Yum Brands to Buy Burger Chain -- WSJ

January 07 2020 - 3:02AM

Dow Jones News

By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 7, 2020).

Yum Brands Inc. said it would buy fast-casual burger chain Habit

Restaurants Inc. as it seeks to broaden its range of restaurants

and reach more customers.

Yum said it had struck a deal to buy the California-based parent

of Habit Burger Grill for $14 a share, or about $375 million.

Habit's shares closed Friday at $10.51, giving it a valuation of

around $275 million. The companies said they expect the deal to

close by early this summer.

Habit's shares rose 33% on Monday to about $14. Yum's shares

traded roughly flat around $102.

Yum, the parent company of fast-food chains KFC, Pizza Hut and

Taco Bell, said Habit's fast-casual model has strong potential for

international expansion. The chain of around 280 restaurants in the

U.S. and China has specialized in chargrilled burgers since opening

in 1969.

The deal is Yum's first acquisition of a stand-alone fast-casual

restaurant chain since the company went public in 1997. Yum, formed

by a spinoff of the restaurant holdings of PepsiCo Inc., is the

world's largest restaurant company by stores, with more than 49,000

in 145 countries.

More U.S. restaurant companies have expanded to own a suite of

brands as they seek to keep up with changing dining trends and grow

internationally. Fast-casual burger chains in particular have

proliferated in recent years. Premium burger brands have faced

tough times as the concept has grown saturated.

"We thought it was a sweet spot within fast-casual," Yum Chief

Executive David Gibbs said in an interview. Mr. Gibbs took the helm

of Louisville, Ky.-based Yum this month, succeeding veteran CEO

Greg Creed.

Private-equity backed Inspire Brands Inc. last year bought Jimmy

John's Gourmet Sandwiches, adding it to a portfolio that includes

the Sonic burger chain, Arby's and Buffalo Wild Wings. Privately

held JAB Holding Co. and Focus Brands are also broadening their

brand holdings.

Habit said it hopes to grow to more than 2,000 locations with

backing from Yum.

"There is plenty of runway left," Habit CEO Russell Bendel said

in an interview.

Yum said the deal would have a minimal impact on earnings this

fiscal year, with profits expected from the acquisition beginning

in 2021. Habit will be run independently within Yum, as are Yum's

other brands, Mr. Gibbs said. The company expects to maintain

Habit's existing management team and headquarters in Irvine,

Calif.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

January 07, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

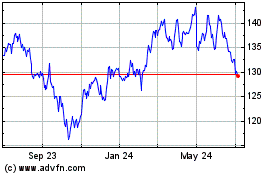

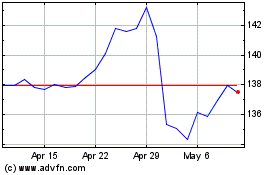

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024