UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT

NO. 1 TO

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

DATA443

RISK MITIGATION, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

7372

|

|

86-0914051

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

101

J Morris Commons Lane, Suite 105

Morrisville,

NC 27560

(919)

858-6542

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive office)

Jason

Remillard

Chief

Executive Officer

101

J Morris Commons Lane, Suite 105

Morrisville,

NC 27560

(919)

858-6542

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Keith

A. Rosenbaum

23

Corporate Plaza, Suite 150

Newport

Beach, California 92660

(949)

851-4300

Approximate

date of commencement of proposed sale to the public: From time-to-time after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. [X]

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the

same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large

accelerated filer

|

[ ]

|

|

|

|

Accelerated

filer

|

[ ]

|

|

|

|

Non-accelerated

filer

|

[ ]

|

|

|

|

Smaller

reporting company

|

[X]

|

|

|

|

Emerging

growth company

|

[X]

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

[ ]

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Number of

Shares of

Common

Stock to be

Registered(1) (2)

|

|

|

Proposed

Maximum

Offering

Price Per

Share(3)

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration

Fee (4)

|

|

|

Common Stock, $0.001 par value per share, issuable upon purchase of Shares (as defined below)

|

|

|

166,666,667

|

|

|

$

|

0.0064

|

|

|

$

|

1,066,667

|

|

|

$

|

116.37

|

|

|

Common Stock, $0.001 par value per share, issuable upon exercise of Warrants (as defined below)

|

|

|

100,000,000

|

|

|

$

|

0.0064

|

|

|

$

|

640,000

|

|

|

$

|

69.82

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

|

|

|

266,666,667

|

|

|

$

|

0.0064

|

|

|

$

|

1,706,667

|

|

|

$

|

186.19

|

(5)

|

|

(1)

|

All

shares registered pursuant to this registration statement are to be offered by the Selling Security Holder. Pursuant to Rule 416(a)

under the Securities Act of 1933, as amended (the “Securities Act”), the securities being registered hereunder

include such indeterminate number of additional securities as may be issuable to prevent dilution resulting from stock splits,

stock dividends or similar transactions.

|

|

|

|

|

(2)

|

Represents

shares of the registrant’s Common Stock issuable upon purchase shares of Common Stock. Such shares will be issued

to the Selling Security Holder named in this registration statement upon purchase.

|

|

|

|

|

(3)

|

Estimated

in accordance with Rule 457(c) under the Securities Act solely for the purpose of calculating the registration fee based upon

the average of the high and low prices of the Registrant’s common stock on the OTC Pink Market on December 22,

2020, which date is within five business days of the filing of this registration statement. The shares offered hereunder may

be sold by the Selling Security Holder from time to time in the open market, through privately negotiated transactions, or

a combination of these methods at market prices prevailing at the time of sale or at negotiated prices.

|

|

|

|

|

(4)

|

The

fee is calculated by multiplying the aggregate offering amount by 0.000109100, pursuant to Section 6(b) of the Securities

Act.

|

|

|

|

|

(5)

|

Previously paid.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED

JANUARY 21, 2021

|

The

information in this preliminary Prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary Prospectus is not an offer to sell

these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or

sale is not permitted.

DATA443

RISK MITIGATION, INC.

266,666,667

Shares of Common Stock

This

prospectus relates to the offer and resale of up to: (i) 166,666,667 shares of our common stock, par value $0.001 per share (the

“Common Stock”) that may be purchased (the “Purchase Shares”) by Triton Funds, LP, a Delaware

limited partnership (“Triton”), pursuant to the Common Stock Purchase Agreement dated December 11, 2020 between

the Company and Triton (the “CSPA”); and, (ii) 100,000,000 shares of Common Stock to be issued (the “Warrant

Shares”) to Triton upon the exercise of warrants pursuant to that certain Common Stock Purchase Warrant dated December

11, 2020 (the “Warrant Agreement”). Triton is also referred to herein as the “Selling Security Holder”.

We

will not receive any proceeds from the sale of the shares of Common Stock by Triton. However, we will receive proceeds from our

sale of shares to Triton pursuant to the CSPA and the Warrant Agreement. We will sell shares to Triton under CSPA, subject to

the conditions listed therein, at a price equal to $0.006 per share. We will issue shares to Triton under the Warrant Agreement

at a price equal to $0.01 per share.

The

Selling Security Holder identified in this prospectus may offer the shares of Common Stock from time-to-time through public or

private transactions at prevailing market prices or at privately negotiated prices. The Selling Security Holder can offer all,

some or none of its shares of Common Stock, thus we have no way of determining the number of shares of Common Stock it will hold

after this offering. See “Plan of Distribution”.

The

Selling Security Holder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act. Any broker-dealers

or agents that are involved in selling the shares of Common Stock may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents

and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the

Securities Act.

Triton,

as the Selling Security Holder, may offer an indeterminate number of shares of the Company’s Common Stock, which will consist

of up to $2,000,000 of shares of Common Stock held by the Selling Security Holder pursuant to the CSPA and the Warrant Agreement.

If issued presently, the 266,666,667 shares of Common Stock registered for resale by Triton would represent 26.26% of our

issued and outstanding shares of common stock, as of Janaury 20, 2021.

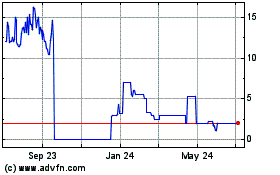

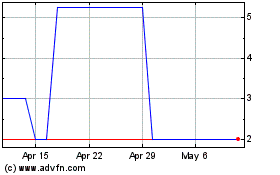

Our common stock is quoted

on the OTC Link LLC quotation system operated by OTC Markets, Group, Inc., under the symbol “ATDS” on the Pink Sheets

tier. On January 20, 2021, the reported closing price of our Common Stock was $0.0148 per share.

We

are an “emerging growth company,” as defined in Section 2(a) of the Securities Act, and, as such, have elected to

comply with certain reduced public disclosure requirements for this Prospectus and future filings. This Prospectus complies with

the requirements that apply to an issuer that is an emerging growth company. See “Prospectus Summary—Implications

of Being an Emerging Growth Company”.

Investing

in our Common Stock involves a high degree of risk. This offering is highly speculative and these securities involve a high

degree of risk and should be considered only by persons who can afford the loss of their entire investment. You should review

carefully the risks and uncertainties described under the heading “Risk Factors” beginning

on page 10 of this Prospectus, and under similar headings in any amendments or supplements to this Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus is January __, 2021

TABLE

OF CONTENTS

In

this Prospectus, “we”; “us”; “our”; the “Company”; the “company”;

and, “ATDS” refer to DATA443 RISK MITIGATION, INC., a Nevada corporation, and where appropriate, its subsidiaries,

unless expressly indicated or the content requires otherwise.

ABOUT

THIS PROSPECTUS

The

registration statement of which this Prospectus forms a part that we have filed with the Securities and Exchange Commission,

or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this

prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading

“Where You Can Find More Information” before making your investment decision.

You

should rely only on the information provided in this prospectus or in any prospectus supplement or any free writing prospectuses

or amendments thereto. Neither we, nor the Selling Security Holder, have authorized anyone else to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that

the information in this prospectus is accurate only as of the date hereof. Our business, financial condition, results of operations

and prospects may have changed since that date.

Neither

we, nor the Selling Security Holder, are offering to sell or seeking offers to purchase these securities in any jurisdiction where

the offer or sale is not permitted. Neither we, nor the Selling Security Holder, have done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about,

and observe any restrictions relating to, the offering of the securities as to distribution of the prospectus outside of the United

States.

Information

contained in, and that can be accessed through, our web site, www.data443.com, does not constitute part of this

Prospectus.

This

Prospectus includes market and industry data that has been obtained from third party sources, including industry publications,

as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which

we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s

knowledge of such industries has been developed through its experience and participation in these industries. While our management

believes the third-party sources referred to in this prospectus are reliable, neither we nor our management have independently

verified any of the data from such sources referred to in this prospectus or ascertained the underlying economic assumptions relied

upon by such sources. Internally prepared and third-party market forecasts in particular are estimates only and may be inaccurate,

especially over long periods of time. In addition, the underwriters have not independently verified any of the industry data prepared

by management or ascertained the underlying estimates and assumptions relied upon by management. Furthermore, references in this

prospectus to any publications, reports, surveys, or articles prepared by third parties should not be construed as depicting the

complete findings of the entire publication, report, survey, or article. The information in any such publication, report, survey,

or article is not incorporated by reference in this prospectus.

INFORMATION

SUMMARY

This

summary highlights information about this offering and the information included in this Prospectus. This summary does not contain

all of the information that you should consider before investing in our securities. You should carefully read this entire Prospectus,

especially the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and our consolidated financial statements included herein, including the notes thereto, before

making an investment decision.

Company

Organization

Data443

Risk Mitigation, Inc. was original incorporated under the name LandStar, Inc. as a Nevada corporation on May 4, 1998, for the

purpose of purchasing, developing, and reselling real property, with its principal focus on the development of raw land. From

incorporation through December 31, 1998, LandStar had no business operations and was a development-stage company. LandStar did

not purchase or develop any properties and decided to change its business plan and operations. On March 31, 1999, the Company

acquired approximately 98.5% of the common stock of Rebound Rubber Corp. pursuant to a share exchange agreement with Rebound Rubber

Corp. (“Rebound Rubber”) and substantially all of Rebound Rubber’s shareholders. The acquisition was

effected by issuing 14,500,100 shares of common stock, which constituted 14.5% of the 100,000,000 authorized shares of LandStar,

and 50.6% of the 28,622,100 issued and outstanding shares on completion of the acquisition (all numbers are pre-reverse split).

The acquisition was treated for accounting purposes as a continuation of Rebound Rubber under the LandStar capital structure.

If viewed from a non-consolidated perspective, on March 31, 1999 LandStar issued 14,500,100 shares for the acquisition of the

outstanding shares of Rebound Rubber.

The

share exchange with Rebound Rubber (and other transactions occurring in March 1999) resulted in a change of control of LandStar

and the appointment of new officers and directors of the Company. These transactions also redefined the focus of the Company on

the development and exploitation of the technology to de-vulcanize and reactivate recycled rubber for resale as a raw material

in the production of new rubber products. The Company’s business strategy was to sell the de-vulcanized material (and compounds

using the materials) to manufacturers of rubber products.

Prior

to 2001 the Company had no revenues. In 2001 and 2002 revenues were derived from management services rendered to a rubber recycling

company.

In

August 2001 the Company amended its Articles of Incorporation to authorize 500,000,000 shares of common stock, $0.001 par value;

and, 150,000,000 shares of preferred stock, $0.01 par value. Preferred shares could be designated into specific classes and issued

by action of the Company’s Board of Directors. In May 2008 the Company’s Board established a class of Convertible

Preferred Series A (the “Series A”), authorizing 10,000,000 shares. The Series A provided for, among other

things, (i) each share of Series A was convertible into 1,000 shares of the Company’s common stock; and, (ii) a holder of

Series A was entitled to vote 1,000 shares of common stock for each share of Series A on all matters submitted to a vote by shareholders.

In

September 2008 the Company amended its Articles to increase the number of authorized shares to 985,000,000, $0.001 par value.

In January 2009 the Company amended its Articles to increase the number of authorized shares to 4,000,000,000, $0.001 par value.

In January 2010 the Company once again amended its Articles to increase the number of authorized shares to 8,888,000,000, $0.001

par value.

The

Company’s last filing of financial information with the SEC was the Form 10-QSB it filed on December 19, 2002 for the quarter

ended 30 September 2002. No other filings were effected with the SEC until the Company filed a Form 15 May 19, 2008, which terminated

the Company’s filing obligations with SEC.

The

Company was effectively dormant for a number of years. In or around February 2014 there was a change in control when Kevin Hayes

acquired 1,000,000 shares of the Series A (pre-reverse split), and was appointed as the sole director and officer. In or around

April 2017 there was another change in control when Kevin Hayes sold the 1,000,000 shares of Series A to Hybrid Titan Management,

which then proceeded to assign the Series A to William Alessi. Mr. Alessi was then appointed as the sole director and officer

of the Company. Mr. Alessi initiated legal action in his home state of North Carolina to confirm, among other things, his ownership

of the Series A; his “control” over the Company; and, the status of creditors of the Company. In or around June 2017

the court entered judgment in favor of Mr. Alessi.

In

or around July 2017, while under the majority ownership and management of Mr. Alessi, the Company sought to effect a merger transaction

(the “Merger”) under which the Company would be merged into Data443 Risk Mitigation, Inc. (“Data443”).

Data443 was formed as a North Carolina corporation in July 2017 under the original name LandStar, Inc. The name of the North Carolina

corporation was changed to Data443 in December 2017. In November 2017 the controlling interest in the Company was acquired by

our current chief executive officer and sole board member, Jason Remillard, when he acquired all of the Series A shares from Mr.

Alessi. In that same transaction Mr. Remillard also acquired all of the shares of Data443 from Mr. Alessi. Mr. Remillard was then

appointed as the sole director and sole officer of the Company, and of Data443. Initially, Mr. Remillard sought to recognize the

Merger initiated by Mr. Alessi and respect the results of the Merger. The Company relied upon documents previously prepared and

proceeded as if the Merger had been effected.

In

January 2018 the Company acquired substantially all of the assets of Myriad Software Productions, LLC, which is owned 100% by

Mr. Remillard. Those assets were comprised of the software program known as ClassiDocs, and all intellectual property and goodwill

associated therewith. This acquisition changed the Company’s status to no longer being a “shell” under applicable

securities rules. In consideration for the acquisition, the Company agreed to a purchase price of $1,500,000 comprised of (i)

$50,000 paid at closing; (ii) $250,000 in the form of our promissory note; and, (iii) $1,200,000 in shares of our common stock,

valued as of the closing, which equated to 1,200,000,000 shares of our common stock (pre-reverse split). The shares have not yet

been issued and are not included as part of the issued and outstanding shares of the Company. However, these shares have been

recorded as additional paid in capital within our consolidated financial statements for the period ending 30 June 2018.

In

April 2018 the Company amended the designation for its Series A Preferred Stock by providing that a holder of Series A was entitled

to (i) vote 15,000 shares of common stock for each share of Series A on all matters submitted to a vote by shareholders; and,

(ii) convert each share of Series A into 1,000 shares of our common stock.

In

May 2018 the Company amended and restated its Articles of Incorporation. The total authorized number of shares is: 8,888,000,000

shares of common stock, $0.001 par value; and, 50,000,000 shares of preferred stock, $0.001 par value, designated in the discretion

of the Board of Directors. The Series A remains in full force and effect.

In

June 2018, after careful analysis and in reliance upon professional advisors retained by the Company, it was determined that the

Merger had, in fact, not been completed, and that the Merger was not in the best interests of the Company and its shareholders.

As such, the Merger was legally terminated. In place of the Merger, in June 2018 the Company acquired all of the issued and outstanding

shares of stock of Data443 (the “Share Exchange”). As a result of the Share Exchange, Data443 became a wholly-owned

subsidiary of the Company, with both the Company and Data443 continuing to exist as corporate entities. The finances and business

conducted by the respective entities prior to the Share Exchange will be treated as related party transactions in anticipation

of the Share Exchange. As consideration in the Share Exchange, we agreed to issue to Mr. Remillard: (a) One hundred million (100,000,000)

shares of our common stock; and (b) On the eighteen (18) month anniversary of the closing of the Share Exchange (the “Earn

Out Date”), an additional 100,000,000 shares of our common stock (the “Earn Out Shares”) provided

that Data 443 has at least an additional $1MM in revenue by the Earn Out Date (not including revenue directly from acquisitions).

The aforementioned shares are all pre-reverse split. None of our shares of our common stock to be issued to Mr. Remillard under

the Share Exchange have been issued. As such, none of said shares are included as part of the issued and outstanding shares of

the Company. However, the shares committed to Mr. Remillard have been recorded as common shares issuable and included in additional

paid-in capital and the earn out shares have been reflected as a contingent liability for common stock issuable within the consolidated

financial statements as of December 31, 2019.

On

or about June 28, 2018 we secured the rights to the WordPress GDPR Framework through our wholly owned subsidiary Data443 for a

total consideration of €40,001, or $46,521, payable in four payments of €10,000, with the first payment due at closing,

and the remaining payments issuable at the end of July, August and September, 2018. All of the payments were made and upon issuance

of the final payment, we have the right to enter into an asset transfer agreement for the nominal cost of one euro (€1).

On

or about October 22, 2018 we entered into an asset purchase agreement with Modevity, LLC (“Modevity”) to acquire certain

assets collectively known as ARALOC™, a software-as-a service (“SaaS”) platform that provides cloud-based data

storage, protection, and workflow automation. The acquired assets consist of intellectual and related intangible property including

applications and associated software code, and trademarks. While the Company did not acquire any of the customers or customer

contracts of Modevity, the Company did acquire access to books and records related to the customers and revenues Modevity created

on the ARALOC™ platform as part of the asset purchase agreement. These assets were substantially less than the total assets

of Modevity, and revenues from the platform comprised a portion of the overall sales of Modevity. We are required to create the

technical capabilities to support the ongoing operation of this SaaS platform. A substantial effort on the part of the Company

is needed to continue generating ARALOC™ revenues through development of a sales force, as well as billing and collection

processes. We paid Modevity (i) $200,000 in cash; (ii) $750,000, in the form of our 10-month promissory note; and, (iii) 164,533,821

shares of our common stock. In July 2020 the Company completed all payments due to Modevity under the asset purchase agreement.

On

February 7, 2019, we entered into an Exclusive License and Management Agreement (the “License Agreement”) with

WALA, INC., which conducts business under the name ArcMail Technology (“ArcMail”). Under the License Agreement,

we were granted the exclusive right and license to receive all benefits from the marketing, selling and licensing, of the ArcMail

business products, including, without limitation, the goodwill of the business. The term of the License Agreement is twenty-seven

(27) months, with the following payments to be made by the Company to ArcMail: (i) $200,000 upon signing the License Agreement;

(ii) monthly payments starting 30 days after the execution of the License Agreement in the amount of $25,000 per month during

months one through six; (iii) monthly payments in the amount of $30,000 per month during months seven through 17; and (iv) in

month 18, final payment in the amount of $765,000. In connection with the execution of the License Agreement, two other agreements

were also executed: (a) a Stock Purchase Rights Agreement, under which the Company has the right, though not the obligation, to

acquire 100% of the issued and outstanding shares of stock of ArcMail from Rory Welch, the CEO of ArcMail (the right can be exercised

over a period of 27 months); and (b) a Business Covenants Agreement, under which ArcMail and Mr. Welch agreed to not compete with

the Company’s use of the ArcMail business under the License for a period of twenty-four (24) months. Mr. Welch shall continue

to serve as ArcMail’s CEO. The Company has not purchased any outstanding shares under the Stock Purchase Rights Agreement.

On

June 21, 2019, the Company filed an amendment to its articles of incorporation to increase the total number authorized shares

of the Company’s common stock, par value $0.001 per share, from 8,888,000,000 shares to 15,000,000,000 shares.

On

June 26, 2019 we furnished notice to the holders of record of our outstanding shares of (i) common stock, $0.001 par value per

share and (ii) Convertible Preferred Series A Stock, $0.001 par value per share (“Series A Preferred Stock”),

that as of June 24, 2019 (the “Record Date”) and on that date, in accordance with Section 78.320 of the Nevada

Revised Statutes (the “NRS”), a stockholder of the Company holding a majority of the voting power of the Company

as of the Record Date (the “Consenting Stockholder”) approved the following corporate actions:

(1)

Amendment of our articles of incorporation (“Articles of Incorporation”) to provide for a decrease in the authorized

shares of the Company’s common stock, $0.001 par value per share, from 15,000,000,000 shares to 60,000,000 shares (the “Authorized

Common Stock Reduction”);

(2)

Amendment of our Articles of Incorporation to provide for a decrease in the authorized shares of the Company’s preferred

stock, $0.001 par value per share, from 50,000,000 shares to 337,500 shares (the “Authorized Preferred Stock Reduction”);

(3)

That the Board of Directors of the Company (the “Board of Directors”) be authorized to implement a reverse

stock split of the Company’s common stock, $0.001 par value per share, and preferred stock, $0.001 par value per share,

each at a ratio of 1:750 (the “Reverse Stock Split”);

(4)

Adoption of the LandStar, Inc. 2019 Omnibus Stock Incentive Plan (the “2019 Plan”); and

(5)

Amendment of our Articles of Incorporation to change our corporate name from “LandStar, Inc.” to “Data443 Risk

Mitigation, Inc.” (the “Name Change”).

On

September 16, 2019, the Company entered into an Asset Purchase Agreement with DMBGroup, LLC to acquire certain assets collectively

known as DataExpress®, a software platform for secure sensitive data transfer within the hybrid cloud. The total

purchase price of approximately $2.8 million consists of: (i) a $410,000 cash payment at closing; (ii) a promissory note in the

amount of $940,000, payable in the amount of $41,661 over 24 monthly payments starting on October 15, 2019, accruing at a rate

of 6% per annum; (iii) assumption of approximately $98,000 in liabilities and, (iv) approximately 2,465,753 shares of our common

stock. As of September 30, 2019, these shares have not been issued and are recorded as “Stock issuable for asset purchase”

included in additional paid in capital.

On

October 14, 2019, the Company filed an amendment to its Articles of Incorporation to change its name to Data443 Risk Mitigation,

Inc., and to effect a 1-for-750 reverse stock split of its issued and outstanding shares of common and preferred shares, each

with $0.001 par value, and to reduce the numbers of authorized common and preferred shares to 60,000,000 and 337,500, respectively.

On October 28, 2019, the name change and the split and changes in authorized common and preferred shares was effected, resulting

in approximately 7,282,678,714 issued and outstanding shares of the Company’s common stock to be reduced to approximately

9,710,239, and 1,000,000 issued and outstanding shares of the Company’s preferred shares to be reduced to 1,334 as of October

28, 2019. All per share amounts and number of shares, including the authorized shares, in the consolidated financial statements

and related notes have been retroactively adjusted to reflect the reverse stock split and decrease in authorized common and preferred

shares.

On

March 05, 2020 the Company amended its Articles of Incorporation to increase the number of shares of authorized common stock to

250,000,000. On April 15, 2020 the Company further amended its Articles of Incorporation to increase the number of shares of authorized

common stock to 750,000,000. On August 17, 2020 the Company again amended its Articles of Incorporation to increase the number

of shares of authorized common stock to 1.5 billion. On November 25, 2020 the Company filed a Certificate of Designation to authorize

and create its Series B Preferred shares, consisting of 80,000 shares. On December 15, 2020 the Company again amended its Articles

of Incorporation to increase the number of shares of authorized common stock to 1.8 billion.

Business

Overview

We

are in the data security and privacy business, operating today as a software and services provider. The Company is the de facto

industry leader in data privacy solutions for All Things Data Security™, providing software and services to enable

secure data across local devices, network, cloud, and databases, at rest and in flight. Its suite of products and services is

highlighted by: (i) ARALOC™, which is a market leading secure, cloud-based platform for the management, protection

and distribution of digital content to the desktop and mobile devices, which protects an organization’s confidential content

and intellectual property assets from leakage — malicious or accidental — without impacting collaboration between

all stakeholders; (ii) DATAEXPRESS®, the leading data transport, transformation and delivery product trusted by

leading financial organizations worldwide; (iii) ArcMail™, which is a leading provider of simple, secure and

cost-effective email and enterprise archiving and management solutions; (iv) ClassiDocs® the Company’s award-winning

data classification and governance technology, which supports CCPA, LGPD, and GDPR compliance; (v) ClassiDocs™

for Blockchain, which provides an active implementation for the Ripple XRP that protects blockchain transactions from inadvertent

disclosure and data leaks; (vi) Data443® Global Privacy Manager, the privacy compliance and consumer loss mitigation

platform which is integrated with ClassiDocs™ to do the delivery portions of GDPR and CCPA as well as process

Data Privacy Access Requests – removal request – with inventory by ClassiDocs™; (vii) Resilient Access™,

which enables fine-grained access controls across myriad platforms at scale for internal client systems and commercial public

cloud platforms like Salesforce, Box.Net, Google G Suite, Microsoft OneDrive and others; (viii) Data443™ Chat

History Scanner, which scans chat messages for Compliance, Security, PII, PI, PCI & custom keywords; (ix) the CCPA Framework

WordPress plugin, which enables organizations of all sizes to comply with the CCPA privacy framework; (x) FileFacets™, a

Software-as-a-Service (SaaS) platform that performs sophisticated data discovery and content search of structured and unstructured

data within corporate networks, servers, content management systems, email, desktops and laptops; (xi) the GDPR Framework WordPress

plugin, with over 30,000 active users and over 400,000 downloads it enables organizations of all sizes to comply with the GDPR

and other privacy frameworks; and (xii) IntellyWP™, a leading purveyor of user experience enhancement products

for webmasters for the world’s largest content management platform, WordPress.

Data

security and privacy legislation is driving significant investment by organizations to offset risks from data breaches and damaging

information disclosures of various types. We provide solutions for the marketplace that are designed to protect data via the cloud,

hybrid, and on-premises architectures. Our suite of security products focus on protection of: sensitive files and emails; confidential

customer, patient, and employee data; financial records; strategic and product plans; intellectual property; and any other data

requiring security, allowing our clients to create, share, and protect their data wherever it is stored.

We

deliver solutions and capabilities via all technical architectures, and in formats designed for each client. Licensing and subscription

models are available to conform to customer purchasing requirements. Our solutions are driven by several proprietary technologies

and methodologies that we have developed or acquired, giving us our primary competitive advantage.

We

sell substantially all of our products and services directly to end-users, though some sales may also be effected through channel

partners, including distributors and resellers which sell to end-user customers. We believe that our sales model, which combines

the leverage of a channel sales model with our own highly trained and professional sales force, will play a significant role in

our ability to grow and to successfully deliver our value proposition for data security. While our products serve customers of

all sizes in all industries, the marketing focus and majority of our sales focus is on targeting organizations with 100 users

or more who can make larger purchases with us over time and have a greater potential lifetime value.

Risk

Factors

An

investment in our securities involves a high degree of risk. You should carefully consider the risks summarized below. These risks

are discussed more fully in the section titled “Risk Factors.” These risks include, but are not limited to,

the following:

|

|

●

|

We

will need additional capital to fund our operations;

|

|

|

|

|

|

|

●

|

There

is substantial doubt about our ability to continue as a going concern;

|

|

|

|

|

|

|

●

|

We

will face intense competition in our market, and we may lack sufficient financial and other resources to maintain and improve

our competitive position;

|

|

|

|

|

|

|

●

|

We

are dependent on the continued services and performance of our chief executive officer, Jason Remillard;

|

|

|

|

|

|

|

●

|

Our

common stock is currently quoted on the OTC Pink and is thinly-traded, reducing your ability to liquidate your investment

in us;

|

|

|

|

|

|

|

●

|

We

have had a history of losses and may incur future losses, which may prevent us from attaining profitability;

|

|

|

|

|

|

|

●

|

The

market price of our common stock may be volatile and may fluctuate in a way that is disproportionate to our operating performance;

|

|

|

|

|

|

|

●

|

We

have shares of preferred stock that have special rights that could limit our ability to undertake corporate transactions,

inhibit potential changes of control and reduce the proceeds available to our common stockholders in the event of a change

in control;

|

|

|

|

|

|

|

●

|

We

have never paid and do not intend to pay cash dividends;

|

|

|

|

|

|

|

●

|

Our

sole director and chief executive officer has the ability to control all matters submitted to stockholders for approval, which

limits minority stockholders’ ability to influence corporate affairs; and

|

|

|

|

|

|

|

●

|

The

other factors described in “Risk Factors.”

|

Corporate

Information

Our

principal executive offices are located at 101 J Morris Commons Lane, Suite 105, Morrisville, North Carolina 27560, and our telephone

number is (919) 858-6542.

Implications

of Being an Emerging Growth Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the “JOBS

Act.” An emerging growth company may take advantage of certain reduced disclosure and other requirements that are otherwise

generally applicable to public companies. As a result, the information that we provide to stockholders may be different than the

information you may receive from other public companies in which you hold equity. For example, so long as we are an emerging growth

company:

|

|

●

|

we

are not required to engage an auditor to report on our internal control over financial reporting pursuant to Section 404(b)

of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act;

|

|

|

|

|

|

|

●

|

we

are not required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or the

PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information

about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

|

|

|

|

●

|

we

are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,”

“say-on-frequency” and “say-on-golden parachutes”; and

|

|

|

|

|

|

|

●

|

we

are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement

to disclose the correlation between executive compensation and performance and the requirement to present a comparison of

our Chief Executive Officer’s compensation to our median employee compensation.

|

We

may take advantage of these reduced disclosure and other requirements until the last day of our fiscal year following the fifth

anniversary of the completion of our IPO, or such earlier time that we are no longer an emerging growth company. For example,

if certain events occur before the end of such five-year period, including if we have more than $1.07 billion in annual revenue,

have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1.0 billion of non-convertible

debt over a three-year period, we will cease to be an emerging growth company.

As

mentioned above, the JOBS Act permits us, as an emerging growth company, to take advantage of an extended transition period to

comply with new or revised accounting standards applicable to public companies. We have elected not to opt out of the extended

transition period which means that when an accounting standard is issued or revised, and it has different application dates for

public or private companies, as an emerging growth company, we can adopt the new or revised standard at the time private companies

adopt the new or revised standard. This may make it difficult or impossible because of the potential differences in accounting

standards used to compare our financial statements with the financial statements of a public company that is not an emerging growth

company, or the financial statements of an emerging growth company that has opted out of using the extended transition period.

OFFERING

SUMMARY

|

Shares

of Common Stock currently outstanding

|

|

1,015,299,215 shares

|

|

|

|

|

|

Shares

of Common Stock being offered

|

|

266,666,667

shares of Common Stock issuable to Triton under the terms of the CSPA and the Warrant Agreement.

|

|

|

|

|

|

Common

stock to be outstanding immediately after this offering1

|

|

1,281,965,882

shares

|

|

|

|

|

|

Offering

price per share

|

|

The

Selling Security Holder may sell all or a portion of the shares being offered pursuant to this Prospectus at fixed prices

and prevailing market prices at the time of sale, at varying prices or at negotiated prices.

|

|

|

|

|

|

Use

of proceeds

|

|

We

will not receive any proceeds from the sale of the Common Stock offered by the Selling Security Holder. However, we will receive

proceeds from initial sale of shares to Triton, pursuant to the CSPA and the Warrant Agreement. The proceeds from the sale

of shares will be used for general corporate and working capital purposes, repayment of debt, and potential acquisitions.

|

|

|

|

|

|

Risk

factors

|

|

Investing

in our common stock involves a high degree of risk, and the purchasers of our Common Stock may lose all or part of their investment.

Before deciding to invest in our securities, please carefully read the section entitled “Risk Factors”

beginning on page 10 and the other information in this Prospectus.

|

|

|

|

|

|

Trading

Symbol

|

|

Our

Common Stock is quoted on the OTC Pink under the symbol “ATDS.”

|

1

The number of shares of our common stock outstanding prior to and to be outstanding immediately after this offering, as

set forth in the table above, is based on 1,015,299,215 shares outstanding as of January 21,2021, and excluding

the 266,666,667 shares of Common Stock issuable in this offering.

FINANCIAL

SUMMARY

The

following table presents a summary of certain of our historical financial information. Historical results are not necessarily

indicative of future results and you should read the following summary financial data in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes

included elsewhere in this Prospectus. The summary financial data as of December 31, 2019 and December 31, 2018, and for the fiscal

years ended December 31, 2019 and 2018 was derived from our audited financial statements included elsewhere in this Prospectus.

The summary financial data as of September 30, 2020 and for the nine months ended September 30, 2020 and 2019, was derived from

our unaudited interim financial statements included elsewhere in this Prospectus. The summary financial data in this section is

not intended to replace the financial statements and is qualified in its entirety by the financial statements and related notes

included elsewhere in this Prospectus.

|

|

|

Nine Months Ended September

30,

|

|

|

Fiscal Year Ended December

31,

|

|

|

Statement of Operations Data:

|

|

2020

|

|

|

2019

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

1,644,087

|

|

|

$

|

1,129,785

|

|

|

$

|

1,453,413

|

|

|

$

|

28,722

|

|

|

Cost of goods sold

|

|

|

161,749

|

|

|

|

86,982

|

|

|

|

117,106

|

|

|

|

-

|

|

|

Total operating expenses

|

|

|

4,100,856

|

|

|

|

3,665,785

|

|

|

|

5,270,386

|

|

|

|

(2,230,025

|

)

|

|

Total other (expenses) income

|

|

|

(11,635,817

|

)

|

|

|

6,650,312

|

|

|

|

3,326,708

|

|

|

|

(12,861,308

|

)

|

|

Net Income (Loss)

|

|

$

|

(14,254,335

|

)

|

|

$

|

4,027,330

|

|

|

$

|

(607,.71

|

)

|

|

$

|

(15,091,333

|

)

|

|

Net Income (Loss) per Common Share, Basic

|

|

$

|

(0.09

|

)

|

|

$

|

0.45

|

|

|

$

|

(0.07

|

)

|

|

$

|

(2.59

|

)

|

|

Net Income (Loss) per Common Share, Diluted

|

|

$

|

(0.09

|

)

|

|

$

|

0.42

|

|

|

$

|

(0.07

|

)

|

|

$

|

(2.59

|

)

|

|

Weighted Average Number of Shares Outstanding, Basic

|

|

|

156,095,522

|

|

|

|

8,853,850

|

|

|

|

9,198,761

|

|

|

|

5,816,217

|

|

|

Weighted Average Number of Shares Outstanding, Diluted

|

|

|

156,095,522

|

|

|

|

9,607,448

|

|

|

|

9,198,761

|

|

|

|

5,816,217

|

|

|

|

|

As of

|

|

|

Balance Sheet Data:

|

|

September 30,

2020

|

|

|

December 31,

2019

|

|

|

December 31,

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

482,715

|

|

|

$

|

18,673

|

|

|

$

|

324,935

|

|

|

Working Capital Deficiency

|

|

|

(9,087,554

|

)

|

|

|

(9,403,571

|

)

|

|

|

(13,937,457

|

)

|

|

Total Assets

|

|

|

3,409,868

|

|

|

|

3,749,734

|

|

|

|

2,114,768

|

|

|

Total Liabilities

|

|

|

10,615,562

|

|

|

|

10,146,185

|

|

|

|

14,422,142

|

|

|

Additional Paid-In Capital

|

|

|

28,051,429

|

|

|

|

15,204,771

|

|

|

|

8,689,353

|

|

|

Accumulated Deficit

|

|

|

(35,865,250

|

)

|

|

|

(21,610,915

|

)

|

|

|

(21,003,544

|

)

|

|

Total Stockholders’ Deficit

|

|

$

|

(7,205,694

|

)

|

|

$

|

(6,396,451

|

)

|

|

$

|

(12,307,374

|

)

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. In addition to the other information contained in this Prospectus,

prospective investors should carefully consider the following risks before investing in our securities. If any of the following

risks actually occur, as well as other risks not currently known to us or that we currently consider immaterial, our business,

operating results and financial condition could be materially adversely affected. As a result, the trading price of our common

stock could decline, and you may lose all or part of your investment in our common stock.

Special

Information Regarding Forward-Looking Statements

Some

of the statements in this Prospectus are “forward-looking statements”. These forward-looking statements involve certain

known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

These factors include, among others, the factors set forth herein under “Risk Factors.” The words “believe,”

“expect,” “anticipate,” “intend,” “plan,” and similar expressions identify forward-looking

statements. We caution you not to place undue reliance on these forward-looking statements. We undertake no obligation to update

and revise any forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements

in this document to reflect any future or developments.

Risks

Related to Our Business and Industry

We

will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will

cause our business to fail.

We

will need to raise additional funds through public or private debt or equity sales in order to fund our future operations and

fulfill contractual obligations in the future. These financings may not be available when needed. Even if these financings are

available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of

book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse

effect on our ability to implement our current business plan and develop our products, and as a result, could require us to diminish

or suspend our operations and possibly cease our existence.

Even

if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand

our operations. If we do not raise the additional capital, the value of any investment in us may become worthless. In the event

we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing

our business plan.

Technology

is constantly undergoing significant changes and evolutions and it is imperative that we keep up with an ever changing technological

landscape in order to ensure the continued viability of our products and services.

Our

industry is categorized by rapid technological progression, ever increasing innovation, changes in customer requirements, legal

and regulatory compliance mandates, and frequent new product introductions. As a result, we must continually change and improve

our products in response to such changes, and our products must also successfully interface with products from other vendors,

which are also subject to constant change. While we believe we have the competency to aid our clients in all aspects of data security,

we will need to constantly work on improving our current assets in order to keep up with technological advances that will almost

certainly occur.

We

cannot guarantee that we will be able to anticipate future market needs and opportunities or be able to develop new products or

expand the functionality of our current products in a timely manner or at all. Even if we are able to anticipate, develop and

introduce new products and expand the functionality of our current products, there can be no assurance that enhancements or new

products will achieve widespread market acceptance. Should we fail to do so, our business may be adversely affected and in the

worst possible scenario, we may have to cease operations altogether if we do not adapt to the constant changes that occur in the

way business is conducted.

We

intend to acquire or invest in companies, which may divert our management’s attention and result in additional dilution

to our stockholders. We may be unable to integrate acquired businesses and technologies successfully or achieve the expected benefits

of such acquisitions.

Our

success will depend, in part, on our ability to expand our solutions and services and grow our business in response to changing

technologies, customer demands and competitive pressures. It is our express plan to do so through the acquisition of, or investment

in, new or complementary businesses and technologies rather than through internal development. The identification of suitable

acquisition or investment candidates can be difficult, time-consuming, and costly, and we may not be able to successfully complete

identified acquisitions or investments. The risks we face in connection with acquisitions and/or investments include:

|

|

●

|

an

acquisition may negatively affect our operating results because it may require us to incur charges or assume substantial debt

or other liabilities, may cause adverse tax consequences or unfavorable accounting treatment, may expose us to claims and

disputes by stockholders and third parties, including intellectual property claims and disputes, or may not generate sufficient

financial return to offset additional costs and expenses related to the acquisition;

|

|

|

●

|

we

may encounter difficulties or unforeseen expenditures in integrating the business, technologies, products, personnel or operations

of any company that we acquire;

|

|

|

●

|

an

acquisition or investment may disrupt our ongoing business, divert resources, increase our expenses, and distract our management;

|

|

|

●

|

an

acquisition may result in a delay or reduction of customer purchases for both us and the company acquired due to customer

uncertainty about continuity and effectiveness of service from either company;

|

|

|

●

|

we

may encounter difficulties in, or may be unable to, successfully sell any acquired products or effectively integrate them

into or with our existing solutions;

|

|

|

●

|

our

use of cash to pay for acquisitions or investments would limit other potential uses for our cash;

|

|

|

●

|

if

we incur debt to fund any acquisitions or investments, such debt may subject us to material restrictions on our ability to

conduct our business; and

|

|

|

●

|

if

we issue a significant amount of equity securities in connection with future acquisitions, existing stockholders may be diluted

and earnings per share may decrease.

|

The

occurrence of any of these risks could adversely affect our business, operating results and financial condition.

We

will face intense competition in our market, especially from larger, well established companies, and we may lack sufficient financial

and other resources to maintain and improve our competitive position.

The

market for data security and data governance solutions is intensely competitive and is characterized by constant change and innovation.

We face competition from both traditional, larger software vendors offering enterprise-wide software frameworks and services,

and smaller companies offering point solutions for specific identity and data governance issues. We also compete with IT equipment

vendors and systems management solution providers whose products and services address identity and data governance requirements.

Our principal competitors vary depending on the product we offer. Many of our existing competitors have, and some of our potential

competitors could have, substantial competitive advantages, such as:

|

|

●

|

greater

name recognition and longer operating histories;

|

|

|

●

|

more

comprehensive and varied products and services;

|

|

|

●

|

broader

product offerings and market focus;

|

|

|

●

|

greater

resources to develop technologies or make acquisitions;

|

|

|

●

|

more

expansive intellectual property portfolios;

|

|

|

●

|

broader

distribution and established relationships with distribution partners and customers;

|

|

|

●

|

greater

customer support resources; and

|

|

|

●

|

substantially

greater financial, technical, and other resources.

|

Given

their larger size, greater resources, and existing customer relationships, our competitors may be able to compete and respond

more effectively than we can to new or changing opportunities, technologies, standards, or customer requirements. Our competitors

may also seek to extend or supplement their existing offerings to provide data security and data governance solutions that more

closely compete with our offerings. Potential customers may also prefer to purchase, or incrementally add solutions, from their

existing suppliers rather than a new or additional supplier regardless of product performance or features.

In

addition, with the recent increase in large merger and acquisition transactions in the technology industry, particularly transactions

involving cloud-based technologies, there is a greater likelihood that we will compete with other large technology companies in

the future. Some of our competitors have made acquisitions or entered into strategic relationships to offer a more comprehensive

product than they individually had offered. Companies and alliances resulting from these possible consolidations and partnerships

may create more compelling product offerings and be able to offer more attractive pricing, making it more difficult for us to

compete effectively. In addition, continued industry consolidation may adversely impact customers’ perceptions of the viability

of small and medium-sized technology companies and consequently their willingness to purchase from those companies. Conditions

in our market could change rapidly and significantly as a result of technological advancements, partnering by our competitors

or continuing market consolidation. These competitive pressures in our market or our failure to compete effectively may result

in price reductions, fewer orders, reduced revenue and gross margins, increased net losses, and loss of market share. Any failure

to meet and address these factors could adversely affect our business, financial condition, and operating results.

We

are dependent on the continued services and performance of our chief executive officer, Jason Remillard, the loss of whom could

adversely affect our business.

Our

future performance depends in large part on the continued services and continuing contributions of our chief executive officer

and sole director, Jason Remillard, to successfully manage our company, to execute on our business plan, and to identify and pursue

new opportunities and product innovations. The loss of services of Mr. Remillard could significantly delay or prevent the achievement

of our development and strategic objectives and adversely affect our business.

Our

officers and directors lack experience in and with the reporting and disclosure obligations of publicly-traded companies.

Our

chief executive officer and sole director, Jason Remillard, lacks experience in and with the reporting and disclosure obligations

of publicly-traded companies and with serving as an officer and director of a publicly-traded company. Such lack of experience

may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures,

which may result in material misstatements to our financial statements and an inability to provide accurate financial information

to our stockholders. Consequently, our operations, future earnings, and ultimate financial success could suffer irreparable harm

due to Mr. Remillard’s lack of experience with publicly-traded companies and their reporting requirements in general. Notwithstanding

Mr. Remillard’s recent experience as our CEO and his commitment to best public company practices, there is no assurance

he will be successful.

A

failure to hire and integrate additional sales and marketing personnel or maintain their productivity could adversely affect our

results of operations and growth prospects.

Our

business requires intensive sales and marketing activities. Our sales and marketing personnel are essential to attracting new

customers and expanding sales to the customers we recently acquired through acquisitions; this is key to our future growth.

We face a number of challenges in successfully expanding our sales force. We must locate and hire a significant number of qualified

individuals, and competition for such individuals is intense. We may be unable to achieve our hiring or integration goals due

to a number of factors, including, but not limited to, the number of individuals we hire; challenges in finding individuals

with the correct background due to increased competition for such hires; and increased attrition rates among new hires and

existing personnel. Furthermore, based on our past experience, it often can take up to 12 months before a new sales force member

is trained and operating at a level that meets our expectations. We plan to invest significant time and resources in training

new members of our sales force, and we may be unable to achieve our target performance levels with new sales personnel as rapidly

as we have done in the past due to larger numbers of hires or lack of experience training sales personnel to operate in new jurisdictions.

Our failure to hire a sufficient number of qualified individuals, to integrate new sales force members within the time periods

we have achieved historically or to keep our attrition rates at levels comparable to others in our industry may materially impact

our projected growth rate.

If

we are unable to attract new customers and expand sales to existing customers, both domestically and internationally, our growth

could be slower than we expect, and our business may be harmed.

Our

future growth depends in part upon increasing our customer base. Our ability to achieve significant growth in revenues in the

future will depend, in large part, upon the effectiveness of our sales and marketing efforts, both domestically and internationally,

and our ability to attract new customers. If we fail to attract new customers and maintain and expand those customer relationships,

our revenues will grow more slowly than expected, and our business will be harmed.

Our

future growth also depends upon expanding sales of our products to existing customers and their organizations. If our customers

do not purchase additional licenses or capabilities, our revenues may grow more slowly than expected, may not grow at all, or

may decline. There can be no assurance that our efforts would result in increased sales to existing customers and additional revenues.

If our efforts are not successful, our business would suffer.

If

we are unable to maintain successful relationships with our channel partners, our business could be adversely affected.

We

intend to rely on channel partners, such as distribution partners and resellers, to sell licenses and support and maintenance

agreements. Our ability to achieve revenue growth in the future may depend in part on our success in maintaining successful relationships

with our channel partners. Agreements with channel partners tend to be non-exclusive, meaning our channel partners may offer customers

the products of several different companies. If our channel partners do not effectively market and sell our products and services,

choose to use greater efforts to market and sell their own products or those of others, or fail to meet the needs of our customers,

our ability to grow our business may be adversely affected. Further, agreements with channel partners generally allow them to

terminate their agreements for any reason upon 30 days’ notice. A termination of the agreement has no effect on orders already

placed. The loss of a substantial number of our channel partners, our possible inability to replace them, or the failure to recruit

additional channel partners could materially and adversely affect our results of operations. If we are unable to maintain our

relationships with these channel partners, our business, results of operations, financial condition, or cash flows could be adversely

affected.

Breaches

in our security, cyber-attacks, or other cyber-risks could expose us to significant liability and cause our business and reputation

to suffer.

Our

operations involve transmission and processing of our customers’ confidential, proprietary, and sensitive information. We

have legal and contractual obligations to protect the confidentiality and appropriate use of customer data. Despite our security

measures, our information technology and infrastructure may be vulnerable to attacks as a result of third party action, employee

error, or misconduct. Security risks, including, but not limited to, unauthorized use or disclosure of customer data, theft of

proprietary information, loss or corruption of customer data and computer hacking attacks or other cyber-attacks, could expose

us to substantial litigation expenses and damages, indemnity and other contractual obligations, government fines and penalties,

mitigation expenses and other liabilities. We are continuously working to improve our information technology systems, together

with creating security boundaries around our critical and sensitive assets. We provide advance security awareness training to

our employees and contractors that focuses on various aspects of the cyber security world. All of these steps are taken in order

to mitigate the risk of attack and to ensure our readiness to responsibly handle any security violation or attack. However, because

techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until

successfully launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative

measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security

measures and our products could be harmed, we could lose potential sales and existing customers, our ability to operate our business

could be impaired, and we may incur significant liabilities.

Failure

to protect our proprietary technology and intellectual property rights could substantially harm our business.

The

success of our business depends on our ability to obtain, protect, and enforce our trade secrets, trademarks, copyrights, patents

and other intellectual property rights. We attempt to protect our intellectual property under patent, trademark, copyright and

trade secret laws, and through a combination of confidentiality procedures, contractual provisions and other methods, all of which

offer only limited protection. The process of obtaining patent protection is expensive and time-consuming, and we may choose not

to seek patent protection for certain innovations and may choose not to pursue patent protection in certain jurisdictions. In

addition, issuance of a patent does not guarantee that we have an absolute right to practice the patented invention.

Our

policy is to require our employees (and our consultants and service providers that develop intellectual property included in our

products) to execute written agreements in which they assign to us their rights in potential inventions and other intellectual

property created within the scope of their employment (or, with respect to consultants and service providers, their engagement

to develop such intellectual property), but we cannot assure you that we have adequately protected our rights in every such agreement

or that we have executed an agreement with every such party. Finally, in order to benefit from intellectual property protection,

we must monitor, detect, and pursue infringement claims in certain circumstances in relevant jurisdictions, all of which is costly

and time-consuming. As a result, we may not be able to obtain adequate protection of our intellectual property.

The

data security, cyber-security, data retention, and data governance industries are characterized by the existence of a large number

of relevant patents and frequent claims and related litigation regarding patent and other intellectual property rights. From time-to-time,

third parties have asserted and may assert their patent, copyright, trademark and other intellectual property rights against us,

our channel partners, or our customers. Successful claims of infringement or misappropriation by a third party could prevent us

from distributing certain products or performing certain services or could require us to pay substantial damages (including, for

example, treble damages if we are found to have willfully infringed patents and increased statutory damages if we are found to

have willfully infringed copyrights), royalties or other fees. Such claims also could require us to cease making, licensing or

using solutions that are alleged to infringe or misappropriate the intellectual property of others or to expend additional development

resources to attempt to redesign our products or services or otherwise to develop non-infringing technology. Even if third parties

may offer a license to their technology, the terms of any offered license may not be acceptable, and the failure to obtain a license

or the costs associated with any license could cause our business, results of operations or financial condition to be materially

and adversely affected. In some cases, we indemnify our channel partners and customers against claims that our products infringe

the intellectual property of third parties. Defending against claims of infringement or being deemed to be infringing the intellectual

property rights of others could impair our ability to innovate, develop, distribute, and sell our current and planned products

and services. If we are unable to protect our intellectual property rights and ensure that we are not violating the intellectual

property rights of others, we may find ourselves at a competitive disadvantage to others who need not incur the additional expense,

time, and effort required to create the innovative products that have enabled us to be successful to date.

Real

or perceived errors, failures, or bugs in our technology could adversely affect our growth prospects.

Because

we use complex technology, undetected errors, failures, or bugs may occur. Our technology is often installed and used in a variety

of computing environments with different operating system management software, and equipment and networking configurations, which

may cause errors or failures of our technology or other aspects of the computing environment into which it is deployed. In addition,

deployment of our technology into computing environments may expose undetected errors, compatibility issues, failures, or bugs

in our technology. Despite testing by us, errors, failures, or bugs may not be found until our technology is released to our customers.