Blackline Announces $8 Million Bought Deal Financing and $12 Million Concurrent Private Placement

August 10 2022 - 7:00AM

Blackline Safety Corp. ("

Blackline" or the

"

Company") (TSX: BLN), a global leader in

connected safety, is pleased to announce that it has entered into

an agreement with a syndicate of underwriters (the

“

Underwriters”) led by PI Financial Corp. to

purchase on a bought deal basis, 3,640,000 common shares of

Blackline (“

Common Shares”) at a price of $2.20

per Common Share (the “

Offering Price”) for gross

proceeds to the Company of approximately $8.0 million (the

“

Offering”). The Company has granted the

Underwriters an over-allotment option exercisable at any time up to

30 days following the closing of the Offering, to purchase up to an

additional 15% Common Shares at a price per Common Share equal to

the Offering Price. In the event that the over-allotment option is

exercised in full, the gross proceeds of the Offering will be

approximately $9.2 million.

Concurrently with the Offering, the Company

intends to complete a non-brokered private placement (the

"Concurrent Private Placement") of $12 million of

Common Shares (the "Placement Common Shares") at

Offering Price to DAK Capital Inc. ("DAK"), and

entities owned and controlled by Cody Slater, the Chief Executive

Officer and Chairman of the Company and Brad Gilewich, a director

of the Company. The Concurrent Private Placement is expected to

close concurrently with the closing of the Offering. The Placement

Common Shares will be subject to a statutory hold period.

Completion of the Concurrent Private Placement is subject to a

number of conditions, including the approval of the Toronto Stock

Exchange. Completion of the Offering is conditional upon the

concurrent closing of the Concurrent Private Placement for gross

proceeds of not less than $10 million.

The Company intends to use the net proceeds from

the Offering and Concurrent Private Placement for general corporate

and working capital purposes.

The Common Shares issuable pursuant to the

Offering will be offered by way of a short form prospectus to be

filed with the securities commissions and other similar regulatory

authorities in each of the provinces of Canada, other than Quebec,

pursuant to National Instrument 44-101 Short Form Prospectus

Distributions, and in the United States on a private placement

basis pursuant to an exemption from the registration requirements

of the United States Securities Act of 1933, as amended. The

closing of the Offering and Concurrent Private Placement is

scheduled to occur on or about August 25, 2022, and is subject to

certain conditions including, but not limited to, the receipt of

all necessary approvals including the approval of the Toronto Stock

Exchange and the securities regulatory authorities, and the

satisfaction of other customary closing conditions.

In respect of the Concurrent Private Placement,

each of DAK, Mr. Slater and Mr. Gilewich are currently "related

parties" of the Company in accordance with Multilateral Instrument

61-101- Protection of Minority Security Holders in Special

Transactions ("MI 61-101"). As such, the

acquisition of Placement Common Shares by such persons in

connection with the Concurrent Private Placement will be considered

a "related party transaction" pursuant to MI 61-101. Pursuant to MI

61-101, absent an available exemption, the Company may be required

to obtain minority approval and a formal valuation for the issuance

of Placement Common Shares to such persons in connection with the

Concurrent Private Placement. Such an exemption is expected to be

available for the issuance of Placement Common Shares pursuant to

Sections 5.5(a) and 5.7(a) of MI 61-101, respectively, because

neither the fair market value of the subject matter of, nor the

fair market value consideration for the transaction insofar as it

involves such related parties, exceeds 25% of the Company's market

capitalization.

About Blackline Safety:

Blackline Safety is a technology leader driving innovation in the

industrial workforce through IoT. With connected safety devices and

predictive analytics, Blackline enables companies to drive towards

zero safety incidents and improved operational performance.

Blackline provides wearable devices, personal and area gas

monitoring, cloud-connected software and data analytics to meet

demanding safety challenges and enhance overall productivity for

organizations with coverage in more than 100 countries. Armed with

cellular and satellite connectivity, Blackline provides a lifeline

to tens of thousands of people, having reported over 185 billion

data-points and initiated over five million emergency responses.

For more information, visit BlacklineSafety.com and

connect with us

on Facebook, Twitter, LinkedIn and Instagram.

INVESTOR/ANALYST CONTACTCody Slater,

CEOcslater@blacklinesafety.comTelephone: +1 403 451 0327

MEDIA CONTACTShane Grennan,

CFOsgrennan@blacklinesafety.comTelephone: +1 403 451-0327

Note Regarding Forward-Looking

Statements

This press release contains certain

forward–looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" and similar expressions are

intended to identify forward-looking information or statements. In

particular, but without limiting the forgoing, this press release

contains statements concerning the anticipated use of the net

proceeds of the Offering and Concurrent Private Placement, the

closing date of the Offering and Concurrent Private Placement and

expected exemptions for the Concurrent Private Placement under MI

61-101. Although Blackline believes that the expectations reflected

in these forward-looking statements are reasonable, undue reliance

should not be placed on them because Blackline can give no

assurance that they will prove to be correct. Since forward looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. The intended

use of the net proceeds of the Offering and Concurrent Private

Placement by Blackline might change if the board of directors of

Blackline determines that it would be in the best interests of

Blackline to deploy the proceeds for some other purpose and the

closing date for the Offering may be changed and the noted

exemptions under MI 61-101 stated herein may not be available to

the Company. The forward looking statements contained in this press

release are made as of the date hereof and Blackline undertakes no

obligations to update publicly or revise any forward looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

This press release shall not constitute

an offer to sell or a solicitation of an offer to buy the

securities in any jurisdiction. The common shares of Blackline will

not be and have not been registered under the United States

Securities Act of 1933, as amended, and may not be offered or sold

in the United States, or to a U.S. person, absent registration or

applicable exemption therefrom.

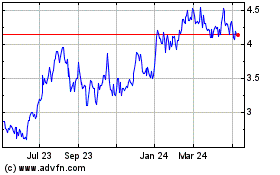

Blackline Safety (TSX:BLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

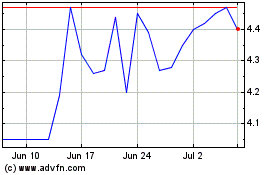

Blackline Safety (TSX:BLN)

Historical Stock Chart

From Apr 2023 to Apr 2024