Waste Management Wants Consumers to Pay More as It Moves More Trash

May 10 2020 - 9:29AM

Dow Jones News

By Nina Trentmann

Devina Rankin wants to charge cities and towns more to pick up

their trash and recyclables, since Americans working from home are

producing more waste -- and it costs more to get rid of it.

"We need to have conversations about the level of service we are

required to provide because it is different than what we signed up

for," the Waste Management Inc. finance chief said. The weight of

residential waste has increased 15% to 25% since the beginning of

widespread lockdown orders in the U.S., she said.

Meanwhile, Ms. Rankin said volumes in its higher-margin

commercial and industrial business were down 16% in the first

quarter compared with a year earlier.

The Houston-based company has about 18.3 million residential

customers across the U.S. and Canada. The drop in commercial and

industrial trash reduced Waste Management's revenue by about $40

million in the first quarter, hurting its profit margin.

Waste Management and other haulers typically have multiyear

contracts with municipalities for removal of trash and recyclables.

The price paid stays the same, even if there's more waste

produced.

Waste Management's trucks now make more trips to pick up

residential trash and bring it to a landfill or sorting facility.

Disposal costs are rising because of the increased volumes, and Ms.

Rankin said she expects those higher costs to continue even as

businesses and offices reopen.

A 2018 ban by China on waste imports, which sent global prices

for recyclable materials lower, affected some of the company's

margins. The decline in prices for paper, plastic, cardboard and

metal hurt waste-collection companies, which previously recouped a

large chunk of their recycling costs by selling the materials.

However, there is now greater U.S. demand for recycled paper and

cardboard to produce things such as toilet paper and packaging, Ms.

Rankin said. Waste Management is selling 80% to 85% of its recycled

materials domestically, compared with about 70% before the

coronavirus pandemic.

The company has been able to charge higher fees for some

municipalities since the 2018 China ban, and Ms. Rankin said she is

optimistic it will be able to do more of that. "The fundamental

shift in residential waste is well understood and will make the

conversations with municipalities increasingly effective," Ms.

Rankin said.

Waste Management might be successful in asking for price

increases in negotiations with municipalities, assuming more

Americans continue to work from home once the pandemic has ended,

said Noah Kaye, a research analyst at Oppenheimer & Co., an

investment bank.

"The contracts were not set up to reflect a 20% increase in

waste by households. These are extra costs for waste haulers," Mr.

Kaye said.

Waste Management employs around 17,000 drivers in the U.S. and

Canada. Ms. Rankin slashed costs by cutting overtime for hourly

employees in response to the decline in commercial waste.

Other waste haulage companies have reduced additional services,

for example yard collections, to bring down costs, said Jeff

Silber, a managing director at BMO Capital Markets. "Higher

residential volumes will not go away for a while," he said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

May 10, 2020 09:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

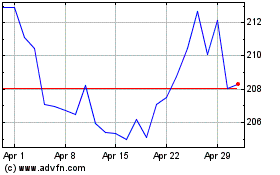

Waste Management (NYSE:WM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Waste Management (NYSE:WM)

Historical Stock Chart

From Apr 2023 to Apr 2024