Current Report Filing (8-k)

May 21 2019 - 4:37PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15 (d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2019

AMBASE CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-07265

|

95-2962743

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

ONE SOUTH OCEAN BOULEVARD, SUITE 301

BOCA RATON, FLORIDA 33432

(Address of principal executive offices, including zip code)

(201) 265-0169

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (

see

General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ___

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ___

Item 1.01 Entry into a Material Definitive Agreement

In September 2017, the Company entered into a Litigation Funding Agreement (the “LFA”) with Mr. Richard A. Bianco, the Company’s Chief

Executive Officer, (“Mr. R. A. Bianco”). Pursuant to the LFA, Mr. R. A. Bianco agreed to provide litigation funding to the Company, up to an aggregate amount of seven million dollars ($7,000,000) (the “Litigation Fund Amount”) to satisfy actual

documented litigation costs and expenses of the Company, including attorneys’ fees, expert witness fees, consulting fees and disbursements in connection with the Company’s legal proceedings (the “111 West 57

th

Litigation”) related to the

Company’s equity investment in the real property located at 105 through 111 West 57th Street in New York, New York (the “111 West 57th Property”).

After receiving substantial AMT tax credit carryforward refunds in March 2019, in light of the Company’s improved liquidity, in April 2019 the

Company’s Board of Directors (the “Board”) authorized the establishment of a Special Committee of the Board (the “Special Committee”) to evaluate and negotiate possible changes to the LFA. The Special Committee was comprised exclusively of the

independent directors on the Board.

On May 20, 2019, after receiving approval from the Special Committee, the Company and Mr. R. A. Bianco entered into an amendment to the LFA

(the “Amendment”) which provides for the following: (i) the repayment of $3,672,000 in funds previously provided to the Company by Mr. R. A. Bianco pursuant to the LFA (the “Advanced Amount”), (ii) the release of Mr. R. A. Bianco from all further

funding obligations under the LFA, and (iii) a modification of the relative distribution between Mr. R. A. Bianco and the Company of any Litigation Proceeds received by the Company from the 111 West 57

th

Litigation, as described below.

The Amendment provides that, in the event that the Company receives any Litigation Proceeds from the 111 West 57

th

Litigation, such

Litigation Proceeds shall be distributed as follows:

|

(i)

|

first, 100% to the Company in an amount equal to the lesser of (a) the amount of actual litigation expenses incurred by the Company

with respect to the Company’s 111 West 57

th

Litigation (including the Advanced Amount to the extent repaid by the Company); or (b) $7,500,000; and

|

|

(ii)

|

thereafter, any additional amounts shall be distributed (a) 75% to the Company and (b) 25% to the Mr. R. A. Bianco.

|

A copy of the Amendment is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

With respect to the 111 West 57th Litigation, the Company is continuing to pursue various legal courses of action, and is considering other

possible economic strategies, including the possible sale of the Company’s interest in and/or rights with respect to the 111 West 57th Property. Additionally, the Company is continuing to pursue other options to realize the Company’s investment value

and/or protect its legal rights, however, the Company can give no assurances regarding the outcome of these matters.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

Exhibit No.

|

|

|

10.1

|

Amendment, dated May 20, 2019, to the September 2017 Litigation Funding Agreement between Mr. Richard A. Bianco and the Company.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

AMBASE CORPORATION

|

|

|

|

|

|

By

/s/ John Ferrara

|

|

|

John Ferrara

|

|

|

Vice President and Chief Financial Officer and Controller

|

|

|

AmBase Corporation

|

|

|

Date: May 21, 2019

|

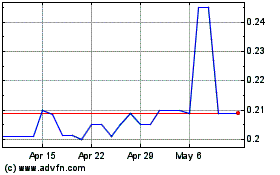

Ambase (PK) (USOTC:ABCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

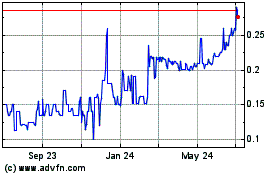

Ambase (PK) (USOTC:ABCP)

Historical Stock Chart

From Apr 2023 to Apr 2024