Royal Bank of Canada Plans to Roll out U.S. Online Bank -- 2nd Update

February 21 2020 - 3:16PM

Dow Jones News

By Vipal Monga and Dave Sebastian

Royal Bank of Canada plans to roll out a direct-to-consumer bank

in the U.S. as it seeks to boost its deposit base and

wealth-management franchise.

"The loan book has been growing faster than the deposit book, so

growing our deposit strategy has become of paramount importance,"

said Chief Executive Dave McKay in a call with analysts following

the release of the bank's earnings report Friday. "So you'll see us

likely launch a direct-to-consumer bank in the United States

sometime at the end of this year."

Though Mr. McKay didn't provide details about the types of

services the online bank would offer, he said it would allow RBC to

cultivate customers "a little bit down market" from the extremely

wealthy clients the bank's wealth-management business usually

courts.

RBC's business catering to wealthy clients in the U.S. is

largely driven by its City National franchise, a bank it bought in

2015 for $5.4 billion. The deal has paid off by allowing the bank

to benefit from the growth in U.S. wealth-management

businesses.

RBC has been growing its City National branch network. It has

four branches in New York, and plans to open three more in the city

this year. The bank will also add one more branch in Washington,

D.C., doubling its branch network in the nation's capital.

Overall, RBC posted a net income of 3.51 billion Canadian

dollars ($2.64 billion), or C$2.40 a share, for its fiscal first

quarter ended Jan. 31. The result beat the C$2.26 a share that

analysts polled by FactSet had expected. It earned C$3.17 billion,

or C$2.15 a share, a year earlier.

Revenue at the bank's U.S. wealth-management business, which

includes City National, rose 12%, or $131 million, from a year

earlier. Loans and deposits both grew 19%, but net interest margins

fell 0.17 percentage point as interest rates fell.

Total revenue at Canada's largest bank by assets grew to C$12.84

billion from C$11.59 billion in the prior year. Analysts were

expecting C$11.47 billion.

Net income in the capital-markets division rose 35% to C$882

million as RBC booked higher fixed-income trading revenue and had

higher mergers-and-acquisitions activity and debt origination. The

boost from the capital markets business also raised costs, however.

Noninterest expenses rose 10% from last year, as the bank paid out

more in bonuses.

The personal-and-commercial banking unit's net income rose 7% to

C$1.69 billion, led by average loan growth of 7%, an increase in

residential mortgages and average deposit growth of 9% in

Canada.

The bank's provision for credit losses was C$419 million, 18%

lower than a year ago. The bank set aside less money for impaired

loans in personal-and-commercial banking, and wealth

management.

Bank executives said companies faced growing risk from the

coronavirus epidemic's impact on global economic activity and a

railway blockade by indigenous and climate-change activists in

Canada that has snarled supply chains.

"We are monitoring the situation closely," said Rod Bolger, the

bank's finance chief, in an interview. He said the bank has

"limited direct exposure" to the coronavirus epidemic because it

has no direct business in China, but some clients are feeling the

effect of the disruption on manufacturing and supply chains.

RBC's capital ratio was 12% for the quarter, compared with 11.4%

in the year-ago period. Mr. Bolger said the bank is "very

comfortable" at the level and doesn't see any reason to increase

the ratio much from there.

The bank raised its quarterly dividend by 2.9% to C$1.08,

payable May 22 to shareholders of record on April 23.

Write to Vipal Monga at vipal.monga@wsj.com and Dave Sebastian

at dave.sebastian@wsj.com

(END) Dow Jones Newswires

February 21, 2020 15:01 ET (20:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

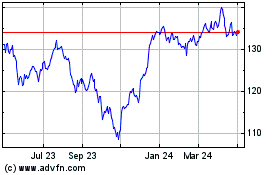

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

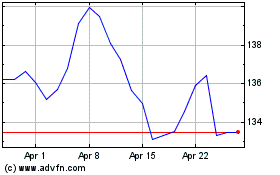

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024