SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant

ý

Filed by a Party other than the Registrant

¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨

Definitive Proxy Statement

ý

Definitive Additional Materials

¨

Soliciting Material Pursuant to §240.14a-12

YELP INC.

(Name of Registrant as Specified In Its Charter)

Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

ý

No fee required.

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1.

Title of each class of securities to which transaction applies:

____________________________________________________________________________________

2.

Aggregate number of securities to which transaction applies:

____________________________________________________________________________________

|

|

|

|

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

____________________________________________________________________________________

4.

Proposed maximum aggregate value of transaction:

____________________________________________________________________________________

5.

Total fee paid:

____________________________________________________________________________________

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

1.

Amount Previously Paid:

____________________________________________________________________________________

2.

Form, Schedule or Registration Statement No.:

____________________________________________________________________________________

3.

Filing Party:

____________________________________________________________________________________

4.

Date Filed:

____________________________________________________________________________________

Dear Fellow Stockholder,

Yelp

is holding its Annual Meeting of Stockholders on June 6, 2019. Ahead of this meeting, we would like to thank you for your continued support and investment in Yelp. We also encourage you to vote your shares in accordance with the recommendations of the Board of Directors on all proposals. In particular,

we request your support on

Proposal 3, Advisory Vote on Executive Compensation

(the "say-on-pay" proposal). Since the beginning of the year, Yelp has announced significant changes to its Board of Directors, its business strategies and its executive compensation practices. Yelp’s leadership believes these changes will drive the continued success of its business, which it looks forward to sharing with its customers, stockholders and employees alike.

Yelp’s Mission

Is

the Business Strategy

Our mission is to connect consumers with great local businesses. To accelerate Yelp’s growth, we are focusing on five important initiatives: (1) winning in key verticals, such as Restaurants and Home & Local Services; (2) expanding our slate of business product offerings; (3) driving more value to our customers; (4) capturing the enterprise opportunity; and (5) continuing to enhance the consumer experience. We expect the product development and go-to-market efforts we undertake in support of these initiatives to help us achieve a mid-teens compound annual revenue growth rate from 2019 through 2023. Together with focusing on our most efficient sales channels and optimizing our sales force and marketing investments, we also expect these efforts to deliver an even more profitable Yelp, which includes achieving Adjusted EBITDA margins in the 30-35% range by 2023. Although we are just getting started on these long-term initiatives, we note the following recent topline growth trend:

Growth in Annual Revenue

New Board Members and Governance Enhancements

To support the execution of our growth strategies, we have refreshed our Board of Directors and Board committees, adding three new members, George Hu, Sharon Rothstein and Brian Sharples, to replace Geoff Donaker, Peter Fenton and Jeremy Levine, respectively, who stepped down from the Board earlier this year. George, Sharon and Brian bring a wealth of practical, hands-on knowledge and skill sets, including scaling operations, sales, marketing, product and monetization, to our Board. Their additions further strengthen our talented and diverse team.

We also remain committed to corporate governance practices that promote long-term stockholder value creation, including by providing the right leadership structure and composition of the Board. This year we further improved our governance practices by adopting majority voting with a director resignation policy for uncontested director elections and refreshing the composition and leadership of our Board committees. These governance enhancements come in addition to other recent enhancements to our compensation program and policies, as discussed below.

Chief Executive Officer Pay Rises and Falls with Stockholder Value

In 2018, for the sixth consecutive year, Yelp’s Chief Executive Officer, or CEO, Jeremy Stoppelman, received a nominal base salary of $1.00. In addition, Yelp’s Compensation Committee determined not to offer cash incentive compensation opportunities to our CEO or other executive officers, resulting in CEO compensation consisting almost solely of stock options:

Our Compensation Committee and CEO each believe in the strong pay-for-performance alignment that this compensation mix provides. Although the options are subject to time-based vesting, because their exercise prices represent the market value of our common stock on their grant dates, they will have value only to the extent that shares held by our stockholders also increase in value, making them inherently performance-based. With typical vesting periods of four years, these stock options provide a strong incentive for our CEO to build value that can be sustained over time while also serving as effective retention tools.

As a result of this compensation program design,

our CEO's realizable pay

— that is, the compensation actually available (or "realizable") to him —

may be substantially lower than his reported pay

— that is, the value of compensation on the date it was granted, as reported in our annual proxy statements in accordance with financial accounting principles —

if our performance does not improve our stock price

. This has been the case in each of the last three years; for example, our CEO's realizable pay was $1.00 in 2018 compared to his approximately $5.4 million of reported pay for 2018.

CEO Realizable Pay vs. Reported Pay

____________________

|

|

|

|

(1)

|

Reported pay represents (a) Mr. Stoppelman's nominal annual salary of $1.00, plus (b) the aggregate grant date fair value of shares underlying stock options granted to Mr. Stoppelman in the applicable year calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718.

|

|

|

|

|

(2)

|

Realizable pay represents (a) Mr. Stoppelman's nominal annual salary of $1.00, plus (b) the value of stock options, whether vested or unvested, granted to Mr. Stoppelman in the applicable year that are in-the-money based on a stock price of $34.99 per share, the closing price of our stock on December 31, 2018.

|

|

|

|

|

(3)

|

Realized pay represents Mr. Stoppelman's "take-home" pay as reflected in his Form W-2 for each year, including any gains from options exercised during the applicable year (regardless of the option grant date).

|

|

|

|

|

(4)

|

Indexed total stockholder return, or TSR, represents the return associated with a hypothetical $100 investment in our common stock at the beginning of the relevant period.

|

Compensation Best Practices — Highlights

In connection with the evolution of our business and governance practices in 2018 and to date in 2019, we also took the opportunity to strengthen our compensation governance practices and begin evolving our executive compensation program. Based on feedback from our stockholders, we enhanced our compensation governance policies to incorporate best practices that lower governance risk and further our pay-for-performance policy, including the following highlights:

|

|

|

|

|

|

|

|

|

þ

What We Do

|

|

ý

What We Do Not Do

|

|

ü

|

Maintain a completely independent Compensation Committee

|

|

û

|

No guaranteed

salary increases, guaranteed bonuses or guaranteed equity compensation

|

|

ü

|

Retain an independent compensation consultant

|

|

û

|

No strict benchmarking of compensation

|

|

ü

|

Structure a substantial majority of total compensation as long-term equity awards

|

|

û

|

No "single-trigger" change in control cash payments or guaranteed equity acceleration

|

|

ü

|

Grant performance-based long-term equity awards

|

|

û

|

No excessive perquisites or personal benefits

|

|

ü

|

Employ our executive officers at will

|

|

û

|

No excise tax “gross-ups” for change in control or termination benefits

|

|

ü

|

Provide reasonable change in control and severance benefits that do not exceed the executive’s annual cash compensation (i.e. base salary + cash bonus amount, if any) at the time of termination

|

|

û

|

No pension arrangements, defined benefit retirement programs or non-qualified deferred compensation plans

|

|

ü

|

Maintain stock ownership guidelines for executive officers and directors

|

|

û

|

No

hedging, pledging or other inherently speculative transactions in our equity securities

|

|

ü

|

Subject cash and equity incentive compensation to a clawback policy

|

|

û

|

No repricing or exchange of underwater stock options without express stockholder approval

|

Our Compensation Committee also took a first step in evolving our executive compensation program to enhance the link between executive pay and company performance by granting performance-based restricted stock unit awards to our named executive officers in 2019. These performance-based awards vest subject to both (1) Yelp’s achievement of an average closing price that equals or exceeds 125% of the grant date closing price over any 60-trading day period during the four years following grant date and (2) a four-year quarterly vesting schedule. We expect this evolution to continue in the near- to medium-term as our Compensation Committee further refines the structure of our compensation program to bring it into alignment with our updated business strategy and to reflect ongoing stockholder feedback.

Stockholder Engagement

We believe that effective corporate governance should include regular, constructive conversations with our stockholders. Beginning in the fall of 2018, we expanded our stockholder engagement program with certain members of our Board, executive management and investor relations team engaging with stockholders directly to discuss our corporate governance and executive compensation programs, as well as to answer questions and elicit feedback. Our CEO, Chief Financial Officer and Chief Operating Officer also regularly engage in dialogue with our stockholders in connection with our quarterly announcement of financial results, at conferences and through other channels. Management provides an overview of these discussions and feedback to the Board and relevant committees for consideration and appropriate follow up.

In the fourth quarter of 2018 and early 2019, we reached out to stockholders collectively representing over two-thirds of our outstanding shares. Members of executive management, our Chairperson, Diane Irvine, and the Chairperson of our Compensation Committee, Fred Anderson, ultimately engaged in substantive discussions relating to governance and compensation matters with stockholders collectively representing approximately 50% of our outstanding shares. The key feedback from our stockholders and the actions we took in response were as follows:

Further, in response to stockholder feedback and as part of our commitment to transparency, we also expanded disclosures in our 2019 proxy statement to provide additional insight into our corporate governance, executive compensation, corporate responsibility practices and other matters of importance.

Should you have any questions or comments regarding our executive compensation program or other governance practices, we invite you to reach out to us at Yelp Investor Relations via email to ir@yelp.com.

Thank you for your ongoing support of Yelp.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

Diane M. Irvine

Chair, Board of Directors

Yelp Inc.

|

Fred D. Anderson, Jr.

Chair, Compensation Committee

Yelp Inc.

|

Special Note Regarding Forward-Looking Statements

This letter contains forward-looking statements relating to, among other things, the future performance of Yelp and its consolidated subsidiaries that involve risks, uncertainties and assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this letter that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements regarding Yelp's:

|

|

|

|

•

|

belief that recent changes to its Board of Directors, its business strategies and its executive compensation practices will drive its continued success;

|

|

|

|

|

•

|

investment priorities for 2019 and beyond, including its product and go-to-market efforts and sales and marketing optimization efforts, as well as its ability to execute against those priorities and the resulting impact on its operating results;

|

|

|

|

|

•

|

expected revenue growth and Adjusted EBITDA margin targets for the 2019 to 2023 period and its ability to achieve those targets;

|

|

|

|

|

•

|

ability to transition the business and create a more valuable company by focusing on five new strategic initiatives, as well as its ability to execute on those initiatives and deliver value to its customers, stockholders and employees; and

|

|

|

|

|

•

|

plans to further evolve its compensation program to bring it into alignment with its updated business strategy and to reflect ongoing stockholder feedback.

|

These statements are based on the beliefs and assumptions of our management, which are in turn based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, Yelp's:

|

|

|

|

•

|

limited operating history in an evolving industry;

|

|

|

|

|

•

|

ability to generate sufficient revenue to maintain profitability, particularly in light of its significant ongoing sales and marketing expenses and its ongoing investments in Yelp Reservations, Yelp Waitlist and other products;

|

|

|

|

|

•

|

ability to maintain and expand its advertiser base, particularly as an increasing portion of advertisers have the ability to cancel their ad campaigns at any time;

|

|

|

|

|

•

|

ability to realize the intended benefits of its Grubhub partnership, which may adversely affect its business relationships, operating results and business generally;

|

|

|

|

|

•

|

reliance on traffic to its website from search engines like Google and the quality and reliability of such traffic;

|

|

|

|

|

•

|

ability to generate and maintain sufficient high quality content from its users;

|

|

|

|

|

•

|

ability to maintain a strong brand and manage negative publicity that may arise; and

|

|

|

|

|

•

|

ability to upgrade and develop its systems, infrastructure and customer service capabilities on a timely basis.

|

Factors that could cause or contribute to such differences also include, but are not limited to, those discussed under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q.

Undue reliance should not be placed on the forward-looking statements in this letter, which are based on information available to Yelp on the date hereof. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

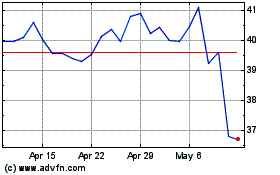

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024