Fast Food's Bet on Breakfast Goes Bust During Covid-19 Pandemic

November 05 2020 - 5:59AM

Dow Jones News

By Julie Wernau

The pandemic is sinking one of the fast-food industry's biggest

bets: breakfast.

Once the best hope for increasing sales, mornings are now the

slowest time of day at fast-food restaurants, as many Americans

work and attend school from home. Even as fast-food sales have

recovered in recent weeks from the early months of the coronavirus

pandemic, breakfast has trailed behind.

Breakfast-dependent chains including Dine Brands Global Inc.'s

IHOP and Dunkin' Brands Group Inc. are closing hundreds of

restaurants. McDonald's Corp. and Restaurant Brands International

Inc.'s Burger King have said sales of breakfast items remain weak.

The operator of Friendly's, an East Coast diner chain, has filed

for bankruptcy protection.

The trouble at breakfast is one of the most significant problems

for a fast-food industry designed to cater to consumers on the go.

With Covid-19 cases climbing again across much of the U.S., many

consumers are likely to keep eating breakfast at home--and they are

finding plenty of options.

Sales of packaged breakfast items including cereal and ground

coffee have risen in recent months after years of tepid sales. Some

food manufacturers said they are trying to capitalize on the

trend.

"We are in a position to own breakfast," said Carlos

Abrams-Rivera, U.S. president at Kraft Heinz Co., which makes Oscar

Mayer bacon, Maxwell House coffee and Philadelphia cream

cheese.

For years, fast-food chains poured money and resources into

breakfast. IHOP planned to introduce a fast-casual brand called

Flip'd to serve pancakes to people on the go. And other chains were

focused on menu items that could conveniently fit in cup

holders.

Vinald Francis, a 38-year-old medical-illustration and

visual-design specialist in Rhode Island, said he used to stop for

breakfast at McDonald's or Burger King multiple times a week on his

morning commute. Now he eats toast or yogurt at home. "My whole

diet has kind of changed, " he said.

Chris Kempczinski, chief executive of McDonald's, said in July

on an earnings call that breakfast has been the biggest drag on

sales during the pandemic. New offerings from competitors betting

on breakfast were adding to the pressure, he said.

Some of those bets appeared to be working before the pandemic

closed dining rooms across the country. In early March, Wendy's Co.

introduced a breakfast menu nationally, emphasizing sandwiches with

real eggs, including the Breakfast Baconator. McDonald's and Burger

King were investing in new menu items and marketing focused on

breakfast, including Burger King's Croissan'wich. Breakfast

transactions for fast food during one week in March were up 5% from

a year earlier, according to the market-research firm NPD Group, a

big increase from recent years' pace.

Then came widespread lockdown orders, and millions of Americans

stopped commuting as they shifted to remote work. By mid-April,

breakfast transactions were down 54% from a year earlier, worse

than the 42% drop for restaurant transactions overall. Breakfast

transactions have since recovered some, running 10% below last

year's levels for the week ending Oct. 25, according to NPD Group.

That trails improvement in fast-food transactions overall.

Fast-food chains said some of the commuters they planned to

serve may never come back. Some, including McDonald's, are hoping

to sell to families picking up breakfast at the drive-through. The

company is offering a deal this week on its new breakfast pastries

to draw consumers away from the breakfast table. Dunkin' and IHOP

said that even as they close some stores, they hope to open others

in places where breakfast sales can take off.

Other chains are looking beyond breakfast. Operators have added

back breakfast items--such as the Cheesy Toasted Breakfast Burrito

and Cinnabon Delights--at only about half of Yum Brands Inc.'s

7,000 Taco Bell restaurants in the U.S. Restaurant Brands said it

is improving the quality of the food on the lunch menu as well as

breakfast at its Tim Hortons chain. IHOP introduced an "IHOPPY

hour" in September, the first time it has used discounts to draw

customers in the afternoon. The menu includes traditional breakfast

items such as eggs and pancakes as well as the usual burgers and

fried chicken.

Luigi Ricchio, 47, a senior webcast producer in the Chicago area

who used to grab McDonald's breakfast by his office, said he has

been going out to get breakfast food at irregular times of day just

for a break from being at home. "You can go get soup at 11 a.m. and

you can get an egg-and-cheese sandwich at 3 p.m.," he said.

Wendy's stuck with its breakfast rollout during the pandemic.

Breakfast now represents about 7% of its sales, in the range of

what the company expected before the pandemic began. The company

said it is planning more advertising about its breakfast menu to

gain ground after competitors have pulled back.

Todd Penegor, president and chief executive, said on an earnings

call this week: "We are confident that we can continue to grow this

business into the future as more and more people fall back into

their daily routines."

Annie Gasparro contributed to this article.

Write to Julie Wernau at Julie.Wernau@wsj.com

(END) Dow Jones Newswires

November 05, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

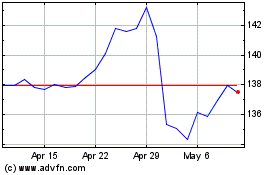

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

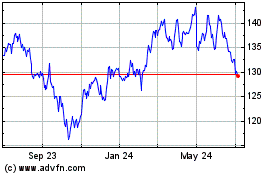

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024