Welcome to Walmart. The Robot Will Grab Your Groceries.

January 08 2020 - 11:29AM

Dow Jones News

By Sarah Nassauer

In the backroom of a Walmart store in Salem, N.H., is a

floor-to-ceiling robotic system that the country's largest retailer

hopes will help it sell more groceries online.

Workers stand on platforms in front of screens assembling online

orders of milk, cereal and toilet paper from the hulking automated

system. Wheeled robots carrying small baskets move along metal

tracks to collect those items. They are bagged for pickup later by

shoppers or delivery to homes.

Walmart is one of several grocers including Albertsons Cos. and

Kroger Co. that are using automation to improve efficiency in a

fast-growing but costly business that comes with a range of

logistical challenges.

The backroom robots could help Walmart cut labor costs and fill

orders faster and more accurately. It also could address another

problem: unclogging aisles that these days can get crowded with

clerks picking products for online orders.

A store worker can collect around 80 products from store shelves

an hour, estimated John Lert, founder and CEO of Alert Innovation,

the startup that has worked with Walmart to design the system

dubbed Alphabot. It is designed to collect 800 products an hour per

workstation, Mr. Lert said. Workers stock the 24-foot high machine

each day with the products most often ordered online, including

refrigerated and frozen foods. Fresh produce is still picked by

hand in store aisles.

A version of the Alphabot system will be built in the backroom

of two more stores later this year, one in Oklahoma and another in

California, and a fourth version of the system is already built in

a store near Walmart's headquarters, a Walmart spokesman said. Mr.

Lert and the spokesman declined to share the cost of the system.

Walmart started testing Alphabot in Salem two years ago, but in

recent weeks started using it to fill a significant portion of

online grocery orders for the first time.

Walmart, already the country's largest seller of groceries by

revenue, has become an online grocery heavyweight, too, by offering

a service from thousands of stores that lets shoppers pick up

online orders from store parking lots without leaving their cars.

It also offers home grocery delivery from more than a thousand

stores.

Online orders are still a relatively small part of total grocery

spending. E-commerce was about 3.5% of overall food and beverage

category sales last year, according to market researcher Forrester.

Some data show online grocery sales are growing fast, but the

logistical and profit challenges of asking workers to select food

for shoppers or delivering fresh food to homes have kept retailers

battling to find a model that works.

Using store workers to manually collect products from shelves

isn't only costly, it makes it hard to tell online shoppers exactly

what's available at any given moment.

"The whole problem with picking inventory from the shelf is

inventory is never where it's supposed to be," said Sucharita

Kodali, retail analyst at Forrester. "People move it around, and

fast-moving items are never there."

Walmart, which employs around 1.5 million workers in the U.S.,

told investors last year that the retailer aimed to add automation

and remodel stores to better accommodate online orders after some

shoppers complained about clogging in the aisles. Walmart can't

"disadvantage our most profitable customer, which is the one who

drives to the store and does all the work themselves," then-Walmart

U.S. chief Greg Foran said at the time.

Albertsons, whose chains include Safeway and Jewel-Osco, is

adding automated online grocery fulfillment devices in store

backrooms designed by Takeoff Technologies. It added two of the

systems to California Safeway stores last year. Kroger and

Koninklijke Ahold Delhaize NV's online grocery unit, Peapod, are

investing in larger, more-remote distribution centers to further

automate the process of grocery delivery.

Using stores and backrooms to collect online grocery orders

gives retailers another way to generate income from assets they

already have, industry consultants and executives say. Walmart also

has been looking for other ways to use its existing base of around

4,700 U.S. stores to compete with Amazon.com Inc., including adding

more services like health care and selling technology like

computing power based in stores to other businesses.

Walmart first talked to Alert Innovation about building an

automation system in 2016, Mr. Lert said. At the time, Walmart

executives believed that for online grocery fulfillment to become

more profitable, fulfillment had to happen close to customers and

without sending workers weaving through aisles for every order, Mr.

Lert said.

Walmart added 20,000 square feet of space to the Salem store to

facilitate the Alphabot system and more space for shoppers to pick

up orders in cars. It picked Salem because of its proximity to

Alert's headquarters in North Billerica, Mass.

The store hired around 10 additional people to keep the machine

stocked and continue picking some fresh produce from the store

shelves, the Walmart spokesman said. "At this point we haven't seen

any movement in the head count."

In a continued test of the concept, the spokesman said, the two

additional stores where Walmart plans to install Alphabot are in

areas with high demand for online grocery orders.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

January 08, 2020 11:14 ET (16:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

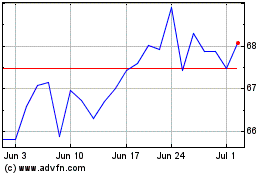

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

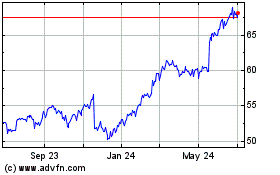

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024