Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on May 11, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

YETI Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

45-5297111

(I.R.S. Employer

Identification Number)

|

7601 Southwest Parkway

Austin, Texas 78735

(512) 394-9384

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Matthew J. Reintjes

President and Chief Executive Officer, Director

YETI Holdings, Inc.

7601 Southwest Parkway

Austin, Texas 78735

(512) 394-9384

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

Copies to:

|

Bryan C. Barksdale

Senior Vice President, General Counsel and Secretary

YETI Holdings, Inc.

7601 Southwest Parkway

Austin, Texas 78735

|

|

John-Paul Motley, Esq.

Robert Plesnarski, Esq.

O'Melveny & Myers LLP

400 South Hope Street

Los Angeles, CA 90071

|

Approximate date of commencement of proposed sale to public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

Large accelerated filer ý

|

|

Accelerated filer o

|

|

Non-accelerated filer o

|

|

Smaller reporting company o

Emerging growth company o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered

|

|

Proposed Maximum

Offering Price Per

Unit

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

|

|

Common Stock, par value $0.01 per share

|

|

(1)

|

|

(2)

|

|

(2)

|

|

(2)

|

|

|

-

(1)

-

This

registration statement registers an unspecified number of shares of common stock of YETI Holdings, Inc., as may from time to time be offered at indeterminate

prices, which may be issued with respect to such shares of common stock by way of stock splits, stock dividends, reclassifications or similar transactions.

-

(2)

-

In

accordance with Rules 456(b) and 457(r) of the Securities Act, the registrant is deferring payment of all of the registration fee. Any registration

fees will be paid subsequently on a pay-as-you-go basis based on the aggregate offering price of the shares of common stock to be offered in one or more offerings to be made hereunder.

Table of Contents

PROSPECTUS

YETI Holdings, Inc.

15,000,000 Shares of Common Stock

Offered, from time to time, by the Selling Stockholders

From time to time in one or more offerings, the selling stockholders identified in this prospectus may offer and sell up to 15,000,000 shares of

our common stock. The selling stockholders acquired the shares of common stock offered by this prospectus in a private placement. We are registering the offer and sale of the shares of common stock by

the selling stockholders to satisfy registration rights that we granted to the selling stockholders. The registration of these shares of our common stock does not necessarily mean that any of our

common stock will be sold by the selling stockholders. We will not receive any proceeds from the resale of shares of common stock, from time to time in one or more offerings, by the selling

stockholders, but we have agreed to pay substantially all of the expenses incidental to the registration, offering and sale of the common stock by the selling stockholders, except that we will not

bear any brokers' or underwriters' discounts and commissions, fees and expenses of counsel to underwriters or brokers, transfer taxes or transfer fees relating to the sale of shares of our common

stock by the selling stockholders.

This

prospectus provides a description of the common stock the selling stockholders may offer. Each time the selling stockholders sell common stock, we, or parties acting on our behalf,

will provide a prospectus supplement and/or free writing prospectus that will contain specific information about the terms of that offering and the common stock being sold in that offering. The

applicable prospectus supplement and/or free writing prospectus may also add, update or change information contained in this prospectus. If the information varies between this prospectus and the

accompanying prospectus supplement or free writing prospectus, you should rely on the information in the prospectus supplement or free writing prospectus. You should carefully read this prospectus and

any prospectus supplement and free writing prospectus accompanying this prospectus, together with any documents incorporated by reference herein or therein, before you invest in our common stock.

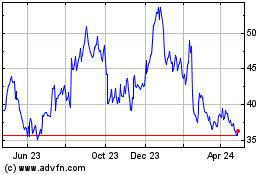

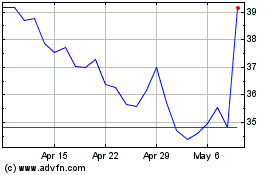

Our

common stock is listed on the New York Stock Exchange (the "NYSE") under the symbol "YETI." On May 8, 2020, the last reported sale price of our common stock on the NYSE was

$29.09 per share.

Investment in any securities offered by this prospectus involves a high degree of risk. Please read carefully the section entitled "Risk Factors"

on page 2 of this prospectus, the "Risk Factors" section contained in the applicable prospectus supplement and/or free writing prospectus and the risk factors included and incorporated by reference in

this prospectus or the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is May 11, 2020.

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement on Form S-3 that we filed with the Securities and Exchange

Commission (the "SEC") as a "well-known seasoned issuer" as defined in Rule 405 under the Securities Act of 1933, as amended (the "Securities Act"), utilizing a "shelf" registration or

continuous offering process. Under this shelf registration process, the selling stockholders may, from time to time in one or more offerings, sell up to 15,000,000 shares of common stock, at prices

and on terms to be determined by market conditions at the time of the offering.

This

prospectus provides you with a general description of the common stock the selling stockholders may offer. Each time the selling stockholders sell common stock pursuant to the

registration statement of which this prospectus forms a part, we, or parties acting on our behalf, will provide a prospectus supplement and/or free writing prospectus that will contain specific

information about the terms of that offering and the common stock being sold in that offering. The applicable prospectus supplement or

free writing prospectus may also add, update or change information contained in this prospectus. If the information varies between this prospectus and the accompanying prospectus supplement or free

writing prospectus, you should rely on the information in the prospectus supplement or free writing prospectus.

You

should rely only on the information contained or incorporated by reference in this prospectus, any prospectus supplement and any free writing prospectus prepared by or on behalf of

us or to which we have referred you. We have not authorized anyone, including the selling stockholders, to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

Before

purchasing any common stock, you should carefully read this prospectus, any prospectus supplement and any free writing prospectus, together with the additional information

described under the heading "Incorporation by Reference." You should assume that the information contained in this prospectus, any prospectus supplement or any free writing prospectus is accurate only

as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our

business, financial condition, results of operations and prospects may have changed since those dates. This prospectus contains summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for complete information. All of the summaries contained herein are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain

copies of those documents as described below under the heading "Where You Can Find More Information."

This

prospectus and any applicable prospectus supplement or free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any common stock other than

the registered common stock to which they relate. Neither we nor any selling stockholder are making offers to sell any common stock described in this prospectus in any jurisdiction in which an offer

or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the common stock or possession or distribution of this prospectus supplement in that

jurisdiction. Persons who come into possession of this prospectus supplement in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to

this offering and the distribution of this prospectus supplement applicable to that jurisdiction.

ii

Table of Contents

Unless

otherwise expressly indicated or the context otherwise requires, when this prospectus, any prospectus supplement or any free writing prospectus uses the terms "Company," "YETI,"

"we," "our" and "us" refer to YETI Holdings, Inc. and its consolidated subsidiaries. We operate on a "52-to 53-week" fiscal year ending on the Saturday closest in proximity to

December 31, such that each quarterly period will be 13 weeks in length, except during a 53-week year when the fourth quarter will be 14 weeks. When this prospectus, any

prospectus supplement or any free writing prospectus refers to particular years or quarters in connection with the discussion of our results of operations or financial condition, those references mean

the relevant fiscal years and fiscal quarters, unless otherwise stated.

The

information in this prospectus, in any accompanying prospectus supplement, in any free writing prospectus and in the documents incorporated by reference or deemed incorporated by

reference herein or therein concerning market share, ranking, industry data and forecasts, including but not limited to data regarding the estimated size of the market, projected growth rates, and

perceptions and preferences of consumers, is obtained from industry sources, third-party studies and surveys, including market analyses and reports, public filings and internal company sources.

Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the

accuracy or completeness of included information. Although we believe that this publicly available information and the information provided by these industry sources is reliable, we have not

independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. While we are not aware of any misstatements regarding

any industry data presented in this prospectus, our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change

based on various factors, including those discussed under "Risk Factors."

Trademarks, Trade Names, and Service Marks

We use various trademarks, trade names, and service marks in our business, including, without limitation, YETI®,

Tundra®, Hopper®, Hopper Flip®, YETI TANK®, Rambler®, Colster®, Roadie®, BUILT FOR THE WILD®,

LOAD-AND-LOCK®, YETI Authorized™, YETI PRESENTS™, YETI Custom Shop™, Panga®, LoadOut®, Camino®, Hondo®,

SideKick®, SideKick Dry®, Silo®, YETI ICE™, EasyBreathe™, FlexGrid™, PermaFrost™, T-Rex™,

Haul™, NeverFlat™, StrongArm™, Vortex™, SteadySteel™, Hopper BackFlip™, ThickSkin™, DryHaul™,

SureStrong™, LipGrip™, No Sweat™, Boomer™, Tocayo™, Lowlands™, TripleGrip™, TripleHaul™,

Hauler™, Over-the-Nose™, FatLid™, MagCap™, MagSlider™, DoubleHaul™, HydroLok™, ColdCell™,

U-Dock™, Hitchpoint™, Wildly Stronger! Keep Ice Longer!®, YETI

Coolers™, LoadOut GoBox™, Pack Attic™, Wildproof™, Bearfoot™, GridGuard™, Diehard™, Doublebarrel™, YETI

Hopper®, YETI Rambler Colster®, Rambler On®, YETI Rambler®, YETI Brick®, Flip™, Tundra Haul™, HotShot™,

Coldcell Flex™, ThermoSnap™, Daytrip®, Crossroads™, Color Inspired By True Events™, Trailhead™, and YETI V SERIES™.

YETI also uses trade dress for its distinctive product designs. For convenience, we may not include the ® or ™ symbols in this prospectus or the documents incorporated by

reference, but such omission is not meant to and does not indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names,

or service marks referred to in this prospectus or the documents that are incorporated by reference that are not owned by us are the property of their respective owners.

Industry, Market, and Other Data

This prospectus, including the documents incorporated by reference, includes estimates, projections, and other information concerning our

industry and market data, including data regarding the estimated size of the market, projected growth rates, and perceptions and preferences of consumers. We obtained this data from industry sources,

third-party studies, including market analyses and reports, and internal company surveys. Industry sources generally state that the information contained therein has been obtained from sources

believed to be reliable. Although we are responsible for all of the disclosure contained in this prospectus, and we believe the industry and market data to be reliable as of the date of this

prospectus, this information could prove to be inaccurate.

iii

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is a part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act and does not

contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or as indicated below. Statements in this prospectus concerning any document

we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the

complete document to evaluate these

statements. You can review a copy of the registration statement available on the SEC's website at www.sec.gov.

In

addition, we are subject to the informational requirements of the Securities Exchange Act of 1934, as amended ("the Exchange Act"), and, in accordance with the Exchange Act, file

annual, quarterly and current reports, proxy and information statements and other information with the SEC. Our SEC filings are available to the public free of charge on the SEC's website at

www.sec.gov. Our filings with the SEC are also available free of charge on our website at www.YETI.com. We may post information that is important to investors on our website. Information contained on

our website is not incorporated by reference into this prospectus and you should not consider information contained on our website to be part of this prospectus. You may also request a copy of our SEC

filings, at no cost, by writing or telephoning us at the following address and telephone number:

YETI

Holdings, Inc.

Attention: Legal Department

7601 Southwest Parkway

Austin, Texas 78735

(512) 394-9384

iv

Table of Contents

INCORPORATION BY REFERENCE

The SEC allows us to "incorporate by reference" into this prospectus the information we file with it, which means that we can disclose important

information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Any statement contained in a document incorporated or

considered to be incorporated by reference in this prospectus will be considered to be modified or superseded for purposes of this prospectus to the extent a statement contained in this prospectus or

in any other subsequently filed document that is or is deemed to be incorporated by reference in this prospectus modifies or supersedes such statement. We incorporate by reference in this prospectus

the following information (other than, in each case, documents or information deemed to have been furnished and not filed in accordance with SEC rules):

-

•

-

our Annual Report on Form 10-K

for the fiscal year ended December 28, 2019 (filed with the SEC on February 18, 2020);

-

•

-

our Quarterly Report on

Form 10-Q for the fiscal quarter ended March 28, 2020 (filed with the SEC on May 7, 2020);

-

•

-

the information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 28, 2019

from our Definitive Proxy Statement on Schedule 14A (filed with the SEC on

April 9, 2020);

-

•

-

our Current Reports on Form 8-K filed with the SEC on

February 4, 2020,

February 20, 2020,

March 5, 2020 and

May 7, 2020 (only with respect to Item 5.02 thereof); and

-

•

-

the description of our common stock, par value $0.01 per share, contained in

Exhibit 4.5 of our Annual Report on Form 10-K for the year ended

December 28, 2019 (filed with the SEC on February 18, 2020), which updated the description thereof contained in our

Registration Statement on Form 8-A initially filed with the SEC on

October 23, 2018, including any amendments or reports filed for the purpose of updating such description.

We

also incorporate by reference each of the documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date of this

prospectus and prior to the termination of the offerings under this prospectus and any prospectus supplement. These documents include periodic reports, such as Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements. We will not, however, incorporate by reference in this prospectus any documents or portions

thereof that are not deemed "filed" with the SEC, including any information furnished pursuant to Item 2.02 or Item 7.01 of our Current Reports on Form 8-K after the date of this

prospectus unless, and except to the extent, specified in such Current Reports.

We

will provide to each person, including any beneficial owner, to whom a prospectus (or a notice of registration in lieu thereof) is delivered a copy of any of these filings (other than

an exhibit to these filings, unless the exhibit is specifically incorporated by reference as an exhibit to this prospectus) at no cost, upon a request to us by writing or telephoning us at the address

and telephone number set forth above under "Where You Can Find More Information."

v

Table of Contents

FORWARD-LOOKING STATEMENTS

Statements in this prospectus, including the documents that are incorporated by reference, that are not historical facts are "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements are based on our current

intent, belief and expectations. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking

statements. These statements are often, but not always, made through the use of words or phrases such as "anticipate," "believes," "can," "could," "may," "predicts," "potential," "should," "will,"

"estimate," "plans," "projects," "continuing," "ongoing," "expects," "intends" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future

operating or financial performance or other events or trends. For example, all statements we make relating to our plans and objectives for future operations, growth or initiatives and strategies are

forward-looking statements.

These

forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and our management's

beliefs and

assumptions. We derive many of our forward-looking statements from our own operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are

reasonable, we caution predicting the impact of known factors is very difficult, and we cannot anticipate all factors that could affect our actual results. All of our forward-looking statements are

subject to risks and uncertainties that may cause our actual results to differ materially from our expectations. These statements are only predictions and involve estimates, known and unknown risks,

assumptions and uncertainties that could cause actual results to differ materially from those expressed in such statements, including as a result of the following factors, among

others:

-

•

-

the extent to which the coronavirus ("COVID-19") pandemic and measures taken to contain its spread ultimately impact our business, results of

operations and financial condition;

-

•

-

our ability to maintain and strengthen our brand and generate and maintain ongoing demand for our products;

-

•

-

our ability to successfully design, develop and market new products;

-

•

-

our ability to effectively manage our growth;

-

•

-

our ability to expand into additional consumer markets, and our success in doing so;

-

•

-

the success of our international expansion plans;

-

•

-

our ability to compete effectively in the outdoor and recreation market and protect our brand;

-

•

-

the level of customer spending for our products, which is sensitive to general economic conditions and other factors;

-

•

-

problems with, or loss of, our third-party contract manufacturers and suppliers, or an inability to obtain raw materials;

-

•

-

fluctuations in the cost and availability of raw materials, equipment, labor, and transportation and subsequent manufacturing delays or

increased costs;

-

•

-

the implementation of announced, or the enactment of new, tariffs by the U.S. government or by countries to which we export our products or raw

materials;

-

•

-

our ability to accurately forecast demand for our products and our results of operations;

-

•

-

our relationships with our national, regional, and independent retailers, who account for a significant portion of our sales;

vi

Table of Contents

-

•

-

the impact of natural disasters and failures of our information technology on our operations and the operations of our manufacturing partners;

-

•

-

our ability to attract and retain skilled personnel and senior management, and to maintain the continued efforts of our management and key

employees;

-

•

-

the impact of our indebtedness on our ability to invest in the ongoing needs of our business; and

-

•

-

the impact of our loss of "controlled company" exceptions under NYSE listing standards, subject to applicable phase-in periods, and our

inability to rely on reduced disclosure requirements as a result of no longer qualifying as an "emerging growth company" under the Jumpstart Our Business Startups Act of 2012.

The

above is not a complete list of factors or events that could cause actual results to differ from our expectations, and we cannot predict all of them. The factors noted above and the

risks included in our other SEC filings may be increased or intensified as a result of the COVID-19 pandemic, including if there is a resurgence of the COVID-19 virus after the initial outbreak

subsides. The extent to which the COVID-19 pandemic ultimately impacts our business, results of operations and financial condition will depend on future developments, which are highly uncertain and

cannot be predicted. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements

disclosed under "Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 28, 2019 and "Item 1A. Risk Factors" in our Quarterly Report on

Form 10-Q for the quarter ended March 28, 2020, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC, including

subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and in any prospectus supplement.

Potential

investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on any

forward-looking statements we make. These forward-looking statements speak only as of the date on which they are made and are not guarantees of future performance or developments and involve known and

unknown risks, uncertainties and other factors that are in many cases beyond our control. Except as required by law, we undertake no obligation to update or revise any forward-looking statements

publicly, whether as a result of new information, future developments or otherwise.

vii

Table of Contents

YETI HOLDINGS, INC.

Headquartered in Austin, Texas, we are a global designer, retailer, and distributor of a variety innovative outdoor products. From coolers and

drinkware to backpacks and bags, our products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes our

customers. By consistently delivering high-performing, exceptional products, we have built a strong following of brand loyalists throughout the world, ranging from serious outdoor enthusiasts to

individuals who simply value products of uncompromising quality and design. We have an unwavering commitment to outdoor and recreation communities, and we are relentless in our pursuit of building

superior products for people to confidently enjoy life outdoors and beyond. For additional information about our business, operations and financial results, see the documents listed under

"Incorporation by Reference."

Our

principal executive and administrative offices are located at 7601 Southwest Parkway, Austin, Texas 78735. Our telephone number is (512) 394-9384 and our website is

www.YETI.com. We may post

information that is important to investors on our website. However, the information included or referred to on, or otherwise accessible through, our website is not intended to form a part of or

be incorporated by reference into this prospectus, any accompanying prospectus supplement or any free writing prospectus.

1

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, in addition to the other information

contained in this prospectus and any prospectus supplement or free writing prospectus, you should carefully consider any risk factors set forth in the applicable prospectus supplement and the

documents incorporated by reference in this prospectus, including the risk factors discussed under the heading "Risk Factors" in our most recent Annual Report on Form 10-K and each subsequently

filed Quarterly Report on Form 10-Q and any risk factors set forth in our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. See "Where You

Can Find More Information" and "Incorporation by Reference." Each of the risks described in these documents could materially and adversely affect our business, financial condition, results of

operations and prospects, and could result in a partial or complete loss of your investment. Additional risks and uncertainties not currently known to us, or that we currently deem immaterial, may

also adversely impact our business operations. In addition, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate

results or trends in future periods.

2

Table of Contents

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. Any proceeds from the sale by the

selling stockholders of the shares of common stock offered by this prospectus will be received by the selling stockholders. We have agreed to pay certain expenses in connection with the registration

of the shares of common stock to be sold by the selling stockholders offered by this prospectus. For more information, see "Selling Stockholders" and "Certain Relationships and Related Party

Transactions with the Selling Stockholders."

3

Table of Contents

DESCRIPTION OF CAPITAL STOCK

General

The following description summarizes certain important terms of our capital stock. This description summarizes the provisions that are included

in our amended and restated certificate of incorporation and amended and restated bylaws. Because it is only a summary, it does not contain all the information that may be important to you. For a

complete description of the matters set forth in this section, you should refer to our amended and restated certificate of incorporation, amended and restated bylaws, the Stockholders Agreement, dated

October 24, 2018, by and among YETI Holdings, Inc., Cortec Group Fund V, L.P. and its affiliates, and certain other stockholders named therein (the "Stockholders Agreement") and

the Registration Rights Agreement, dated October 24, 2018, by and among YETI Holdings, Inc., Cortec Group Fund V, L.P. and certain other stockholders named therein, as amended by

Amendment No. 1 to the Registration Rights Agreement, dated May 6, 2019, and Amendment No. 2 to the Registration Rights Agreement, dated December 11, 2019 (collectively,

the "Registration Rights Agreement"), which are incorporated by reference as exhibits to the registration statement of which this prospectus forms a part, and to the applicable provisions of

Delaware law.

Authorized Capital Stock

Our authorized capital stock consists of 630,000,000 shares of capital stock, par value $0.01 per share, of

which:

-

•

-

600,000,000 shares are designated as common stock; and

-

•

-

30,000,000 shares are designated as preferred stock.

Outstanding Capital Stock

As of May 1, 2020, there were 86,898,386 shares of our common stock outstanding and no shares of preferred stock outstanding. As of

February 7, 2020, our shares of common stock were held by 29 stockholders of record. Our Board of Directors is authorized to issue additional shares of our capital stock without

stockholder approval, except as required by the NYSE listing standards.

Common Stock

Voting Rights. The holders of our common stock are entitled to one vote per share on any matter to be voted upon by stockholders.

Our directors are

elected by a plurality of the votes cast by stockholders entitled to vote on the election. All other matters to be voted on by stockholders must be approved by a majority in voting power of the votes

cast by the holders of all of the shares of stock present or represented at the meeting and voting affirmatively or negatively on such matter, except when a different vote is required by express

provision of applicable law, regulation applicable to us or our securities, the rules or regulations of any stock exchange applicable to us, our amended and restated certificate of incorporation or

our amended and restated bylaws. Our amended and restated certificate of incorporation does not provide for cumulative voting in connection with the election of directors and, accordingly, holders of

more than 50% of the shares voting are able to elect all of our directors, subject to the rights of Cortec Group Fund V, L.P. and its affiliates ("Cortec") to elect certain directors and select

certain nominees for directors as discussed below under "—Stockholders Agreement". The holders of a majority of the shares of common stock issued and outstanding constitute a quorum at all

meetings of stockholders for the transaction of business.

Dividends. The holders of our common stock are entitled to dividends if, as, and when declared by our Board of Directors, from

funds legally

available therefor, subject to certain contractual limitations on our ability to declare and pay dividends.

4

Table of Contents

Other Rights. No holder of our common stock has any preemptive right to subscribe for any shares of our capital stock.

Upon

any voluntary or involuntary liquidation, dissolution, or winding up of our affairs, the holders of our common stock are entitled to share ratably in all assets remaining after

payment of creditors and subject to prior distribution rights of our preferred stock, if any.

Preferred Stock

Our Board of Directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to

establish from time to time the

number of shares to be included in each series, and to fix the designation, powers, preferences, and rights of the shares of each series and any of its qualifications, limitations, or restrictions, in

each case without further vote or action by our stockholders. Our Board of Directors can also increase or decrease the number of shares of any series of preferred stock, but not below the number of

shares of that series then outstanding, without any further vote or action by our stockholders. Our Board of Directors may authorize the issuance of preferred stock with voting or conversion rights

that could adversely affect the voting power or other rights of the holders of our common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions

and other corporate purposes, could, among other things, have the effect of delaying, deferring, or preventing a change in our control and might adversely affect the market price of our common stock

and the voting and other rights of the holders of our common stock. We have no current plan to issue any shares of preferred stock.

Options

As of May 1, 2020, we had outstanding options to purchase an aggregate of 1,474,779 shares of our common stock, with a weighted

average exercise price of approximately $16.72 per share, under the YETI Holdings, Inc. 2012 Equity and Performance Incentive Plan, as amended and restated June 20, 2018 (the "2012

Plan") and the YETI Holdings, Inc. 2018 Equity and Incentive Compensation Plan (the "2018 Plan").

In

October 2018, our Board of Directors adopted the 2018 Plan and ceased granting awards under the 2012 Plan. The 2018 Plan became effective prior to completion of our initial public

offering of our common stock ("IPO"), with new awards being available for issuance under the 2018 Plan as of the completion of our IPO. Any remaining shares available for issuance under the 2012 Plan

as of our IPO effectiveness date are not available for future issuance. However, shares subject to stock awards granted under the 2012 Plan (a) that expire or terminate without being exercised,

(b) that are forfeited under an award, or (c) that are transferred, surrendered, or relinquished upon the payment of any exercise price by the transfer to us of our common stock or upon

satisfaction of any withholding amount, return to the 2018 Plan share reserve for future grant.

Stockholders Agreement

In connection with our IPO, we entered into the Stockholders Agreement with Cortec Management V, LLC, as managing general partner of

Cortec Group Fund V, L.P., and other holders of our common stock party thereto pursuant to which we are required to take all necessary action for individuals designated by Cortec to be included

in the slate of nominees recommended by the Board of Directors for election by our stockholders. Under the Stockholders Agreement, Cortec has the right to nominate (i) three directors so long

as it beneficially owns at least 30% of our

then-outstanding shares of common stock, (ii) two directors so long as it beneficially owns at least 15% but less than 30% of our then-outstanding shares of common stock, and (iii) one

director so long as it beneficially owns at least 10% but less than 15% of our then-outstanding shares of common stock (we refer to any director nominated by Cortec as a "Cortec Designee"). The

Stockholders Agreement also provides that so long

5

Table of Contents

as

Cortec beneficially owns 20% or more of our then-outstanding shares of common stock, we will agree to take all necessary action to cause a Cortec Designee to serve as (i) Chair of the Board

of Directors and (ii) Chair of the nominating and governance committee.

Registration Rights

In connection with our IPO, we entered into the Registration Rights Agreement with Cortec, Roy J. Seiders, Ryan R. Seiders,

certain of their respective affiliates, and certain other stockholders, which was subsequently amended in May 2019 and December 2019. Under the terms of the Registration Rights Agreement, any of

Cortec Group Fund V, L.P., Cortec Co-Investment Fund V, LLC, Roy J. Seiders, Ryan R. Seiders, RRS Ice 2, LP or RJS Ice 2, LP may demand registration of, or an underwritten

offering of, all or a portion of such holder's common stock. If such holder demands registration or an underwritten offering, the other parties to the Registration Rights Agreement may request that up

to all of their shares of common stock be included in such registration statement or underwritten offering, as the case may be. In each case, the amount registered under the demand registration or

offered in an underwritten offering is subject to certain limitations and conditions, including that (i) we are not obligated to effectuate more than four demand registrations or underwritten

offerings in any 12-month period and (ii) any demand registration or underwritten offering must be for an anticipated aggregate offering price of at least $250 million. In addition, in

the event that we register additional shares of common stock or any series of preferred stock for sale to the public, we will be required to give notice of such registration to the other parties to

the Registration Rights Agreement and, subject to certain limitations, include shares of common stock held by them in the registration. We are responsible for paying all registration expenses and

expenses associated with an underwritten offering in connection with any registration or underwritten offering pursuant to the registration rights agreement (including the costs associated with this

registration), excluding any underwriting fees, commissions, discounts and allowances and related legal fees. The Registration Rights Agreement includes customary indemnification provisions in favor

of the stockholders party thereto against certain losses and liabilities arising out of or based upon any filing or other disclosure made by us under the securities laws relating to any such

registration.

Anti-takeover Effects of Certain Provisions of our Amended and Restated Certificate of Incorporation

and Amended and Restated Bylaws

Provisions of our amended and restated certificate of incorporation and amended and restated bylaws may delay or discourage transactions

involving an actual or potential change in our control or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares, or transactions

that our stockholders might otherwise deem to be in their best interests. Therefore, these provisions could adversely affect the price of our common stock. Among other things, our amended and restated

certificate of incorporation and amended and restated bylaws:

-

•

-

provide that our Board of Directors is classified into three classes of directors;

-

•

-

prohibit stockholders from taking action by written consent;

-

•

-

provide that stockholders may remove directors only for cause, and only with the approval of holders of at least 662/3% of our

then outstanding capital stock;

-

•

-

provide that the authorized number of directors may be changed only by resolution of our Board of Directors;

-

•

-

provide that all vacancies, including newly created directorships, may, except as otherwise required by law or as set forth in the Stockholders

Agreement, be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum;

6

Table of Contents

-

•

-

provide that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors at

a meeting of stockholders must provide notice in writing in a timely manner, and also specify requirements as to the form and content of a stockholder's notice;

-

•

-

restrict the forum for certain litigation against us to Delaware;

-

•

-

do not provide for cumulative voting rights (therefore allowing the holders of a majority of the shares of common stock entitled to vote in any

election of directors to elect all of the directors standing for election, subject to the rights of Cortec to elect certain directors and select certain nominees for directors as discussed above under

"—Stockholders Agreement");

-

•

-

provide that special meetings of our stockholders may be called only by the Chair of our Board of Directors, our Chief Executive Officer or the

Board of Directors pursuant to a resolution adopted by a majority of the total number of authorized directors;

-

•

-

provide that stockholders will be permitted to amend our amended and restated bylaws only upon receiving at least 662/3% of the

votes entitled to be cast by holders of all outstanding shares then entitled to vote generally in the election of directors, voting together as a single class; and

-

•

-

provide that certain provisions of our amended and restated certificate of incorporation may only be amended upon receiving at least

662/3% of the votes entitled to be cast by holders of all outstanding shares then entitled to vote, voting together as a single class.

Further,

we have opted out of Section 203 of the General Corporation Law of the State of Delaware (the "DGCL"). However, our amended and restated certificate of

incorporation contains similar provisions providing that we may not engage in certain "business combinations" with any "interested stockholder" for a three-year period following the time that the

stockholder became an interested stockholder, unless:

-

•

-

prior to such time, our Board of Directors approved either the business combination or the transaction which resulted in the stockholder

becoming an interested stockholder;

-

•

-

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at

least 85% of our voting stock outstanding at the time the transaction commenced, excluding certain shares; or

-

•

-

at or subsequent to that time, the business combination is approved by our Board of Directors and by the affirmative vote of holders of at

least 662/3% of our outstanding voting stock that is not owned by the interested stockholder.

Generally,

a "business combination" includes a merger, asset, or stock sale or other transaction resulting in a financial benefit to the interested stockholder. Subject to certain

exceptions, an "interested stockholder" is a person who, together with that person's affiliates and associates, owns, or within the previous three years owned, 15% or more of our outstanding voting

stock. For purposes of this section only, "voting stock" has the meaning given to it in Section 203 of the DGCL.

Under

certain circumstances, this provision will make it more difficult for a person who would be an "interested stockholder" to effect various business combinations with the Company for

a three-year period. This provision may encourage companies interested in acquiring the Company to negotiate in advance with our Board of Directors because the stockholder approval requirement would

be avoided if our Board of Directors approves either the business combination or the transaction which results in the

stockholder becoming an interested stockholder. These provisions also may have the effect of preventing changes in our Board of Directors and may make it more difficult to accomplish transactions

which stockholders may otherwise deem to be in their best interests.

7

Table of Contents

Our

amended and restated certificate of incorporation provides that Cortec and its affiliates and any of their direct or indirect transferees and any group as to which such persons are a

party, do not constitute "interested stockholders" for purposes of this provision.

Choice of Forum

Unless we consent to the selection of an alternative forum, the Court of Chancery of the State of Delaware is, to the fullest extent permitted

by law, the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of fiduciary duty owed by any of our

current or former stockholders, directors, officers, or other employees to us or to our stockholders, (iii) any action asserting a claim against us arising pursuant to the DGCL, or

(iv) any action asserting a claim against us that is governed by the internal affairs doctrine. The choice of forum provision does not apply to any actions arising under the Securities Act or

the Exchange Act.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Broadridge Corporate Issuer Solutions, Inc.

Listing

Our common stock is listed on the NYSE under the symbol "YETI."

8

Table of Contents

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS WITH SELLING STOCKHOLDERS

Stockholders Agreement

In connection with our IPO, we entered into the Stockholders Agreement with Cortec Management V, LLC, as managing general partner of

Cortec Group Fund V, L.P., and other holders of our common stock party thereto pursuant to which we are required to take all necessary action for individuals designated by Cortec to be included

in the slate of nominees recommended by

the Board of Directors for election by our stockholders. Under the Stockholders Agreement, Cortec has the right to nominate (i) three directors so long as it beneficially owns at least 30% of

our then-outstanding shares of common stock, (ii) two directors so long as it beneficially owns at least 15% but less than 30% of our then-outstanding shares of common stock, and

(iii) one director so long as it beneficially owns at least 10% but less than 15% of our then-outstanding shares of common stock (we refer to any director nominated by Cortec as a "Cortec

Designee"). The Stockholders Agreement also provides that so long as Cortec beneficially owns 20% or more of our then-outstanding shares of common stock, we will agree to take all necessary action to

cause a Cortec Designee to serve as (i) Chair of the Board of Directors and (ii) Chair of the nominating and governance committee.

Registration Rights Agreement

In connection with our IPO, we entered into the Registration Rights Agreement with Cortec, Roy J. Seiders, Ryan R. Seiders,

certain of their respective affiliates, and certain other stockholders, which was subsequently amended in May 2019 and December 2019. Under the terms of the Registration Rights Agreement, any of

Cortec Group Fund V, L.P., Cortec Co-Investment Fund V, LLC, Roy J. Seiders, Ryan R. Seiders, RRS Ice 2, LP or RJS Ice 2, LP may demand registration of, or an

underwritten offering of, all or a portion of such holder's common stock. If such holder demands registration or an underwritten offering, the other parties to the Registration Rights Agreement may

request that up to all of their shares of common stock be included in such registration statement or underwritten offering, as the case may be. In each case, the amount registered under the demand

registration or offered in an underwritten offering is subject to certain limitations and conditions, including that (i) we are not obligated to effectuate more than four demand registrations

or underwritten offerings in any 12-month period and (ii) any demand registration or underwritten offering must be for an anticipated aggregate offering price of at least $250 million.

In addition, in the event that we register additional shares of common stock or any series of preferred stock for sale to the public, we will be required to give notice of such registration to the

other parties to the Registration Rights Agreement and, subject to certain limitations, include shares of common stock held by them in the registration. We are responsible for paying all registration

expenses and expenses associated with an underwritten offering in connection with any registration or underwritten offering pursuant to the registration rights agreement (including the costs

associated with this registration), excluding any underwriting fees, commissions, discounts and allowances and related legal fees. The Registration Rights Agreement includes customary indemnification

provisions in favor of the stockholders party thereto against certain losses and liabilities arising out of or based upon any filing or other disclosure made by us under the securities laws relating

to any such registration.

Letter Agreements, Waivers and Amendments to Registration Rights Agreement

On May 6, 2019, we entered into a letter agreement (the "May 2019 Letter Agreement") with John D. Bullock, Jr., Andrew S. Hollon, Cortec

Group Fund V, L.P., Cortec

Co-Investment Fund V, LLC, Cortec Group Fund V (Parallel), L.P., RJS ICE, LP, RJS ICE 2, LP, RRS ICE 2, LP, Roy J. Seiders and Ryan R. Seiders

(collectively, the "Majority Stockholders"). Pursuant to the May 2019 Letter Agreement, in exchange for their allocated sales in our secondary offering of 10,925,000 shares of common stock sold by

selling stockholders, completed on May 8, 2019 (the "May 2019

9

Table of Contents

Offering"),

Messrs. Bullock and Hollon agreed to enter into (i) an amendment to the Registration Rights Agreement, pursuant to which Messrs. Bullock and Hollon will be deemed to

hold no registrable shares under the Registration Rights Agreement at such time as they hold 150,000 and 300,000 registrable shares, respectively, and (ii) a waiver to the Registration Rights

Agreement to facilitate the selling stockholder allocations in the May 2019 Offering (the "May 2019 Waiver"), pursuant to which YETI Holdings, Inc. and the Majority Stockholders agreed to use

their commercially reasonable efforts to effect the May 2019 Offering, subject to market conditions and certain other contingencies and considerations, and each party agreed that the number of shares

of common stock to be included in the May 2019 Offering was to be allocated according to the terms of the May 2019 Waiver. In addition, each of Messrs. Bullock and Hollon adopted trading plans

established under Rule 10b5-1 of the Exchange Act, pursuant to which they would each sell, subject to the terms of such trading plans, a significant portion of their remaining shares of common

stock commencing following the expiration of the lock-up agreements they entered into in connection with the May 2019 Offering. Such trading plans were adopted by each of Messrs. Bullock and

Hollon in the second quarter of 2019, and all shares included in such trading plans have now been sold. In addition, as of September 4, 2019, Messrs. Bullock and Hollon held less than

150,000 and 300,000 registrable shares, respectively, and, accordingly were deemed to hold no registrable shares under the Registration Rights Agreement.

On

November 4, 2019, we and certain parties to the Registration Rights Agreement entered into a waiver to the Registration Rights Agreement to facilitate the selling stockholder

allocations in our secondary offering of 11,500,000 shares of common stock sold by selling stockholders, completed on November 12, 2019 (the "November 2019 Offering"), and waived the

requirement to enter into lock-up agreements for certain parties to the Registration Rights Agreement that did not participate in the November 2019 Offering. In addition, on December 11, 2019,

we and certain parties to the Registration Rights Agreement entered into a letter agreement and an amendment to the Registration Rights Agreement, pursuant to which (i) Oaktree Specialty

Lending Corporation ("Oaktree"), Christopher S. Conroy, the Christopher S. Conroy Irrevocable Spousal Trust and Steven W. Hoogendoorn were deemed to hold no registrable shares under the Registration

Rights Agreement as of December 11, 2019 and (ii) in exchange, Oaktree agreed to adopt and implement a trading plan established under Rule 10b5-1 of the Exchange Act, pursuant to

which it would sell, subject to the terms of such trading plan, its remaining shares of common stock commencing following the expiration of the lock-up agreement it entered into in connection with

November 2019 Offering. Oaktree adopted such trading plan and all shares included in such trading plan have now been sold.

Other Related-Party Transactions

Roy J. Seiders serves in a non-executive capacity as Chairman and Founder of YETI Coolers, LLC pursuant to an employment agreement dated

September 14, 2015. Total cash payments made by us to Mr. Seiders, including salary, bonus, and dividends in respect of vested options, were approximately $54,000 for such service during

2019, $0.7 million 2018 and $1.0 million for 2017.

Ryan

R. Seiders, who currently serves as a Co-Founder of YETI Coolers, LLC pursuant to an employment agreement dated September 14, 2015, is the brother of Roy J. Seiders.

Total cash payments made by us to Mr. Seiders, including salary, bonus, and dividends in respect of vested options, were approximately $51,000 for 2019, $0.7 million for 2018 and

$0.7 million for 2017.

In

2012, we entered into a management services agreement with Cortec that provided for a management fee based on 1.0% of total sales, not to exceed $750,000 annually, plus certain

out-of-pocket expenses. Each of Messrs. Lipsitz, Najjar, and Schnadig are Managing Partners of Cortec. During each of 2018 and 2017, we incurred fees and out-of-pocket expenses under this

agreement of $0.8 million. This agreement was terminated in connection with our IPO and no further payments are due to Cortec.

10

Table of Contents

In

March 2016, the unvested stock options outstanding under the 2012 Plan, including those held by Messrs. Reintjes, Shields, and Barksdale, were modified to convert

performance-based options to time-based options and to change the vesting period for time-based options.

Under

the revised terms of Roy Seiders' option agreement, the options are subject solely to time-vesting restrictions as follows: (i) 138,156 of the options vested on

July 31, 2017 and (ii) the remaining 138,950 options vested on July 31, 2018.

Under

the revised terms of Ryan Seiders' option agreement, the options are subject solely to time-vesting restrictions as follows: (i) 135,774 of the options vested on

July 31, 2017 and (ii) the remaining 135,774 options vested on July 31, 2018.

We

lease warehouse space in Austin, Texas, from Hidalgo Ice, LP, an entity owned by Roy Seiders and Ryan Seiders. The lease is month to month, can be cancelled upon

30 days' written notice and requires monthly payments of $8,700. Total cash payments made by us to this entity under the lease agreement were $0.1 million for each of 2019, 2018 and

2017.

Indemnification of Directors and Officers

Our restated certificate of incorporation and amended and restated bylaws provide that our directors and officers will be indemnified by us to

the fullest extent authorized by Delaware law as it currently exists or may in the future be amended, against all expenses and liabilities reasonably incurred in connection with their service for or

on our behalf. In addition, our restated certificate of incorporation provides that our directors will not be personally liable for monetary damages to us or our stockholders for breaches of their

fiduciary duty as directors.

In

addition to the indemnification provided by our restated certificate of incorporation and amended and restated bylaws, we have entered into agreements to indemnify our directors,

executive officers and certain other officers and agents. These agreements, among other things and subject to certain standards to be met, require us to indemnify these directors, officers and agents

for certain expenses, including attorneys' and experts' fees, judgments, fines, penalties and settlement amounts incurred by any such person in any action or proceeding, including any action by or in

our right, arising out of that person's services as a director, officer or agent of us or any of our subsidiaries or any other company or enterprise to which the person provides services at our

request. These agreements also require us to advance expenses to these officers and directors for investigating, defending, being a witness in or participating in, or preparing to investigate, defend,

be a witness or participate in, any such action or proceeding, subject to an undertaking to repay such amounts if it is ultimately determined that such director, officer or agent was not entitled to

be indemnified for such expenses.

We

maintain, at our expense, an insurance policy that insures our officers and directors, subject to customary exclusions and deductions, against loss arising from claims made for breach

of fiduciary duty or other wrongful acts as a director or executive officer and to us with respect to payments that may be made by us to these directors and executive officers pursuant to our

indemnification obligations or otherwise as a matter of law. We have also entered into additional and enhanced insurance arrangements to provide coverage to our directors and executive officers

against loss arising from claims relating to public securities matters.

11

Table of Contents

SELLING STOCKHOLDERS

The selling stockholders named below may offer, from time to time in one or more offerings, up to an aggregate of 15,000,000 shares of our

common stock, subject to adjustments for stock splits, stock dividends and reclassifications. The following table sets forth the names of the selling stockholders (and/or the beneficial owners) and

the number of shares of common stock held by each of them as of May 1, 2020. The table below reflects the current intended allocation of the sale of 15,000,000 shares of our common stock by the

selling stockholders. The selling stockholders may agree, however, to sell the shares in different amounts among the selling stockholders, but in any event not to exceed 15,000,000 shares in the

aggregate.

Information

in the table below with respect to beneficial ownership has been furnished by each of the selling stockholders. The shares are being registered to permit public secondary

trading of the shares, and selling stockholders may offer the shares for resale from time to time in one or more offerings. Beneficial ownership is determined in accordance with the rules and

regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if they have or share the power to vote or direct the voting thereof, or to dispose or direct

the disposition thereof, or have the right to acquire such powers within 60 days. In computing the percentage ownership of a person, shares of our common stock subject to the options held by

that person are deemed to be outstanding if they are exercisable within 60 days of May 1, 2020. The shares subject to options are not deemed to be outstanding for the purpose of

computing the percentage ownership of any other person. All percentages in the following tables are based on a total of 86,898,386 shares of our common stock outstanding as of May 1, 2020.

The

selling stockholders listed in the table below may have sold, transferred, otherwise disposed of or purchased, or may sell, transfer, otherwise dispose of or purchase, at any time

and from time to time, shares of our common stock in transactions exempt from the registration requirements of the Securities Act or in the open market after the date on which they provided the

information set forth in the table below. We do not know which (if any) of the selling stockholders named below actually will offer to sell shares pursuant to this prospectus, or the number of shares

that each of them will offer.

Any

affiliate of a broker-dealer will be deemed to be an "underwriter" within the meaning of Section 2(a)(11) of the Securities Act, unless such selling stockholder purchased in

the ordinary course of business and, at the time of its purchase of the stock, did not have any agreements or understandings, directly or indirectly, with any person to distribute the stock. As a

result, any profits on the sale of the common stock by selling stockholders who are deemed to be "underwriter" and any

discounts, commissions or concessions received by any such broker-dealers who are deemed to be "underwriters" will be deemed to be underwriting discounts and commissions under the Securities Act.

Selling stockholders who are deemed to be "underwriters" will be subject to the prospectus delivery requirements of the Securities Act and to certain statutory liabilities, including, but not limited

to, those under Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act.

Information

about additional selling stockholders, if any, including their identities and the common stock to be registered on their behalf, will be set forth in a prospectus supplement,

in a post-effective amendment or in filings that we make with the SEC under the Exchange Act, which are incorporated by reference in this prospectus. Information concerning the selling stockholders

may change from time to time. Any changes to the information provided below will be set forth in a supplement to this prospectus, in a post-effective amendment or in filings we make with the SEC under

the Exchange Act, which are incorporated by reference into this prospectus if and when necessary.

Unless

otherwise indicated and subject to applicable community property laws, to our knowledge, each selling stockholder named in the following table possesses sole voting and investment

power over

12

Table of Contents

the

shares listed. Unless otherwise noted below, the address of each selling stockholder listed in the table is c/o YETI Holdings, Inc., 7601 Southwest Parkway, Austin, Texas 78735.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial

Ownership Before

Resale

|

|

|

|

Beneficial

Ownership After

Resale(1)

|

|

|

|

Common Stock

|

|

|

|

Common Stock

|

|

|

Name of selling stockholder

|

|

Number of

Shares

|

|

%

|

|

Number of

shares

offered

|

|

Number of

Shares

|

|

%

|

|

|

Cortec(2)

|

|

|

18,367,597

|

|

|

21.1

|

%

|

|

12,750,018

|

(7)

|

|

5,617,579

|

|

|

6.5

|

%

|

|

RJS Ice 2, LP(3)

|

|

|

5,402,115

|

|

|

6.2

|

%

|

|

965,797

|

|

|

4,436,318

|

|

|

5.1

|

%

|

|

RRS Ice 2, LP(4)

|

|

|

3,161,890

|

|

|

3.6

|

%

|

|

565,287

|

|

|

2,596,603

|

|

|

3.0

|

%

|

|

YHI CG Group Investors, LLC(5)

|

|

|

1,035,523

|

|

|

1.2

|

%

|

|

718,898

|

|

|

316,625

|

|

|

*

|

|

|

Allison S. Klazkin(6)

|

|

|

2,589

|

|

|

*

|

|

|

1,798

|

|

|

791

|

|

|

*

|

|

-

*

-

Less

than 1.0%.

-

(1)

-

Assumes

that each named selling stockholder sells all of the shares of our common stock it is offering for sale under this prospectus and neither acquires nor

disposes of any other shares, or rights to purchase other shares of our common stock, subsequent to the date as of which we obtained information regarding its holdings. Because the selling

stockholders are not obligated to sell all or any portion of the shares of our common stock shown as offered by them, we cannot estimate the actual number of shares (or the actual percentage of the

class) of our common stock that will be held by any selling stockholder upon completion of the offering. We are registering the offer and sale of the shares of common stock by the selling stockholders

to satisfy registration rights we granted to the selling stockholders. See "Certain Relationships and Related Party Transactions with Selling Stockholders—Registration Rights Agreement."

-

(2)

-

Includes

(i) 16,937,844 shares of common stock held by Cortec Group Fund V, L.P, (ii) 389,571 shares of common stock held by Cortec

Co-Investment Fund V, LLC, (iii) 1,035,523 shares of common stock held by Cortec Group Fund V (Parallel), L.P., (iv) 2,070 shares of common stock held by John T.

Miner, and (v) 2,589 shares of common stock held by Allison S. Klazkin.

Cortec

Management V, LLC is the managing general partner of Cortec Group Fund V, L.P. Cortec Group GP, LLC is the manager of Cortec Management V, LLC and Cortec

Co-Investment Fund V, LLC. The manner in which the investments of Cortec Group Fund V, L.P. and Cortec Co-Investment Fund V, LLC are held, including shares of common stock, and

any decisions concerning their ultimate voting and disposition, are subject to the control of Cortec Group GP, LLC, as manager of Cortec Management V, LLC and Cortec Co-Investment

Fund V, LLC. The managers of Cortec Group GP, LLC currently consist of David L. Schnadig, Jeffrey A. Lipsitz, Michael E. Najjar, Jeffrey R. Shannon and Jonathan A. Stein. A vote

of such managers holding at least 662/3% of Cortec Group GP, LLC is required to approve actions on behalf of Cortec Group GP, LLC with respect to shares of

common stock held by Cortec Group Fund V, L.P. and Cortec Co-Investment Fund V, LLC. As a result, none of the managers of Cortec Group GP, LLC has direct or indirect voting

or dispositive power with respect to such shares of common stock held by Cortec Group Fund V, L.P. and Cortec Co-Investment Fund V, LLC.

Cortec

Management V (Co-Invest), LLC is the general partner of Cortec Group Fund V (Parallel), L.P. The manner in which the investments of Cortec Group Fund V

(Parallel), L.P. are held, including shares of common stock, and any decisions concerning their ultimate voting and disposition, are subject to the control of Cortec Management V

(Co-Invest), LLC. The managers of Cortec Management V (Co-Invest), LLC currently consist of David L. Schnadig, Jeffrey A. Lipsitz, R. Scott Schafler and Michael E. Najjar. A majority

vote of such managers is required to approve actions with respect to shares of common stock held by Cortec Group Fund V

13

Table of Contents

(Parallel), L.P.

As a result, none of the managers of Cortec Management V (Co-Invest), LLC has direct or indirect voting or dispositive power with respect to such shares of common stock

held by Cortec Group Fund V (Parallel), L.P.

As

Cortec Group Fund V (Parallel), L.P. is required by the terms of its limited partnership agreement to dispose of its equity investments in the same manner and at the same time as

Cortec Group Fund V, L.P. and Cortec Co-Investment Fund V, LLC, John T. Miner and Allison S. Klazkin may only dispose of their respective equity investments in the same manner and

at the same time as Cortec Group Fund V, L.P., Cortec Management V, LLC, as managing general partner of Cortec Group Fund V, L.P. may also be deemed to have beneficial ownership

over the shares of common stock held by Cortec Group Fund V (Parallel), L.P., Cortec Co-Investment Fund V, LLC, John T. Miner and Allison S. Klazkin. Cortec

Group GP, LLC, as manager of Cortec Management V, LLC may also be deemed to have beneficial ownership over the shares of common stock held by Cortec Group Fund V

(Parallel), L.P., John T. Miner and Allison S. Klazkin. A vote of such managers holding at least 662/3% of Cortec Group GP, LLC is required to approve actions on

behalf of Cortec Group GP, LLC with respect to shares of common stock held by Cortec Group Fund V, L.P. As a result, none of the managers of Cortec Group GP, LLC has

direct or indirect voting or dispositive power with respect to shares of common stock held by Cortec Group Fund V (Parallel), L.P., John T. Miner and Allison S. Klazkin.

Each

of the managers of Cortec Group GP, LLC and Cortec Management V (Co-Invest), LLC disclaims beneficial ownership of the shares of common stock beneficially owned by such

entities. Each of the managers of Cortec Group GP, LLC, Cortec Group GP, LLC and Cortec Management V, LLC disclaims

beneficial ownership of the shares of common stock held by John T. Miner and Allison S. Klazkin.

The

address of Cortec Group Fund V, L.P., Cortec Co-Investment Fund V, LLC, Cortec Group Fund V (Parallel), L.P., Cortec Management V, LLC, Cortec Group GP,

LLC, and Cortec Management V (Co-Invest), LLC is 140 East 45th Street, 43rd Floor, New York, New York 10017.

-

(3)

-

Represents

5,402,115 shares of common stock held by RJS Ice 2, LP. Roy J. Seiders is the manager of RJS ICE Management, LLC, the general partner of RJS

Ice 2, LP, and may be deemed to beneficially own the shares of common stock held by RJS Ice 2, LP. The address of RJS ICE Management, LLC is P.O. Box 163325, Austin,

Texas 78716.

-

(4)

-

Includes

3,161,890 shares of common stock held by RRS Ice 2, LP. Ryan R. Seiders is the manager of RRS ICE Management, LLC, the general partner of RRS

Ice 2, LP, and may be deemed to beneficially own the shares of common stock held by RRS Ice 2, LP. The address of RRS ICE Management, LLC is P.O. Box 163325, Austin,

Texas 78716.

-

(5)

-

RDV

Corporation is the manager of YHI CG Group Investors, LLC. Robert H. Schierbeek, the chief executive officer of RDV Corporation, has direct voting and

dispositive power with respect to the shares of common stock held by YHI CG Group Investors, LLC. The address of YHI CG Group Investors, LLC is 126 Ottawa Avenue NW, Suite 500,

Grand Rapids, Michigan 49503.

-

(6)

-

The

address of Allison S. Klazkin is 140 East 45th Street, 43rd Floor, New York, New York 10017.

-

(7)

-

Includes

shares of common stock offered by Allison S. Klazkin.

14

Table of Contents

PLAN OF DISTRIBUTION

General

The selling stockholders may sell some or all of the shares of common stock that they hold, from time to time in one or more offerings, by a

variety of methods, including the following:

-

•

-

on any national securities exchange or quotation service on which our common stock may be listed at the time of sale, including the NYSE;

-

•

-

in the over-the-counter market;

-

•

-