UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Sec.240.14a-11(c) or Sec.240.14a-12

Amerityre Corporation

(Name of Registrant as Specified in Charter)

n/a

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and O-11.

(1) Title of each class of securities to which transaction applies: n/a

(2) Aggregate number of Securities to which transaction applies: n/a

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule O-11 (set forth the amount on which the filing fee is calculated and state how it was determined): n/a

(4) Proposed maximum aggregate value of transaction: n/a

(5) Total fee paid: n/a

☐ Fee paid previously by written preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number of the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: n/a

(2) Form, Schedule or Registration Statement No.: n/a

(3) Filing: n/a

(4) Date: n/a

Preliminary Proxy Statement

Message to our Shareholders from our Chief Executive Officer:

Dear Amerityre Shareholders:

Fiscal year 2019 saw the continued improvement in the company’s financial performance, with Amerityre achieving record full-year profitability (positive net income before preferred dividends). This is the second time in three years Amerityre has recorded a full year profit. When I joined Amerityre approximately 5 years ago, we developed and implemented a turnaround program that focused on increasing organizational efficiency, eliminating unprofitable business segments, and finding new ways to leverage our world class intellectual property. When we started this journey there were concerns as to our viability as a company; today we are financially stable and in much better position to take advantage of business opportunities. The magnitude of this achievement should not be underestimated, and I am proud of our employees who have worked very hard over this period to make Amerityre successful.

On many fronts one could say our turnaround is complete, as the immediate financial issues have been resolved. However, as a small company we recognize the need to maintain the operational vigilance and cost discipline that has fostered our improvement, and our focus on improving our efficiency will not change. However, the past year has highlighted the need for Amerityre to increase sales revenues by developing our product distribution channels. Our sales revenue this past year was almost identical to the level of the previous two fiscal years. This is an achievement when one considers the various headwinds we have encountered over the past year – continued depression in farm incomes, the implementation of tariffs, general business environment uncertainty due to inconsistent government policy, and a strong US dollar negatively impacting our export market opportunities. Our challenge this upcoming year is to develop relationships with larger tire distributors and OEMs to provide better platforms to sell our unique, market-leading, products.

Amerityre continues to represent the market’s best choice for Polyurethane foam and elastomer tires. About 1 year ago we launched our new Elastothane 500 TM formulation in several of our tire products, particularly in our lawn/garden tire portfolio. We continue to believe this formulation will gain popularity in those applications where higher abrasion and impact resistance are required, namely agricultural applications and industrial tire applications. We have taken our approach of elastomer segment tires and applied it to several pilot testing programs that could develop into new significant business. This validates our company belief that every commercial opportunity provides us a chance to increase our skill set and intellectual property. This enables us to continue the improvement of current products and the development of new ones.

Our ability to solve the customer problems in the flat free tire market using our superior technology places us apart from our competitors who compete mainly on pricing. Our challenge is to continue to leverage our technological advantages by creating relationships with manufacturers and end users who appreciate a quality, truly sustainable, tire product. I am confident that we have the product portfolio to greatly increase our market share, provided we can gain access to a larger and more efficient distribution network. The search and establishment of these sales relationships will be my top priority in the coming year, as it is my belief that it is the most important success factor to our long term success.

Our annual meeting will be held on December 4, 2019 at our Boulder City, NV facility. I welcome all shareholders to attend this meeting and see firsthand the improvements we have made to your business over the past 4 years. I am as puzzled and as frustrated as many of my fellow shareholders that the value of the company, as determined by the stock market, does not reflect the increase in value created by our recent efforts. As I have told shareholders at previous shareholder meetings, we do not manage our business to the whims of the stock market, but I do believe the value and potential of Amerityre will eventually be recognized.

As always, I appreciate the support of our shareholders during my tenure as CEO and your trust in our plan to improve Amerityre performance. Please continue your support by reviewing and completing your vote on the items we have put on this year’s proxy. I look forward to seeing you at the upcoming annual meeting.

Michael Sullivan

Chief Executive Officer and Chairman of the Board of Directors

PRELIMINARY PROXY STATEMENT

AMERITYRE CORPORATION

1501 Industrial Road

Boulder City, Nevada 89005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, DECEMBER 4, 2019

TO THE STOCKHOLDERS OF AMERITYRE CORPORATION:

The Annual Meeting of the Stockholders (the “Annual Meeting”) of Amerityre Corporation (the “Company”) will be held in the Company’s manufacturing plant at 1501 Industrial Road, Boulder City, Nevada 89005, on Wednesday, December 4, 2019 at 10:00 am, Pacific Time, to:

|

Proposals

|

|

Vote Required

|

|

Broker Discretionary Vote Allowed

|

|

Effect of Abstentions and Broker Non-Votes on the Proposal

|

|

|

|

|

|

|

|

|

|

(1)

|

Elect members of the Board of Directors serve for a one-year term expiring at the next annual meeting of the shareholders;;

|

|

Plurality

|

|

No

|

|

None

|

|

|

|

|

|

|

|

|

|

|

(2)

|

Ratify the selection of Haynie & Company PC as the Company’s independent auditor for the Company’s fiscal year ending June 30, 2020;

|

|

Majority of the votes cast

|

|

Yes

|

|

None

|

|

|

|

|

|

|

|

|

|

|

(3)

|

Approve an amendment to the Articles of Incorporation to increase the number of shares of common stock authorized;

|

|

Majority of the outstanding voting power

|

|

Yes

|

|

Vote Against

|

|

|

|

|

|

|

|

|

|

|

(4)

|

Advisory vote to approve the compensation of the Named Executive Officers; and

|

|

Majority of the votes cast

|

|

No

|

|

None

|

|

|

|

|

|

|

|

|

|

|

(5)

|

Advisory vote on whether voting on the compensation of the Named Executive Officers should be held every one, two or three years

|

|

Not applicable

|

|

No

|

|

None

|

The foregoing matters are described in more detail in the accompanying Proxy Statement.

Only stockholders of record at the close of business on October 7, 2019 (the “record date”), are entitled to notice of and to vote at the annual meeting.

For the annual meeting, instead of mailing a printed copy of our proxy materials (including our annual report) to each stockholder of record, we are providing access to these materials via the internet. Accordingly, on October 21, 2019, we began mailing a notice of internet availability of proxy materials (the “notice”) to all stockholders of record as of October 7, 2019, and posted our proxy materials on the website as described in the notice. As explained in greater detail in the notice, all stockholders may access our proxy materials on our website or may request a printed set of our proxy materials. In addition, the notice and website provide information on how to request all future proxy materials in printed form or electronically.

Your vote is important. If you are unable to attend in person and wish to have your shares voted, please vote as soon as possible, whether online or by returning a proxy card sent to you in response to your request for printed proxy materials.

Holders of more than 50 percent of the company’s 47,727,867 issued and outstanding shares of common stock must be represented at the annual meeting to constitute a quorum for conducting business. The affirmative vote of a plurality of the voting power represented by shares at the annual meeting in person or by proxy and entitled to vote on the proposal will be required for the election of directors (proposal 1) assuming that a quorum is present or represented at the annual meeting. The affirmative vote of a majority of the voting power represented by shares at the annual meeting in person or by proxy and entitled to vote on the proposal will be required for approval of proposal 2 and proposal 3, assuming that a quorum is present or represented at the annual meeting. The advisory vote (proposal 4) to approve the compensation of our named executive officers will be approved if the votes cast in favor of the proposal exceeds the votes cast against the proposal. Abstentions and broker non-votes will not be counted as either votes cast for or against this proposal. For proposal 5, the advisory vote on the frequency of voting on the compensation of the named executive officers (one year, two years or three years) that receives the highest number of votes cast by the stockholders will be deemed the frequency for the advisory say-on-pay vote preferred by the stockholders. The proxy card provides stockholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining) and, therefore, stockholders will not be voting to approve or disapprove the recommendation of the board. Abstentions and broker non-votes will have no effect on the results of this vote.

The attendance at and/or vote of each stockholder at the annual meeting is important and each stockholder is encouraged to attend.

Amerityre Corporation

By order of the board of directors

/s/ Michael F. Sullivan

Michael F. Sullivan, Chief Executive Officer

Boulder City, Nevada

Dated: October 10, 2019

IMPORTANT

If your shares are held in the name of a brokerage firm, nominee, or other institution, you are considered the beneficial owner of shares held in street name. As the beneficial owner, you have the right to direct your broker, nominee or other institution how to vote your shares. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you bring with you a legal proxy from the stockholder of record. Please promptly contact the person responsible for your account and give instructions for your shares to be voted.

The Company’s offices and plant are located 1501 Industrial Road, Boulder City, Nevada, 89005.

PROPOSAL NO. 1

ELECTION OF BOARD OF DIRECTORS

The following table sets forth the name, age and year first elected of each director of the Company:

|

Name of Current Director

|

|

Age

|

|

Director Since

|

|

Michael F. Sullivan (1)

|

|

54

|

|

December 2014

|

|

Terry Gilland

|

|

72

|

|

January 2015

|

|

George Stoddard

|

|

78

|

|

December 2016

|

|

David Clark

|

|

59

|

|

December 2016

|

|

David Hollister

|

|

53

|

|

December 2016

|

|

|

|

|

|

|

|

(1) Michael F. Sullivan was appointed Chairman of the Board of Directors on December 3, 2015.

|

The following persons have been nominated for re-election as directors of the Company:

|

Michael F. Sullivan

|

Terry Gilland

|

|

|

|

|

George Stoddard

|

David Hollister

|

|

|

|

|

David Clark

|

|

Certain biographical information with respect to the nominees for director is set forth below. Each director, if elected by the stockholders, will serve until our 2020 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified. Vacancies on the Board of Directors during the year may be filled by the majority vote of the directors in office at the time of the vacancy without action by the stockholders.

Biographical Information on Nominees

Michael F. Sullivan was appointed CEO of Amerityre in April 2015. He joined Amerityre in May 2014 as a consultant and was appointed COO in December 2014. He has over 33 years of experience in Engineering and Operations management. His career started at Johnson Matthey in 1987, where during his 10 year tenure he completed a 5 year expatriate assignment in Belgium designing, constructing and managing Europe’s largest autocatalyst facility. He has served in a variety of senior operating roles for companies in the medical device, chemical, metal coating, and consulting industries. Mr. Sullivan holds a BSE in Chemical Engineering from the University of Pennsylvania and an MBA in Finance and Marketing from the Haas School of Business at UC Berkeley. He has been a director of Amerityre since December 2014.

We believe that Mr. Sullivan’s qualifications to serve on the Board of Directors include his current leadership of the Company in addition to his engineering and operations management background.

Terry Gilland is a Certified Public Accountant with over 40 years of experience in finance, accounting and auditing. Mr. Gilland was appointed to the Board of Directors and assumed the Audit Committee Chair position in January 2015. Mr. Gilland has a Bachelor of Science and Master’s in Accounting from the University of Missouri and is a Nevada CPA. From 2008 – 2013 and 1972 - 2000 Mr. Gilland was a partner in the McGladrey LLP Las Vegas, NV and the Des Moines, IA office with clients in a variety of industries including construction, manufacturing, retail, legal, and advertisement. From 2000 – 2008 Mr. Gilland was President of Taylor Construction Group, a large general contractor ($300 million in revenues) with offices in De Moines and Cedar Rapids, IA, Kansas City, Denver and San Diego. During Mr. Gilland’s time with Taylor Construction, he dealt with Bankers and Surety companies and was responsible for all of the businesses owned by Taylor. He has been a director since January 2015.

We believe that Mr. Gilland’s qualifications to serve on the Board of Directors include his extensive Securities and Exchange Commission (“SEC”) and GAAP reporting skillset as well as his financing connections in Southern Nevada.

George Stoddard has over 45 years’ experience buying, growing and fine tuning business and investments for maximum profit and efficiency. From 1968 - 2011 Mr. Stoddard was a business owner, including L.A. Time Distribution and Mobile Pipe Wrappers and Coaters, Inc., the last of which Mr. Stoddard grew from $218,000 in annual sales to over $6,000,000 in annual sales. Mr. Stoddard retired in 2011. Mr. Stoddard has an Associate of Arts degree from East Los Angeles College and attended Cal Poly Pomona majoring in Aerospace Engineering and Math. Mr. Stoddard has been a director of Amerityre since December 2015.

We believe that Mr. Stoddard’s qualifications to serve on the Board of Directors include his general business and sales knowledge.

David Clark has 20 years of experience in start-up organizations spanning multiple industries. Since 2010, Mr. Clark has been the principal at Clark Consulting Services, which provides various independent executive level services on a project basis. From 2003 to 2010, Mr. Clark was the founder and Chief Executive Officer (“CEO”) of CommPartners, a voice over IP network and service provider. In 2010, CommPartners filed for voluntary protection under Federal Bankruptcy law. This bankruptcy was the result of litigation filed pertaining to industry rate structures, not financial capabilities. CommPartners was profitable and cash flow positive at the time of the filing. The bankruptcy was resolved via asset sales in 2011. Prior to CommPartners, Mr. Clark held various executive level positions in both start-up and advertising companies. Mr. Clark has a BA in Mass Communications from Texas Tech University. Mr. Clark has been a director of Amerityre since December 2015.

We believe that Mr. Clark’s qualification to serve on the Board of Directors include his marketing and advertising experience which will assist the Company with marketing strategy initiatives

David Hollister has 25 years of experience working with companies in a variety of marketing and product development roles. Since 2011 he has been the principal at Hollister Interactive Group, LLC, which provides digital consulting services to companies across a range of industries such as Consumer Goods, Finance, Education, Fitness, Commercial Real Estate, and Hospitality. David works closely with clients to offer business strategy, ecommerce strategy, website design, and marketing strategy services. From 2008 to 2011 David was Vice President, Global Ecommerce for Perfect Fitness, a manufacturer of home exercise equipment, where he developed and implemented the company’s product strategy and ecommerce organization. Prior to Perfect Fitness, David held a variety of executive positions with companies such as Gap, Inc.’s Old Navy division, and Intuit. David has a B.S. in Aerospace Engineering from San Diego State University, and an M.B.A. from American University in Washington D.C. Mr. Hollister has been a director of Amerityre since December 2015.

We believe that Mr. Hollister’s qualification to serve on the Board of Directors include his marketing and ecommerce experience. He will provide valuable insights as we continue to implement our e-commerce initiatives through our website.

Board Leadership Structure

We have chosen to combine the Chief Executive Officer and Board Chairman positions. We believe that this Board leadership structure is the most efficient for the Company to have one individual managing the overall strategy development process and the implementation of our marketing and growth initiatives. .. Mr. Michael Sullivan currently serves as both Chief Executive Officer of the Company and Chairman of the Board.

As discussed below, David Clark is an independent director. The Company considers him a lead director due to his various roles which include Board Secretary, Compensation Committee Chair and member of the Nominating Committee.

Director Independence

As of this filing, Mr. Sullivan is not deemed independent under the Nasdaq Listing Rules, because of his involvement as an officers or employee of the Company.

Directors Terry Gilland, George Stoddard, David Clark and David Hollister, are deemed to be independent under the definition of independence per Nasdaq Rule 5605(a)(2), which standard for independence has been adopted by the Company. In addition, these directors meets the additional requirements for Audit Committee members under Nasdaq Rule 5605(c), not having participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years, and being able to read and understand fundamental financial statements, including the Company's balance sheet, income statement, and cash flow statement. See compensation tables above.

The Board’s Role in Risk Oversight

The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk. At least annually, the full Board reviews strategic risks and opportunities facing the Company. Certain other important categories of risk are assigned to the committees below (which are comprised mostly of independent directors) that report back to the full Board. In general, the committees oversee the following risks:

The Audit Committee oversees risks related to financial controls, capital structure of the enterprise (including borrowing, liquidity, allocation of capital, major capital transactions and expenditures), legal, regulatory and compliance risks, and the overall risk management governance structure and risk management function.

The Compensation Committee oversees the Company’s compensation programs to ensure they do not incentivize excessive risk-taking.

During fiscal year ended June 30, 2019 the full Board received reports from management on the most important strategic issues and risks facing the Company, as well as, reports regarding enterprise risk assessments and risk management practices.

The Board believes that its leadership structure supports the risk oversight function. Additionally, as indicated above, certain important categories of risk are assigned to committees, consisting of mostly independent directors that receive, review and evaluate management reports on risk, thereby preserving the benefit of independent risk oversight along with full Board responsibility and review.

Communications with the Board of Directors

Stockholders can communicate directly with any of the Company’s directors, including its non-management directors, by sending a written communication to a director c/o Amerityre Corporation, 1501 Industrial Road, Boulder City, Nevada 89005. In addition, any party who has concerns about the accounting, internal controls or auditing matters, or potential violations of our Code of Conduct may send communications per the instructions on the Company’s website. Such communications may be confidential or anonymous.

Board committees and charters

The Board and its committees meet throughout the year and act by written consent from time to time as appropriate. The Board delegates various responsibilities and authority to its Board committees.

The following table identifies the current committee members:

|

Name

|

|

Audit

|

|

Compensation

|

|

Nominating

|

|

Michael F. Sullivan

|

|

X

|

|

|

|

[Chair]

|

|

Terry Gilland

|

|

[Chair]

|

|

X

|

|

|

|

George Stoddard

|

|

|

|

X

|

|

|

|

David Clark

|

|

|

|

[Chair]

|

|

X

|

|

David Hollister

|

|

|

|

X

|

|

|

Audit Committee

The Audit Committee includes Terry Gilland, Chairman, and Michael Sullivan. Terry Gilland is deemed to be independent in accordance with the independence standards under the Nasdaq Listing Rules. Mr. Sullivan is not deemed independent under the Nasdaq Listing Rules, because he is the CEO of the Company. Our Board of Directors has determined that Mr. Gilland is an "audit committee financial expert" as defined under SEC regulations. The tasks and responsibilities of the Audit Committee include (i) the review and discussion of the audited financial statements with management, (ii) discussing with the independent auditors the matters required to be discussed by the Statement of Auditing Standards No. 114, as may be modified or supplemented, (iii) receiving from auditors disclosure regarding the auditors' Independence Standards Board Standard No. 1, as may be modified or supplemented, and (iv) approving the engagement of the auditors. The Audit Committee charter, which has been approved by the Board, is posted on our website at www.amerityre.com. The Audit Committee met four times during the fiscal year ended June 30.

Compensation Committee

Our Compensation Committee consists of Terry Gilland, George Stoddard, David Clark (chair) and David Hollister. All are deemed to be independent in accordance with the independence standards under the Nasdaq Listing Rules. The Compensation Committee is convened as necessary but at least once annually to review executive compensation and make recommendations regarding compensation to the full Board of Directors. The Compensation Committee was convened one time during the fiscal year ended June 30, 2019. The Compensation Committee charter, which has been approved by the Board, is posted on our website at www.amerityre.com.

In determining the compensation of our Chief Executive Officer and our other executive officers, the Compensation Committee considers the financial condition and operational performance of the Company during the prior year. In determining the compensation for executive officers other than the Chief Executive Officer, the Compensation Committee considers the recommendations of the Chief Executive Officer and comparable market rates. However, due to financial constraints the Compensation Committee was required to develop compensation packages that were less cash-based and more equity based.

The Compensation Committee reviews the compensation practices of other companies, based in part on market survey data and other statistical data relating to executive compensation obtained through industry publications and other sources. The Compensation Committee does not seek to benchmark the Company’s compensation program directly with other publicly traded companies or other companies with which we may compete for potential executives, since some of these competitors are privately held companies for which executive compensation information is not available.

Nominating Committee

Our Nominating Committee included Michael F. Sullivan (chair) and David Clark. Mr. Sullivan is not deemed independent under the Nasdaq Listing Rules, because he is the CEO of the Company. The Nominating Committee is convened as necessary to consider and recommend potential nominees for directorships to the full Board of Directors. The Nominating Committee did not meet during the fiscal year ended June 30, 2019 as all directors are up for reelection. The Nominating Committee charter, which has been approved by the Board is posted on our website at www.amerityre.com. Pursuant to the charter, the Nominating Committee will consider candidates for directorships proposed by any stockholder although there is no formal procedure for making such proposals. During the past 5 years there has been no stockholder -led proposals for nominees for director.

Director Diversity

While the Company does not have a formal policy on Board diversity, the Nominating Committee Charter specifically lists diversity among the criteria to be considered in selecting and recommending candidates for Board membership. We believe a diverse Board provides a valuable variety of backgrounds, professional experiences and perspectives which enhances the oversight and leadership of the Company.

Meetings of our Board of Directors

Our Board of Directors held eleven (11) meetings during the fiscal year ended June 30, 2019, all of which were conducted in person or by telephone conferencing. Messrs. Gilland, Hollister and Stoddard attended less than 75 percent of all board and applicable committee meetings during the year; but all Board meetings maintained a quorum in able to conduct business. Directors and director nominees are expected to attend the Company’s Annual Meeting of Stockholders. All Board Members attended our prior year’s annual meeting on November 30, 2018.

Directors’ Compensation

On April 25, 2017, the Board of Directors adopted the 2017 Omnibus Stock Option and Award Plan (the “2017 Plan”) which contains provisions for up to 3,000,000 stock options and shares of restricted stock to be granted to employees, consultants and directors.

On November 28, 2018, the Company’s Board of Directors received a total of 350,000 shares as Board compensation for the term ending November 2019. Under the arrangement each non-executive Board member received 75,000 shares, and the Audit Committee Chair received 125,000 shares. The shares vest ratably December 2018 – November 2019, and were valued at a fixed rate of $0.02, the closing stock price on November 28, 2018.

There was no cash granted to any Board member for their service as a Board member for the fiscal year ending June 30, 2019.

It is anticipated that Board member compensation will be provided for fiscal year 2020 Board members. The actual amount of compensation will be determined at the December 2019 Board meeting.

Vote Required

The affirmative vote of a plurality of the votes cast, in person or by proxy, at the Annual Meeting will be required for the election of Directors. The Board of Directors recommends a vote “FOR” all the nominees. It is intended that in the absence of contrary specifications, proxies will be voted for the election of the nominees named above. However, under SEC regulations, broker non-votes will not be counted in the election of Directors. In the event any nominee is unable to serve, the proxies will be voted for a substitute nominee, if any, to be designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unavailable.

PROPOSAL NO. 2

RATIFY THE SELECTION OF HAYNIE & COMPANY PC AS

THE COMPANY’S INDEPENDENT AUDITOR

The Board of Directors has selected Haynie & Company PC as the Company’s independent auditor for the fiscal year ending June 30, 2020. To the knowledge of the Company, at no time has Haynie & Company PC had any direct or indirect financial interest in or any connection with the Company other than as independent public accountants. It is anticipated that a representative of Haynie & Company PC will be available by telephone during the Annual Meeting to respond to appropriate questions if any arise.

Principal Accounting Fees and Services

All of the services provided and fees charged by Haynie & Company PC were approved by our Audit Committee. The following table shows the fees for professional services rendered by Haynie & Company PC for the years ended June 30, 2018 and June 30, 2019.

|

|

|

Year Ended

June,

2019

($)

|

|

|

Year Ended

June 30,

2018

($)

|

|

|

Audit Fees (1)

|

|

|

63,306

|

|

|

|

58,223

|

|

|

Audit Related Fees

|

|

|

–

|

|

|

|

–

|

|

|

Tax Fees

|

|

|

4,500

|

|

|

|

4,500

|

|

|

All Other Fees

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

67,806

|

|

|

|

62,723

|

|

(1) Audit Fees – these fees relate to services rendered for the audits of our annual financial statements, review of our quarterly financial statements, and for other services that are normally provided by the auditor in connection with statutory or regulatory filings or engagements.

(2) Audit related fees – these fees relate to audit related consulting.

(3) The tax fees for fiscal year ended 2019 have yet been determined, as such services are still in progress.

The Audit Committee approved all of the above services prior to the commencement of work.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Directors (the “Committee”) assists the Board of Directors in fulfilling its oversight responsibilities with respect to the external reporting process and the adequacy of our internal controls. Specific responsibilities of the Committee are set forth in the Audit Committee Charter, which is available on our website: http://www.amerityre.com.

The members of the Committee are Terry Gilland, George Stoddard, and David Hollister. All meet the independence standards of Nasdaq’s Listing Rules.

The members of the Committee reviewed and discussed with our management and Haynie & Company PC the audited financial statements contained in our annual report on Form 10-K for the fiscal year ended June 30, 2019, and also discussed with Haynie & Company PC the matters required to be discussed by Statement on Auditing Standards No. 114 (Communications with Audit Committees), as amended. The members of the Committee received from Haynie & Company PC the written disclosures required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence.

Based on their review of our audited financial statements, and on their discussion with our management and with Haynie & Company PC, the members of the Committee recommended to the Board of Directors that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ended June 30, 2019.

AUDIT COMMITTEE

|

/s/ Terry Gilland

|

|

/s/ George Stoddard

|

|

Terry Gilland

|

|

George Stoddard

|

|

|

|

|

|

/s/ David Hollister

|

|

|

|

David Hollister

|

|

|

|

|

|

|

Vote Required

Ratification of the Company’s independent auditor requires the approval of a majority of the voting power represented by shares at the Annual Meeting in person or by proxy and entitled to vote, assuming that a quorum is present or represented at the Annual Meeting. The Board of Directors recommends a vote “FOR” the ratification of the selection of Haynie & Company PC as the Company’s independent auditor for the fiscal year ending June 30, 2020. It is intended that in the absence of contrary specifications, proxies will be voted for the selection of Haynie & Company PC.

PROPOSAL NO. 3

APPROVE AN AMENDMENT TO THE ARTICLES OF INCORPORATION

TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK AUTHORIZED

FROM 75,000,000 SHARES TO 100,000,000 SHARES

As discussed in Mr. Sullivan’s letter to the shareholders at the beginning of this proxy, fiscal year 2019 saw the continued improvement in financial performance, with Amerityre achieving record full-year profitability (positive net income before preferred dividends). However, company investments have been limited to those able to be financed from current cash flow. Due to limited available resources the Company has not made major investments to strengthen its market presence or to upgrade production equipment in support of its evolving product portfolio. Obtaining a substantial bank line of credit has been very difficult, leaving the issuance of equity as the only avenue for raising significant finds for expansion.

The Company currently is authorized to issue up to 75,000,000 shares of its $0.001 par value common stock. As of the September 30, 2019, there are 47,727,867 shares of common stock issued and outstanding and approximately 73,614,000 shares of common stock equivalents consisting of outstanding common stock, stock option plans, and shares reserved for prior grants of unvested restricted stock, exercise of options, and conversion of the Company’s Preferred Stock.

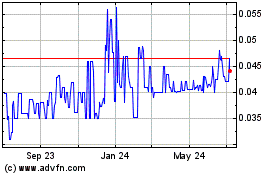

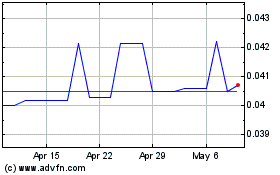

The Board of Directors believes that it might be necessary in the future to raise additional funds through an equity issue to take advantage of potential market opportunities and grow revenues to a level where the Company is consistently profitable and further self-sustaining. As shares of Amerityre are currently trading at approximately $0.02 per share, an issuance of 20,000,000 to 30,000,000 shares of common stock would result in an equity raise between $400,000 and $600,000. However, currently there are only approximately 1,386,000 shares available for issuance. Further we do not have enough authorized common stock to permit us to issue management new shares or options in December when their contracts expire, nor do we have shares available for grants to our independent directors.

Our common shareholders approved an identical measure last year but our Preferred Shareholder did not give their approval, so the proposal was not implemented. We are asking our common shareholders to re-approve the proposal. Concurrent with this year’s shareholder proposal, the Company is working again with its Preferred Shareholder to obtain the necessary written approval also required per the Preferred Share Agreement to effect the common share increase. Should the shareholders approve the increase but the Preferred Shareholder not approve the increase, the Company will not increase the authorized shares of the Company until such time as our outstanding preferred stock automatically converts on April 8, 2020.

The Company has no immediate plans to utilize these additional shares, and given the currently low price of Amerityre stock the Company is hesitant to conduct an equity financing at this time. However, having these shares approved will enable the Company to move quickly to take advantage of potential opportunities should the right opportunity present itself. Specifically, we expect that additional capital would be required in the future for the following:

|

|

●

|

Upgrade manufacturing equipment to support new manufacturing technologies;

|

|

|

●

|

Finance programs to increase our sales and product distribution initiatives; and,

|

It is the Board’s determination that there is insufficient authorized common stock remaining to raise the necessary capital for the above initiatives. The Board of Directors unanimously recommends increasing the authorized shares of common stock from 75,000,000 shares to 100,000,000 shares. This action is being recommended to provide the Company with additional equity to invest in initiatives to support revenue growth and increase profitability.

Reasons to Approve the Increase in Authorized Shares

At the end of 2016, we were able to obtain term bank debt financing to finance critical manufacturing equipment and operating enhancements which will be placed in service in early fiscal year 2017. In 2018 and 2019, we used our internally generated cash resources to invest in the Company inclusive of a lighting overhaul in our Boulder City plant. Management continues to evaluate financing options but is choosing to delay financing at terms that will subject the Company to high costs of debt. Management is also reluctant to raise money through stock sales at what we believe are highly dilutive share prices. Additionally, Management has notified our Preferred Shareholder that we have suspended future payments of their preferred cash dividend payments to allow the Company to increase its working capital levels. A discussion of these activities can be found in the Management’s Discussion and Analysis of the Company’s June 30, 2019 Form 10-K, filed with the SEC on September 13, 2019. Even with these efforts, the Company has not had the ability to invest in all of the available opportunities to increase revenue growth and profitability. Therefore, the Board believes it is not only prudent, but crucial, to have additional equity capital available for use by the Company.

We have been working to improve our liquidity and access to capital resources. In order to fully execute the strategic business plan, we required more capital resources. We will continue to investigate potential opportunities to secure short-term loans, long-term bank financing, revolving lines of credit with banking institutions and equity based transactions with interested financial firms and strategic industry partners in our effort to improve the Company’s financial position and enhance shareholder value.

The Company currently does not have an existing revolving credit facility but we were able to obtain term bank debt financing at the end of 2016 to finance critical manufacturing equipment and operating enhancements, the majority of which was placed in service in fiscal year 2017. We continue to work with our vendors to obtain extended credit terms and increase credit lines where needed. Additionally, we continue to focus on adherence to established collection policies and proactive communication with repeat customers, including adjusting credit limits to allow for increased sales volume where warranted.

We are intent on focusing on the sale and distribution of profitable product lines. Management continues to look for further financing facilities at affordable terms that will allow the Company to maintain sufficient raw material and finished goods inventory to capitalize on sales growth opportunities. We are limiting our capital expenditures to that required to maintain current manufacturing capability or support key business initiatives identified in our strategic sales plan. We continue to work to reduce our overall costs wherever possible.

The issuance of the additional shares will cause some dilution to current shareholders, but we anticipate that the opportunity to increase Company revenue and profitability would generate additional shareholder value that would more than offset the effects of any dilution.

Effects of the Increase in Authorized Shares

The Company currently is authorized to issue up to 75,000,000 shares of its $0.001 par value common stock. As of the September 30, 2019, there are 47,727,867 shares of common stock issued and outstanding and approximately 73,614,000 common stock equivalents consisting of outstanding comment stock, stock option plans, conversion features of the Company’s Preferred Stock and vesting stock awards. Following approval of the requested increase in shares of common stock, we will have approximately 26,386,000 shares authorized and available for issuance.

Currently we do not have any arrangements or understandings for the remaining portion of the authorized but unissued shares.

If approved, the additional authorized but unissued and unreserved shares of our common stock could be issued by the Board without further shareholder approval. It is our present intention to issue additional shares (1) retain critical company personnel, (2) fund revenue growth initiatives and (3) enhance our manufacturing capabilities as identified above.

Exchange Act Matters

Our common stock is registered under the Securities Exchange Act of 1934 (the “Exchange Act”), and we are subject to the periodic reporting and other requirements of the Exchange Act. Any increase in authorized capital, if implemented, will not affect the registration of our common stock under the Exchange Act or our reporting or other requirements. Our common stock is currently quoted, and following any increase will continue to be quoted, on the OTCQB Marketplace. We do not expect that our common stock will be traded under a new symbol, nor do we expect that the CUSIP number for our common stock will change. Any increase in authorized common stock will be reflected on new certificates issued by the Company and in electronic entry systems but will not otherwise affect outstanding shares.

Accounting Matters

The increase in authorized shares will not affect total shareholders’ equity on our balance sheet.

Tax Consequences

To our best knowledge, any increase in our authorized shares will have no tax consequences for our shareholders.

Effect of Not Obtaining the Required Vote for Approval

If the increase in authorized shares is not approved, our ability to continue operations and pursue business opportunities might be severely limited. Our ability to raise additional funds will be severely constrained, and, without funding, we may not have sufficient remaining equity to retain officers, directors and employees, or engage necessary consultants.

Procedure for Effecting the Increase in Authorized Shares

The increase will become effective as of the date of filing the amendment to the Articles of Incorporation with the State of Nevada, with such date being referred to as the “effective time.” The form of the Certificate of Amendment to our Articles of Incorporation is included below:

FORM OF PROPOSED AMENDMENT TO ARTICLES OF INCORPORATION

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 – After Issuance of Stock)

1. Name of corporation:

Amerityre Corporation

2. The articles have been amended as follows: (provide article numbers, if available)

Article III: The Corporation shall have the authority to issue a total of 105,000,000 shares, consisting of 5,000,000 shares of preferred stock having a par value of $0.001 per share (hereinafter referred to a “Preferred Stock”) and 100,000,000 shares of common stock, par value $0.001 per share (hereinafter referred to as “Common Stock”).

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise a least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: _______________ (_____%)

4. Effective date of filing: (optional)

5. Signature: (required)

/s/_________________

Signature of Officer

*If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

NO NEW CERTIFICATES WILL BE ISSUED TO ANY SHAREHOLDER AS A RESULT OF THE INCREASE AND SHAREHOLDERS SHOULD NOT SUBMIT EXISTING CERTIFICATES FOR RE-ISSUANCE.

Vote Required

Approval of the increase in authorized shares of the Company’s common stock requires the approval of a majority of the outstanding common stock as of the Record Date or 23,863,934 shares. The Board of Directors recommends a vote “FOR” the increase from 75,000,000 authorized shares of common stock to 100,000,000 authorized shares of common stock. It is intended that in the absence of contrary specifications, proxies will be voted for the increase. Broker non-votes and abstentions will not be counted in the vote for the increase.

PROPOSAL NO. 4

ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

In accordance with the SEC’s proxy rules, we are seeking an advisory, non-binding stockholder vote with respect to the compensation of the named executive officers listed in the Summary Compensation Table in the “Executive Compensation” section of this proxy statement for fiscal year 2019 and as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and the philosophy, policies and practices described in this proxy statement. This vote is commonly known as a “Say-on-Pay” advisory vote.

We believe that our compensation programs and policies for the fiscal year ended June 30, 2019 were effective in aligning the Company’s developmental goals with shareholder interests, and remain worthy of continued stockholder support. Accordingly, we ask for our stockholders to indicate their support for the compensation paid to the named executive officers by voting FOR the following non-binding resolution at the Annual Meeting of Stockholders:

“RESOLVED, that the Company’s stockholders approve the compensation of the named executive officers for fiscal year 2019 listed in the Summary Compensation Table in the ‘Executive Compensation’ section of the proxy statement and as disclosed pursuant to Item 402 of Regulation S-K.”

Vote Required

Approval of this proposal requires that votes cast in favor of the proposal exceed the votes cast against the proposal. Your vote is advisory and the result is not binding upon the Company. Although not binding, our Board values the opinions of our stockholders and will consider the outcome of the vote, along with other relevant factors, in deciding whether any actions are necessary to address any concerns raised by the vote and when making future compensation decisions for the named executive officers. The Board recommends that the stockholders vote for the approval of the compensation of the named executive officers, as stated in the above non-binding resolutions. It is intended that in the absence of contrary specifications, proxies will be voted for the approval of the compensation of the named executive officers. Broker non-votes and abstentions will not be counted in the advisory vote for the approval of the compensation of the named executive officers.

PROPOSAL NO. 5

ADVISORY VOTE ON THE FREQUENCY OF VOTING ON THE

COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

In addition to the Say-on-Pay advisory vote, we are seeking an advisory, non-binding vote regarding the frequency of future advisory Say-on-Pay votes in accordance with the SEC’s proxy rules, known as a “Say-on-Pay Frequency” advisory vote.

Stockholders will be able to vote that we hold this Say-on-Pay advisory vote every year, two years, or three years, or stockholders may abstain from voting on this proposal.

After due consideration, the Board has decided to recommend that this Say-on-Pay advisory vote on executive compensation occur every three years. While there are valid arguments for annual and biennial votes, we believe that a vote once every three years is the best approach for the Company and its stockholders for a number of reasons, including that a triennial vote will allow our stockholders to better evaluate our executive compensation program in relation to our short- and long-term company performance. Additionally, a triennial vote will provide us with time to respond to stockholder concerns and implement appropriate revisions.

The Board’s decision was based further on the premise that this recommendation could be modified in future years if it becomes apparent that a vote once every three years is not meaningful or a more frequent vote is recommended by best corporate governance practices.

Vote Required

The frequency (one year, two years or three years) that receives the highest number of votes cast by the stockholders will be deemed the frequency for the advisory Say-on-Pay vote preferred by the stockholders. Your vote is advisory and the results are not binding upon the Company. Although not binding, the Board values the opinions of our stockholders and will review and consider the outcome of the vote, along with other relevant factors, in evaluating the frequency of future advisory votes on executive compensation. The Board recommends that stockholders vote for the option of “THREE YEARS” as the preference for the frequency of holding future advisory votes on the compensation of our named executive officers. It is intended that in the absence of contrary specifications, proxies will be voted for the approval of three years for the frequency of advisory votes on the compensation of the Company’s named executive officers. Broker non-votes and abstentions will not be counted in the advisory vote on the frequency of approval of the compensation of the named executive officers.

EXECUTIVE OFFICERS

The following sets forth certain information regarding our officers as of September 30, 2019 and for the fiscal year ended June 30, 2019:

|

Name of Officer

|

|

Age

|

|

Position

|

|

Officer Since

|

|

Michael F. Sullivan (1)

|

|

54

|

|

Chief Executive Officer

|

|

April 2015

|

|

Lynda R. Keeton-Cardno

|

|

47

|

|

Chief Finance Officer

|

|

January 2015

|

|

(1) Michael F. Sullivan was first appointed Chief Operating Officer December 1, 2014; then appointed Chief Executive Officer April 1, 2015; and appointed Chairman of the Board December 3, 2015.

|

See above for Mr. Sullivan’s biography.

Lynda R. Keeton-Cardno was appointed as the Company’s Principal Financial and Accounting Officer, and Secretary/Treasurer on January 21, 2015. Since, 2004 Ms. Keeton-Cardno has been the CEO/Managing Member of Lynda R. Keeton CPA, LLC, dba Keeton CPA, an accounting firm based in Henderson, Nevada which provides accounting, audit and consulting services to public and private companies. Between January 1996 and April 2002 Ms. Keeton-Cardno worked for Arthur Andersen, LLP in Phoenix, Arizona and Las Vegas, Nevada in the audit and advisory and technology risk consulting divisions. Ms. Keeton-Cardno is a Nevada licensed certified public accountant and received her accounting degree from Arizona State University’s School of Business and Honor’s College. In her various roles she has extensive background and experience in managing high performing accounting departments, filings with the SEC and work needed for review by the Public Companies Accounting Oversite Board.

Long Term Equity Incentives

Long term incentive awards are a key element of the Company’s total compensation package for individuals in significant positions of responsibility, including the members of our Board of Directors who are compensated entirely in Amerityre stock. Such awards may be made under the 2017 Plan to senior management and select employees who are key to the Company’s achievement of its long-term goals. The purpose of the 2017 Plan is to promote the long term growth and profitability of Amerityre by (i) providing certain officers and employees with incentives to maximize stockholder value, and (ii) enabling Amerityre to attract, retain and reward the best available persons for positions of responsibility. The 2017 Plan provides for a variety of long-term awards including incentive or non-qualified stock options, restricted stock, and performance awards.

The Plan is administered by the Board unless and until the Board delegates administration to the Committee as defined by the 2017 Plan. Awards granted under the 2017 Plan may be incentive stock options, or ISOs, as defined in the Internal Revenue Code of 1986, as amended, or the Code, or stock bonus awards which are awarded to our employees, including officers, who, in the opinion of the Board of Directors or the Compensation Committee, have contributed, or are expected to contribute, materially to our success.

All of our employees and officers are eligible to participate under the 2017 Plan. A maximum of 3,000,000 shares are available for grant under the 2017 Plan. Under the 2017 Plan, the Board and the Compensation Committee have broad authority to award equity-based compensation arrangements to any eligible employees, officers, or directors of Amerityre.

The following Summary Compensation Table sets forth the aggregate compensation paid or accrued by the Company to the named executive officers, as defined in Regulation S-K Item 402(m)(2) (the “Named Executive Officers”) as of June 30, 2019 and 2018.

Summary Compensation Table

|

Officers Name & Principal Position

|

|

Year

|

|

Salary

(In $) (1)

|

|

|

Bonus

(In $)

|

|

|

Stock

(In $)

|

|

|

Total

(In $)

|

|

|

Michael Sullivan

|

|

2019

|

|

|

150,000

|

|

|

|

30,000

|

|

|

|

32,274

|

|

|

|

212,274

|

|

|

CEO (3)

|

|

2018

|

|

|

150,000

|

|

|

|

12,500

|

|

|

|

18,765

|

|

|

|

181,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lynda Keeton-Cardno

|

|

2019

|

|

|

36,000

|

|

|

|

7,500

|

|

|

|

1,200

|

|

|

|

44,700

|

|

|

CFO

|

|

2018

|

|

|

31,953

|

|

|

|

5,250

|

|

|

|

1,200

|

|

|

|

38,403

|

|

(1) Annual gross wages.

(2) Based on the aggregate grant date fair value computed in accordance with ASC 718.

(3) Michael F. Sullivan was first appointed Chief Operating Officer December 1, 2014; then appointed Chief Executive Officer April 1, 2015.

(4) See footnote 4 “Stock Transactions” of the Company’s financial statements as filed on Form 10-k on September 13, 2019 for all assumptions made in the valuation of stock awards.

Employment Agreements

On September 26, 2018, Michael F. Sullivan, the Company’s Chief Executive Officer finalized the negotiation of the replacement and extension of his Employment Agreement.

The Employment Agreement replaces the old Employment Agreement and extends his term of employment to December 31, 2019.

Mr. Sullivan’s compensation package and other material terms are a summarized below. See the full agreement as filed as Exhibit 10.1 for Form 8-K, which was filed on October 2, 2018.

|

●

|

Compensation. Under his Employment Agreement, Mr. Sullivan is entitled to receive:

|

(a) An annual salary of $150,000 per year

(b) Stock awards of 1.98 million shares of the Company’s common stock vesting monthly during the calendar year of 2019;

(c) Bonus compensation of up to twenty (20)% of his annual salary based on the Company meeting financial objectives of (i) net sales revenue exceeding $4 million in 2019 or (ii) net positive income exceeding $100,000 before payment of preferred dividends in 2019; and,

(d) Health and medical insurance as available for full-time employees, and participation in any retirement, pension, profit-sharing, stock option, or other plan as in effect from time to time on the same basis as other employees.

If the Company terminates Mr. Sullivan’s employment without cause, Mr. Sullivan is entitled to the lesser of either (i) four (4) months of his annual salary, pro rata of earned bonus compensation, and four (4) months of benefits, or (ii) the balance of his annual salary through the end of the Employment Agreement’s term, pro rata earned bonus compensation, and executive benefits through the balance of the term.

Under her Employment Agreement with the Company, as amended, Lynda R. Keeton-Cardno devotes 25% of her time to the Company and receives an annual salary of $36,000, renegotiable yearly. In January 2019, Ms. Keeton-Cardno’s employment agreement was extended for 1 year. With the January 2019 extension, Ms. Keeton-Cardno received a 60,000 share restricted stock grant, which were valued at $0.02 per share, vesting quarterly January 2019 through December 2019. If Ms. Keeton-Cardno is terminated by the Company without cause, if there is a change in majority ownership of the Company resulting in the Company ceasing to be publicly traded, or if her position or duties are changed without prior written agreement, all stock due to Ms. Keeton-Cardno under her Employment Agreement will be issued and vest immediately upon any such event.

The Compensation Committee, at its discretion, may award bonuses to the executive officers of the organization in addition to the terms of the above employment contract. For the year ended June 30, 2019 the following bonuses were awarded, both payable in cash:

|

|

●

|

Michael F. Sullivan: $30,000.

|

|

|

●

|

Lynda R. Keeton-Cardno: $7,500.

|

Grants of Plan Based Awards

The Named Executive Officers received grants of restricted stock described below. In this Proxy Statement, we also describe past grants of restricted stock to our independent directors. When we refer to the phrase “vesting ratably” we mean that the grants vest over time subject to the executive or the director continuing to provide services to us as of each applicable vesting date.

On January 21, 2017, the Company’s Chief Financial Officer, Ms. Keeton-Cardno, received 60,000 shares as part of her employment renewal. The shares were valued at $0.04 as of January 20, 2017 and vested ratably through December 2017. All of these shares have been issued: 30,000 in fiscal year 2018, 30,000 in fiscal year 2017.

Under a new 2017 Employment Agreement, the Company’s Chief Executive Officer, Mr. Sullivan, received a stock award of 2.4 million shares of the Company’s common stock vesting ratably over 23 months (February 2017 – December 2018). As of June 30, 2019, all of these shares had vested: 1,356,521 shares issued in fiscal year 2019, and 521,739 shares issued in each fiscal year 2018 and fiscal year 2017.

On January 21, 2018, the Company’s Chief Financial Officer, Ms. Keeton-Cardno, received 60,000 shares as part of her employment renewal. The shares were valued at $0.02, the closing stock price as of January 21, 2018, and vested ratably through December 2018. In addition to the stock, her base compensation was adjusted to $36,000 per annum. All of these shares have been issued in fiscal year 2019.

On May 24, 2018, the Board of Director’s approved a partial payment of Mr. Sullivan’s 2017 bonus in stock. This partial payment of $10,000 resulted in the issuance of 500,000 shares of stock.

On July 20, 2018, in association with the Company’s yearend close and results, the Compensation Committee of the Board approved a discretionary bonus to Mr. Sullivan of which half was paid in stock. This resulted in 375,000 share of stock being issued in fiscal year 2019.

On September 26, 2018, the Company replaced and extended Mr. Sullivan’s Employment Agreement. The Agreement extended his term of employment to December 31, 2019. Inclusive in this new Agreement is a stock award of 1.98 million shares of the Company’s common stock vesting monthly over 12 months (January 2019 – December 2019), valued at a fixed rate of $0.0163, the closing stock price on September 28, 2018. As of June 30, 2019, 990,000 of these shares had vested and were issued.

On January 2, 2019, the Company’s Chief Financial Officer, Ms. Keeton-Cardno, received 60,000 restricted shares as part of her employment renewal. The shares were valued at $0.02, the closing stock price as of January 2, 2019 and vest quarterly through December 2019. As of June 30, 2019, 30,000 shares of stock vested and issued.

On June 26, 2019, the Compensation Committee, awarded the following bonuses, payable in cash, for the year ended June 30, 2019:

|

|

●

|

Ms. Keeton-Cardno: $7,500.

|

Outstanding Equity Awards at Fiscal Year End

The following table sets forth the outstanding equity awards of the Named Executive Officers as of June 30, 2019.

|

Name

|

|

Option Awards

|

|

|

Stock Awards

|

|

|

|

|

No. of

Securities Underlying Unexercised Options (#) Exercisable

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration Date

|

|

|

No. of Shares or Units of Stock That Have Not Vested

(#)

|

|

|

|

|

Market Value of Shares or Units of Stock That Have Not Vested

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M. Sullivan(1)

|

|

|

480,000

|

|

|

|

0.10

|

|

|

12/1/21

|

|

|

|

990,000

|

|

(1

|

)

|

|

|

19,800

|

|

|

|

|

|

1,440,000

|

|

|

|

0.10

|

|

|

12/1/20

|

|

|

|

-

|

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L. Keeton-Cardno(2)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

30,000

|

|

(2

|

)

|

|

|

600

|

|

|

(1)

|

Vests monthly through December 2019.

|

|

(2)

|

Vests quarterly through December 2019.

|

Option Exercises and Stock Vested

Pension Benefits and Nonqualified Deferred Compensation

The Company does not provide pension benefits or provide any other qualified retirement plans or non-nonqualified deferred compensation plans for its employees or directors.

DIRECTOR COMPENSATION

The following table sets forth the aggregate compensation paid or accrued by the Company to the Directors for the fiscal year ended June 30, 2019.

|

Name

|

|

Stock

Awards

(In $)

|

|

|

Total

(In $)

|

|

|

Terry Gilland

|

|

|

2,167

|

|

|

|

2,167

|

|

|

George Stoddard

|

|

|

1,375

|

|

|

|

1,375

|

|

|

David Clark

|

|

|

1,375

|

|

|

|

1,375

|

|

|

David Hollister

|

|

|

1,375

|

|

|

|

1,375

|

|

Grants to Independent Directors

The grants to our independent directors described below were all under our 2017 Plan.

On January 31, 2017, the Company’s Board of Director’s received a total of 225,000 restricted shares as Board compensation for the term ending November 2017. Each non-executive Board member received 50,000 shares, and the Audit Committee Chair received 75,000 shares. The shares vested ratably January – December 2017, and were valued at a fixed rate of $0.0155, the closing stock price on January 31, 2017. All of these shares are fully vested.

On November 30, 2017, the Company’s Board of Directors received a total of 265,000 shares as Board compensation for the term ending November 2018. Each non-executive Board member received 60,000 shares, and the Audit Committee Chair received 85,000 shares. The shares vested ratably December 2017 – November 2018, and were valued at a fixed rate of $0.02, the closing stock price on November 30, 2017. As of June 30, 2019, all shares of stock have vested.

As of November 28, 2018, the Company’s Board of Directors received a total of 350,000 shares as Board compensation for the term ending November 2019. Under the arrangement, each non-executive Board member received 75,000 shares, and the Audit Committee Chair received 125,000 shares. The shares vest ratably December 2018 – November 2019, and were valued at $0.02 the closing stock price on November 28, 2018. As of June 30, 2019, 175,000 shares of stock had vested.

In the event of a reorganization, recapitalization, stock split, stock dividend, combination of shares, merger, consolidation or any other change in our corporate structure affecting common stock, or a sale by us of all or a substantial part of its assets, or any distribution to stockholders other than a cash dividend, our Board of Directors will make appropriate adjustment in the number and kind of shares authorized by the 2017 Plan, and any adjustments to outstanding awards as it deems appropriate. However, no fractional shares of common stock will be issued pursuant to any such adjustment, and the fair market value of any fractional shares resulting from adjustments will be paid in cash to the awardee.

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Common stock

The following table set forth as of September 30, 2019, the name and address and the number of shares of our common stock held of record or beneficially by each person who held of record, or was known by us to own beneficially, more than five percent of our issued and outstanding common stock, and the name and shareholdings of each director and Named Executive Officer as defined by Item 402 of Regulation S-K, and of all officers and directors as a group. In determining the number of shares beneficially owned by a person, options or warrants to purchase common stock held by that person that are currently exercisable, or become exercisable within 60 days following, are deemed outstanding; however, such shares are not deemed outstanding for purposes of computing the percentage ownership of any other person. We believe that all of the persons named in this table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and except as indicated in the other footnotes to this table.

|

Security Ownership of Certain Beneficial Owners

|

|

|

Name

|

|

Amount of Common Stock Beneficially Owned(1)

|

|

|

Percentage of Class(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael F. Sullivan, CEO and Chairman of the Board (3)

|

|

|

7,857,581

|

|

|

|

16.2

|

%

|

|

Terry Gilland, Director (4)

|

|

|

435,000

|

|

|

|

0.9

|

%

|

|

George Stoddard, Director (5)

|

|

|

285,000

|

|

|

|

0.6

|

%

|

|

David Clark, Director (6)

|

|

|

285,000

|

|

|

|

0.6

|

%

|

|

David Hollister, Director (7)

|

|

|

285,000

|

|

|

|

0.6

|

%

|

|

Lynda R. Keeton-Cardno, CFO

|

|

|

477,500

|

|

|

|

1.0

|

%

|

|

Total beneficial ownership of all officers and directors as a group (6 persons) (8)

|

|

|

9,625,081

|

|

|

|

19.8

|

%

|

(1) All shares owned directly are owned beneficially and of record and such stockholder has sole voting, investment, and dispositive power, unless otherwise noted. Also includes director shares earned but not issued as of this filing. This table does not include any unvested stock options except for those vesting within 60 days. All addresses are c/o Amerityre Corporation, 1501 Industrial Road, Boulder City, Nevada 89005.

(2) Applicable percentages are based on 48,555,867 shares of common stock outstanding as of the Record Date. Includes shares of common stock and options underlying common stock as of the Record Date.

(3) Mr. Sullivan’s beneficial ownership consists of 5,937,581 shares of common stock and 1,920,000 common stock options. Does not include 165,000 unvested shares. Mr. Sullivan is a director, Named Executive Officer, and beneficial owner of more than five percent of the Company’s securities, but is listed only once in the above table in accordance with SEC Rules and guidance.

(4) Mr. Gilland’s beneficial ownership consists of 285,000 shares of common stock and 150,000 common stock options. All shares and options for Mr. Gilland are vested.

(5) Mr. Stoddard’s beneficial ownership consists of 185,000 shares of common stock and 100,000 common stock options. All shares and options for Mr. Stoddard are vested.

(6) Mr. Clark’s beneficial ownership consists of shares 185,000 of common stock and 100,000 common stock options. All shares and options for Mr. Clark are vested.

(7) Mr. Hollister’s beneficial ownership consists of 185,000 shares of common stock 100,000 common stock options. All shares and options for Mr. Clark are vested.

(8) Represents Lynda Keeton-Cardno’s 477,500 shares of common stock and no common stock options. Does not include 10,000 unvested shares.

Equity Compensation Plan Information

The following table sets forth information as of June 30, 2019 with respect to compensation plans under which our equity securities are authorized for issuance.

|

Plan Category

|

|

Number of Securities to be Issued upon Exercise of Outstanding Options, Restricted Stock Units

and Performance Units

A

|

|

|

Weighted-Average Exercise Price of Outstanding Options, Restricted Stock Units

and Performance Units

B

|

|

|

Number of Securities Remaining Available for Future Issuance Under

Equity Compensation Plans

C

|

|

|

Equity compensation plans approved by security holders (1)

|

|

|

1,600,000

|

|

|

$

|

0.16

|

|

|

|

-

|

|

|

Equity compensation plans not approved by security holders

|

|

|

2,370,000

|

|

|

$

|

0.10

|

|

|

|

481,000

|

|

|

Total

|

|

|

3,970,000

|

|

|

|

|

|

|

|

481,000

|

|

|

|

(1)

|

Represents shares issued under an expired 2005 plan, which was previously approved by shareholders. This plan had a 10 year life and expired July 2015.

|

FINANCIAL AND OTHER INFORMATION

The Company’s most recent audited financial statements and other information are contained in the Company’s annual report on Form 10-K for the period ending June 30, 2019. Such reports once filed, are available to stockholders on the Company’s website at http://www.amerityre.com, upon written request addressed to the Company at the Company’s executive offices or on the SEC’s EDGAR website at http://www.sec.gov.

STOCKHOLDER PROPOSALS

No proposals have been submitted by stockholders of the Company for consideration at the Annual Meeting. It is anticipated that the next annual meeting of stockholders will be held during November 2020. Stockholders who, in accordance with Rule 14a-8 of the Exchange Act wish to present proposals for inclusion in the proxy materials to be distributed in connection with next year’s Annual Meeting Proxy Statement must submit their proposals so that they are received at our principal executive offices no later than the close of business on June 30, 2020, and are otherwise in compliance with applicable laws and regulations and the governing provisions of the articles of incorporation and bylaws of the Company. As the rules of the SEC make clear, simply submitting a proposal does not guarantee that it will be included.

Stockholder proposals and director nominations for our 2020 Annual Meeting not intended for inclusion in the proxy materials for the meeting must be delivered to our principal executive offices no earlier than July 15, 2020 and no later than August 19, 2020 to be considered timely.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE