Brookfield Business Partners (NYSE: BBU, BBUC; TSX: BBU.UN, BBUC),

together with institutional partners (collectively “Brookfield”)

today announced it has entered into a partnership to acquire

Nielsen Holdings plc (NYSE: NLSN) (“Nielsen” or the “Company”) in

an all-cash transaction valued at approximately $16 billion.

Nielsen is a global leader in third-party

audience measurement, data and analytics across all forms of media

and content, generating $3.5 billion in annual global revenue. The

Company is an essential service provider to the video and audio

advertising industry providing critical measurement data for

advertising buyers and sellers.

“We are pleased to invest in Nielsen, a

market-leading company that is deeply embedded in the media

ecosystem as a trusted service provider to its customers,"

commented Dave Gregory, Managing Partner, Brookfield Business

Partners. “Nielsen is well positioned to lead the industry into the

next generation of audience measurement across all channels and

platforms."

Investment Highlights

- Market-leading

position. Nielsen is a global leader in audience

measurement and a trusted partner to its customers across the

entire media ecosystem. The Company has more than 50 years of

statistically significant historical data and its scale is

unmatched by competitors.

- Essential service

provider. Nielsen’s measurement data underpins the $100+

billion video and audio advertising markets and its measurement

data is the established industry standard by which video and audio

advertising spend transacts.

- Resilient performance and

outlook. The Company’s history of consistent growth is

driven by its valued offering and longstanding customer

relationships. Nielsen’s scale and existing market position should

support the Company’s ability to consistently grow its measurement

business.

- Value creation

potential. Nielsen is well positioned to be the leader in

cross-media measurement as audience viewership behavior continues

to evolve. The development and adoption of Nielsen ONE, Nielsen’s

cross-media measurement service, will deliver a unified measure of

consumer viewership across all media and support the Company’s

growth strategy.

Funding

Brookfield will invest approximately $2.65

billion by way of preferred equity, convertible into 45% of

Nielsen’s common equity. Brookfield will be actively involved in

the Company’s governance. Brookfield Business Partners expects to

invest approximately $600 million, and the balance of Brookfield’s

investment will be funded from institutional partners.

Prior to or following closing, a portion of

Brookfield Business Partners' commitment may be syndicated to other

institutional investors.

Transaction Process

The transaction is subject to customary closing

conditions and is expected to close in the second half of 2022.

Brookfield Business Partners is

a global business services and industrials company focused on

owning and operating high-quality businesses that provide essential

products and services and benefit from a strong competitive

position. Investors have flexibility to invest in our company

either through Brookfield Business Partners L.P. (NYSE: BBU; TSX:

BBU.UN), a limited partnership, or Brookfield Business Corporation

(NYSE, TSX: BBUC), a corporation. For more information, please

visit https://bbu.brookfield.com.

Brookfield Business Partners is the flagship

listed vehicle of Brookfield Asset Management’s Private Equity

Group. Brookfield Asset Management is a leading global alternative

asset manager with approximately $690 billion of assets under

management. More information is available at

www.brookfield.com.

For more information, please contact:

| Investor

RelationsAlan FlemingTel: +1 (416) 645 2736Email:

alan.fleming@brookfield.com |

MediaSebastien

BouchardTel: +1 (416) 943-7937Email:

sebastien.bouchard@brookfield.com |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND

INFORMATION

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian and U.S. securities laws.

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future events or conditions,

include statements regarding the operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies and outlook of Brookfield Business Partners, as well as

the outlook for North American and international economies for the

current fiscal year and subsequent periods, and include words such

as “expects,” “anticipates,” “plans,” “believes,” “estimates,”

“seeks,” “intends,” “targets,” “projects,” “forecasts” or negative

versions thereof and other similar expressions, or future or

conditional verbs such as “may,” “will,” “should,” “would” and

“could.”

Although we believe that our anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, which may

cause the actual results, performance or achievements of Brookfield

Business Partners to differ materially from anticipated future

results, performance or achievement expressed or implied by such

forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: the

impact or unanticipated impact of general economic, political and

market factors in the countries in which we do business; including

as a result of the ongoing novel coronavirus (SARS-CoV-2) pandemic,

including any SARS-CoV-2 variants (collectively, “COVID-19”); the

behavior of financial markets, including fluctuations in interest

and foreign exchange rates; global equity and capital markets and

the availability of equity and debt financing and refinancing

within these markets; strategic actions including dispositions; the

ability to complete and effectively integrate acquisitions into

existing operations and the ability to attain expected benefits;

changes in accounting policies and methods used to report financial

condition (including uncertainties associated with critical

accounting assumptions and estimates); the ability to appropriately

manage human capital; the effect of applying future accounting

changes; business competition; operational and reputational risks;

technological change; changes in government regulation and

legislation within the countries in which we operate; governmental

investigations; litigation; changes in tax laws; ability to collect

amounts owed; catastrophic events, such as earthquakes; hurricanes

and pandemics/epidemics; the possible impact of international

conflicts and other developments including terrorist acts and cyber

terrorism; and other risks and factors detailed from time to time

in our documents filed with the securities regulators in Canada and

the United States.

In addition, our future results may be impacted

by various government mandated economic restrictions resulting from

the ongoing COVID-19 pandemic and the related global reduction in

commerce and travel and substantial volatility in stock markets

worldwide, which may negatively impact our revenues, affect our

ability to identify and complete future transactions, impact our

liquidity position and result in a decrease of cash flows and

impairment losses and/or revaluations on our investments and

assets, and therefore we may be unable to achieve our expected

returns. See “Risks Associated with the COVID-19 Pandemic” in the

“Risks Factors” section included in our Management’s Discussion and

Analysis of Financial Condition and Results of Operations in our

Form 20-F for the year ended December 31, 2020.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive. When

relying on our forward-looking statements, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Except as required by law,

Brookfield Business Partners undertakes no obligation to publicly

update or revise any forward-looking statements or information,

whether written or oral, that may be as a result of new

information, future events or otherwise.

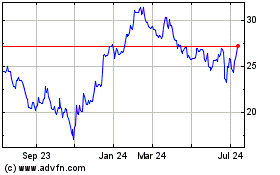

Brookfield Business Part... (TSX:BBU.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brookfield Business Part... (TSX:BBU.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024