The report found consumer interest in all types

of local businesses plummeted across the nation, Los Angeles

suffered the most business closures, and the economic impact to New

York equates to that of eight Hurricane Sandys

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today released first quarter data for the

Yelp Economic Average (YEA) report, a benchmark of local economic

strength in the U.S. Given the unprecedented changes brought by the

coronavirus (COVID-19), the report has been adapted to reveal the

dramatic shifts we’re currently seeing in local economies through a

variety of indicators since the start of 2020. YEA found that

business closure rates rose by 200% or more in metros and states

across the U.S and consumer interest in local businesses fell, by

50% or more in many categories, in a span of two weeks. The report

also observed that some businesses saw a surge in interest,

including fitness and exercise equipment (up 437% in seasonally

adjusted share of relevant page views, reviews, and photos since

March 10), community-supported agriculture (up 407%), and guns and

ammo (up 191%).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20200428005293/en/

The Q1 Yelp Economic Average takes a

holistic look at the local economic changes since the start of

2020. (Graphic: Business Wire)

YEA reflects data from millions of local businesses and tens of

millions of users on Yelp’s platform. To accommodate this past

quarter’s report, Yelp measured business closures; consumer

interest, behavior, searches and reviews; and perspective on how

local economic impact compared to previous natural disasters in the

U.S. According to researchers, Yelp provides a timely and accurate

measure of a huge swath of the economy that is often missed by many

major indicators.

“In 15 days, the economy transformed as much as it had in our

prior 15 years of operation, combined,” said Carl Bialik, Yelp’s

data science editor. “This quarter has been unlike any other as

businesses suddenly closed nationwide, consumer interest plummeted,

businesses overhauled their business models, and workers and

consumers changed lifelong habits overnight. Between March 10 to

March 21, one of the hardest hit categories was bars and other

nightlife businesses, which declined in consumer interest by 81%.

Salons and other beauty businesses were down 77%, hotels and other

travel businesses were down 75%, and restaurants were down

52%.”

Business Closures Rise Nationwide, Across Metros and

Categories

YEA found the rate of closures nationwide, and so many other

indicators of local economic strength, sharply turned during the

second and third weeks of March as warnings gave way to

shelter-in-place orders and other governmental measures to curb the

pandemic. On or around March 16, closure rates increased by two to

four times, and have remained at that new, elevated rate.

Since March 1, more than 175,000 businesses have been marked on

Yelp as shut down, temporarily or permanently. The Los Angeles

metro area saw the largest number of closed businesses, followed by

New York and Chicago. Seattle and San Francisco have had the

highest rate of business closures, as a share of all businesses,

among major metros, while Philadelphia and Miami have the lowest

rate of business closures among major metros. The businesses marked

as closed include more than 48,000 shopping establishments, 30,000

restaurants, and 24,000 spas and other beauty businesses.

The Local Economic Impact Equivalent of Several Major

Hurricanes

YEA analyzed how consumer interest in local businesses during

COVID-19 compared to the economic impact of other U.S. natural

disasters. The New York metro area experienced the equivalent of

eight Hurricane Sandys. The Houston metro area was hit by the

economic equivalent of four Hurricane Harveys, Miami by four Irmas,

and New Orleans by four Isaacs. The report found that hurricanes

were the closest precedents in economic impact, with the largest

immediate effect among other economic shocks.

Consumers Moved Fast, Often Ahead of Their

Governments

Consumer activity turned steeply downwards on (or around) March

11 across nearly all 50 states no matter what measures local

governments had or had not implemented at that time. Notably,

consumers often were out in front of their leaders: New Yorkers’

search behavior started to reflect the new reality on March 11, two

days before Californians’ and 11 days before New York Gov. Andrew

Cuomo ordered his state’s residents to stay home.

Business Owners Adapted, and Some Saw Demand Increase

The data showed how some businesses were unusually well-suited

to meet the needs of customers stuck at home, and how others

adapted with virtual services, delivery, and even shifts to their

business model. Fitness & exercise equipment (up 436% in

seasonally adjusted share of relevant page views, reviews, and

photos since March 10), cosmetic and beauty companies (up 139%),

pizzerias (up 71%) and chicken-wing joints (up 84%) were all able

to quickly pivot to abide by stay-at-home orders.

As people stopped dining out at restaurants, the ratio of

searches for dining-in to dining out increased by 300 times in a

few weeks. At the same time, many high-end restaurants and cocktail

bars quickly pivoted to prepare takeout options. Other businesses

such as photographers, art teachers, fitness instructors, and party

planners all have found new ways to continue to operate while still

respecting social distancing measures.

Consumer Behavior Was Consistent Across Political

Parties

Although some polls have shown Americans’ attitude toward the

virus differed by political affiliation, our data suggests

otherwise. By state, metro, or county, businesses and consumers

responded in much the same way, irrespective of local

circumstances, including which political party holds sway over

local offices or how the state voted in the 2016 presidential

election.

Support for Local Businesses Surfaces in Searches and

Reviews

Consumer behavior changed as rapidly as businesses have had to

adapt. The report found that searches for flowers were at

near-Valentine’s Day levels — with particularly elevated interest

in the Northeast and Great Lakes regions. People have also started

noting the health measures taken by establishments and by their

fellow consumers with mentions of sanitizer, gloves, and phrases

related to keeping physical distance from each other rising in the

second week of March. Mentions of masks rose steeply after the

federal government recommended their usage for all Americans, but

the rate of review mentions had been rising steadily

beforehand.

Reviewers also increased their usage of several phrases touching

on support of businesses: supporting restaurants, supporting their

favorite businesses, and supporting locally. Physical-distancing

requirements led to the steep decline in mention of service staff,

dropping off to mentions by under 2% of reviewers from a typical

rate of over 10%. Consumers are now interacting with service staff

less and instead adopting other ways of transacting, such as

curbside pick-up or contact-less delivery. By the end of March,

roughly one in six reviewers each day mentioned phrases related to

the coronavirus at a high rate rarely seen for other types of

phrases in Yelp’s reviews.

See all of our Yelp Economic Average reports, how we calculated

Q1 2020 YEA, and other resources at yelpeconomicaverage.com. Yelp

is regularly updating its Coronavirus Economic Impact Report to

outline how local economies continue to fare in these uncertain

times.

Please find more assets and images here. For more information

and Yelp’s latest company metrics, visit:

https://www.yelp-press.com/company/fast-facts/default.aspx

Methodology

Business Closures

On each date, starting with March 1, we count U.S. businesses

that were open on March 1 and were closed on that day. Closure can

be permanent or temporary, and is signaled by a business owner

marking the business as closed, including by changing its hours or

through a COVID-19 banner on its Yelp page. Closure counts are

likely an estimate of the businesses most impacted, with many

others not counted because they remain open with curtailed hours

and staffing, or because they have not yet updated their Yelp

business pages to reflect closures. Closures are counted by state,

metro area, and category; some businesses are in more than one

category. One-day closures that appear to be unrelated to the

pandemic, such as for Easter, are not counted.

Consumer Interest Changes By Political Party

We measure consumer interest by page views, and political

affiliation by 2016 presidential election results, using data from

MIT Elections Data and Science Lab. We aggregate consumer interest

and political affiliation at the county level and then by business

category. We compute the relative changes of page views with

respect to March 10. Then within each category, we compare these

relative changes along the temporal and the political

dimensions.

When Consumers Changed Their Behavior

The turning points for consumer behavior by state is measured

using seasonally adjusted daily search volume. The overall period

of change is the period in which daily search volume was

continuously falling. The period of rapid change shown in the chart

is the period between when search volume fell to 25% below its

initial level, and when it reached within 25% of the new

plateau.

Local Economic Impact

We measure daily consumer interest, in terms of daily U.S.

counts of a few of the many actions people take to connect with

businesses on Yelp: viewing business pages or posting photos or

reviews. By metro area (core-based statistical areas), we compare

daily consumer interest with the level expected based on a forecast

model accounting for seasonal, day-of-week, holiday, and other

underlying trends.

We then use this model to identify anomalous events that cause

the actual activity to deviate significantly from the expected

level. The beginning of each event is defined to be one day before

the day on which user activity first deviates more than 10% from

the normal level. We say the event “ends” when activity has

returned to roughly the expected level for several days. We start

tracking the effect of the pandemic on March 9 for each

location.

The total impact of the event is the total difference between

expected and actual activity for the duration of the event’s

impact. For example, if during a hurricane we see a daily average

of 25% less activity than expected over 10 days and during the

pandemic we see a daily average of 50% less activity than expected

over 40 days, we would say that the pandemic had eight times the

economic impact of the hurricane: twice the daily impact, for four

times as many days.

Consumer Interest By Business Category

We measure daily consumer interest, in terms of seasonally

adjusted daily U.S. counts of a few of the many actions people take

to connect with businesses on Yelp: viewing business pages or

posting photos or reviews. We start with the biggest U.S.

categories by consumer actions. Among those, we select the biggest

gainers and biggest decliners in terms of their seasonally adjusted

share of all root category consumer actions since March 1. Then we

choose representative ones to show the trend, which we’re charting

from March 1 through April 19.

Searches and Reviews

We look for phrases whose frequency in daily and weekly mentions

in search queries or users’ reviews changed significantly, grouping

related terms. For reviews, we evaluate the increase or decrease in

frequency of users who use a specific word or phrase since February

2020. For search queries, we compare frequencies of search terms to

all queries over the same weeks this year and last year to identify

the largest changes. We aggregate searches by state to identify

trends in specific localities, and compare the frequency of

mentions of celebrations to the frequency of mentions of illness or

death in recent florist reviews, to understand the reasons for

increased search frequency in flower delivery.

About Yelp Inc.

Yelp Inc. (www.yelp.com) connects people with great local

businesses. With unmatched local business information, photos and

review content, Yelp provides a one-stop local platform for

consumers to discover, connect and transact with local businesses

of all sizes by making it easy to request a quote, join a waitlist,

and make a reservation, appointment or purchase. Yelp was founded

in San Francisco in July 2004. Since then, Yelp has taken root in

major metros in more than 30 countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200428005293/en/

Yelp Inc. Julianne Rowe jrowe@yelp.com

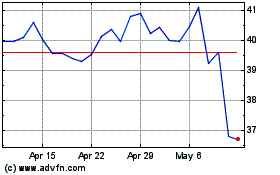

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024