Amended Report of Foreign Issuer (6-k/a)

April 27 2020 - 6:52AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of April, 2020

Commission File Number: 001-38652

X Financial

(Exact name of registrant as specified in its charter)

7-8F, Block A, Aerospace Science and Technology Plaza

No. 168, Haide Third Avenue, Nanshan District

Shenzhen, 518067, the People’s Republic of China

+86-755-86282977

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation ST Rule 101(b)(1): Not Applicable

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation ST Rule 101(b)(7): Not Applicable

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

EXPLANATORY NOTE

This Amendment No.1 (the “Amendment”) to the Current Reports on Form 6-K originally furnished by X Financial (the “Company”) with the Securities and Exchange Commission on November 20, 2019, August 19, 2019 and May 20, 2019, respectively, is being furnished to amend its previously issued unaudited condensed consolidated financial statements to reflect certain accounting adjustments in the consolidation of two additional trusts and fair value adjustments on consolidated trusts. In the ordinary course of business, the Company, its subsidiaries and its variable interest entities (collectively referred to as the “Group”) engage in a variety of activities with certain trusts and consolidates a trust in its financial statements if the Group is considered as the primary beneficiary of such trust. The Group determines whether it is the primary beneficiary of a trust at the time when it becomes involved with the trust and reassesses the conclusion on an ongoing basis. The Group consolidates a trust when it has both the power to direct the activities that most significantly impact the trust’s economic performance and a right to receive benefits or an obligation to absorb losses of the trust that could be potentially significant to the trust. When it is considered the primary beneficiary of the trust, the Group will consolidate the trust. The Group has reassessed the consolidation scope of trusts and identified that two additional trusts that should have been consolidated starting from May 22, 2019 and July 30, 2019, respectively, were not consolidated but accounted for as a true sale in its previously issued unaudited condensed consolidated financial statements. In addition, regarding the consolidated trusts, the Group elects the fair value option for the loan assets and liabilities of the consolidated trusts that otherwise would not have been carried at fair value. Such election is irrevocable and is applied to financial instruments on an individual basis at initial recognition. As the Group’s loans and payable to investors of the consolidated trusts do not trade in an active market with readily observable prices, the Group estimates the fair value of loans and payable to investors of the consolidated trusts using a discounted cash flow valuation methodology by discounting the estimated future net contractual cash flows involving significant unobservable inputs which include discount rate, expected prepayment rate and net accumulative expected loss rate. The Group has reassessed the appropriateness of the net contractual cash flows and unobservable inputs used in the discounted cash flow valuation methodology. For the newly established consolidated trusts in 2019, the Group considered that adjustments on the discounted cash flow valuation methodology should be made in its previously issued unaudited condensed consolidated financial statements.

As a result of the consolidation adjustments with respect to additional trusts and fair value adjustments on consolidated trusts, for the quarters ended September 30, 2019, June 30, 2019 and March 31, 2019, the Group’s net income for the period from January 1, 2019 to September 30, 2019 will increase by RMB45.9 million from RMB648.9 million to RMB694.8 million. For the quarter ended September 30, 2019, the Group’s total net revenue will decrease by RMB12.5 million from RMB866.8 million to RMB854.3 million; total operating expenses will increase by RMB3.6 million from RMB632.1 million to RMB635.7 million; fair value adjustments related to consolidated trusts will increase by RMB60.1 million from RMB-11.0 million to RMB49.1 million; and net income will increase by RMB38.0 million from RMB131.6 million to RMB169.6 million; and as of September 30, 2019, the Group’s total assets will increase by RMB729.4 million from RMB7,578.7 million to RMB8,308.1 million; and total liabilities will increase by RMB683.5 million from RMB3,382.2 million to RMB4,065.7 million. For the quarter ended June 30, 2019, the Group’s total net revenue will decrease by RMB17.3 million from RMB809.6 million to RMB792.3 million; total operating expenses will decrease by RMB1.5 million from RMB546.8 million to RMB545.3 million; fair value adjustments related to consolidated trusts will increase by RMB34.5 million from RMB14.8 million to RMB49.3 million; and net income will increase by RMB12.5 million from RMB303.6 million to RMB316.1 million; and as of June 30, 2019, the Group’s total assets will increase by RMB385.2 million from RMB6,809.6 million to RMB7,194.8 million; and total liabilities will increase by RMB377.4 million from RMB2,789.6 million to RMB3,167.0 million. For the quarter ended March 31, 2019, the Group’s fair value adjustments related to consolidated trusts will decrease by RMB 0.4 million from RMB33.0 million to RMB32.6 million; and net income will decrease by RMB4.6 million from RMB213.8 million to RMB209.2 million; and as of March 31, 2019, the Group’s total assets will increase by RMB65.6 million from RMB5,752.4 million to RMB5,818.0 million; and total liabilities will increase by RMB70.3 million from RMB2,099.4 million to RMB2,169.7 million. The determination to the consolidation scope of the trusts and fair value adjustments on consolidated trusts as described above was made by the Company’s management with the concurrence of the audit committee of the Company’s board of directors.

The Company’s previously issued unaudited condensed consolidated financial statements for the previous quarters in 2019 and related earnings press releases and communications for the affected reporting periods should be read taking into account the above adjustments.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

X Financial

|

|

|

|

|

|

|

By:

|

/s/ Yue Tang

|

|

|

Name: Yue Tang

|

|

|

Title: Chairman and Chief Executive Officer

|

|

|

|

|

|

Date: April 27, 2020.

|

|

|

3

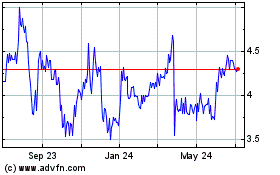

X Financial (NYSE:XYF)

Historical Stock Chart

From Mar 2024 to Apr 2024

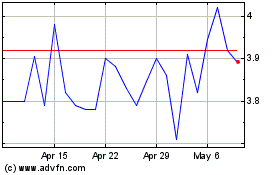

X Financial (NYSE:XYF)

Historical Stock Chart

From Apr 2023 to Apr 2024