Westport Fuel Systems Inc. (“

Westport") (TSX:WPRT

/ Nasdaq:WPRT) reported financial results for the third quarter

ended September 30, 2022, and provided an update on

operations. All figures are in U.S. dollars unless otherwise

stated.

THIRD QUARTER 2022 HIGHLIGHTS

- Revenues decreased 4% to $71.2

million compared to the same period in 2021, primarily driven by

the weakening of the Euro against the U.S. dollar. Excluding

foreign currency translation, total revenues would have increased

by 10%.

- Higher sales volumes for the

independent aftermarket ("IAM") business unit in Eastern Europe,

Algeria, and Peru, partially offset by lower sales volume to

Russian customers.

- Revenues from Original Equipment

Manufacturer ("OEM") business unit customers were comparable to the

same period 2021, including increased sales of hydrogen,

electronics and fuel storage products, offset by lower sales of CNG

and LNG products due to higher natural gas prices in the European

market.

- Net loss of $11.9 million for the

quarter ended September 30, 2022, compared to a net loss of $5.8

million for the same quarter last year. The decrease in earnings

was driven by the loss of equity income from the termination and

sale of the Cummins Westport Inc (“CWI”) joint venture and foreign

exchange loss.

- Cash and cash equivalents were

$86.5 million at the end of the third quarter of 2022. Cash used in

operating activities during the quarter was $8.6 million, due to

operating losses of $10.9 million and debt repayment of $3.6

million, partially offset by net changes to working capital.

- Adjusted EBITDA[1] of negative

$4.5 million compared to negative $1.4 million for the

same period in 2021.

- Announced impressive hydrogen HPDI

test results from the demonstration program with Scania. Applying

Westport’s HPDI technology fueled with hydrogen to Scania's

13-Litre CBE1 platform, demonstrated peak Brake Thermal Efficiency

of 51.5% complemented by 48.7% at road load conditions, with

engine-out NOx similar to the base diesel engine.

[1] Adjusted earnings before interest, taxes and

depreciation is a non-GAAP measure. Please refer to NON-GAAP

FINANCIAL MEASURES in Westport’s Management Discussion and Analysis

for the reconciliation.

“While economies and our industry continue to be

hit with significant headwinds including inflation and dramatically

rising energy costs, we are seeing some positive trends emerge and

are optimistic about our long-term future. While these headwinds

are expected to continue, Westport is preparing for growth and

profitability, focused on driving value in new and existing

passenger car markets, working directly with key OEMs to advance

evaluation of our H2 HPDI™ solution for long-haul, heavy-duty

transport, and enhancing margins throughout the business. Absent

the effects of foreign exchange changes, revenue would have

increased by 10% year-over-year, a significant improvement given

the environment our industry has been facing.

Sales growth of our fuel storage, hydrogen

components, and electronics products along with continued growth in

volumes to our OEM customers in India all drove increased revenue

in our OEM business this quarter. Unfortunately, these strengths

were offset by the impact of high natural gas prices on European

market sales to light-duty and heavy-duty OEMs.

Looking to the future, the world’s population

continues to grow, and the need to move freight follows this

growth. Affordable solutions for heavy-duty, long-haul transport

are required and our H2 HPDI™ fuel systems meet the demand for

a high performance, high efficiency, clean, affordable

solution.

We are thrilled with the recent results of our

demonstration program with Scania. Our solution not only allows

OEMs to preserve their existing manufacturing infrastructure and

associated substantial capital investments, but it also

demonstrates that an engine using HPDI with hydrogen can achieve

significantly better performance and efficiency than with diesel

fuel. These results are a step forward in demonstrating our H2

HPDI™ fuel system is a cost-competitive pathway to reduce CO2

emissions from heavy-duty transportation applications that require

robust and reliable solutions.

Despite the decrease in business in Russia due

to the Russian/Ukraine conflict and related sanctions, our team was

diligent in expanding into new markets and deepening our work in

current markets, achieving revenue above what we delivered last

year in Euros , even with the impact of the foreign exchange. Light

duty vehicles represent 95% of the vehicles on the road and

contribute 75% of on-road CO2 emissions. Battery electric is one

possible solution for some customers, in some markets, however

there are plenty of global markets and customers who cannot afford

expensive vehicles. Battery electric vehicles are expensive.

Westport delivers affordable, low-carbon solutions for global

customers who cannot afford luxury vehicle prices.

We remain confident that our clean and

affordable products will be an important part of the solution and

competitive in global markets.”

David M. Johnson, Chief Executive Officer

3Q22 Operations

|

CONSOLIDATED RESULTS |

|

|

|

|

($ in millions, except per share amounts) |

3Q22 |

3Q21 |

Over /(Under)% |

9M22 |

9M21 |

Over /(Under)% |

|

Revenues |

$ |

71.2 |

|

$ |

74.3 |

|

(4 |

)% |

$ |

227.7 |

|

$ |

229.8 |

|

(1 |

)% |

|

Gross Margin(2) |

$ |

11.3 |

|

$ |

10.1 |

|

11 |

% |

$ |

31.7 |

|

$ |

38.9 |

|

(18 |

)% |

|

Gross Margin % |

|

16 |

% |

|

14 |

% |

|

|

14 |

% |

|

17 |

% |

|

|

Operating Expenses |

$ |

22.2 |

|

$ |

18.8 |

|

18 |

% |

$ |

64.8 |

|

$ |

59.4 |

|

9 |

% |

|

Income from Investments Accounted for by the Equity Method(1) |

$ |

0.2 |

|

$ |

4.1 |

|

(95 |

)% |

$ |

1.0 |

|

$ |

18.7 |

|

(95 |

)% |

|

Net Income (Loss) |

$ |

(11.9 |

) |

$ |

(5.8 |

) |

107 |

% |

$ |

(15.8 |

) |

$ |

8.3 |

|

290 |

% |

|

Net Income (Loss) per Share |

$ |

(0.07 |

) |

$ |

(0.03 |

) |

78 |

% |

$ |

(0.09 |

) |

$ |

0.05 |

|

(280 |

)% |

|

EBITDA(2) |

$ |

(8.0 |

) |

$ |

(1.2 |

) |

558 |

% |

$ |

(4.0 |

) |

$ |

14.6 |

|

(127 |

)% |

|

Adjusted EBITDA(2) |

$ |

(4.5 |

) |

$ |

(1.4 |

) |

221 |

% |

$ |

(14.9 |

) |

$ |

7.5 |

|

(299 |

)% |

(1) This includes income primarily from our

Cummins Westport Inc. ("CWI") and Minda Westport Technologies

Limited joint ventures.

(2) EBIT, EBITDA, Adjusted EBITDA, and Gross

Margin are non-GAAP measures. Please refer to NON-GAAP FINANCIAL

MEASURES for the reconciliation.

Revenues for the three months ended September

30, 2022, decreased 4% year-over-year to $71.2 million

primarily driven by the weakening of the Euro against the U.S.

dollar's significant impact on the translation of the financial

results to U.S. dollars, lower sales volumes to our initial OEM

launch partner due to fuel price volatility in Europe and

contractual decrease in sales price year over year. This was

partially offset by the increased sales volumes from IAM, fuel

storage, hydrogen, electronics businesses, despite lower sales

volumes to the Russian market resulting from the impact of

sanctions from the ongoing Russian-Ukraine conflict, and softness

in demand from higher relative CNG and LNG fuel prices in

Europe.

Net loss was $11.9 million for the third

quarter of 2022, compared to a net loss of $5.8 million for

the same quarter last year. The decrease in earnings was driven by

the loss of equity income from the termination and sale of the CWI

joint venture and foreign exchange loss. The prior year quarter had

an additional $4.1 million in equity income primarily from

CWI. This was partially offset by higher year-over-year gross

margins of $1.2 million.

Westport generated negative $4.5 million in

Adjusted EBITDA during the third quarter of 2022, compared to

negative $1.4 million Adjusted EBITDA for the same period in

2021.

Segment Information

|

SEGMENT RESULTS |

Three months ended September 30, 2022 |

| |

Revenue |

|

Operating income (loss) |

|

|

Depreciation & amortization |

|

Equity income |

|

OEM |

$ |

44.1 |

|

$ |

(7.3 |

) |

|

$ |

2.1 |

|

$ |

0.2 |

| IAM |

|

27.1 |

|

|

2.2 |

|

|

|

0.7 |

|

|

— |

| Corporate |

|

— |

|

|

(5.8 |

) |

|

|

0.1 |

|

|

— |

| Total

Consolidated |

$ |

71.2 |

|

$ |

(10.9 |

) |

|

$ |

2.9 |

|

$ |

0.2 |

|

SEGMENT RESULTS |

Three months ended September 30, 2021 |

| |

Revenue |

|

Operating income (loss) |

|

|

Depreciation & amortization |

|

Equity income |

|

OEM |

$ |

48.0 |

|

$ |

(7.4 |

) |

|

$ |

2.4 |

|

$ |

0.3 |

| IAM |

|

26.3 |

|

|

0.7 |

|

|

|

0.8 |

|

|

— |

| Corporate |

|

— |

|

|

(1.9 |

) |

|

|

0.1 |

|

|

3.8 |

| Total

Consolidated |

$ |

74.3 |

|

$ |

(8.6 |

) |

|

$ |

3.3 |

|

$ |

4.1 |

|

SEGMENT RESULTS |

Nine Months Ended September 30, 2022 |

| |

Revenue |

|

Operating income (loss) |

|

|

Depreciation& amortization |

|

Equity income |

|

OEM |

$ |

150.2 |

|

$ |

(19.2 |

) |

|

$ |

6.3 |

|

$ |

1.0 |

| IAM |

|

77.5 |

|

|

1.8 |

|

|

|

2.4 |

|

|

— |

| Corporate |

|

— |

|

|

(15.7 |

) |

|

|

0.3 |

|

|

— |

| Total

Consolidated |

$ |

227.7 |

|

$ |

(33.1 |

) |

|

$ |

9.0 |

|

$ |

1.0 |

|

SEGMENT RESULTS |

Nine Months Ended September 30, 2021 |

| |

Revenue |

|

Operatingincome (loss) |

|

|

Depreciation & amortization |

|

Equity income |

|

OEM |

$ |

138.2 |

|

$ |

(17.3 |

) |

|

$ |

6.5 |

|

$ |

0.5 |

| IAM |

|

91.6 |

|

|

3.4 |

|

|

|

3.8 |

|

|

— |

| Corporate |

|

— |

|

|

(6.6 |

) |

|

|

0.2 |

|

|

18.2 |

| Total

Consolidated |

$ |

229.8 |

|

$ |

(20.5 |

) |

|

$ |

10.5 |

|

$ |

18.7 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Original Equipment Manufacturer

Segment

Revenue for the three and nine months ended

September 30, 2022, was $44.1 million and $150.2 million,

respectively, compared with $48.0 million and

$138.2 million for the three and nine months ended September

30, 2021. The decrease in revenue for the three months ended

September 30, 2022 was primarily driven by the 16% decrease in the

average Euro rate versus the U.S. dollar for the third quarter

which offset the higher sales volumes of our fuel storage, DOEM,

hydrogen, and electronics businesses period over period. Our

heavy-duty OEM sales volumes decreased 16% year-over-year mainly

due to the unfavorable fuel price differential between LNG and

diesel in Europe caused by the shortage of LNG supply.

The increase in revenue for the nine months

ended was primarily driven by the additional revenues from

increased sales volumes to OEMs in India of our light-duty CNG

products where we continue to see strong government support and

policies in place for the significant expansion of CNG vehicles,

increased sales volumes of our electronics, fuel storage, hydrogen

and DOEM products. This was partially offset by lower sales volumes

in Western Europe for our light-duty OEM products, lower revenues

year over year in our heavy-duty OEM business, and the foreign

exchange impact of the depreciation of the Euro.

For the third quarter, gross margin increased by

$1.6 million to $4.7 million, or 11% of revenue, compared

to $3.1 million, or 6% of revenue for the three months ended

September 30, 2021. The improvement was driven by increased sales

volumes in multiple OEM businesses, improved sales mix of

heavy-duty OEM system parts, partially offset by the annual

contractual price reduction to our initial OEM launch partner and

decrease in gross margin in our light-duty OEM business due to

increase in sales volumes to emerging markets with lower gross

margins. Further, we continue to incur higher production input

costs from supply chain challenges, and inflation in logistics,

utilities, and other costs, which we have only partially been able

to pass on to our OEM customers.

Year to date, gross margin decreased by $0.9

million to $14.4 million, or 10% of revenue, compared to

$15.3 million, or 11% of revenue for the nine months ended

September 30, 2021. Gross margin and gross margin percentage from

our HPDI 2.0 fuel systems product will vary based on production and

sales volumes, levels of development work, successful

implementation of initiatives to reduce the cost of input

materials, and foreign exchange rates. Margin pressure is expected

to continue through 2022 as production costs and contracted price

discounts with the existing OEM customers are only partially offset

by cost reductions of materials until a higher scale is achieved.

Despite headwinds from higher LNG fuel prices relative to diesel,

sales volumes to our initial OEM launch partner for the first nine

months of 2022 were comparable to the prior year. Higher LNG prices

are decreasing the demand for LNG trucks. Until relative LNG prices

fall relative to diesel, we expect HPDI 2.0 fuel system sales

growth to our initial OEM launch partner may be slowed. Partially

offsetting the decrease in gross margin includes the increased

gross margin from our fuel storage, hydrogen, electronics and DOEM

businesses.

In spite of these pressures, we remain confident

in the outlook for our OEM segment. Low to zero-emission

transportation is our future and our HPDI story provides an

affordable solution. We are increasingly optimistic about marketing

HPDI into new geographies such as India where we have already seen

OEM interest in the product. Supportive government policies to

mitigate climate change globally bolster the adoption of our

products and the increasing usage of biomethane now with hydrogen

tomorrow using HPDI accelerates the energy transition in heavy-duty

transport.

Independent Aftermarket

Segment

Revenue for the three and nine months ended

September 30, 2022, was $27.1 million and $77.5 million,

respectively, compared with $26.3 million and $91.6 million for the

three and nine months ended September 30, 2021. The revenue

increase compared to the same quarter last year was driven

primarily by higher sales volumes in Eastern Europe, especially

Poland, Algeria and Peru.

For the nine months ended September 30, 2022,

the decrease in revenue was primarily driven by lower sales volumes

to the Russian market due to the ongoing Russia-Ukraine conflict

and related sanctions, lower sales volumes to Eastern Europe and

Egypt and the aforementioned foreign exchange impact. The prior

year included a large one-time infrastructure project of $5.3

million in Tanzania to build fueling infrastructure to enable the

sale and operation of gaseous fueled vehicles.

For the third quarter, gross margin decreased by

$0.4 million to $6.6 million, or 24% of revenue, compared to $7.0

million, or 27% of revenue, for the three months ended September

30, 2021. Gross margin decreased by $6.3 million to $17.3 million,

or 22% of revenue, for the nine months ended September 30, 2022,

compared to $23.6 million, or 26% of revenue, for the nine months

ended September 30, 2021. The decrease in gross margin percentage

for both the three and nine months ended September 30, 2022, was

primarily driven by higher production input costs incurred in

materials, transportation, and energy costs caused by the global

supply chain shortage, inflation, and European energy supply

shortage. The loss of higher margin sales volumes to the Russian

market contributed $1.1 million to the decrease in margins.

The opportunity Westport has to expand market share

in current markets and advancing into emerging markets with our LPG

solutions is a real, decisive factor for growth. Supportive LPG

pricing is creating a promising demand trend for our business as

Westport continues to address and serve markets which can’t afford

expensive electric vehicles but are still looking for cleaner

solutions. These are the areas where Westport can continue to win

and drive market share.

FINANCIAL STATEMENTS & MANAGEMENT'S

DISCUSSION AND ANALYSIS

To view Westport financials for the third

quarter ended September 30th, 2022, please visit

https://investors.wfsinc.com/financials/

CONFERENCE CALL &

WEBCAST

Westport has scheduled a conference call for

Tuesday, November 8, 2022, at 7:00 am Pacific Time (10:00 am

Eastern Time) to discuss these results. To access the conference

call by telephone, please dial 1-800-319-4610 (Canada & USA

toll-free) or 604-638-5340. The live webcast of the conference call

can be accessed through the Westport website at

https://investors.wfsinc.com/

To access the conference call replay, please

dial 1-800-319-6413 (Canada & USA toll-free) or +1-604-638-9010

using the passcode 9432. The telephone replay will be available

until Tuesday, November 15th, 2022.

About Westport Fuel Systems

Westport Fuel Systems is driving innovation to

power a cleaner tomorrow. The company is a leading supplier of

advanced fuel delivery components and systems for clean, low-carbon

fuels such as natural gas, renewable natural gas, propane, and

hydrogen to the global automotive industry. Westport Fuel Systems’

technology delivers the performance and fuel efficiency required by

transportation applications and the environmental benefits that

address climate change and urban air quality challenges.

Headquartered in Vancouver, Canada, with operations in Europe,

Asia, North America and South America, the company serves customers

in more than 70 countries with leading global transportation

brands. For more information, visit www.wfsinc.com.

Cautionary Note Regarding Forward

Looking Statements This press release contains

forward-looking statements, including statements regarding revenue

expectations, future strategic initiatives and future growth,

future of our development programs (including those relating to

HPDI and Hydrogen), expected margin pressure, the Russia-Ukraine

conflict and related impacts, expectations regarding slower sales

growth to our OEM launch partner due to higher LNG prices, the

demand for our products, the future success of our business and

technology strategies, intentions of partners and potential

customers, the performance and competitiveness of Westport Fuel

Systems’ products and expansion of product coverage, future market

opportunities as well as Westport Fuel Systems management’s

response to any of the aforementioned factors. These statements are

neither promises nor guarantees but involve known and unknown risks

and uncertainties and are based on both the views of management and

assumptions that may cause our actual results, levels of activity,

performance or achievements to be materially different from any

future results, levels of activities, performance or achievements

expressed in or implied by these forward-looking statements. These

risks, uncertainties and assumptions include those related to our

revenue growth, operating results, industry and products, the

general economy, conditions of and access to the capital and debt

markets, access to required semiconductors, solvency, governmental

policies, sanctions and regulation, technology innovations,

fluctuations in foreign exchange rates, operating expenses,

continued reduction in expenses, ability to successfully

commercialize new products, the performance of our joint ventures,

the availability and price of natural gas, global government

stimulus packages and new environmental regulations, the acceptance

of and shift to natural gas vehicles, the relaxation or waiver of

fuel emission standards, the inability of fleets to access capital

or government funding to purchase natural gas vehicles, the

development of competing technologies, our ability to adequately

develop and deploy our technology, the actions and determinations

of our joint venture and development partners, the effects and

duration of COVID-19, the Russia-Ukraine conflict and ongoing

semiconductor shortages as well as other risk factors and

assumptions that may affect our actual results, performance or

achievements or financial position discussed in our most recent

Annual Information Form and other filings with securities

regulators. Readers should not place undue reliance on any such

forward-looking statements, which speak only as of the date they

were made. We disclaim any obligation to publicly update or revise

such statements to reflect any change in our expectations or in

events, conditions or circumstances on which any such statements

may be based, or that may affect the likelihood that actual results

will differ from those set forth in these forward-looking

statements except as required by National Instrument 51-102. The

contents of any website, RSS feed or twitter account referenced in

this press release are not incorporated by reference herein.

Contact InformationInvestor

RelationsWestport Fuel SystemsT: +1

604-718-2046

NON-GAAP FINANCIAL MEASURES

Management reviews the operational progress of

its business units and investment programs over successive periods

through the analysis of net income, EBITDA and Adjusted EBITDA. The

Company defines EBITDA as net income or loss from continuing

operations before income taxes adjusted for interest expense (net),

depreciation and amortization. Westport Fuel Systems defines

Adjusted EBITDA as EBITDA from continuing operations excluding

expenses for stock-based compensation, unrealized foreign exchange

gain or loss, and non-cash and other adjustments. Management uses

Adjusted EBITDA as a long-term indicator of operational performance

since it ties closely to the business units’ ability to generate

sustained cash flow and such information may not be appropriate for

other purposes. Adjusted EBITDA includes the company's share of

income from joint ventures.

The terms EBITDA and Adjusted EBITDA are not

defined under U.S. generally accepted accounting principles

("U.S. GAAP") and are not a measure of operating

income, operating performance or liquidity presented in accordance

with U.S. GAAP. EBITDA and Adjusted EBITDA have limitations as an

analytical tool, and when assessing the company's operating

performance, investors should not consider EBITDA and Adjusted

EBITDA in isolation, or as a substitute for net loss or other

consolidated statement of operations data prepared in accordance

with U.S. GAAP. Among other things, EBITDA and Adjusted EBITDA do

not reflect the company's actual cash expenditures. Other companies

may calculate similar measures differently than Westport Fuel

Systems, limiting their usefulness as comparative tools. The

company compensates for these limitations by relying primarily on

its U.S. GAAP results and using EBITDA and Adjusted EBITDA as

supplemental information.

|

GAAP & NON-GAAP FINANCIAL MEASURES |

|

($ in millions) |

3Q21 |

4Q21 |

1Q22 |

2Q22 |

3Q22 |

|

Three months ended |

|

Net income (loss) |

$ |

(5.8 |

) |

$ |

5.3 |

|

$ |

7.7 |

|

$ |

(11.6 |

) |

$ |

(11.9 |

) |

|

|

|

|

|

|

|

|

Income tax expense (recovery) |

|

0.4 |

|

|

(0.7 |

) |

|

(0.1 |

) |

|

0.1 |

|

|

0.9 |

|

|

Interest expense, net |

|

0.9 |

|

|

0.3 |

|

|

1.0 |

|

|

0.7 |

|

|

0.2 |

|

|

Depreciation and amortization |

|

3.3 |

|

|

3.5 |

|

|

3.1 |

|

|

3.1 |

|

|

2.8 |

|

|

EBITDA |

|

(1.2 |

) |

|

8.4 |

|

|

11.7 |

|

|

(7.7 |

) |

|

(8.0 |

) |

|

|

|

|

|

|

|

|

Stock based compensation |

|

0.7 |

|

|

0.6 |

|

|

0.5 |

|

|

0.9 |

|

|

0.8 |

|

|

Unrealized foreign exchange (gain) loss |

|

(0.9 |

) |

|

0.5 |

|

|

0.8 |

|

|

2.5 |

|

|

2.7 |

|

|

Asset impairment |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Bargain purchase gain |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Gain on sale of Investment |

|

— |

|

|

— |

|

|

(19.1 |

) |

|

— |

|

|

— |

|

|

Adjusted EBITDA |

$ |

(1.4 |

) |

$ |

10.0 |

|

$ |

(6.1 |

) |

$ |

(4.3 |

) |

$ |

(4.5 |

) |

|

|

|

WESTPORT FUEL SYSTEMS INC.Condensed Consolidated

Interim Balance Sheets (unaudited)(Expressed in thousands of United

States dollars, except share amounts)September 30, 2022 and

December 31, 2021 |

|

|

|

|

|

September 30, 2022 |

|

December 31, 2021 |

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents (including restricted cash) |

|

$ |

86,501 |

|

|

$ |

124,892 |

|

|

Accounts receivable |

|

|

90,882 |

|

|

|

101,508 |

|

|

Inventories |

|

|

82,854 |

|

|

|

83,128 |

|

|

Prepaid expenses |

|

|

8,952 |

|

|

|

6,997 |

|

|

Assets held for sale |

|

|

— |

|

|

|

22,039 |

|

|

Total current assets |

|

|

269,189 |

|

|

|

338,564 |

|

|

Long-term investments |

|

|

4,441 |

|

|

|

3,824 |

|

|

Property, plant and equipment |

|

|

56,900 |

|

|

|

64,420 |

|

|

Operating lease right-of-use assets |

|

|

22,123 |

|

|

|

28,830 |

|

|

Intangible assets |

|

|

7,531 |

|

|

|

9,286 |

|

|

Deferred income tax assets |

|

|

9,136 |

|

|

|

11,653 |

|

|

Goodwill |

|

|

2,707 |

|

|

|

3,121 |

|

|

Other long-term assets |

|

|

20,940 |

|

|

|

11,615 |

|

|

Total assets |

|

$ |

392,967 |

|

|

$ |

471,313 |

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

82,369 |

|

|

$ |

99,238 |

|

|

Current portion of operating lease liabilities |

|

|

3,460 |

|

|

|

4,190 |

|

|

Short-term debt |

|

|

8,702 |

|

|

|

13,652 |

|

|

Current portion of long-term debt |

|

|

10,582 |

|

|

|

10,590 |

|

|

Current portion of long-term royalty payable |

|

|

1,320 |

|

|

|

5,200 |

|

|

Current portion of warranty liability |

|

|

8,960 |

|

|

|

13,577 |

|

|

Total current liabilities |

|

|

115,393 |

|

|

|

146,447 |

|

|

Long-term operating lease liabilities |

|

|

18,432 |

|

|

|

24,362 |

|

|

Long-term debt |

|

|

32,850 |

|

|

|

45,125 |

|

|

Long-term royalty payable |

|

|

4,250 |

|

|

|

4,747 |

|

|

Warranty liability |

|

|

1,615 |

|

|

|

5,214 |

|

|

Deferred income tax liabilities |

|

|

3,182 |

|

|

|

3,392 |

|

|

Other long-term liabilities |

|

|

4,809 |

|

|

|

5,607 |

|

|

Total liabilities |

|

|

180,531 |

|

|

|

234,894 |

|

|

Shareholders’ equity: |

|

|

|

|

|

Share capital: |

|

|

|

|

|

Unlimited common and preferred shares, no par value |

|

|

|

|

|

171,296,279 (2021 - 170,799,325) common shares issued and

outstanding |

|

|

1,243,250 |

|

|

|

1,242,006 |

|

|

Other equity instruments |

|

|

9,140 |

|

|

|

8,412 |

|

|

Additional paid in capital |

|

|

11,516 |

|

|

|

11,516 |

|

|

Accumulated deficit |

|

|

(1,007,817 |

) |

|

|

(992,021 |

) |

|

Accumulated other comprehensive loss |

|

|

(43,653 |

) |

|

|

(33,494 |

) |

|

Total shareholders' equity |

|

|

212,436 |

|

|

|

236,419 |

|

|

Total liabilities and shareholders' equity |

|

$ |

392,967 |

|

|

$ |

471,313 |

|

|

|

|

WESTPORT FUEL SYSTEMS INC.Condensed Consolidated

Interim Statements of Operations and Comprehensive Income (Loss)

(unaudited)(Expressed in thousands of United States dollars, except

share and per share amounts) Three and nine months ended September

30, 2022 and 2021 |

|

|

|

|

|

Three months endedSeptember 30, |

|

|

Nine months endedSeptember 30, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Revenue |

|

$ |

71,182 |

|

|

$ |

74,343 |

|

|

$ |

227,690 |

|

|

$ |

229,794 |

|

|

Cost of revenue and expenses: |

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

59,910 |

|

|

|

64,214 |

|

|

|

195,986 |

|

|

|

190,905 |

|

|

Research and development |

|

|

6,473 |

|

|

|

6,207 |

|

|

|

17,661 |

|

|

|

20,419 |

|

|

General and administrative |

|

|

8,649 |

|

|

|

9,058 |

|

|

|

26,853 |

|

|

|

27,581 |

|

|

Sales and marketing |

|

|

3,351 |

|

|

|

3,176 |

|

|

|

10,914 |

|

|

|

9,828 |

|

|

Foreign exchange (gain) loss |

|

|

2,648 |

|

|

|

(893 |

) |

|

|

5,985 |

|

|

|

(2,495 |

) |

|

Depreciation and amortization |

|

|

1,074 |

|

|

|

1,224 |

|

|

|

3,342 |

|

|

|

4,188 |

|

|

Gain on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(146 |

) |

|

|

|

|

82,105 |

|

|

|

82,986 |

|

|

|

260,741 |

|

|

|

250,280 |

|

|

Loss from operations |

|

|

(10,923 |

) |

|

|

(8,643 |

) |

|

|

(33,051 |

) |

|

|

(20,486 |

) |

| |

|

|

|

|

|

|

|

|

|

Income from investments accounted for by the equity method |

|

|

202 |

|

|

|

4,098 |

|

|

|

953 |

|

|

|

18,738 |

|

|

Gain on sale of investment |

|

|

— |

|

|

|

— |

|

|

|

19,119 |

|

|

|

— |

|

|

Interest on long-term debt and accretion on royalty payable |

|

|

(796 |

) |

|

|

(1,380 |

) |

|

|

(2,695 |

) |

|

|

(4,437 |

) |

|

Bargain purchase gain from acquisition |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,856 |

|

|

Interest and other income, net of bank charges |

|

|

555 |

|

|

|

482 |

|

|

|

793 |

|

|

|

1,212 |

|

|

Income (loss) before income taxes |

|

|

(10,962 |

) |

|

|

(5,443 |

) |

|

|

(14,881 |

) |

|

|

883 |

|

|

Income tax expense (recovery) |

|

|

965 |

|

|

|

325 |

|

|

|

915 |

|

|

|

(7,438 |

) |

|

Net income (loss) for the period |

|

|

(11,927 |

) |

|

|

(5,768 |

) |

|

|

(15,796 |

) |

|

|

8,321 |

|

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

Cumulative translation adjustment |

|

|

(5,514 |

) |

|

|

(4,067 |

) |

|

|

(10,159 |

) |

|

|

(7,864 |

) |

|

Comprehensive income (loss) |

|

$ |

(17,441 |

) |

|

$ |

(9,835 |

) |

|

$ |

(25,955 |

) |

|

$ |

457 |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) per share: |

|

|

|

|

|

|

|

|

|

Net income (loss) per share - basic and diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.09 |

) |

|

$ |

0.05 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

171,246,067 |

|

|

|

169,500,461 |

|

|

|

171,200,403 |

|

|

|

156,673,290 |

|

|

Diluted |

|

|

171,246,067 |

|

|

|

169,500,461 |

|

|

|

171,200,403 |

|

|

|

158,533,077 |

|

|

|

|

WESTPORT FUEL SYSTEMS INC.Condensed Consolidated

Interim Statements of Cash Flows (unaudited)(Expressed in thousands

of United States dollars)Three and nine months ended September 30,

2022 and 2021 |

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Cash flows from (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Net income (loss) for the period |

|

$ |

(11,927 |

) |

|

$ |

(5,768 |

) |

|

$ |

(15,796 |

) |

|

$ |

8,321 |

|

|

Items not involving cash: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,900 |

|

|

|

3,309 |

|

|

|

9,040 |

|

|

|

10,485 |

|

|

Stock-based compensation expense |

|

|

815 |

|

|

|

629 |

|

|

|

2,210 |

|

|

|

1,252 |

|

|

Unrealized foreign exchange (gain) loss |

|

|

2,648 |

|

|

|

(893 |

) |

|

|

5,985 |

|

|

|

(2,495 |

) |

|

Deferred income tax |

|

|

531 |

|

|

|

69 |

|

|

|

— |

|

|

|

(9,606 |

) |

|

Income from investments accounted for by the equity method |

|

|

(202 |

) |

|

|

(4,098 |

) |

|

|

(953 |

) |

|

|

(18,738 |

) |

|

Interest on long-term debt and accretion on royalty payable |

|

|

796 |

|

|

|

1,380 |

|

|

|

2,695 |

|

|

|

4,437 |

|

|

Change in inventory write-downs to net realizable value |

|

|

476 |

|

|

|

87 |

|

|

|

1,025 |

|

|

|

409 |

|

|

Bargain purchase gain from acquisition |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,856 |

) |

|

Change in bad debt expense |

|

|

219 |

|

|

|

178 |

|

|

|

278 |

|

|

|

152 |

|

|

Gain on sale of investment |

|

|

— |

|

|

|

— |

|

|

|

(19,119 |

) |

|

|

— |

|

|

Gain on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(146 |

) |

|

Net cash used before working capital changes |

|

|

(3,744 |

) |

|

|

(5,107 |

) |

|

|

(14,635 |

) |

|

|

(11,785 |

) |

| |

|

|

|

|

|

|

|

|

|

Changes in non-cash operating working capital: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

3,342 |

|

|

|

7,574 |

|

|

|

5,813 |

|

|

|

2,532 |

|

|

Inventories |

|

|

(387 |

) |

|

|

(11,851 |

) |

|

|

(12,270 |

) |

|

|

(23,794 |

) |

|

Prepaid expenses |

|

|

(2,555 |

) |

|

|

(1,717 |

) |

|

|

(3,743 |

) |

|

|

4,639 |

|

|

Accounts payable and accrued liabilities |

|

|

(3,055 |

) |

|

|

(2,154 |

) |

|

|

(10,489 |

) |

|

|

4,134 |

|

|

Warranty liability |

|

|

(2,192 |

) |

|

|

(1,136 |

) |

|

|

(6,671 |

) |

|

|

(1,423 |

) |

|

Net cash used in operating activities |

|

|

(8,591 |

) |

|

|

(14,391 |

) |

|

|

(41,995 |

) |

|

|

(25,697 |

) |

|

Cash flows from (used in) investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment and other assets |

|

|

(2,467 |

) |

|

|

(5,084 |

) |

|

|

(8,450 |

) |

|

|

(7,946 |

) |

|

Sale of investments, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

600 |

|

|

Purchase of intangible assets |

|

|

(78 |

) |

|

|

— |

|

|

|

(374 |

) |

|

|

— |

|

|

Acquisition, net of acquired cash |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,948 |

) |

|

Proceeds on sale of investments and assets |

|

|

— |

|

|

|

— |

|

|

|

31,949 |

|

|

|

— |

|

|

Dividends received from joint ventures |

|

|

— |

|

|

|

7,229 |

|

|

|

— |

|

|

|

21,502 |

|

|

Net cash from investing activities of continuing operations |

|

|

(2,545 |

) |

|

|

2,145 |

|

|

|

23,125 |

|

|

|

8,208 |

|

|

Cash flows from (used in) financing activities: |

|

|

|

|

|

|

|

|

|

Repayments of short and long-term facilities |

|

|

(13,353 |

) |

|

|

(17,191 |

) |

|

|

(49,952 |

) |

|

|

(56,606 |

) |

|

Drawings on operating lines of credit and long-term facilities |

|

|

9,707 |

|

|

|

13,987 |

|

|

|

35,099 |

|

|

|

39,985 |

|

|

Payment of royalty payable |

|

|

— |

|

|

|

— |

|

|

|

(5,200 |

) |

|

|

(7,451 |

) |

|

Proceeds from share issuance, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

120,727 |

|

|

Net cash from (used in) financing activities |

|

|

(3,646 |

) |

|

|

(3,204 |

) |

|

|

(20,053 |

) |

|

|

96,655 |

|

|

Effect of foreign exchange on cash and cash equivalents |

|

|

3,109 |

|

|

|

(3,362 |

) |

|

|

532 |

|

|

|

(1,529 |

) |

|

Increase (decrease) in cash and cash equivalents |

|

|

(11,673 |

) |

|

|

(18,812 |

) |

|

|

(38,391 |

) |

|

|

77,637 |

|

|

Cash and cash equivalents, beginning of period (including

restricted cash) |

|

|

98,174 |

|

|

|

160,711 |

|

|

|

124,892 |

|

|

|

64,262 |

|

|

Cash and cash equivalents, end of period (including restricted

cash) |

|

$ |

86,501 |

|

|

$ |

141,899 |

|

|

$ |

86,501 |

|

|

$ |

141,899 |

|

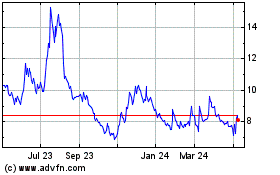

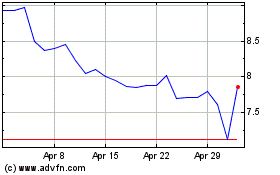

Westport Fuel Systems (TSX:WPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Westport Fuel Systems (TSX:WPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024