Current Report Filing (8-k)

December 02 2020 - 4:45PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 25, 2020

DATA443

RISK MITIGATION, INC.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

000-30542

|

|

86-0914051

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

101

J Morris Commons Lane, Suite 105

Morrisville,

North Carolina 27560

(Address

of Principal Executive Offices)

Registrant’s

telephone number, including area code: 919-858-6542

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

none

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

ITEM

5.03

|

AMENDMENTS

TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR.

|

On

25 November 2020 Data443 Risk Mitigation, Inc. (the “Company”) filed a Certificate of Designation with the

Secretary of State of the State of Nevada (the “Certificate of Designation”), which authorized and established

eighty thousand (80,000) shares of the Series B Preferred Stock, par value $0.001 per share (the “Series B Preferred”).

The Series B will have such designations, rights, and preferences as set forth in the Certificate of Designation, as was determined

by the Company’s Board of Directors in its sole discretion, in accordance with the Company’s Certificate of Incorporation

and Bylaws. The Certificate of Designation became effective with the State of Nevada upon filing.

The

shares of the Series B Preferred (i) have a stated value of Ten Dollars ($10.00) per share; (ii) are convertible into Common Stock

at a price per share equal to sixty one percent (61%) times (representing a discount rate of 39%) the lowest price for the Company’s

common stock during the twenty (20) day of trading preceding the date of the conversion; (iii) earn dividends at the rate of nine

percent (9%) per annum; (iv) earn dividends at the rate of twenty two percent (22%) per annum upon an Event of Default (as defined

in the Certificate of Designation); (v) generally have no voting rights; (vi) rank senior with respect to dividend rights and

rights of liquidation with the Common Stock; and, (vii) rank junior with respect to dividends and right of liquidation to all

existing indebtedness of the Company. The Company may redeem the shares of the Series B Preferred in accordance with the terms

of the Certificate of Designation prior to the one hundred eightieth (180th) day following the date of issuance of

the Series B Preferred.

The

foregoing description of the Certificate of Designation does not purport to be complete and is qualified in its entirety by reference

to the Certificate of Designation, a copy of which is filed as Exhibit 3.1 hereto.

|

ITEM

9.01

|

FINANCIAL

STATEMENTS AND EXHIBITS

|

(d)

Exhibits.

The

following Exhibits are furnished with this Report:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

02 December 2020

|

DATA443

RISK MITIGATION, INC.

|

|

|

|

|

|

By:

|

/S/

JASON REMILLARD

|

|

|

|

Jason

Remillard,

|

|

|

|

Chief

Executive Officer

|

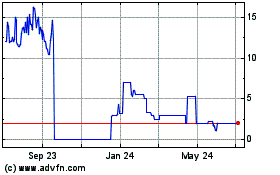

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

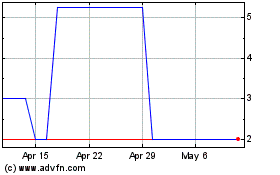

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Historical Stock Chart

From Apr 2023 to Apr 2024