Net Sales Increased 15%

Gross Margin Expanded 700 Basis

Points

Operating Income Increased 171%

Adjusted Operating Income Increased

89%

Updates 2019 Outlook

YETI Holdings, Inc. (“YETI”) (NYSE: YETI) today announced its

financial results for the first quarter ended

March 30, 2019.

YETI reports its financial performance in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”) and as adjusted on a non-GAAP basis. Please see

“Non-GAAP Financial Information” and “Reconciliation of GAAP to

Non-GAAP Financial Information” below for additional information

and reconciliations of the non-GAAP financial measures to the most

comparable GAAP financial measures.

Matt Reintjes, President and Chief Executive Officer, commented,

“We are off to a great start in 2019 with solid growth across our

product categories and distribution channels. Additionally,

our ongoing focus on disciplined growth allows us to drive stronger

profitability while making the investments required to expand brand

and product awareness to existing and new customers. As we

continue to execute our strategic plan, we are raising our full

year outlook and remain excited about the tremendous opportunities

ahead for the company.”

Q1 2019 Highlights

Net sales increased 15% to $155.4 million compared with

$135.3 million during the same period last year. Net sales growth

benefited by approximately 400 basis points from shipments late in

the quarter that were expected to ship in the second quarter.

- Direct-to-consumer (“DTC”) channel net

sales increased 28% to $61.7 million, compared to $48.3 million in

the prior year quarter, led by strong performance in the Drinkware

category.

- Wholesale channel net sales increased

8% to $93.6 million, compared to $87.0 million in the same period

last year, primarily driven by Coolers & Equipment.

- Drinkware net sales increased 20% to

$91.0 million compared to $75.8 million in the prior year

quarter, primarily driven by the continued expansion of our

Drinkware product offerings, including the introduction of new

colorways and strong demand for customization.

- Coolers & Equipment net sales

increased 11% to $59.7 million, compared to $53.7 million

in the same period last year, primarily driven by color updates

across several hard and soft cooler lines, as well as the

introduction of the CaminoTM Carryall bag to our wholesale channel.

Net sales during the period include $1.2 million of net sales

related to our Boomer 8 Dog Bowl, which was previously reported in

our Other category.

Gross profit increased 34% to $76.6 million, or 49.3% of

net sales, compared to $57.2 million, or 42.3% of net sales, in the

first quarter of 2018. The 700 basis point increase in gross margin

was driven by cost improvements across our product portfolio, a

favorable shift in our channel mix led by an increase in DTC

channel net sales, the absence of an inventory charge taken in the

prior year due to a fire at a vendor’s warehouse facility, and

lower inbound freight expenses, partially offset by higher tariff

rates.

Selling, general, and administrative (“SG&A”)

expenses increased to $67.8 million, or 43.7% of net sales,

compared to $53.9 million, or 39.9% of net sales, in the first

quarter of 2018. Approximately 290 basis points of the 380 basis

points increase was attributable to higher selling expenses,

including marketing and outbound freight. The balance of the

increase was primarily due to incremental costs associated with our

transition to becoming a public company, higher information

technology-related costs, and increased non-cash stock-based

compensation expense, partially offset by other general and

administrative cost savings.

Operating income increased 171% to $8.8 million, or 330

basis points to 5.7% of net sales, compared to $3.2 million,

or 2.4% of net sales, during the prior year quarter.

Adjusted operating income increased 89% to $14.7 million,

or 370 basis points, to 9.4% of net sales, compared to $7.7

million, or 5.7% of net sales, during the same period last

year.

Net income was $2.2 million, or $0.03 per diluted share,

compared to a net loss of $3.3 million, or a $0.04 net loss per

diluted share, in the prior year quarter.

Adjusted net income increased to $6.6 million, or $0.08

per diluted share, compared to adjusted net income of

$0.3 million, or $0.00 per diluted share, in the prior year

quarter.

Adjusted EBITDA increased 58% to $21.3 million from $13.4

million during the same period last year.

Balance Sheet and Cash Flow Highlights

Inventory increased 4% to $164.3 million, compared to

$158.5 million at the end of the first quarter of 2018.

Total debt, excluding unamortized deferred financing

fees, was $321.8 million, compared to $473.3 million at the end of

the first quarter of 2018. During the first quarter of 2019, we

made a $11.1 million mandatory debt payment. Our ratio of net debt

to adjusted EBITDA for the trailing twelve months (as defined

below) was 1.9 times at the end of the first quarter of 2019,

compared to 4.0 times at the end of the same period last year.

Cash flow used in operating activities was $30.0 million

and capital expenditures were $8.4 million for first quarter of

2019.

Updated 2019 Outlook

- Net sales are still expected to

increase between 11.5% and 13% compared to 2018, with growth across

both channels and led by the DTC channel;

- Operating income as a percentage of

net sales is now expected to be between 14.2% and 14.5%,

reflecting margin expansion of 110 to 140 basis points, primarily

driven by higher gross margin (versus the previous outlook of 13.9%

and 14.4%, reflecting margin expansion of 80 to 130 basis

points);

- Adjusted operating income as a

percentage of net sales is now expected to be between 16.2% and

16.5%, reflecting margin expansion of 30 to 60 basis points,

primarily driven by higher gross margin (versus the previous

outlook of 15.9% and 16.3%, reflecting margin expansion of zero to

40 basis points);

- An effective tax rate at a more

normalized level of approximately 24.5%, which remains unchanged

from the previous outlook;

- Net income per diluted share is

now expected to be between $0.87 and $0.90, reflecting 25% and 31%

growth (versus the previous outlook of $0.84 and $0.89, reflecting

22% and 29% growth); assuming a normalized tax rate of 24.5% in

2018 (the effective tax rate for 2018 was 17%), earnings growth

would be between 38% and 44% (versus the previous outlook of 34%

and 42%);

- Adjusted net income per diluted

share is now expected to be between $1.02 and $1.06, reflecting

13% to 17% growth (versus the previous outlook of $0.99 and $1.04,

reflecting 10% to 15% growth); assuming a normalized tax rate of

24.5% in 2018 (the effective tax rate for 2018 was 17%), adjusted

earnings growth would be between 21% and 26% (versus the previous

outlook of 18% and 24%);

- Diluted weighted average shares

outstanding of 86 million, which remains unchanged from the

previous outlook;

- Adjusted EBITDA is now expected

to be between $171.9 million and $176.3 million, reflecting 15% to

18% growth (versus the previous outlook of $169.0 million and

$174.3 million, reflecting 13% to 17% growth);

- Capital expenditures are still

expected to be between $35 million and $40 million; and

- Debt repayments of approximately

$80 million and a ratio of net debt to Adjusted EBITDA of

approximately 1.0 times at the end of 2019, which remains unchanged

from the previous outlook, compared to 1.7 times at the end of

2018.

Ratio of Net Debt to Adjusted EBITDA Trailing Twelve

Months

Net debt for the first quarter of 2019, which is total debt of

$321.8 million less cash of $19.0 million, divided by adjusted

EBITDA for the trailing twelve months was 1.9 times. Adjusted

EBITDA for the trailing twelve months ending March 30, 2019 was

$156.9 million and is calculated using the full year 2018 adjusted

EBITDA of $149.0 million less adjusted EBITDA for the first quarter

of 2018 of $13.4 million, plus adjusted EBITDA for the first

quarter of 2019 of $21.3 million.

Net debt for the first quarter of 2018, which is total debt less

cash of $60.4 million, divided by adjusted EBITDA for the trailing

twelve months was 4.0 times. Adjusted EBITDA for the trailing

twelve months ending March 31, 2018 was $104.4 million and is

calculated using the full year 2017 adjusted EBITDA of $97.5

million less adjusted EBITDA for the first quarter of 2017 of $6.5

million, plus adjusted EBITDA for the first quarter of 2018 of

$13.4 million.

Conference Call Details

A conference call to discuss the first quarter of 2019 financial

results is scheduled for today, May 2, 2019, at 8:00 a.m.

Eastern Time. Investors and analysts interested in participating in

the call are invited to dial 877-451-6152 (international callers

please dial 201-389-0879) approximately 10 minutes prior to the

start of the call. A live audio webcast of the conference call will

be available online at http://investors.yeti.com and by dialing

844-512-2921 and entering the access code 13689723. The replay will

be available until May 16, 2019. A copy of this press release will

be furnished to the Securities and Exchange Commission on a Current

Report on Form 8-K, and will be posted to our investor relations

web site, prior to the conference call.

About YETI Holdings, Inc.

YETI is a designer, marketer, retailer, and distributor of a

variety of innovative, branded, premium products to a wide-ranging

customer base. Our mission is to ensure that each YETI product

delivers exceptional performance and durability in any environment,

whether in the remote wilderness, at the beach, or anywhere else

life takes our customers. By consistently delivering

high-performing products, we have built a following of engaged

brand loyalists throughout the United States, Canada, Japan,

Australia, and elsewhere, ranging from serious outdoor enthusiasts

to individuals who simply value products of uncompromising quality

and design. Our relationship with customers continues to thrive and

deepen as a result of our innovative new product introductions,

expansion and enhancement of existing product families, and

multifaceted branding activities.

Non-GAAP Financial Information

This press release includes financial measures that are not

defined by GAAP, including adjusted operating income, adjusted net

income, adjusted net income per diluted share, and adjusted EBITDA.

We define adjusted operating income and adjusted net income as

operating income and net income, respectively, adjusted for

non-cash stock-based compensation expense, asset impairment

charges, investments in new retail locations and international

market expansion, transition to Cortec Group Fund V, L.P. and its

affiliates (“Cortec”) majority ownership, transition to the ongoing

senior management team, and transition to a public company, and, in

the case of adjusted net income, also adjusted for accelerated

amortization of deferred financing fees and the loss from early

extinguishment of debt resulting from early prepayments of debt,

and the tax impact of all adjustments. Adjusted net income per

share is calculated using Adjusted net income, as defined above,

and diluted weighted average shares outstanding. We define adjusted

EBITDA as net income before interest expense, net, provision

(benefit) for income taxes and depreciation and amortization,

adjusted for the impact of certain other items, including: non-cash

stock-based compensation expense; asset impairment charges;

accelerated amortization of deferred financing fees and loss from

early extinguishment of debt resulting from the early prepayment of

debt; investments in new retail locations and international market

expansion; transition to Cortec majority ownership; transition to

the ongoing senior management team; and transition to a public

company. The expenses incurred related to these transitional events

include: management fees and contingent consideration related to

the transition to Cortec majority ownership; severance, recruiting,

and relocation costs related to the transition to our ongoing

senior management team; consulting fees, recruiting fees, salaries

and travel costs related to members of our Board of Directors, fees

associated with Sarbanes-Oxley Act compliance, and incremental

audit and legal fees in connection with our transition to a public

company. All of these transitional costs are reported in SG&A

expenses.

Adjusted operating income, adjusted net income, adjusted net

income per diluted share, and adjusted EBITDA are not defined by

GAAP and may not be comparable to similarly titled measures

reported by other entities. We use these non-GAAP measures, along

with GAAP measures, as a measure of profitability. These measures

help us compare our performance to other companies by removing the

impact of our capital structure; the effect of operating in

different tax jurisdictions; the impact of our asset base, which

can vary depending on the book value of assets and methods used to

compute depreciation and amortization; the effect of non-cash

stock-based compensation expense, which can vary based on plan

design, share price, share price volatility, and the expected lives

of equity instruments granted; as well as certain expenses related

to what we believe are events of a transitional nature. We also

disclose adjusted operating income, adjusted net income, and

adjusted EBITDA as a percentage of net sales to provide a measure

of relative profitability.

We believe that these non-GAAP measures, when reviewed in

conjunction with GAAP financial measures, and not in isolation or

as substitutes for analysis of our results of operations under

GAAP, are useful to investors as they are widely used measures of

performance and the adjustments we make to these non-GAAP measures

provide investors further insight into our profitability and

additional perspectives in comparing our performance to other

companies and in comparing our performance over time on a

consistent basis. adjusted operating income, adjusted net income,

and adjusted EBITDA have limitations as profitability measures in

that they do not include the interest expense on our debts, our

provisions for income taxes, and the effect of our expenditures for

capital assets and certain intangible assets. In addition, all of

these non-GAAP measures have limitations as profitability measures

in that they do not include the effect of non-cash stock-based

compensation expense, the effect of asset impairments, the effect

of investments in new retail locations and international market

expansion, and the impact of certain expenses related to

transitional events that are settled in cash. Because of these

limitations, we rely primarily on our GAAP results.

In the future, we may incur expenses similar to those for which

adjustments are made in calculating adjusted operating income,

adjusted net income, and adjusted EBITDA. Our presentation of these

non-GAAP measures should not be construed as a basis to infer that

our future results will be unaffected by extraordinary, unusual or

non-recurring items.

Forward-looking statements

This press release contains ‘‘forward-looking statements’’

within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than statements of historical or

current fact included in this press release are forward-looking

statements. Forward-looking statements include statements

containing words such as “anticipate,” “assume,” “believe,” “can

have,” “contemplate,” “continue,” “could,” “design,” “due,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “likely,”

“may,” “might,” “objective,” “plan,” “predict,” “project,”

“potential,” “seek,” “should,” “target,” “will,” “would,” and other

words and terms of similar meaning in connection with any

discussion of the timing or nature of future operational

performance or other events. For example, all statements made

relating to our growth plans and expectations and our expectations

for annual growth, including those set forth in the quote from

YETI’s President and CEO, and the 2019 financial outlook provided

herein. All forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those that are expected and, therefore, you should not unduly

rely on such statements. The risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied by these forward-looking statements include but are not

limited to: (i) our ability to maintain and strengthen our brand

and generate and maintain ongoing demand for our products; (ii) our

ability to successfully design and develop new products; (iii) our

ability to effectively manage our growth; (iv) our ability to

expand into additional consumer markets, and our success in doing

so; (v) the success of our international expansion plans; (vi) our

ability to compete effectively in the outdoor and recreation market

and protect our brand; (v) the level of customer spending for our

products, which is sensitive to general economic conditions and

other factors; (vi) problems with, or loss of, our third-party

contract manufacturers and suppliers, or an inability to obtain raw

materials; (vii) fluctuations in the cost and availability of raw

materials, equipment, labor, and transportation and subsequent

manufacturing delays or increased costs; (viii) our ability to

accurately forecast demand for our products and our results of

operations; (ix) our relationships with our national, regional, and

independent retail partners, who account for a significant portion

of our sales; (x) the impact of natural disasters and failures of

our information technology on our operations and the operations of

our manufacturing partners; (xi) our ability to attract and retain

skilled personnel and senior management, and to maintain the

continued efforts of our management and key employees; and (xii)

the impact of our indebtedness on our ability to invest in the

ongoing needs of our business. You should read our filings with the

United States Securities and Exchange Commission (the “SEC”),

including our Annual Report on Form 10-K for the year ended

December 30, 2018, for a more extensive list of factors, that may

be amended, supplemented or superseded from time to time by other

reports YETI files with the SEC, that could affect results. These

forward-looking statements are made based upon detailed assumptions

and reflect management’s current expectations and beliefs. While

YETI believes that these assumptions underlying the forward-looking

statements are reasonable, YETI cautions that it is very difficult

to predict the impact of known factors, and it is impossible for

YETI to anticipate all factors that could affect actual

results.

The forward-looking statements included here are made only as of

the date hereof. YETI undertakes no obligation to publicly update

or revise any forward-looking statement as a result of new

information, future events, or otherwise, except as required by

law.

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended March 30, March

31, 2019 2018 Net sales $ 155,353 $ 135,257 Cost

of goods sold 78,726 78,068 Gross

profit 76,627 57,189 Selling, general, and administrative expenses

67,843 53,945 Operating income 8,784

3,244 Interest expense (6,067 ) (8,126 ) Other income (expense)

63 (18 ) Income (loss) before income taxes

2,780 (4,900 ) Income tax (expense) benefit (613 )

1,639

Net income (loss) $ 2,167 $

(3,261 )

Net income (loss) per share Basic $ 0.03 $

(0.04 ) Diluted $ 0.03 $ (0.04 )

Weighted average common

shares outstanding Basic 84,196 81,419 Diluted 85,857 81,419

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except per share

amounts)

March 30, December 29, March 31,

2019 2018 2018 ASSETS Current assets

Cash $ 19,008 $ 80,051 $ 60,404 Accounts receivable, net 62,998

59,328 60,412 Inventory 164,299 145,423 158,537 Prepaid expenses

and other current assets 20,069 12,211

10,514 Total current assets 266,374 297,013 289,867

Property and equipment, net 78,221 74,097 71,486 Goodwill 54,293

54,293 54,293 Intangible assets, net 90,036 80,019 75,957 Deferred

income taxes 5,740 7,777 9,547 Deferred charges and other assets

1,122 1,014 1,043 Total

assets $ 495,786 $ 514,213 $ 502,193

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) Current

liabilities Accounts payable $ 78,225 $ 68,737 $ 51,637 Accrued

expenses and other current liabilities 44,583 53,022 35,553 Taxes

payable 278 6,390 8,621 Accrued payroll and related costs 5,778

15,551 7,748 Current maturities of long-term debt 43,638

43,638 47,050 Total current

liabilities 172,502 187,338 150,609 Long-term debt, net of current

portion 273,825 284,376 417,980 Other liabilities 13,988

13,528 12,573 Total liabilities

460,315 485,242 581,162 Commitments and contingencies

Stockholders’ equity Common stock, par value $0.01; 600,000 shares

authorized; 84,196, 84,196, and 81,437 shares outstanding at March

30, 2019, December 29, 2018, and March 31, 2018, respectively 842

842 811 Preferred stock, par value $0.01; 30,000 shares authorized;

no shares issued or outstanding — — — Additional paid-in capital

272,332 268,327 220,138 Accumulated deficit (237,596 ) (240,104 )

(299,956 ) Accumulated other comprehensive (loss) income

(107 ) (94 ) 38 Total stockholders’ equity

(deficit) 35,471 28,971 (78,969

) Total liabilities and stockholders’ equity $ 495,786 $

514,213 $ 502,193

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

(In thousands, except per share

amounts)

Three Months Ended March 30, March 31,

2019 2018 Cash Flows from Operating

Activities: Net income (loss) $ 2,167 $ (3,261 ) Adjustments to

reconcile net income to cash (used in) provided by operating

activities: Depreciation and amortization 6,539 5,703 Amortization

of deferred financing fees 574 736 Stock-based compensation 4,005

3,010 Deferred income taxes 1,875 457 Impairment of long-lived

assets 94 — Changes in operating assets and liabilities: Accounts

receivable, net (3,178 ) 6,711 Inventory (19,211 ) 16,534 Other

current assets (7,388 ) (3,385 ) Income tax receivable (452 ) —

Accounts payable and accrued expenses (9,086 ) 1,824 Taxes payable

(6,132 ) (3,656 ) Other 151 627 Net

cash (used in) provided by operating activities (30,042 )

25,300

Cash Flows from Investing Activities:

Purchases of property and equipment (8,380 ) (2,205 ) Purchases of

intangibles, net (11,436 ) (2,929 ) Net cash used in

investing activities (19,816 ) (5,134 )

Cash Flows

from Financing Activities: Repayments of long-term debt (11,125

) (11,388 ) Cash paid for repurchase of common stock — (1,967 )

Proceeds from employee stock transactions — 53 Taxes paid in

connection with exercise of stock options — (57 ) Payments of

dividends — (96 ) Net cash used in financing

activities (11,125 ) (13,455 ) Effect of exchange

rate changes on cash (60 ) 43 Net (decrease) increase in cash

(61,043 ) 6,754 Cash, beginning of period 80,051

53,650 Cash, end of period $ 19,008 $ 60,404

YETI HOLDINGS, INC.

SELECTED FINANCIAL DATA

Reconciliation of GAAP to Non-GAAP

Financial Information

(Unaudited)

(In thousands except per share

amounts)

Three Months Ended March 30, March 31,

2019 2018 Operating income $

8,784 $ 3,244 Adjustments: Non-cash

stock-based compensation expense(1) 4,005 3,010 Long-lived asset

impairment(1) 94 — Investments in new retail locations and

international market expansion(1)(2) 228 240 Transition to Cortec

majority ownership(1)(3) — 750 Transition to the ongoing senior

management team(1)(4) 100 466 Transition to a public company(1)(5)

1,469 38

Adjusted operating

income $ 14,680 $ 7,748

Net income (loss) $ 2,167

$ (3,261 ) Adjustments: Non-cash stock-based

compensation expense(1) 4,005 3,010 Long-lived asset impairment(1)

94 — Investments in new retail locations and international market

expansion(1)(2) 228 240 Transition to Cortec majority

ownership(1)(3) — 750 Transition to the ongoing senior management

team(1)(4) 100 466 Transition to a public company(1)(5) 1,469 38

Tax impact of adjusting items(6) (1,444 ) (982 )

Adjusted net income $ 6,619 $

261 Net income (loss) $

2,167 $ (3,261 ) Adjustments: Interest

expense 6,067 8,126 Income tax expense (benefit) 613 (1,639 )

Depreciation and amortization expense(7) 6,539 5,703 Non-cash

stock-based compensation expense(1) 4,005 3,010 Long-lived asset

impairment(1) 94 — Investments in new retail locations and

international market expansion(1)(2) 228 240 Transition to Cortec

majority ownership(1)(3) — 750 Transition to the ongoing senior

management team(1)(4) 100 466 Transition to a public company(1)(5)

1,469 38

Adjusted EBITDA

$ 21,282 $ 13,433

Net sales $ 155,353 $ 135,257

Operating income as a % of net sales 5.7 % 2.4 % Adjusted operating

income as a % of net sales 9.4 % 5.7 % Net income (loss) as a % of

net sales 1.4 % (2.4 )% Adjusted net income as a % of net sales 4.3

% 0.2 % Adjusted EBITDA as a % of net sales 13.7 % 9.9 % Net

income (loss) per diluted share $ 0.03 $ (0.04 ) Adjusted net

income per diluted share $ 0.08 $ 0.00 Weighted average common

shares outstanding - diluted 85,857 81,419

_________________________

(1) These costs are reported in SG&A

expenses. (2) Represents retail store pre-opening expenses and

costs for expansion into new international markets. (3) Represents

management service fees paid to Cortec, our majority stockholder.

The management services agreement with Cortec was terminated

immediately following the completion of our IPO in October 2018.

(4) Represents severance, recruiting, and relocation costs related

to the transition to our ongoing senior management team. (5)

Represents fees and expenses in connection with our transition to a

public company, including consulting fees, recruiting fees,

salaries, and travel costs related to members of our Board of

Directors, fees associated with Sarbanes-Oxley Act compliance, and

incremental audit and legal fees associated with being a public

company. (6) Represents the tax impact of adjustments calculated at

an expected statutory tax rate of 24.5% and 21.8% for the first

quarter of 2019 and 2018, respectively. (7) Depreciation and

amortization expenses are reported in SG&A expenses and cost of

goods sold.

YETI HOLDINGS, INC.

UPDATED 2019 OUTLOOK

Reconciliation of GAAP to Non-GAAP

Financial Information

(Unaudited)

(In thousands except per share

amounts)

Updated 2019 Outlook Low High

Operating income $ 123,287 $

127,666 Adjustments: Non-cash stock-based compensation

expense(1) 11,860 11,860 Long-lived asset impairment(1) 94 94

Investments in new retail locations and international market

expansion(1)(2) 1,223 1,223 Transition to the ongoing senior

management team(1)(3) 100 100 Transition to a public company(1)(4)

4,476 4,476

Adjusted operating

income $ 141,040 $ 145,419

Net income $ 74,502 $

77,808 Adjustments: Non-cash stock-based compensation

expense(1) 11,860 11,860 Long-lived asset impairment(1) 94 94

Investments in new retail locations and international market

expansion(1)(2) 1,223 1,223 Transition to the ongoing senior

management team(1)(3) 100 100 Transition to a public company(1)(4)

4,476 4,476 Tax impact of adjusting items(5) (4,347 )

(4,347 )

Adjusted net income $ 87,908

$ 91,214 Net income $

74,502 $ 77,808 Adjustments: Interest expense

24,624 24,624 Income tax expense 24,161 25,234 Depreciation and

amortization expense(6) 30,900 30,900 Non-cash stock-based

compensation expense(1) 11,860 11,860 Long-lived asset

impairment(1) 94 94 Investments in new retail locations and

international market expansion(1)(2) 1,223 1,223 Transition to the

ongoing senior management team(1)(3) 100 100 Transition to a public

company(1)(4) 4,476 4,476

Adjusted

EBITDA $ 171,940 $ 176,319

Net sales $ 868,399 $ 880,082 Operating income

as a % of net sales 14.2 % 14.5 % Adjusted operating income as a %

of net sales 16.2 % 16.5 % Net income per diluted share $

0.87 $ 0.90 Adjusted net income per diluted share $ 1.02 $ 1.06

Weighted average common shares outstanding - diluted 86,031 86,031

_________________________

(1) These costs are reported in SG&A

expenses. (2) Represents retail store pre-opening expenses and

costs for expansion into new international markets. (3) Represents

severance, recruiting, and relocation costs related to the

transition to our ongoing senior management team. (4) Represents

fees and expenses in connection with our transition to a public

company, including consulting fees, recruiting fees, salaries, and

travel costs related to members of our Board of Directors, fees

associated with Sarbanes-Oxley Act compliance, and incremental

audit and legal fees associated with being a public company. (5)

Represents tax impact of adjustments calculated at an expected

statutory tax rate of 24.5%. (6) These costs are reported in

SG&A expenses and cost of goods sold.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190502005223/en/

Investor Relations Contact:Tom Shaw,

512-271-6332Investor.relations@yeti.com

Media Contact:Alecia Pulman,

203-682-8224alecia.pulman@icrinc.com

Brittany Fraser, 646-277-1231brittany.fraser@icrinc.com

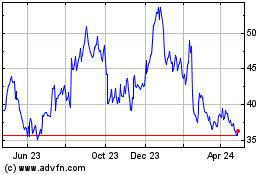

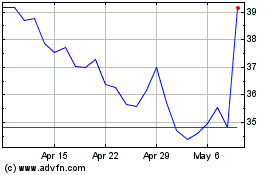

YETI (NYSE:YETI)

Historical Stock Chart

From Mar 2024 to Apr 2024

YETI (NYSE:YETI)

Historical Stock Chart

From Apr 2023 to Apr 2024