provision as well as default

being triggered if the Company loses the “bid” price for its common stock ($0.0001 on the “ask” with zero

market makers on the “bid” per Level 2 and/or a market such as OTC Pink) and a $15,000 penalty if not paid by the

maturity date. The Company is entitled to prepay the Note between the issue date until 180 days from its issuance but not thereafter.

In November 2017, the Company accounted for the convertible promissory note as stock settled debt under ASC 480 and recorded

a debt premium of $57,885 with a charge to interest expense. On February 7, 2018 the Company amended the terms to the Note whereby

Labrys waiving certain existing events of default on the Note and in return will no longer be required, under any circumstances,

to return the commitment shares back to the Company’s treasury. The Company was under default for failing to maintain a

market capitalization of at least $5,000,000 on any trading day. The 335,938 commitment shares were considered issued in February

2018 which was recorded as interest and financing costs at the then market close price of $0.09 per share for a value of $30,234.

The note holder (Labrys)

converted principal of $73,233 and accrued interest of $7,841 during the year ended September 30, 2018. The Company recognized

$15,000 of default charges (technical defaults under note terms) as an addition to the principal amount with a corresponding charge

to debt discount. Additionally, the Company increased debt premium by $8,077 with a charge to interest expense in conjunction with

the principal increase. The principal and accrued interest balance of $49,267 was assigned (under the original terms and conditions)

to GHS Investments LLC on July 13, 2018 and all principal and interest was converted into common stock by GHS at September 30,

2018.

On December 7,

2017, the Company received a payment of $79,000, net of an original issue discount of $5,800 and issue costs of $20,200 fees which

was recorded as a debt discount which is being amortized into interest expense over the Note term, under the terms of a Securities

Purchase Agreement dated November 21, 2017, with EMA Financial, LLC (“EMA Financial”) under which the Company issued

to EMA Financial a convertible note (the “Note”) in the principal amount of $105,000 that bears interest of 10% (24%

default rate) per annum. The Note has a maturity date of December 7, 2018 and has a conversion rate for any unpaid principal and

interest at a conversion price which is the lower of (i) the closing sales price of the Company’s common stock on the trading

day immediately preceding the date of funding and (ii) a 35% discount to (a) the lowest sales price of the shares of the Company’s

common stock within a 20 day trading period including and immediately preceding the conversion date or (b) the lowest bid price

on the conversion date, whichever is lower, and the conversion shares contain piggy-back registration rights. The conversion rate

is further reduced under certain events, including if the closing sales price is less than $0.095 in which case the conversion

rate is a 50% discount under the terms set forth above. No shares of the Company’s common stock can be issued to the extent

EMA Financial would own more than 4.99% of the outstanding shares of the Company’s common stock. The Company also is required

at all times to have authorized and reserved eight times the number of shares that is actually issuable upon full conversion or

adjustment of the Note (based on the conversion price of the Note in effect from time to time) and initially must instruct its

transfer agent to reserve 6,802,000 shares of common stock in the name of EMA Financial for issuance upon conversion. The Note

is subject to customary default provisions and also includes a cross-default provision as well as default being triggered if the

Company loses the “bid” price for its common stock ($0.0001 on the “ask” with zero market makers on the

“bid” per Level 2 and/or a market such as OTC Pink). The Company is entitled to prepay the Note between the issue

date until 180 days from its issuance at a premium of 135% of the unpaid principal and interest if paid within 90 days after the

issue date and 150% thereafter. In connection with the issuance of this Note, the Company determined that the terms of the Note

contain a conversion formula that caused variations in the conversion price resulting in the treatment of the conversion option

as a bifurcated derivative to be accounted for at fair value. Accordingly, under the provisions of FASB ASC Topic No. 815-40,

“Derivatives and Hedging – Contracts in an Entity’s Own Stock”, the embedded conversion option contained

in the convertible instruments were accounted for as derivative liabilities at the date of issuance and shall be adjusted to fair

value through earnings at each reporting date. The fair value of the embedded conversion option derivatives was determined using

the Binomial valuation model. At the end of each period, the Company revalued the embedded conversion option and warrants derivative

liabilities. In connection with this Note, on the initial measurement date of December 7, 2017, the fair values of the embedded

conversion option derivative of $149,028 was recorded as derivative liabilities, $70,028 was charged to current period operations

as initial derivative expense, and $79,000 was recorded as a debt discount and is being amortized into interest expense over the

term of this Note. At each reporting date during the year ended September 30, 2018, the Company revalued the embedded conversion

option derivative liability. At September 30, 2018 the Company has fully recorded derivative liability as part of the gain (loss)

in debt extinguishment in conjunction with the full conversion of the note into common stock.

A number of terms included

in the Securities Purchase Agreement and Note issued subsequently (see paragraph below) were more favorable than the terms granted

to EMA Financial under its Securities Purchase Agreement and the EMA Note. Accordingly, on December 31, 2017, EMA Financial notified

the Company that pursuant to the EMA Securities Purchase Agreement that the EMA Note was automatically amended by increasing (i)

the annual interest rate to 12% percent and (ii) the Original Issue Discount by $3,650.

EMA fully converted

all principal, default charges ($3,650) and accrued interest into common shares during 2018 and surrendered the note. The Company

recognized $273,864 of losses on debt extinguishment during July 2018 as a result of the fair market value of the shares issued

exceeded the recorded amount of the derivative liability discussed above.

On December 13, 2017,

the Company received a payment of $60,000, net of original issue discount fees of $7,500 and $15,000 of issue costs recorded as

debt discounts and amortized to interest expense over the Note term under the terms of a Securities Purchase Agreement dated December

8, 2017, with Morningview Financial, LLC (“Morningview Financial”) under which the Company issued to Morningview Financial

a convertible note (the “Note”) in the principal amount of $82,500 that bears interest of 12% (18% default rate) per

annum. The Note has a maturity date of 12 months and a conversion rate for any unpaid principal and interest and a conversion price

which is a 35% discount to the lowest sales price of the shares of the Company’s common stock within a 20-day trading period

including and immediately preceding the conversion date. The conversion rate is further reduced under certain events, including

if the closing sales price is less than $0.05 in which case the conversion rate is a 45% discount under the terms set forth above.

No shares of the Company’s common stock can be issued to the extent Morningview Financial would own more than 4.99% of the

outstanding shares of the Company’s common stock. The Company also is required at all times to have authorized and reserved

eight times the number of shares that is actually issuable upon full conversion or adjustment of the Note (based on the conversion

price of the Note in effect from time to time). The Note is subject to customary default provisions and also includes a cross-default

provision as well as default being triggered if the Company’s Trading Price as that term is defined in the Note is less than

$.0001 or if a money judgment, writ or similar process shall be entered or filed against the Company or any of its subsidiaries

for more than $50,000, and shall remain unvacated, unbonded or unstayed for a period of 20 days unless otherwise consented to by

the holder of the Note. Additionally, upon default and default notice by the lender, the amount immediately due shall be increased

to 150% or 200% of the outstanding principal and interest due depending upon the default provisions, plus default interest. The

Company is entitled to prepay the Note between the issue date until 180 days from its issuance at a premium of 135% of the unpaid

principal and interest. The Company has accounted for the convertible promissory note as stock settled debt under ASC 480 and recorded

a debt premium of $44,423 with a charge to interest expense. Mornningview Financial assessed charges of $20,625 under technical

default terms of the note during the month of June 2018. The Company increased principal and debt discount by $20,625 and recorded

additional premium of $11,106 in connection with the stock settled debt feature discussed above. As of September 30, 2018 Morningview

had converted all principal and accrued interest into common shares. Debt premium $55,529 was recorded as additional paid in capital

on a prorata basis at each conversion date.

On January 3, 2018,

the Company entered into a Securities Purchase Agreement with Power Up under which the Company received $42,000, net of $11,000

in fees and expenses which were recorded as a debt discount and amortized to interest expense over the Note term, in return for

issuing a convertible promissory note (the “Note”) in the principal amount of $53,000. Power Up received a right of

first refusal for the first nine months from the date of the Note to provide any debt or equity financing less than $150,000.

The Note bears interest at 10% per annum and has a maturity date of October 15, 2018. The Note may be prepaid at a premium ranging

from 112% to 137% depending on the length of time following the date of the Note. The Note is convertible after 180 days into

shares of the Company’s common stock at a discount of 35% of the average of the two lowest closing bid prices of the Company’s

common stock 15 days prior to the date of conversion and the maximum number of shares issued to Power Up may not exceed 4.99%

of the issued and outstanding shares of Bantek common stock. The Note is subject to customary default provisions, including a

cross default provision. The Company is required to have authorized for issuance six times the number of shares that would be

issuable upon full conversion of the Note (assuming that the 4.99% limitation is not in effect) and based on the applicable conversion

price of the Note in effect from time to time, initially to be 3,462,355 shares of common stock. The Company has accounted for

the convertible promissory note as stock settled debt under ASC 480 and recorded a debt premium of $28,538 with a charge to interest

expense. The principal balance and accrued interest were fully converted as of September 30, 2018. Debt premium $28,538 was recorded

as additional paid in capital on a prorata basis at each conversion date.

On January 9, 2018,

the Company received a payment of $84,000, net of $23,500 in fees and expenses which was recorded as a debt discount and amortized

to interest expense over the Note term under the terms of a Securities Purchase Agreement dated November 20, 2017, with Labrys

under which the Company issued to Labrys (i) a convertible note (the “Note”) in the principal amount of $107,500 that

bears interest of 10% per annum and (ii) 421,238 shares of the Company’s common stock as a commitment fee which was to be

returned to the Company in the event that it pays all unpaid principal and interest under the Note within 180 days of December

26, 2017. Pursuant to ASC 260, as of January 9, 2018, the 421,238 contingent shares issued under the Financial Consulting Agreement

are not considered outstanding and are not included in basic net loss per share or as potentially dilutive shares in calculating

the diluted EPS. The Note has a maturity date of nine months or September 26, 2018, and a conversion rate for any unpaid principal

and interest at a 35% discount to the market price which is defined as the average of the two lowest trading prices (defined as

the lower of the trading price or closing bid price) for the Company’s common stock during the fifteen trading day period