The proposed expansion of Pueblo Viejo, already one of the world’s

Tier One1 gold mines, includes an expansion of the mine’s

processing plant and tailings capacity with an estimated

initial capital investment of more than a billion dollars

(100% basis) and the potential to extend the life of the mine into

the 2030s and beyond2. Barrick expects to complete a

feasibility study for the expansion project during 2020. The

proposed capital investment would more than double the contribution

the mine has already made to the Dominican Republic.

Barrick Gold Corporation’s President and Chief

Executive Officer Mark Bristow, speaking at a local media briefing

here today, said the proposed investment was further evidence of

the joint venture partners’ long-term commitment to the social and

economic development of the Dominican Republic.

“We look forward to continue making a

significant and growing contribution to our communities and other

stakeholders and to unlocking the enormous value of its mineral

potential while addressing the historical third-party environmental

issues,” he said. Barrick manages the mine which is a joint

venture with Newmont Goldcorp.

Bristow noted that the joint venture partners

had already invested $5.2 billion in Pueblo Viejo, which

represents almost 20% of the total foreign direct investment in the

Dominican Republic over the past 10 years. Direct cash taxes

paid by the mine amounted to $1.6 billion which represents 57%

of the cash distributions compared to 43% earned by the joint

venture partners. Since 2013 the mine has accounted for 30%

of the country’s exports, and generated a net added value of

$5.7 billion and a total net added value of $8.5 billion,

equal to 2% of the Dominican gross domestic product.

“Some 96% of the mine’s employees are Dominicans

and this has also had a significant impact on the lives of the more

than 90,000 people in neighboring communities who have benefited

from its community upliftment programs. It has also promoted

the development of the local economy, spending more than

$123 million with local contractors and suppliers over the

past six years,” Bristow said.

“We look forward to building on what we have

already achieved here, and to continue creating value for all our

stakeholders, notably the government and people of the Dominican

Republic and our shareholders.”

Enquiries:

|

Mark BristowPresident and CEO+1 647 205 7694+44 788 071 1386 |

Mark HillChief Operating Officer LATAM and Asia Pacific+1 (416) 307

7429+1 (416) 358 4667 |

Kathy du PlessisRelations with Media and Investors+44 20 7557

7738barrick@dpapr.com |

Website: www.barrick.com

About Barrick

On January 1, 2019, a new Barrick was born as a

result of the merger between Barrick Gold Corporation and Randgold

Resources Limited. Shares in the new company trade on NYSE (GOLD)

and TSX (ABX).

The merger has created a sector-leading gold

company which owns five of the industry’s Top 10 Tier One gold

assets Cortez and Goldstrike in Nevada, in the United States

(100%); Kibali in the Democratic Republic of the Congo (45%);

Loulo-Gounkoto in Mali (80%); and Pueblo Viejo in the Dominican

Republic (60%) and two with the potential to become the gold assets

of the first level: Goldrush / Fourmile (100%) and Turquoise Ridge

(75%), both in the United States. With mining operations and

projects in 15 countries, including Argentina, Australia, Canada,

Chile, the Ivory Coast, the Democratic Republic of the Congo, the

Dominican Republic, Mali, Papua New Guinea, Peru, Saudi Arabia,

Senegal, the United States and Zambia, Barrick has the lowest total

cash cost position among its senior gold peers and a diversified

asset portfolio positioned for growth in many of the world's most

prolific gold districts.

Endnotes:

- A Tier One Gold Asset is a mine with a stated life in excess of

10 years with 2017 production of at least 500,000 ounces of gold

and 2017 total cash cost per ounce within the bottom half of Wood

Mackenzie’s cost curve tools (excluding state-owned and

privately-owned mines). For purposes of determining Tier One Gold

Assets, total cash cost per ounce is based on data from Wood

Mackenzie as of August 31, 2018, except in respect of Barrick’s

mines where Barrick may rely on its internal data which is more

current and reliable. The Wood Mackenzie calculation of total cash

cost per ounce may not be identical to the manner in which Barrick

calculates comparable measures. Total cash cost per ounce is a

non-GAAP financial performance measure with no standardized meaning

under IFRS and therefore may not be comparable to similar measures

presented by other issuers. Total cash cost per ounce should not be

considered by investors as an alternative to operating profit, net

profit attributable to shareholders, or to other IFRS measures.

Barrick believes that total cash cost per ounce is a useful

indicator for investors and management of a mining company’s

performance as it provides an indication of a company’s

profitability and efficiency, the trends in cash costs as the

company’s operations mature, and a benchmark of performance to

allow for comparison against other companies. Wood Mackenzie is an

independent third-party research and consultancy firm that provides

data for, among others, the metals and mining industry. Wood

Mackenzie does not have any affiliation to Barrick.

- For additional detail regarding Pueblo Viejo, see the Technical

Report on the Pueblo Viejo mine, Sanchez Ramirez Province,

Dominican Republic, dated March 19, 2018, and filed on SEDAR at

www.sedar.com and EDGAR at www.sec.gov on March 23, 2018.

Technical

Information

The scientific and technical information contained in this

press release has been reviewed and approved by John Steele, CIM,

Metallurgy, Engineering and Capital Projects Executive, who is a

“Qualified Person” as defined in National Instrument 43-101 –

Standards of Disclosure for Mineral Projects.

Cautionary Statement on Forward-Looking

Information

Certain information contained in this press

release, including any information as to Barrick’s strategy, plans,

or future operating or environmental performance, constitutes

“forward-looking statements”. All statements, other than statements

of historical fact, are forward-looking statements. The words

“proposed” “will”, “future”, “expansion”, “estimated”, “extend”,

“expect”, and similar expressions identify forward-looking

statements. In particular, this press release contains

forward-looking statements including, without limitation, with

respect to proposed investments in the Dominican Republic and the

potential for the expansion project at Pueblo Viejo to increase

throughput, convert resources into reserves and extend the life of

the mine.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: fluctuations in the spot

and forward price of gold, copper, or certain other commodities

(such as silver, diesel fuel, natural gas, and electricity); the

speculative nature of mineral exploration and development; changes

in mineral production performance, exploitation, and exploration

successes; risks associated with the Pueblo Viejo expansion project

and other projects in the early stages of evaluation, and for which

additional engineering and other analysis is required to fully

assess their impact; diminishing quantities or grades of reserves;

increased costs, delays, suspensions and technical challenges

associated with the construction of capital projects; operating or

technical difficulties in connection with mining or development

activities, including geotechnical challenges and disruptions in

the maintenance or provision of required infrastructure and

information technology systems; failure to comply with

environmental and health and safety laws and regulations; timing of

receipt of, or failure to comply with, necessary permits and

approvals; uncertainty whether some or all of targeted investments

and projects will meet the Company’s capital allocation objectives

and internal hurdle rate; the impact of global liquidity and credit

availability on the timing of cash flows and the values of assets

and liabilities based on projected future cash flows; adverse

changes in our credit ratings; the impact of inflation;

fluctuations in the currency markets; changes in U.S. dollar

interest rates; changes in national and local government

legislation, taxation, controls or regulations and/ or changes in

the administration of laws, policies and practices, expropriation

or nationalization of property and political or economic

developments in the Dominican Republic, Canada, the United States,

and other jurisdictions in which the Company or its affiliates do

or may carry on business in the future; lack of certainty with

respect to foreign legal systems, corruption and other factors that

are inconsistent with the rule of law; damage to the Company’s

reputation due to the actual or perceived occurrence of any number

of events, including negative publicity with respect to the

Company’s handling of environmental matters or dealings with

community groups, whether true or not; the possibility that future

exploration results will not be consistent with the Company’s

expectations; risks that exploration data may be incomplete and

considerable additional work may be required to complete further

evaluation, including but not limited to drilling, engineering and

socioeconomic studies and investment; risk of loss due to acts of

war, terrorism, sabotage and civil disturbances; litigation and

legal and administrative proceedings; contests over title to

properties, particularly title to undeveloped properties, or over

access to water, power and other required infrastructure; business

opportunities that may be presented to, or pursued by, the Company;

our ability to successfully integrate acquisitions or complete

divestitures; risks associated with working with partners in

jointly controlled assets; employee relations including loss of key

employees; increased costs and physical risks, including extreme

weather events and resource shortages, related to climate change;

availability and increased costs associated with mining inputs and

labor. In addition, there are risks and hazards associated with the

business of mineral exploration, development and mining, including

environmental hazards, industrial accidents, unusual or unexpected

formations, pressures, cave-ins, flooding and gold bullion, copper

cathode or gold or copper concentrate losses (and the risk of

inadequate insurance, or inability to obtain insurance, to cover

these risks).

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40- F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law

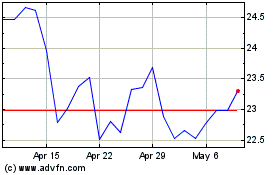

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Mar 2024 to Apr 2024

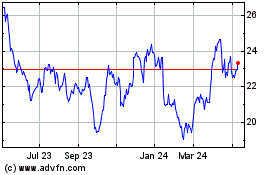

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Apr 2023 to Apr 2024