First Quarter 2020 Net Revenue Grew 6% Compared

to First Quarter 2019

Net Loss of $16 Million

Adjusted EBITDA was $17 Million

As of March 31, 2020, the Company had $491

Million of Cash, Cash Equivalents and Marketable Securities

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today posted its financial results for the

first quarter ended March 31, 2020 in the Q1 2020 Shareholder

Letter available on its Investor Relations website at www.yelp-ir.com.

“The emergence of the COVID-19 pandemic has drastically changed

nearly all aspects of life and has significantly impacted local

businesses and their ability to operate as they once did,” said

Jeremy Stoppelman, Yelp’s co-founder and chief executive officer.

“Our first quarter results demonstrate the strength of our

strategy, as we grew Revenue 6% compared to the first quarter of

2019, despite the emergence of the COVID-19 pandemic in March.

While there is no way of knowing how long this pandemic will last,

we are encouraged by the early signs of stabilization in the

business that we witnessed in the second half of April. We are

confident that our diversified customer base across a variety of

geographies and categories, financial liquidity, and operational

capabilities will enable Yelp to weather the current crisis and

emerge well-positioned to support local economies as they recover

and return to growth.”

Quarterly Conference Call

Yelp will host a live Q&A session today at 2:00 p.m. Pacific

Time to discuss the first quarter 2020 financial results. The

webcast of the Q&A can be accessed on the Yelp Investor

Relations website at www.yelp-ir.com.

A replay of the webcast will be available at the same website.

About Yelp

Yelp Inc. (www.yelp.com) connects

people with great local businesses. With unmatched local business

information, photos, and review content, Yelp provides a one-stop

local platform for consumers to discover, connect, and transact

with local businesses of all sizes by making it easy to request a

quote, join a waitlist, and make a reservation, appointment, or

purchase. Yelp was founded in San Francisco in July 2004.

Yelp intends to make future announcements of material financial

and other information through its Investor Relations website. Yelp

will also, from time to time, disclose this information through

press releases, filings with the Securities and Exchange

Commission, conference calls, or webcasts, as required by

applicable law.

Forward-Looking Statements

This press release contains forward-looking statements relating

to, among other things, Yelp’s future performance, including the

stabilization in its business and its ability to weather and emerge

well positioned from the current crisis, that are based on its

current expectations, forecasts, and assumptions that involve risks

and uncertainties.

Yelp’s actual results could differ materially from those

predicted or implied and reported results should not be considered

as an indication of future performance. Factors that could cause or

contribute to such differences include, but are not limited to:

- the duration and magnitude of the COVID-19 pandemic and

measures implemented to help control its spread;

- Yelp’s ability to maintain and expand its base of advertisers,

particularly as many businesses reduce spending on advertising in

connection with COVID-19;

- Yelp’s limited operating history in an evolving industry;

- Yelp’s ability to generate sufficient revenue to regain

profitability, particularly in light of the ongoing impact of

COVID-19 and Yelp’s relief initiatives; and

- Yelp’s ability to generate and maintain sufficient high-quality

content from its users.

YELP INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

March 31,

December 31,

2020

2019

Assets

Current assets:

Cash and cash equivalents

$

364,576

$

170,281

Short-term marketable securities

122,618

242,000

Accounts receivable, net

85,875

106,832

Prepaid expenses and other current

assets

21,804

14,196

Total current assets

594,873

533,309

Long-term marketable securities

3,500

53,499

Property, equipment and software, net

110,141

110,949

Operating lease right-of-use assets

199,053

197,866

Goodwill

103,976

104,589

Intangibles, net

9,304

10,082

Restricted cash

22,332

22,037

Other non-current assets

42,045

38,369

Total assets

$

1,085,224

$

1,070,700

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

74,702

$

72,333

Operating lease liabilities — current

62,342

57,507

Deferred revenue

3,637

4,315

Total current liabilities

140,681

134,155

Operating lease liabilities —

long-term

175,073

174,756

Other long-term liabilities

7,038

6,798

Total liabilities

322,792

315,709

Stockholders' equity:

Common stock

—

—

Additional paid-in capital

1,283,885

1,259,803

Accumulated other comprehensive loss

(12,863

)

(11,759

)

Accumulated deficit

(508,590

)

(493,053

)

Total stockholders' equity

762,432

754,991

Total liabilities and stockholders'

equity

$

1,085,224

$

1,070,700

YELP INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

March 31,

2020

2019

Net revenue

$

249,901

$

235,942

Costs and expenses:

Cost of revenue (1)

16,847

14,265

Sales and marketing (1)

137,297

124,316

Product development (1)

67,113

58,075

General and administrative (1)

43,536

31,292

Depreciation and amortization

12,358

11,876

Total costs and expenses

277,151

239,824

Loss from operations

(27,250

)

(3,882

)

Other income, net

2,383

4,691

(Loss) income before income taxes

(24,867

)

809

Benefit from income taxes

(9,364

)

(556

)

Net (loss) income attributable to common

stockholders

$

(15,503

)

$

1,365

Net (loss) income per share attributable

to common stockholders

Basic

$

(0.22

)

$

0.02

Diluted

$

(0.22

)

$

0.02

Weighted-average shares used to compute

net (loss) income per share attributable to common stockholders

Basic

71,548

81,772

Diluted

71,548

85,087

(1) Includes stock-based compensation

expense as follows:

Three Months Ended

March 31,

2020

2019

Cost of revenue

$

1,043

$

1,244

Sales and marketing

7,696

7,687

Product development

17,755

16,075

General and administrative

5,256

6,313

Total stock-based compensation

$

31,750

$

31,319

YELP INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2020

2019

Operating Activities

Net (loss) income attributable to common

stockholders

$

(15,503)

$

1,365

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation and amortization

12,358

11,876

Provision for doubtful accounts

15,933

4,264

Stock-based compensation

31,750

31,319

Noncash lease cost

10,378

9,751

Deferred income taxes

(7,450)

(1,259)

Other adjustments, net

(287)

(1,159)

Changes in operating assets and

liabilities:

Accounts receivable

5,024

(6,260)

Prepaid expenses and other assets

(4,118)

(5,292)

Operating lease liabilities

(6,663)

(9,948)

Accounts payable, accrued liabilities and

other liabilities

(636)

6,372

Net cash provided by operating

activities

40,786

41,029

Investing Activities

Sales and maturities of marketable

securities — available-for-sale

164,215

—

Purchases of marketable securities —

held-to-maturity

(87,438)

(157,567)

Maturities of marketable securities —

held-to-maturity

93,200

201,497

Purchases of property, equipment and

software

(7,053)

(8,991)

Other investing activities

295

215

Net cash provided by investing

activities

163,219

35,154

Financing Activities

Proceeds from issuance of common stock for

employee stock-based plans

2,585

1,145

Repurchases of common stock

—

(102,126)

Taxes paid related to the net share

settlement of equity awards

(11,514)

(12,497)

Net cash used in financing activities

(8,929)

(113,478)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(486)

(65)

Change in cash, cash equivalents and

restricted cash

194,590

(37,360)

Cash, cash equivalents and restricted cash

— Beginning of period

192,318

354,835

Cash, cash equivalents and restricted cash

— End of period

$

386,908

$

317,475

Non-GAAP Financial Measures

This press release and statements made during the above

referenced webcast may include information relating to EBITDA,

Adjusted EBITDA and Adjusted EBITDA margin, each of which the

Securities and Exchange Commission has defined as a "non-GAAP

financial measure."

We define EBITDA as net income (loss), adjusted to exclude:

provision for (benefit from) income taxes; other income, net; and

depreciation and amortization.

We define Adjusted EBITDA as net income (loss), adjusted to

exclude: provision for (benefit from) income taxes; other income,

net; depreciation and amortization; stock-based compensation

expense; and, in certain periods, certain other income and expense

items. We define Adjusted EBITDA margin as Adjusted EBITDA divided

by net revenue.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are key

measures used by Yelp management and the board of directors to

understand and evaluate core operating performance and trends, to

prepare and approve Yelp’s annual budget and to develop short- and

long-term operational plans. The presentation of this financial

information, which is not prepared under any comprehensive set of

accounting rules or principles, is not intended to be considered in

isolation or as a substitute for the financial information prepared

and presented in accordance with generally accepted accounting

principles in the United States (“GAAP”).

EBITDA and Adjusted EBITDA have limitations as analytical tools,

and you should not consider them in isolation or as a substitute

for analysis of Yelp’s financial results as reported under GAAP.

Some of these limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and EBITDA and Adjusted EBITDA do not reflect cash

capital expenditure requirements for such replacements or for new

capital expenditure requirements;

- EBITDA and Adjusted EBITDA do not reflect changes in, or cash

requirements for, Yelp's working capital needs;

- EBITDA and Adjusted EBITDA do not reflect tax payments that may

represent a reduction in cash available to Yelp;

- Adjusted EBITDA does not consider the potentially dilutive

impact of equity-based compensation;

- Adjusted EBITDA does not take into account any income or costs

that management determines are not indicative of ongoing operating

performance; and

- other companies, including those in Yelp’s industry, may

calculate EBITDA and Adjusted EBITDA differently, which reduces

their usefulness as comparative measures.

Because of these limitations, you should consider EBITDA,

Adjusted EBITDA and Adjusted EBITDA margin alongside other

financial performance measures, net income (loss) and Yelp’s other

GAAP results.

The following is a reconciliation of net income to EBITDA and

adjusted EBITDA (in thousands):

Three Months Ended

March 31,

2020

2019

Reconciliation of Net (Loss) Income to

EBITDA and adjusted EBITDA:

Net (loss) income

$

(15,503

)

$

1,365

Benefit from income taxes

(9,364

)

(556

)

Other income, net

(2,383

)

(4,691

)

Depreciation and amortization

12,358

11,876

EBITDA

(14,892

)

7,994

Stock-based compensation

31,750

31,319

Adjusted EBITDA

$

16,858

$

39,313

Net revenue

$

249,901

$

235,942

Adjusted EBITDA margin

7

%

17

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200507005827/en/

Investor Relations Contact Kate Krieger ir@yelp.com

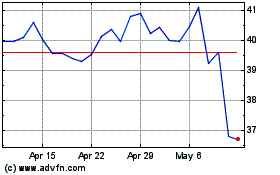

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024