Keystone Pipeline Cancellation Raises Pressure on Canadian Producers

January 22 2021 - 1:51PM

Dow Jones News

By Vipal Monga and Collin Eaton

TORONTO -- President Biden's revocation of a permit for TC

Energy Corp.'s Keystone XL pipeline is raising pressure on Canada's

energy industry to seek new markets for oil and gas, its top

export.

Mr. Biden revoked the Keystone XL permit on Wednesday, hours

after taking office, effectively shutting down a 12-year,

cross-border project that would have carried 830,000 barrels a day

from Alberta to Nebraska and eventually to refiners on the Gulf

Coast. His executive order, which fulfilled a campaign promise,

cited concerns about climate change.

Canada, the world's fourth-largest oil producer, is left with

fewer options to get its dense, sticky crude from landlocked oil

sands to U.S. refiners. Canada and industry executives are also

working to counter claims that tapping oil sands is more damaging

to the climate than some other types of oil. They say Canadian

producers have lowered carbon emissions by using less coal-fired

power and more renewable energy to run their operations, among

other steps.

Chris Bloomer, president of the Canadian Energy Pipeline

Association, a trade group, said Mr. Biden's decision didn't take

into account the work the Canadian industry has done to reduce

emissions. "Obviously, it's very disappointing," he said.

Canadian Prime Minister Justin Trudeau said Wednesday that he

was disappointed with Mr. Biden's decision, but he also offered

support for the U.S. president's commitment to fight climate

change. Mr. Trudeau has set plans to reduce carbon emissions over

the next three decades, including a proposal for an increased

carbon tax.

Mr. Biden's decision to block Keystone XL won't immediately hurt

Canada's oil industry because production and demand have fallen

during the Covid-19 pandemic. In recent years, producers have

increased the amount of crude transported to the U.S. by rail,

traders said, reducing the need for Keystone XL.

But the likely demise of the project has underscored how reliant

Canada remains on the U.S. to export its crude. Canada's proven oil

reserves are third in the world behind Venezuela and Saudi Arabia,

according to the Canadian government, but much of what it pumps is

sent to refiners in the U.S., which buys 98% of Canada's oil

exports.

Canada's energy industry is pushing for more access to growing

markets in China and India, pinning hopes on the completion of a

pipeline next year that would extend from Alberta to the Pacific

coast. Keystone XL's failure makes the Trans Mountain pipeline even

more important, said Matt Murphy, an analyst with Tudor, Pickering,

Holt & Co.

Enbridge Inc., meanwhile, is working to replace a pipeline in

northern Minnesota by later this year. The revamped Line 3 will add

370,000 barrels a day of export capacity from Canada to Superior,

Wisconsin, according to research firm Rystad Energy.

Because Canadian producers have such limited and costly options

for getting their oil to buyers, it trades at a discount to global

benchmarks. The Western Canadian Select grade of dense crude that

is extracted from oil sands was trading at $39.30 on Thursday,

$13.70 below the West Texas Intermediate benchmark, according to

S&P Global Platts.

Trump administration sanctions on Venezuela and Iran and

production cuts by the Organization of the Petroleum Exporting

Countries have also raised the price of heavy crude from overseas

and increased the attractiveness of Canada's cheaper crude in the

U.S.

Refineries in the U.S. aren't clamoring for the Keystone XL

pipeline because its additional capacity would have eased the

logistical bottleneck that makes Canadian crude one of the most

profitable varieties for U.S. refiners, traders and analysts

said.

U.S. refiners have consumed more Canadian crude in recent

months. According to the Energy Information Administration,

Canadian exports of crude oil totaled nearly 4 million barrels for

the week ending Jan. 8, up 2% from a week earlier and comprising

56% of all imports into the U.S.

--Paul Vieira in Ottawa contributed to this article.

Write to Vipal Monga at vipal.monga@wsj.com and Collin Eaton at

collin.eaton@wsj.com

(END) Dow Jones Newswires

January 22, 2021 13:36 ET (18:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

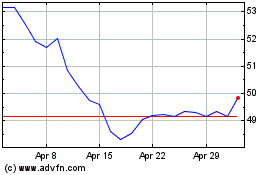

TC Energy (TSX:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

TC Energy (TSX:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024