Sun Life Financial's Bentall Kennedy, GreenOak Real Estate to Combine

December 19 2018 - 4:54AM

Dow Jones News

By WSJ Staff

Sun Life Financial Inc.'s (SLF.T) Bentall Kennedy division and

GreenOak Real Estate LP agreed to combine into a global real-estate

investment firm.

The new firm, named Bentall GreenOak, will be majority-owned by

Toronto-based Sun Life Financial and will operate under its

alternative asset-management arm, Sun Life Investment Management,

the companies said Wednesday.

The deal values Bentall GreenOak at $940 million, said

U.K.-based Tetragon Financial Group Ltd. (TFG.LN), a strategic

investor in GreenOak, in a news release. TFG Asset Management,

Tetragon's diversified alternative asset management business, will

own nearly 13% of the combined entity, the British company

said.

As of Sept. 30, 2018, Bentall Kennedy and GreenOak collectively

had more than 700 institutional clients with about $47 billion in

assets under management, the companies said.

Under the deal, Sun Life Financial will contribute its interest

in Bentall Kennedy and pay GreenOak shareholders $146 million in

cash in exchange for a 56% interest in the combined entity of

Bentall GreenOak, the companies said.

Aside from TFG Asset Management, GreenOak's co-founders, John

Carrafiell and Sonny Kalsi, and the firm's existing senior

management will also hold significant stakes in the combined

venture, according to the companies. Bentall Kennedy's senior

management team will also acquire a "meaningful ownership position"

in Bentall GreenOak, the companies said.

Sun Life Financial, which is financing the transaction with

surplus cash, will have an option to buy the remaining interest in

Bentall GreenOak about seven years after the deal closes, the

Canadian company said. Sun Life Financial said common shareholders'

equity will be reduced by about 730 million Canadian dollars (about

US$540 million) when the transaction is completed.

Gary Whitelaw, Bentall Kennedy's chief executive, will serve in

that role at the combined firm, the companies said.

"Combining Bentall Kennedy with GreenOak extends our

capabilities in real estate investment solutions, in a

complementary way and increases Sun Life Investment Management's

total assets under management to C$75 billion," said Steve Peacher,

president of Sun Life Investment Management, in a news release.

The transaction is subject to customary closing conditions,

including required regulatory approvals, and is expected to close

in the first half of 2019, the companies said.

(END) Dow Jones Newswires

December 19, 2018 04:39 ET (09:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

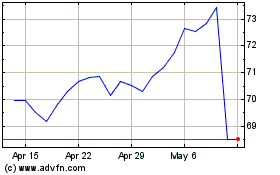

Sun Life Financial (TSX:SLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sun Life Financial (TSX:SLF)

Historical Stock Chart

From Apr 2023 to Apr 2024