Wells Fargo Global Dividend Opportunity Fund Announces Change to Managed Distribution Plan

August 18 2021 - 7:31PM

Business Wire

The Wells Fargo Global Dividend Opportunity Fund (NYSE: EOD), a

closed-end fund, announced today that the fund’s Board of Trustees

has approved a change to the fund’s managed distribution plan.

Effective with the distribution to be declared in August 2021,

the plan will provide for the declaration of quarterly

distributions to common shareholders of the fund at an annual

minimum fixed rate of 9% based on the fund’s average monthly net

asset value (NAV) per share over the prior 12 months. Under the

managed distribution plan, quarterly distributions may be sourced

from income, paid-in capital, and/or capital gains, if any.

Shareholders may elect to reinvest distributions received pursuant

to the managed distribution plan in the fund under the existing

dividend reinvestment plan, which is described in the fund’s

shareholder reports.

The Wells Fargo Global Dividend Opportunity Fund is a closed-end

equity and high-yield bond fund. The fund’s investment objective is

to seek a high level of current income. The fund’s secondary

objective is long-term growth of capital.

Under the managed distribution plan, the fund will distribute

available investment income to its shareholders quarterly. If

sufficient investment income is not available on a quarterly basis,

the fund will distribute long-term capital gains and/or return

capital to its shareholders in order to maintain its managed

distribution level. The fund expects that distributions under the

managed distribution plan may exceed investment income.

Distributions in excess of net investment income will be treated as

distributions of capital gains to the extent of realized gains

during the fiscal year. Any distributions in excess of both net

investment income and realized gains will be treated as returns of

capital. No conclusions should be drawn about the fund’s investment

performance from the amount of the fund’s distributions or from the

terms of the fund’s managed distribution plan.

The amount distributed per share is subject to change at the

discretion of the fund’s Board of Trustees. The managed

distribution plan will be subject to periodic review by the fund’s

Board of Trustees to determine whether the managed distribution

plan should be continued, modified, or terminated. The fund’s Board

of Trustees may amend the terms of the managed distribution plan or

suspend or terminate the managed distribution plan at any time

without prior notice to the fund’s shareholders. The amendment or

termination of the managed distribution plan could have an adverse

effect on the market price of the fund's shares.

With each distribution that does not consist solely of net

investment income, the fund will issue a notice to shareholders

that will provide detailed information regarding the amount and

composition of the distribution and other related information. The

amounts and sources of distributions reported in the notice are

only estimates and are not being provided for tax reporting

purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon the fund’s investment

experience during its full fiscal year and may be subject to

changes. The fund will send shareholders a Form 1099-DIV for the

calendar year that will tell shareholders how to report these

distributions for federal income tax purposes.

For more information on Wells Fargo’s closed-end funds, please

visit our website.

This closed-end fund is no longer available as an initial public

offering and is only offered through broker-dealers on the

secondary market. A closed-end fund is not required to buy its

shares back from investors upon request. Shares of the fund may

trade at either a premium or discount relative to the fund’s net

asset value, and there can be no assurance that any discount will

decrease. The values of, and/or the income generated by, securities

held by the fund may decline due to general market conditions or

other factors, including those directly involving the issuers of

such securities. Equity securities fluctuate in value in response

to factors specific to the issuer of the security. Small- and

mid-cap securities may be subject to special risks associated with

narrower product lines and limited financial resources compared

with their large-cap counterparts and, as a result, small- and

mid-cap securities may decline significantly in market downturns

and may be more volatile than those of larger companies due to

their higher risk of failure. Debt securities are subject to credit

risk and interest rate risk, and high-yield securities and unrated

securities of similar credit quality have a much greater risk of

default and their values tend to be more volatile than higher-rated

securities with similar maturities. Foreign investments may contain

more risk due to the inherent risks associated with changing

political climates, foreign market instability, and foreign

currency fluctuations. Risks of foreign investing are magnified in

emerging or developing markets. Derivatives involve risks,

including interest rate risk, credit risk, the risk of improper

valuation, and the risk of noncorrelation to the relevant

instruments they are designed to hedge or closely track. There are

numerous risks associated with transactions in options on

securities and/or indexes. As a writer of an index call option, the

fund forgoes the opportunity to profit from increases in the values

of securities held by the fund. However, the fund has retained the

risk of loss (net of premiums received) should the price of the

fund’s portfolio securities decline. Similar risks are involved

with writing call options or secured put options on individual

securities and/or indexes held in the fund’s portfolio. This

combination of potentially limited appreciation and potentially

unlimited depreciation over time may lead to a decline in the net

asset value of the fund. The fund is leveraged through a revolving

credit facility and also may incur leverage by issuing preferred

shares in the future. The use of leverage results in certain risks,

including, among others, the likelihood of greater volatility of

the net asset value and the market value of common shares.

Wells Fargo Asset Management (WFAM) is the trade name for

certain investment advisory/management firms owned by Wells Fargo

& Company. These firms include but are not limited to Wells

Capital Management, LLC, and Wells Fargo Funds Management, LLC.

Certain products managed by WFAM entities are distributed by Wells

Fargo Funds Distributor, LLC (a broker-dealer and Member

FINRA).

Wells Fargo Asset Management does not provide accounting, legal,

or tax advice or investment recommendations.

This material is for general informational and educational

purposes only and is NOT intended to provide investment advice or a

recommendation of any kind—including a recommendation for any

specific investment, strategy, or plan.

Some of the information contained herein may include

forward-looking statements about the expected investment activities

of the funds. These statements provide no assurance as to the

funds’ actual investment activities or results. Readers must make

their own assessment of the information contained herein and

consider such other factors as they may deem relevant to their

individual circumstances.

PAR-0821-00541

INVESTMENT PRODUCTS: NOT FDIC INSURED ● NO

BANK GUARANTEE ● MAY LOSE VALUE

WF-CF

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210818005847/en/

Media Jeanette Foster, 415-264-1323

jeanette.d.foster@wellsfargo.com

Shareholder inquiries 1-800-730-6001

Financial advisor inquiries 1-888-877-9275

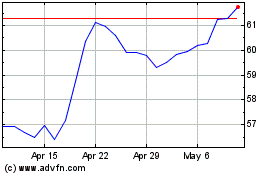

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

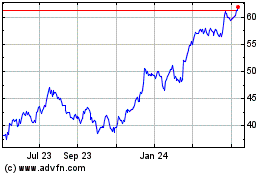

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024