Colabor Group Inc. (TSX: GCL) (“Colabor” or the “Company”) reports

its results for the fourth quarter and the fiscal year ended

December 25, 2021.

Fourth Quarter 2021 Financial Highlights:

-

Sales increased by 12.9% to $150.5 million, compared to $133.3

million for the fourth quarter of 2020, with restaurant dining

rooms open throughout the quarter in 2021 unlike the closing of the

dining rooms from October 1, 2020;

-

Net earnings from continuing operations increased to

$5.3 million compared to $0.6 million for the

corresponding period of 2020, resulting primarily from the

increased income not related to current operations, essentially

from the partial reimbursement of a penalty paid in 2017 to the

Ontario Ministry of Finance;

-

Adjusted EBITDA(1) decreased to $7.1 million from $7.5 million for

the corresponding period of 2020 and decrease in adjusted EBITDA(1)

margin to 4.7% of sales compared to 5.6% of sales during the

corresponding period of 2020. This decrease is mainly explained by

the decrease in subsidies obtained of $1.6 million. Excluding the

impact of subsidies obtained, the adjusted EBITDA(1) margin would

have been 4.6% in 2021 and 4.3% in 2020; and

-

Cash flow generated by operating activities was down to $9.0

million compared to $13.0 million for the fourth quarter of

2020, due to higher utilization of working capital(4).

Fiscal 2021 Financial Highlights:

-

Sales amounted to $475.8 million, up 3.1% compared to fiscal

year 2020, mainly explained by a volume increase from restaurants,

mitigated by the termination of a contract from the Specialized

distribution during the first quarter of 2020;

-

Net earnings from continuing operations increased to

$8.3 million compared to $3.8 million for fiscal year

2020 resulting primarily from the increased income not related to

current operations, as explained above, depreciation and

amortization expenses and financial expenses mitigated by the

decrease of the adjusted EBITDA(1);

-

Adjusted EBITDA(1) decreased to $25.4 million or 5.3% of sales

compared to $28.9 million or 6.3% of sales for the fiscal year

2020. Excluding the impact of subsidies obtained of $4.3 million,

the adjusted EBITDA(1) margin would have been 4.8% in 2021 and 4.7%

in 2020;

-

Cash flow generated by operating activities down to $18.8 million

compared to $36.4 million in 2020 due to higher utilization of

working capital(4);

-

Net debt(2) decreased to $48.4 million, compared to

$52.1 million as at December 26, 2020. The leverage ratio(3)

is 1.9x as at December 25, 2021, compared to 1.8x in 2020; and

-

Conclusion of new credit agreements in February 2021, and

redemption of all outstanding convertible debentures completed on

March 23, 2021.

Table of fourth quarter and fiscal 2021 Financial

Highlights:

| Financial

highlights |

16 weeks |

52 weeks |

|

(in thousands of dollars except percentages, per share data and

financial leverage ratio) |

2021 |

2020 |

2021 |

2020 |

|

|

$ |

$ |

$ |

$ |

|

|

Sales from continuing operations |

150,452 |

133,317 |

475,761 |

461,319 |

|

| Adjusted EBITDA(1) |

7,080 |

7,459 |

25,420 |

28,913 |

|

| Adjusted EBITDA(1) margin

(%) |

4.7 |

5.6 |

5.3 |

6.3 |

|

| Net earnings from continuing

operations |

5,336 |

620 |

8,253 |

3,798 |

|

| Net earnings (loss) |

5,139 |

811 |

7,842 |

(8,612 |

) |

| Per share - basic and diluted

($) |

0.05 |

0.01 |

0.08 |

(0.08 |

) |

| Cash

flow from operating activities |

9,035 |

13,005 |

18,752 |

36,436 |

|

|

Financial position |

|

|

As at |

As at |

|

| |

|

|

December 25, |

December 26, |

|

| |

|

|

2021 |

2020 |

|

| Net debt(2) |

|

|

48,366 |

52,100 |

|

|

Financial leverage ratio(3) |

|

|

1.9x |

1.8x |

|

| (1) |

|

Non-IFRS measure. Refer to the table Reconciliation of Net Earnings

to adjusted EBITDA in MD&A section 6 "Non-IFRS Performance

Measures". Adjusted EBITDA corresponds to net operating earnings

before (income) costs not related to current operations,

depreciation and amortization and expenses for stock-based

compensation plan. |

| (2) |

|

Non-IFRS measure. Refer to MD&A section 6 "Non-IFRS

Performance Measures". Net debt corresponds to bank indebtedness,

current portion of long-term debt, long-term debt and convertible

debentures, net of cash. |

| (3) |

|

Financial leverage ratio is an indicator of the Company's ability

to service its long-term debt. It is defined as net debt / adjusted

EBITDA for the last four quarters. Refer to MD&A section 6

"Non-IFRS Performance Measures". |

“The easing of health measures throughout Quebec

between the end of May and December 31, the diversification of our

channels and the implementation of the first milestones of our

strategic plan have enabled us to support the growth of our

revenues during the fourth quarter. Excluding the grants acquired

during the previous year and the current one, our operating

profitability has also improved in a sustainable manner for the

coming quarters”, said Louis Frenette, President and Chief

Executive Officer of Colabor.

“The successful transformation of our operations

over the past two years, the adjustment of our compensation

practices to industry norms, the renewal of the management team and

our more focused efforts on our value-added activities have enabled

us to be more efficient and competitive”.

“With the refinancing of our balance sheet at

the end of the first quarter, a lower level of indebtedness and

growth opportunities both organically and through acquisitions, we

are now well positioned to continue creating value for all of our

stakeholders”, concluded Louis Frenette.

Results for the Fourth Quarter of

2021

Consolidated sales for the fourth quarter

amounted to $150.5 million compared to $133.3 million during the

corresponding quarter of 2020, an increase of 12.9%. Sales for the

Distribution segment increased by 19.8% explained by a volume

increase from restaurants, since the dinning room remained open in

fall of 2021 unlike a closing on October 1, 2020. Wholesale segment

sales increased by 5.6%, due to open dining rooms in 2021 as

mentioned above, the growth of certain customers less affected by

the effects of the pandemic and by new customers, mitigated by the

partial loss of volume from a single customer.

Adjusted EBITDA(1) from continuing activities

reached $7.1 million or 4.7% of sales from continuing activities

compared to $7.5 million or 5.6% during 2020. These variations are

mainly explained by the decrease in subsidies obtained of $1.6

million, additional labor costs in the current context of labor

shortage, the impact of a week-long strike, as well as investments

to expand our territory and for the repositioning of our private

brand, mitigated by an increase in sales. Excluding the impact of

subsidies obtained, the adjusted EBITDA(1) margin would have been

4.6% in 2021 and 4.3% in 2020.

Net earnings from continuing operations were

$5.3 million, an increase compared to $0.6 million for the

corresponding quarter of the previous year, resulting essentially

from the increase of the income not related to current operations,

the depreciation and amortization expenses, and the financial

expenses, mitigated by the decrease of the adjusted EBITDA(1), as

explained previously.

Net earnings for the fourth quarter were

$5.1 million, compared to net earnings of $0.8 million for the

corresponding period of 2020. The variation is explained by the

facts described above mitigated by the variation of $0.4 million in

net loss from discontinued operations.

Results for Fiscal Year

2021

Cumulative consolidated sales amounted to $475.8

million compared to $461.3 million in fiscal year 2020, an increase

of 3.1% mainly from the Distribution segment. The increase in the

Distribution segment is mainly explained by the increase in volume

from restaurants in the fourth quarter, mitigated by the

termination of a contract from the Specialized distribution during

the first quarter of 2020, as well as the volume decrease related

to the pandemic for restaurants and chains clients during the first

quarter of 2021. Wholesale segment sales have increased by 1.9%

partially explained by the reopening of the restaurant business as

mentioned above, a volume increase from some customers less

affected by the effects of the pandemic and by new customers,

mitigated by a volume decrease related to the pandemic during the

first quarter of 2021 and by the partial loss of volume from a

single customer.

Adjusted EBITDA(1) from continuing operations

reached $25.4 million or 5.3% of sales from continuing operations

compared to $28.9 million or 6.3% in 2020 and is mainly explained

by the reduction of $4.3 million in subsidies obtained.

Excluding the impact of subsidies obtained, the adjusted EBITDA(1)

margin would have been 4.8% in 2021 and 4.7% in 2020.

Net earnings from continuing operations was $8.3

million, up from $3.8 million in last fiscal year. The variation is

mainly explained by the increase of the income not related to

current operations, the depreciation and amortization expenses and

the financial expenses mitigated by the decrease of the adjusted

EBITDA(1) as mentioned previously.

Cash Flow and Financial

Position

Cash flows from operating activities reached

$18.8 million for fiscal year 2021 compared to $36.4 million for

fiscal year 2020. This decrease is mainly due to higher utilization

of working capital(4) and a lower adjusted EBITDA(1), mitigated by

higher income not related to current operations. The higher

utilization of working capital(4) is explained by the timing of

inventories purchase and suppliers payments, as well as higher

collection of receivables in 2020.

As at December 25, 2021, the Company's

working capital(4) was $40.8 million, up from $31.2 million at the

end of the fiscal year 2020. This variation is explained by the

increase in sales during the fourth quarter of 2021 and a

non-recurring gain receivable as at December 25, 2021.

As at December 25, 2021, the Company's net

debt(2) was down to $48.4 million, compared to $52.1 million at the

end of the fiscal year 2020. This decrease is mainly due to credit

facility repayments.

Outlook

“We are starting the year 2022 on solid

foundations. The implementation of our strategic plan allows us to

improve our customer mix, our product offering and gain market

share in certain territories. We are in an excellent position to

take advantage of the gradual recovery of restaurant activities in

Quebec.

Importantly in the context of the pandemic and

labor shortage, our industry-aligned compensation practices will

allow us to improve our competitiveness as an employer and to

retain and attract the best candidates. In these constantly

changing market, I am very proud of the efforts made by our

employees, who adapt to new conditions every day and contribute to

Colabor's success,” commented Louis Frenette.

Non-IFRS Performance

Measures

The information provided in this release

includes non-IFRS performance measures, notably adjusted earnings

before financial expenses, depreciation and amortization and income

taxes ("Adjusted EBITDA")(1). As these concepts are not defined by

IFRS, they may not be comparable to those of other companies. Refer

to Section 6 "Non-IFRS Performance Measures" in the Management's

Discussion and Analysis.

|

Reconciliation of Net Earnings to Adjusted

EBITDA(1) |

16 weeks |

|

52 weeks |

|

(in thousands of dollars) |

2021 |

|

2020 |

|

|

2021 |

|

2020 |

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

Net earnings from continuing operations |

5,336 |

|

620 |

|

|

8,253 |

|

3,798 |

|

Income taxes (recovered) |

(19 |

) |

(320 |

) |

|

1,435 |

|

1,171 |

| Financial expenses |

1,286 |

|

1,975 |

|

|

5,109 |

|

6,712 |

|

Operating earnings |

6,603 |

|

2,275 |

|

|

14,797 |

|

11,681 |

|

Expenses for stock-based compensation plan |

155 |

|

84 |

|

|

303 |

|

309 |

| (Income) costs not related to

current operations |

(3,998 |

) |

344 |

|

|

(3,768 |

) |

1,811 |

| Depreciation and

amortization |

4,320 |

|

4,756 |

|

|

14,088 |

|

15,112 |

|

|

|

|

|

|

|

|

Adjusted EBITDA(1) |

7,080 |

|

7,459 |

|

|

25,420 |

|

28,913 |

Additional Information

The Management Discussion and Analysis and the

consolidated financial statements of the Company are available on

SEDAR (www.sedar.com). Additional information, including the annual

information form, about Colabor Group Inc. can also be found on

SEDAR and on the Company’s website at

www.colabor.com.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined under applicable securities

law. Forward-looking information may relate to Colabor's future

outlook and anticipated events,

business, operations, financial

performance, financial condition or results and, in some

cases, can be identified by terminology such as "may"; "will";

"should"; "expect"; "plan"; "anticipate"; "believe"; "intend";

"estimate"; "predict"; "potential"; "continue"; "foresee"; "ensure"

or other similar expressions concerning matters that are not

historical facts. Particularly, statements regarding the

Company’s financial guidelines, future operating results and

economic performance, objectives and strategies are forward-looking

statements. These statements are based on certain factors and

assumptions including expected growth, results of operations,

performance and business prospects and opportunities, which

Colabor believes are reasonable as of the current

date. Refer in particular to section 2.2 "Development

Strategies and Outlook" of the Company's MD&A available on

SEDAR (www.sedar.com). While Management considers these assumptions

to be reasonable based on information currently available to the

Company, they may prove to be incorrect. Forward-looking

information is also subject to certain factors, including risks and

uncertainties that could cause actual results to differ materially

from what Colabor currently expects. For more exhaustive

information on these risks and uncertainties, the reader should

refer to section 10 "Risks and Uncertainties" of the Company's

MD&A. These factors,which include the risks related to the

pandemic of Covid-19 ("pandemic") and the possible impacts on

consumers and the economy, are not intended to represent a complete

list of the factors that could affect Colabor and future events and

results may vary significantly from what Management currently

foresees. The reader should not place undue importance on

forward-looking information contained in this press release,

information representing Colabor's expectations as of the date of

this press release (or as of the date they are otherwise stated to

be made) and are subject to change after such date. While

Management may elect to do so, the Company is under no obligation

(and expressly disclaims any such obligation) and does not

undertake to update or alter this information at any particular

time, whether as a result of new information, future events or

otherwise, except as required by law.

Conference Call

Colabor will hold a conference call to discuss

these results on Monday, February 28, 2022, beginning at 9:30 a.m.

Eastern time. Interested parties can join the call by dialing

1-888-390-0549 (from anywhere in North America) or 1-416-764-8682.

If you are unable to participate, you can listen to a recording by

dialing 1-888-390-0541 or 1-416-764-8677 and entering the code

912818# on your telephone keypad. The recording will be available

from 1:30 p.m. on Monday, February 28, 2022, until 11:59 p.m.

on March 7, 2022.

Those wishing to join the webcast can do so by clicking on the

following link:

http://www.colabor.com/en/investisseurs/evenements-et-presentations/

About Colabor

Colabor is a distributor and wholesaler of food

and related products serving the hotel, restaurant and

institutional markets or "HRI" in Quebec and in the Atlantic

provinces, as well as the retail market. Within its two operating

segments, Colabor offers specialty food products such as meat,

fresh fish and seafood, as well as food and related products

through its Broadline activities.

Further information:

| Pierre

BlanchetteSenior Vice President and Chief Financial

OfficerColabor Group IncTel.: 450-449-4911 extension

1308investors@colabor.com |

Danielle

Ste-MarieSte-Marie Strategy and Communications

Inc.Investor RelationsTel.: 450-449-0026 extension 1180 |

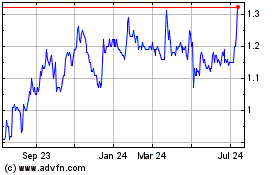

Colabor (TSX:GCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

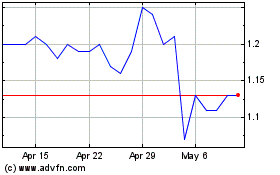

Colabor (TSX:GCL)

Historical Stock Chart

From Apr 2023 to Apr 2024