Lumber Prices Break New Records, Adding Heat to Home Prices

May 03 2021 - 5:19PM

Dow Jones News

By Ryan Dezember

The frenzied climb in lumber prices is generating superlative

profits for sawmill owners. Home buyers, renters and

do-it-yourselfers are footing the bill.

Wood prices pushed further into record territory, a sign that

Weyerhaeuser Co., Canfor Corp. and other sawmill owners are in line

for even fatter profits than the record earnings they have been

reporting for the first three months of 2021.

These companies have emerged as the biggest beneficiaries of the

wood boom. They are feasting on a glut of cheap pine trees in the

U.S. South while their finished products like lumber and plywood

are flying off hardware-store shelves and being bid up by home

builders.

Lumber futures delivery later this month ended Monday at

$1,575.60 per thousand board feet, a record and more than four

times the typical price this time of year. Futures rose by the

daily maximum allowed by the Chicago Mercantile Exchange during

nine of April's 21 trading sessions.

Exchange rules remove daily trading thresholds during the month

in which a futures contract expires, which means May futures have

no limit to how high they may rise before the 15th, when the bets

are settled. On Monday, May futures shot up $75.60, the most ever

in a single day.

On-the-spot prices for two-by-fours and other wood products also

have jumped to fresh highs, according to pricing service Random

Lengths. Traders worried about being left empty-handed capitulated,

and the firm's framing-lumber-composite price made its highest ever

weekly gain, ending April at a record of $1,290.

"Nervousness on the part of many traders was palpable, as they

considered what the downside of the run might look like," Random

Lengths said in its weekly report.

Mill owners say they are backed up with orders into June. Boards

for July delivery, the most actively traded futures contract, ended

Monday at $1,418.50. September lumber cost $1,277.

"Absent a significant increase in mortgage rates or a Covid

resurgence, it is hard to imagine what could cause lumber demand to

drop and prices to moderate in the foreseeable future," said Eric

Cremers, chief executive of PotlatchDeltic Corp., which owns

timberland and mills in Idaho, Arkansas, Michigan and

Minnesota.

The Spokane, Wash., company's wood-products division earned

$125.5 million during the first quarter, its best ever. Lumber

futures have risen by about two-thirds from the $890 average price

that Potlatch fetched during the first quarter.

"Builders are reporting record home sales, and they're going to

need that wood to build those homes," Mr. Cremers told investors

and analysts last week.

To emphasize how tight supplies have gotten for many wood

products, the CEO told them about his own fence, which blew over in

a storm, and the landscaper who had to drive 100 miles out of town

to find cedar posts to fix it.

When the economy was shut down last year to slow the spread of

the coronavirus, sawmills sent workers home and curtailed

production. By April, roughly 40% of North America's sawmill

capacity was shut down.

U.S. wood product output returned to pre-pandemic levels in

December, according to the Federal Reserve. Yet production remains

about 16% lower than the 2006 peak, which is the last time so many

houses were being built.

The Fed last week recommitted to near-zero interest rates, which

have fueled the red-hot housing market. Rising home prices and low

rates have also helped existing homeowners refinance mortgages to

pocket cash without adding much to payments. Mortgage-finance firm

Freddie Mac estimates that Americans last year withdrew nearly $153

billion from their homes in cash-out refinancings. Vacation options

were limited by the pandemic and a remodeling boom ensued.

Demand hasn't been diminished by soaring prices, mill executives

say.

"The prices appear to be passing on," Canfor CEO Don Kayne told

investors Friday. Canfor, which owns mills in northwest Canada and

throughout the U.S. South, notched quarterly records in sales and

profit. "So far we haven't seen the resistance that you would

expect."

Builders including PulteGroup Inc. and the Howard Hughes Corp.

say they have offset higher prices for lumber as well as for other

building materials by raising home prices without slowing sales.

NexPoint Residential Trust Inc. investment chief Matthew McGraner

assured shareholders that high lumber prices weren't eating into

the apartment owner's margins. "Any additional costs, we've been

able to pass on to the tenants," he said.

At a recent investor conference, Lowe's Cos. finance chief David

Denton said the home-improvement chain and its rivals weren't

waiting to see if the run-up in lumber prices would be short-lived

before raising prices.

"That largely gets passed on pretty much real-time into the

marketplace and you're seeing that across the industry," he

said.

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

May 03, 2021 17:04 ET (21:04 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

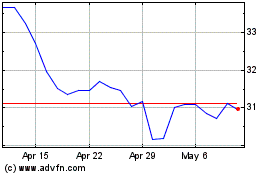

Weyerhaeuser (NYSE:WY)

Historical Stock Chart

From Mar 2024 to Apr 2024

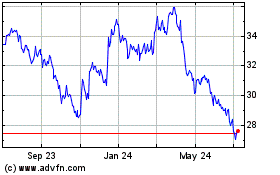

Weyerhaeuser (NYSE:WY)

Historical Stock Chart

From Apr 2023 to Apr 2024