Banking Regulator Rebukes Wells Fargo's HR Operations

December 04 2019 - 6:44PM

Dow Jones News

By Rachel Louise Ensign

Wells Fargo & Co.'s principal regulator has said the bank

has a massive backlog of employee human-resources complaints and

poor controls around pay, a rebuke that adds to the long list of

problems facing the lender's new chief executive.

The bank has been at pains to demonstrate since the October

hiring of Charles Scharf as CEO that it is making progress

repairing the regulatory messes that emerged after a 2016

fake-account scandal, which upended Wells Fargo's reputation as a

staid mortgage lender and forced out some of its top

executives.

The HR complaints came in a July letter from the Office of the

Comptroller of the Currency and laid out a lengthy to-do list,

people familiar with the matter said. Among the issues the HR

department needs to address, the regulator said, are thousands of

employee complaints, an inadequate policy for clawing back

compensation from executives and controls around pay that aren't

tight enough to ward off potential misconduct, the people said.

"We do not comment on specific regulatory matters, however,

Wells Fargo is making progress on our regulatory obligations but

more work needs to be done," a bank spokeswoman said.

Authorities said in September 2016 that Wells Fargo bankers

opened perhaps millions of accounts without customer knowledge or

consent. The scandal revealed an aggressive sales culture coupled

with incentives to push more products on customers.

Mr. Scharf is "already making significant changes," including

this week hiring Santander Holdings USA Inc. CEO Scott Powell as

chief operating officer to "focus on regulatory priorities and

improve our control and operations functions," said Arati Randolph,

the Wells Fargo spokeswoman.

Late last year, the bank put a top executive whose

responsibilities included HR on a leave of absence after the OCC

sent her and another executive letters accusing them of oversight

failures.

The OCC earlier this year considered the unprecedented step of

forcing changes to Wells Fargo's senior management or board, The

Wall Street Journal reported, power it has under a $1 billion

settlement it reached with the bank in 2018. The bank's previous

CEO, Timothy Sloan, stepped down in March, following a rare public

rebuke by the OCC.

In May, Wells Fargo's top OCC examiner spoke to a gathering of

hundreds of the bank's in-house lawyers, people familiar with the

matter said, and offered a blunt critique of the bank's

progress.

Wells Fargo's HR practices came under regulatory scrutiny

following the 2016 scandal, but the OCC raised the pressure earlier

this year, people familiar with the matter said. In the assessment

that followed, the regulator added new warnings known as "matters

requiring attention" to existing ones targeting the HR

operation.

In the letter outlining the warnings, examiners said the bank

had made some progress in fixing issues with compensation and

performance management that were the subject of an outstanding MRA,

the people said. But the regulator didn't lift the warning, saying

the bank failed to put in place adequate controls to ensure pay

practices didn't encourage wrongdoing, the people said.

Wells Fargo also lacked adequate procedures to claw back

compensation from executives suspected of wrongdoing, they

said.

Incentive pay and clawbacks were major issues in the sales

scandal. The lender's board determined that bonuses paid to

low-level employees for product sales encouraged them to open fake

accounts. The bank also was criticized for not forcing top

executives to give up pay when the scandal broke. (Two senior

executives eventually forfeited millions of dollars in

compensation.)

The OCC also called out the bank's backlog of 3,000 employee

complaints, the people said. These likely include complaints from

employees who say they were wrongfully terminated, which HR

staffers are supposed to investigate, one of the people said.

The bank has fired thousands of low-level branch employees as

part of its effort to get the fake-account problem under control.

Many say they were unfairly terminated and have since been

effectively blacklisted from the banking industry.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

December 04, 2019 18:29 ET (23:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

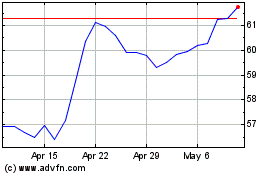

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

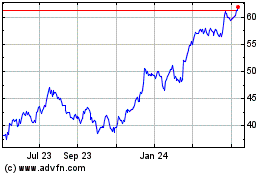

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Apr 2023 to Apr 2024